The crypto market has witnessed yet another blowup in November 2022 with the downfall of FTX. This year has taken down TerraUST, 3AC, Voyager, Celzius, Blockfi, FTX and a dozen of more.

It has been a real pain for a lot of users.

Stablecoins and their adoption seems to be one of the most important use cases for crypto since the last bull run. Let’s take a look how they have performed in 2022!

The TerraUST fiasco has left a mark on the stablecoins industry. It happened back in May 2022 and it seems to be the first in a series of implosions since then. FTX now the last in the row. Before the implosion of the project the combine market cap of LUNA and UST was more then 40B.

A lot of stablecoins saw decrease in their market cap after this and some small ones collapsed as well. The top ones USDT, USDC and BUSD still stands.

With this said let’s see how the market cap of the top stablecoins looks in the last year.

Apart from the fiat backed stablecoins (USDT, USDC, BUSD….) that are keeping USD in banks (or equivalent) there are tokens like DAI, UST, HBD that are backed by other crypto as collateral, and/or using conversion on chain operations to maintain the peg.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Binance USD [BUSD]

- Dai [DAI]

- FRAX [FRAX]

- Terra-UST

There is a few more out there like TrueUSD [TUSD], Huobi USD [HUSD], etc, but we will focus on the above as the biggest ones in market cap.

The period that we will be looking at is from ** 2022.**

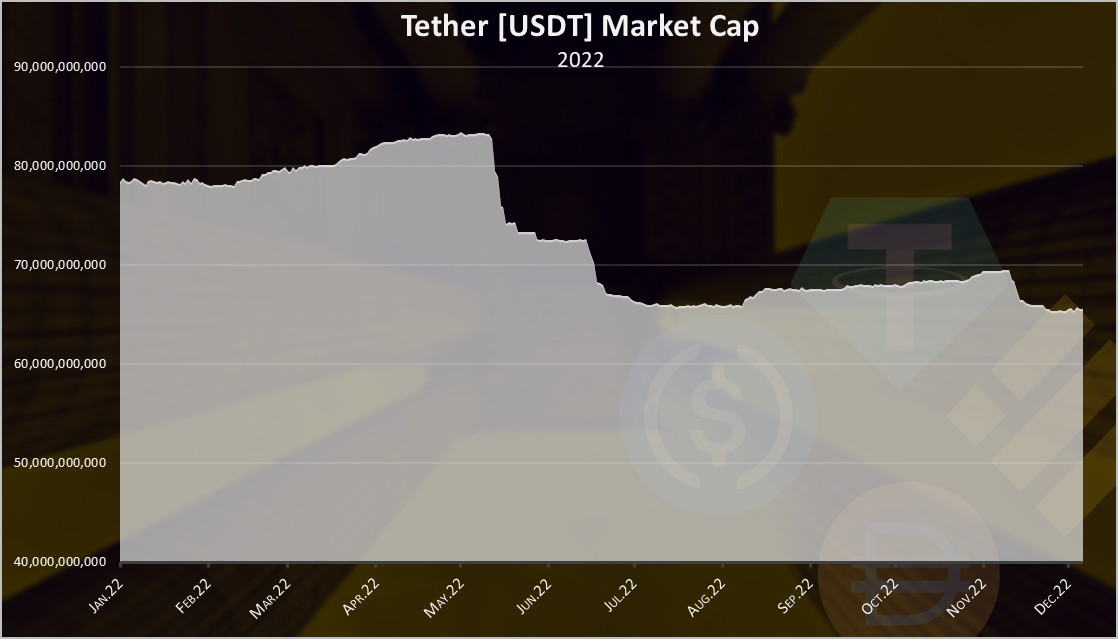

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly its founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank.

Here is the market cap for Tether in the last period.

In the first months of 2022, up to May, Tether was growing slowly, going from 78B to 83B at its peak at the beginning of May. Then UST happened and we can see the major drop in the Tether market cap. Just in a week Tether dropped for a full 10B in market cap and around 15 billion in less than a month. If this was to happen on any traditional bank, bankruptcy is almost certain. Tether here proved that they can manage the pressure.

Afterwards there seems to be a slight recovery in the market cap, from 65B to 70B, and then FTX happen and Tether in now down again to 65B market cap.

On a yearly basis the USDT market cap has dropped from 78B at the beginning of the year to 65B now.

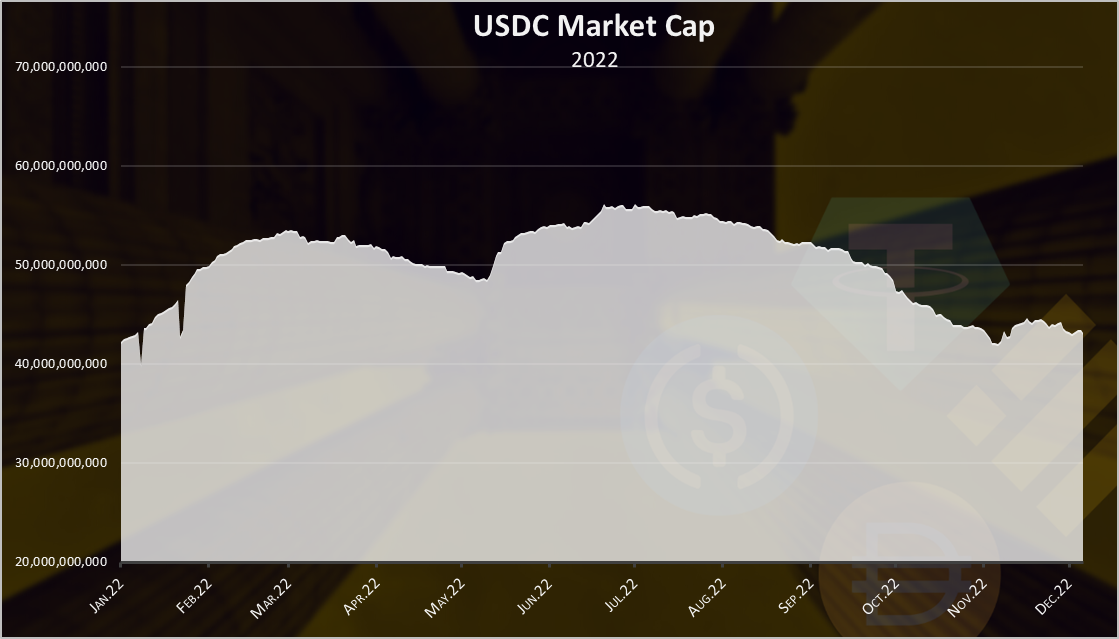

USD Coin [USDC]

USDC is a common project between Circle and Coinbase.

Here is the chart.

What’s interesting about USDC is that it seems to act in the opposite way from USDT. Back in May when USDT dropped, USDC has increased in market cap. We can see a similar pattern in the last days, when USDC has gained in market cap and now is at 44B. The record high for USDC was in the summer with 55B.

On a yearly basis the USDC market is on the similar level where it started the year.

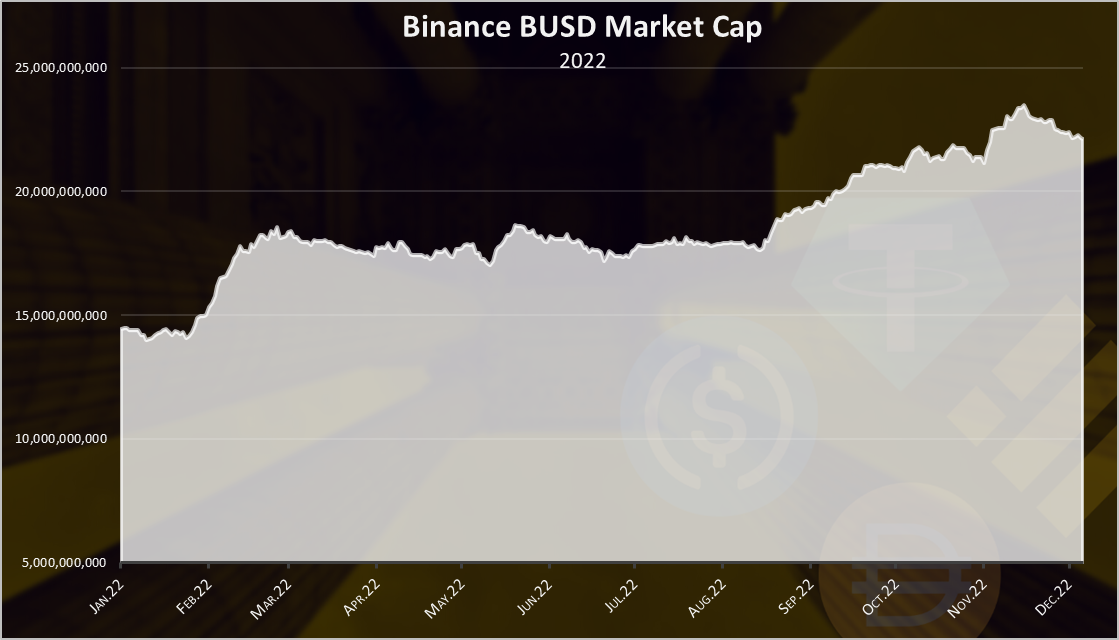

Binance USD [BUSD]

The Binance exchange stablecoin. It’s mostly used on Binance and BSC as well as a trading pair against other cryptos.

BUSD has been on of the rare stabelcoins that has grown through the whole 2022. At the beginning of the year the BUSD market cap was at around 15B and now it is at 22B. It did dipped a bit in the last period when FTX collapsed.

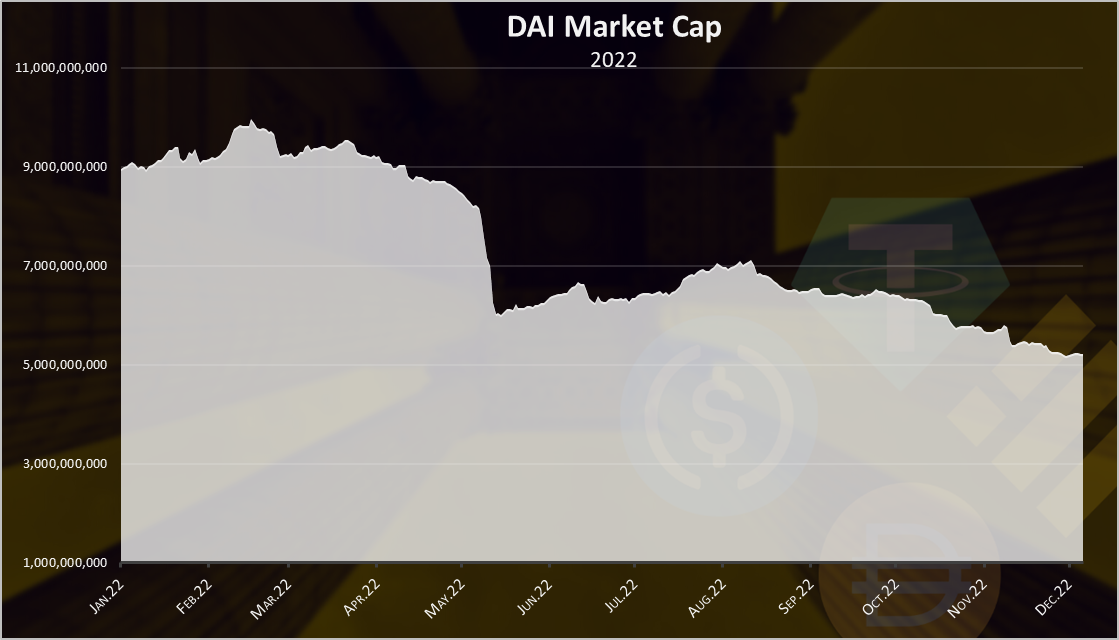

Dai [DAI]

DAI is the decentralized version for stablecoin. It runs as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate DAI as a loan.

DAI as the number one crypto backed stablecoin has reduced its market cap in 2022. DAI works as overcollateralized stablecoin, where users put in 150% or more of other crypto assets to mint 1DAI. Since its backed by crypto asset, and the price of those has dropped it is logical for the overall market cap of DAI to drop as well.

We can see that during the UST fiasco in May 2022, the DAI market cap reduced as well, from , from 8B to 6B. The DAI market cap at the moment is 6.5B, while in the peak it reached almost 10B. In the last period there has been a drop again to 5B where it is now.

One thing about DAI what is a bit conserving is that most of it is now minted by USDC. This put a centralized attack vector on the token.

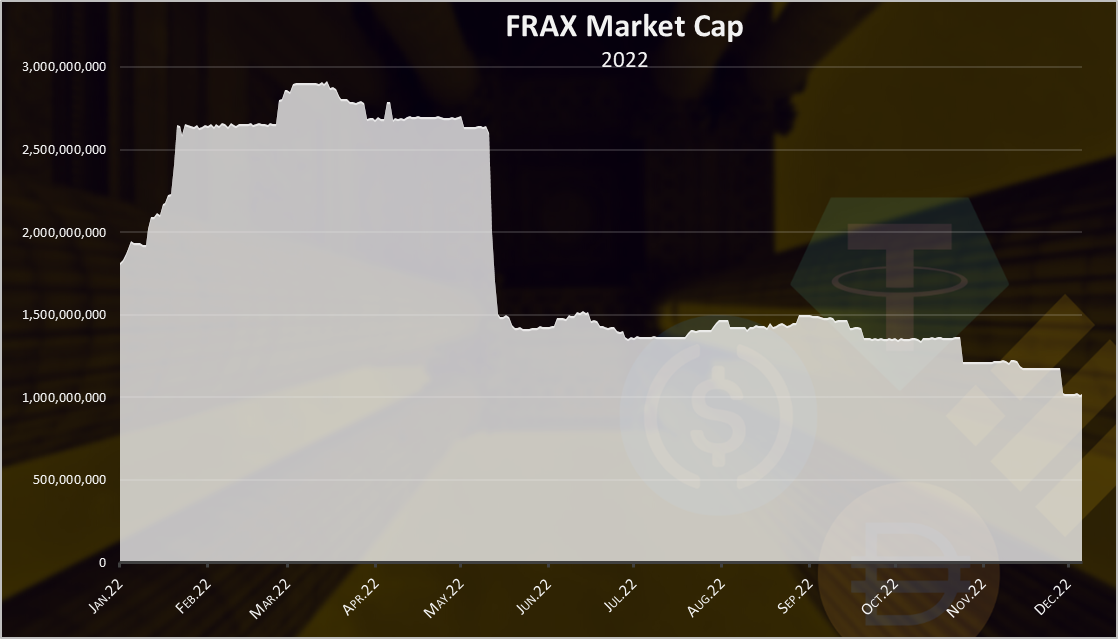

FRAX

FRAX is another crypto backed stablecoin. Unlike DAI, Frax is the fractional-algorithmic stablecoin protocol.

We can see that there was a huge drop back in May for FRAX as well, and a slow drop since then to 1B where it is now.

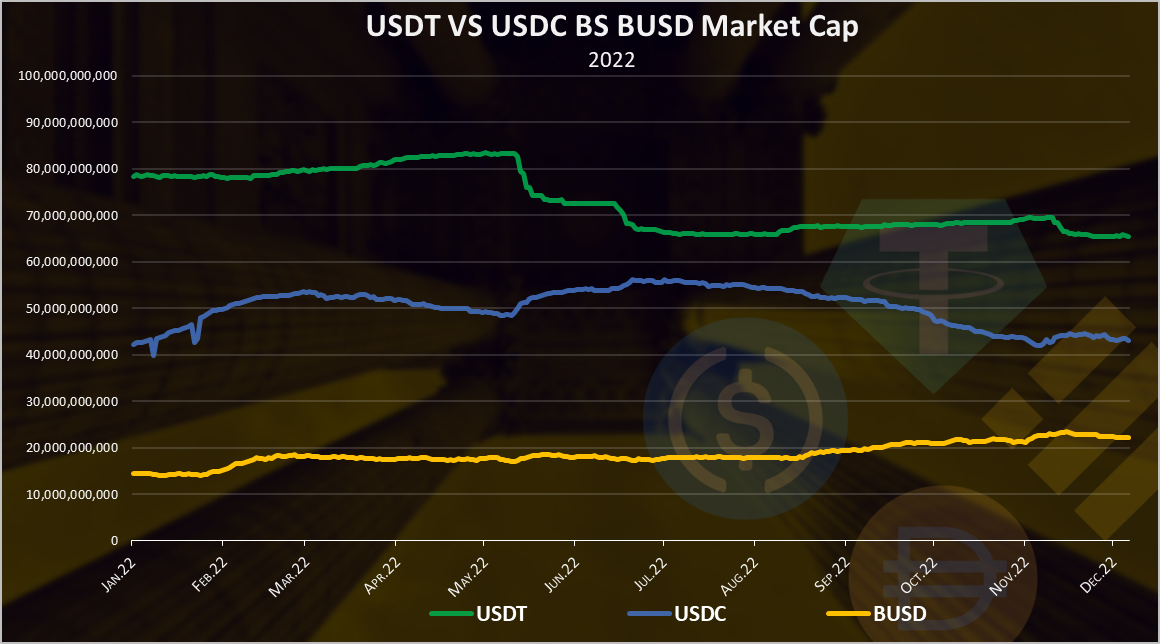

USDT VS USDC VS BUSD

If we compare the top three stablecoins in the year we get this.

USDT and USDC are almost inversely corelated 😊.

BUSD has been slowly growing throughout the whole year.

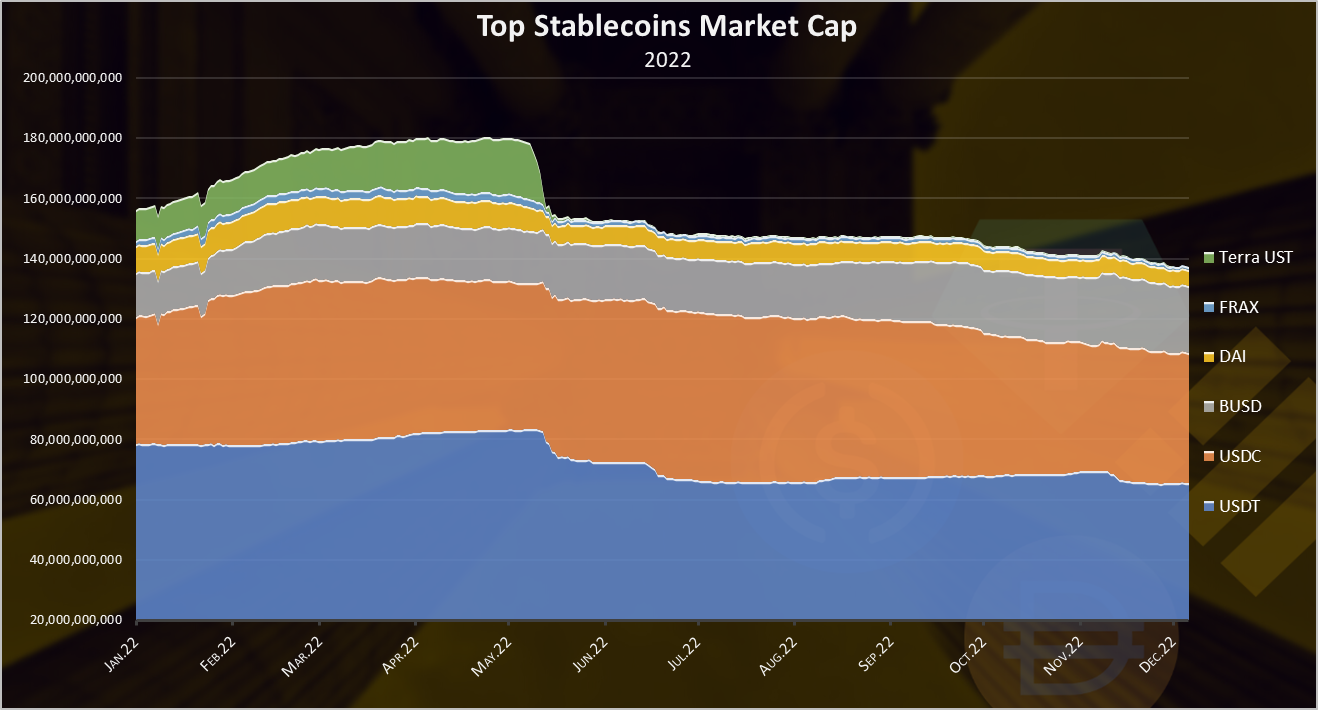

Cumulative Stablecoins Market Cap

Here is the chart for the total stablecoins market cap.

At the peak the market cap for the stablecoins was more than 180B. When TerraUST collapsed it lost almost 30B in a matter of week.

In the last months, the market cap of the stablecoins has dropped as well, but far from what happened back in May. Around 5B in market cap was lost this time.

On a yearly level, the overall stablecoins market cap is down from 155B at the begging of the year to 138B where it is now. A very small drop compared to the overall drop in the crypto market cap.

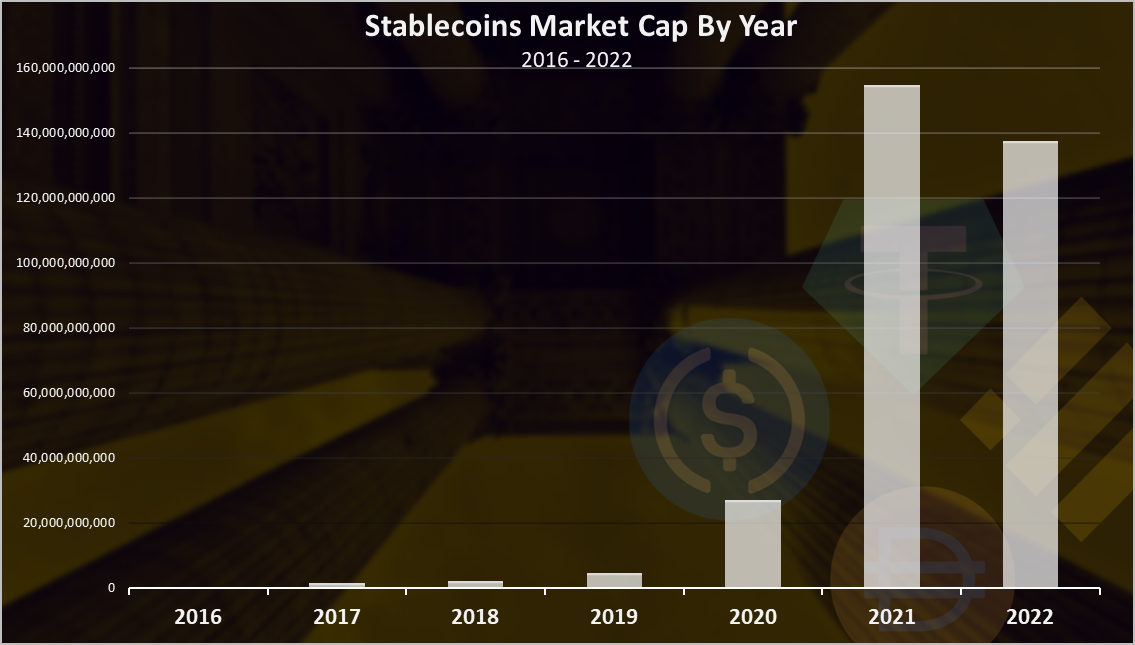

For context on a longer timeframe, on a yearly basis the market cap for stablecoins look like this.

After an explosive growth in 2021, the stablecoins market cap has started dropping in 2022. Will see how will the year end, but obviously the trend is down, alhough much not that much.

For example, the stablecoins market cap has reduced for around 10%, while the top cryptos, BTC and ETH have both seen a drop more than 50%.

Top Stablecoins Rank

Here is the chart for the latest market cap of the top stablecoins.

Tether is still on the top. USDC and BUSD are following. I was on opinion that USDC might flip Tether this year, but Tether is still holding its top position. BUSD is acting like an underdog in the stablecoins arena growing in a bear market.

All the best

@dalz

Posted Using LeoFinance Beta

Can something on this earth be really stable? Maybe not. There are rise and fall but the thing is being strong to rise when fall or better still having some weight to stand in the moment of strong winds,coins or tokens which survive during the time of the strongest blow , stands top to be addressed as stable coins. Tether is showing its capacity and the USDC and BUSD also stood strong I am happy with HBD .

#LeoFinance

Good question :)

NO.

Its just a naming convencion that is used in the crypto industry and that I use here. The more accurate naming for these coins will be USD-pegged coins, since they want to follow the valuenof USD, which by itself is not stable.

HBD FTW!

Yes , USD-pegged coins .

Very true.

Hi i read your whole post. I think we can't trust any coin or stable coin because of luna and ftx crash. People's loses million of dollars in luna and also ftx. In 2010 mtgox default and btc down 15'/' and thr default of ftx btc again down 15'/'. I think everyone wait for the bull market never sale his assets in loss. My portfolio is almost down 90 persont but can't sale single token.

I liked the explanations and didn't even know how to check their values.

I think USDT will stay on the top much longer than anything due to its overall use case, but the bank backs it, and many people don't want to go too far from the bank (YET).

I always appreciate this and thanks for sharing every part of it.

That’s a very good analysis and where does hbd fall in all this analysis. With the recent collapses , I only trust hbd as a real store of value

You shared nice graphics for stablecoins. But I still don't fully trust them.

I like that kind of question, about coins, thank you

If you could answer, it would be awesome as I have a question: What could be a possible scenario when there could be a depeg with HBD?

Like if HIVE drops drastically or some collateral, something like this could effect HBD's USD peg?

HBD can deppeg by design. I have posted about this many times, and most hivers are awere of this. Its called the haircut rule. If the hive debt reaches more than 30%, then HBD is no longer vallued at one dollar. This is a safe mechanisam to prevent UST scenario. When market improves and the debt ia lower, then hbd will be valued at one again.

The rewards earned on this comment will go directly to the people( @dalz ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Binance has been the best exchange this period (best exchange besides being the best exchange as a whole) I am not surprised that BUSD is doing better this period

The idea of stable coins such as Binance USD has enabled investors to hold on to investments in a more stable currency and provides buyers the reassurance that their tokens will maintain stability and avoid the risk of unpredictability such as fluctuating prices. This reduced volatility and widely popular idea will presumably lead to a higher market cap in the future.

Posted Using LeoFinance Beta

This is good analyst,At least we haven’t see negative news about hbd as at this moment ,i only trust hbd out to this stable coins ,and I hope hbd is acceptable soon

Posted Using LeoFinance Beta

in your professional opinion, is it possible for UST to return to $ 1 ?

Like 99.999999% NO.

For UST to return to 1$, the LUNA clasic token need to have market cap more than 10B, to provided the needed colateral.

thanks, this really helps to understand what's going on

HBD will also play an important role in DeFi.

Posted Using LeoFinance Beta

😃😁

Posted Using LeoFinance Beta

Very good 👍👍

Posted Using LeoFinance Beta

@dalz I am a little crypto user. But already hold some coins as like #hive #busd #usdc etc. And soon buy 1000 #hive coin . And it's my target.