How is the second layer solution on Hive doing during these times? Is more Hive deposited or withdrawn from it. Let’s take a look?

Image background generated with Midjoureny

Splinterlands and its tokens and pools are the main ones that drive most of the volume on Hive Engine but there are a lot of other apps and tribes. Gaming tokens seem to be growing more these days.

Here we will be looking at the volume that Hive Engine does in terms of deposits and withdrawals on the platform. It is a nice indicator of the state of the platform.

At the moment there are three major gateways for deposits and withdrawals on Hive Engine:

- Hive Engine (@honey-swap)

- LeoDex (@leodex)

- BeeSwap (@hiveswap)

The fee for deposits and withdrawals on Hive Engine is 0.75% while on BeeSwap is 0.45% and one LeoDex 0.25%.

The period that we will be looking at here is 2022 - 2023.

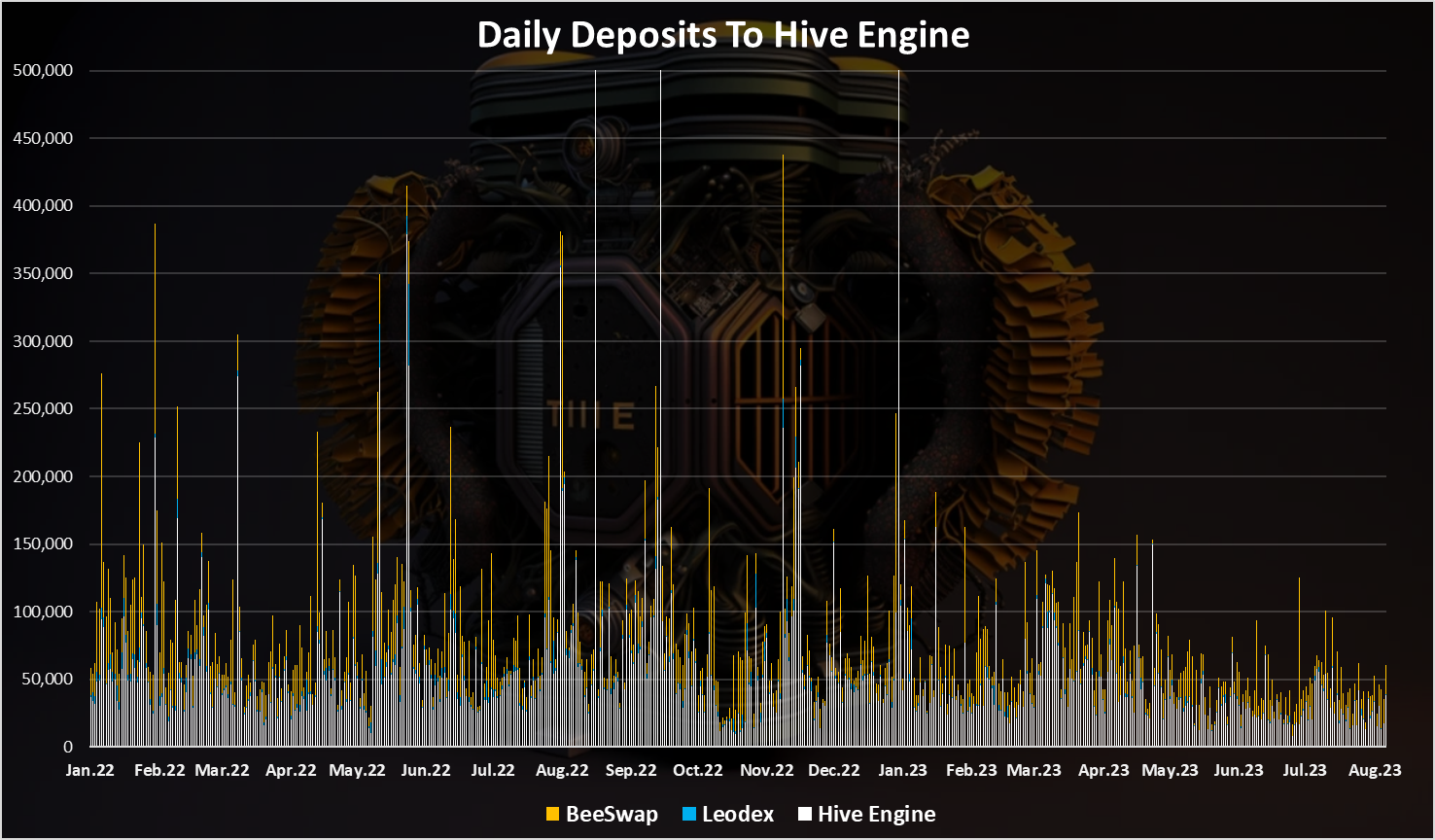

Deposits

For deposits we will be looking at the transfers to the Hive Engine @honey-swap account, @leodex and @hiveswap for BeeSwap.

Here is the chart.

The daily chart is a bit messy with a lot of spikes and ups and downs.

Overall, it seems that the volume has been quite steady with a slow downtrend in 2023. On average around 60k HIVE deposited daily in 2023.

Withdrawals

Next the withdrawals. Here is the chart for the daily withdrawals.

On the withdrawal side we can notice a bit more volatility but still the numbers are around 50k HIVE daily, and some spikes here and there.

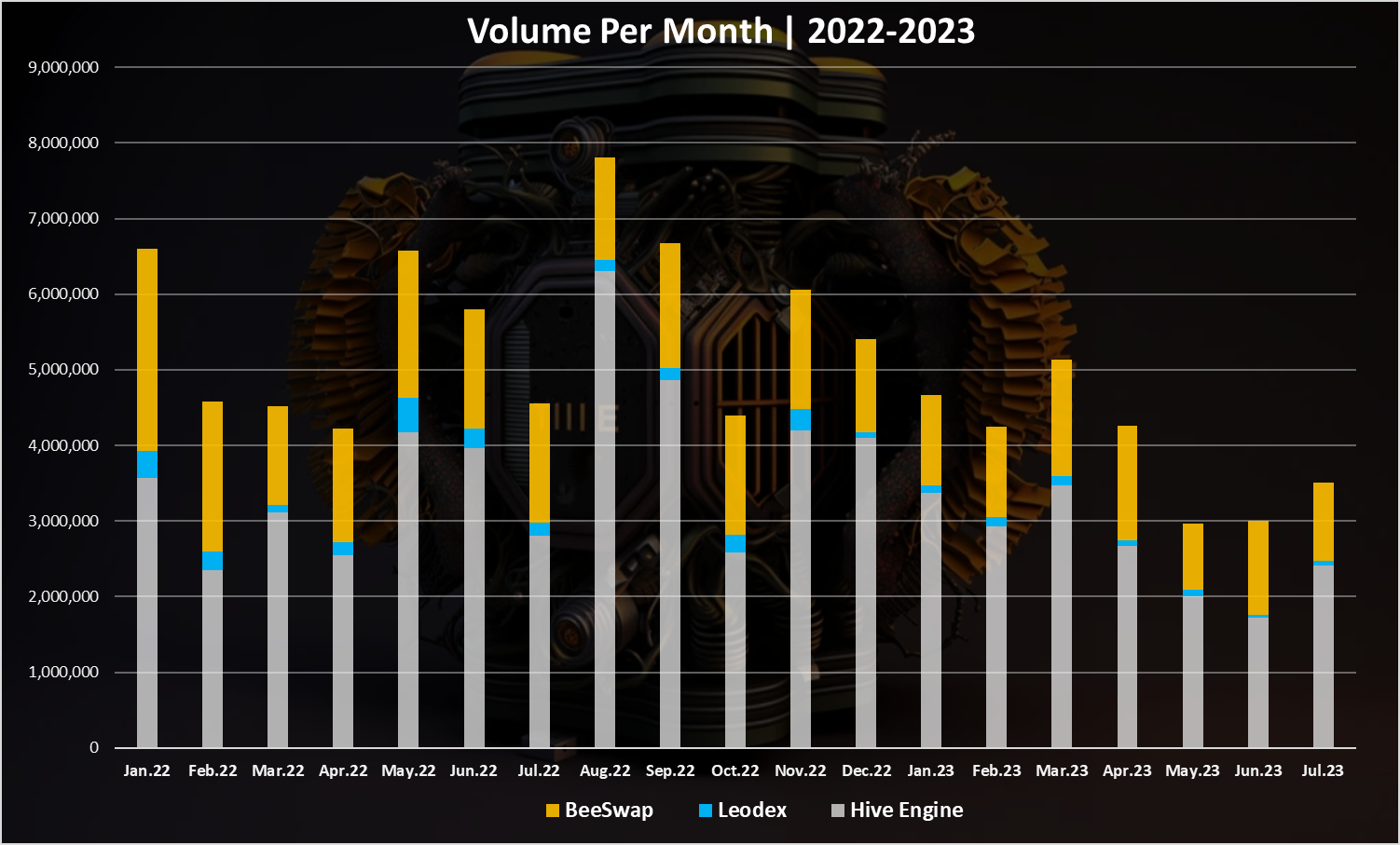

Total Volume Per Month

If we take both the deposits and withdrawals and sum them up on a monthly level, we get this.

This is a bit clearer representation.

We can notice the downtrend in 2023, but in the last month of July there is an uptrend in the volume. The bottom seems to be hit in May 2023. A 3.5M HIVE total volume for the last month.

We can also notice that the official Hive Engine account and the BeeSwap account are making most of the volume, while LEO the leodex has been in decline.

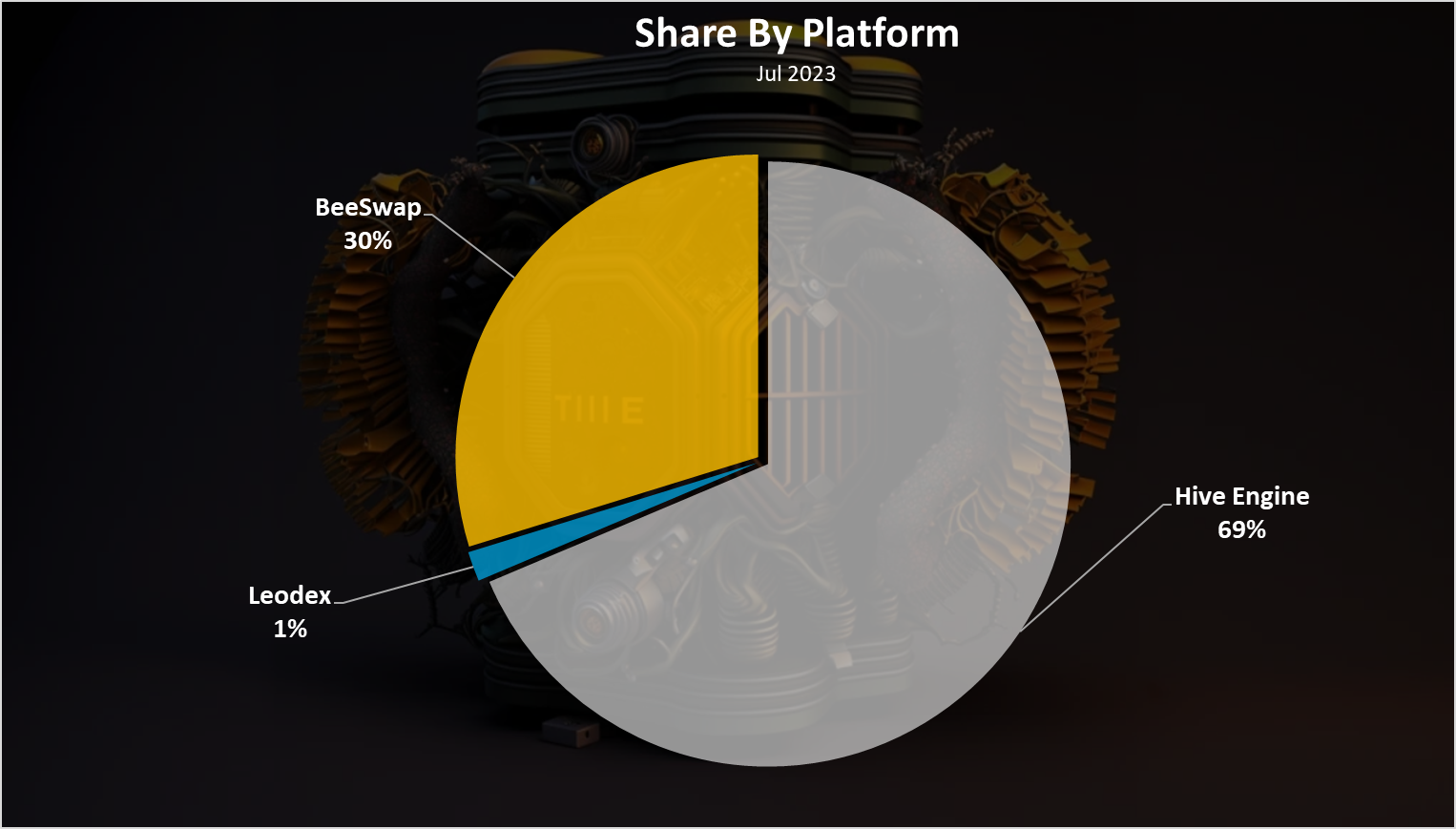

Individual Platforms Share

Here is the chart for the share of the deposits of Hive Engine, LeoDex and BeeSwap.

The Hive Engine account @honey-swap has 69% share of the cumulative volume (deposits and withdrawals). BeeSwap is on the second spot with 30%, followed by Leodex with only 1% for the month.

The official account still holds the majority share, and it is the most liquid of the above. BeeSwap is doing fine on the second spot.

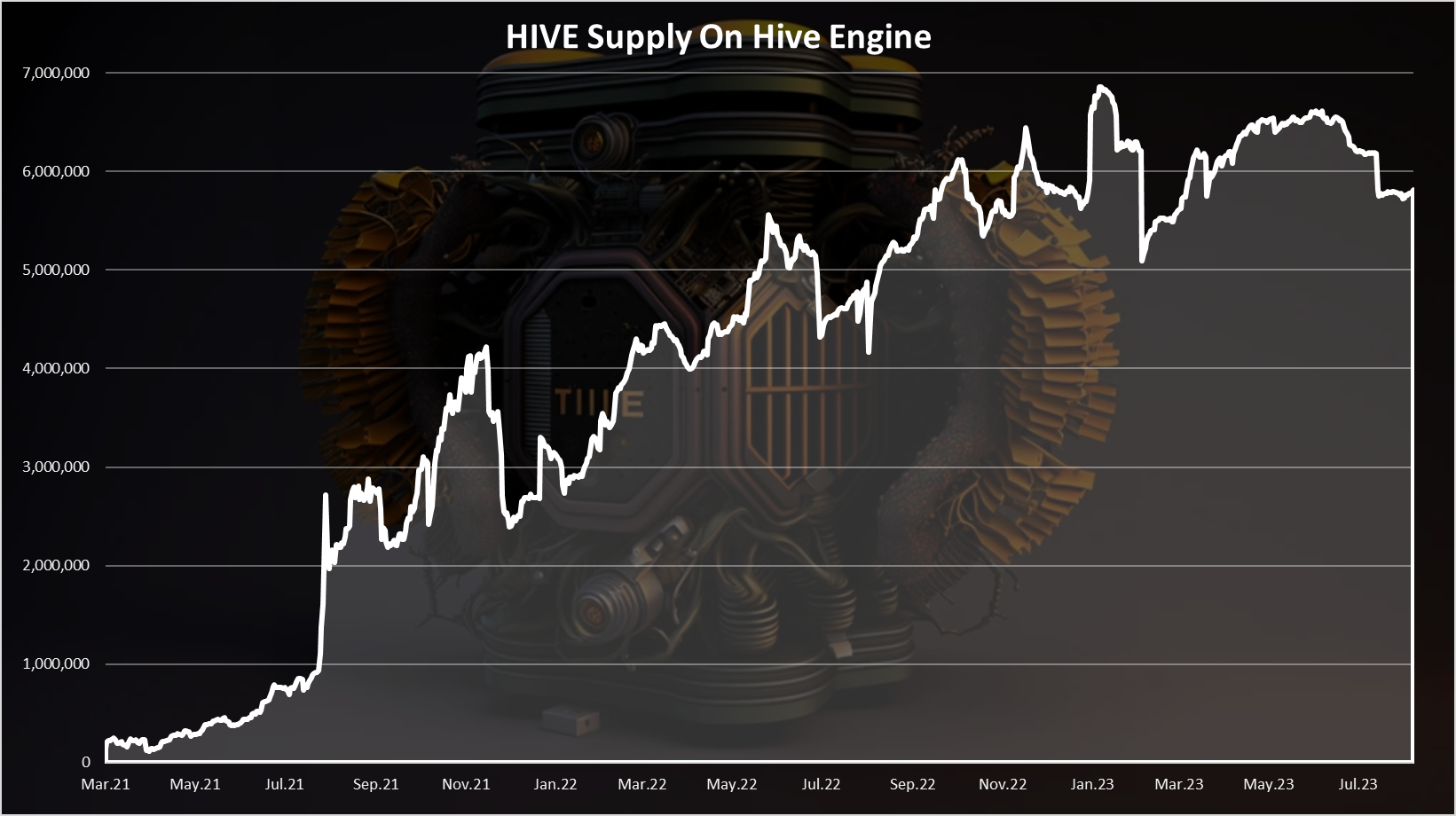

HIVE Supply On Hive Engine

Here is the chart for the HIVE stored on Hive Engine.

As we can see prior to June 2021 there was under 500k HIVE deposited on Hive Engine. Then it started to grow and with a few dips on the way, it has grown almost constantly to almost 7M at the end of 2022. There was a sharp drop in January 2023, a slow growth again up until May, and a small drop again just recently in July 2023.

A total of 5.8M HIVE now on Engine.

With this growth Hive Engine is now positioning itself as one of the major place for HIVE liquidity and as a number four exchange for HIVE. Bittrex is now close to it, with 7M. If it surpasses it soon, it will become then no.3 exchange for HIVE, just after Upbit and Binance.

Top Pools

Here are the top pools:

As we can see the top four pools are all Splinterlands related, then come the HIVE-ETH and HIVE-BTC pools. Some more pools in the top like the BEE token, LTC and the SIM token.

In terms of TVL in pools Hive Engine has been around 4M for a while now.

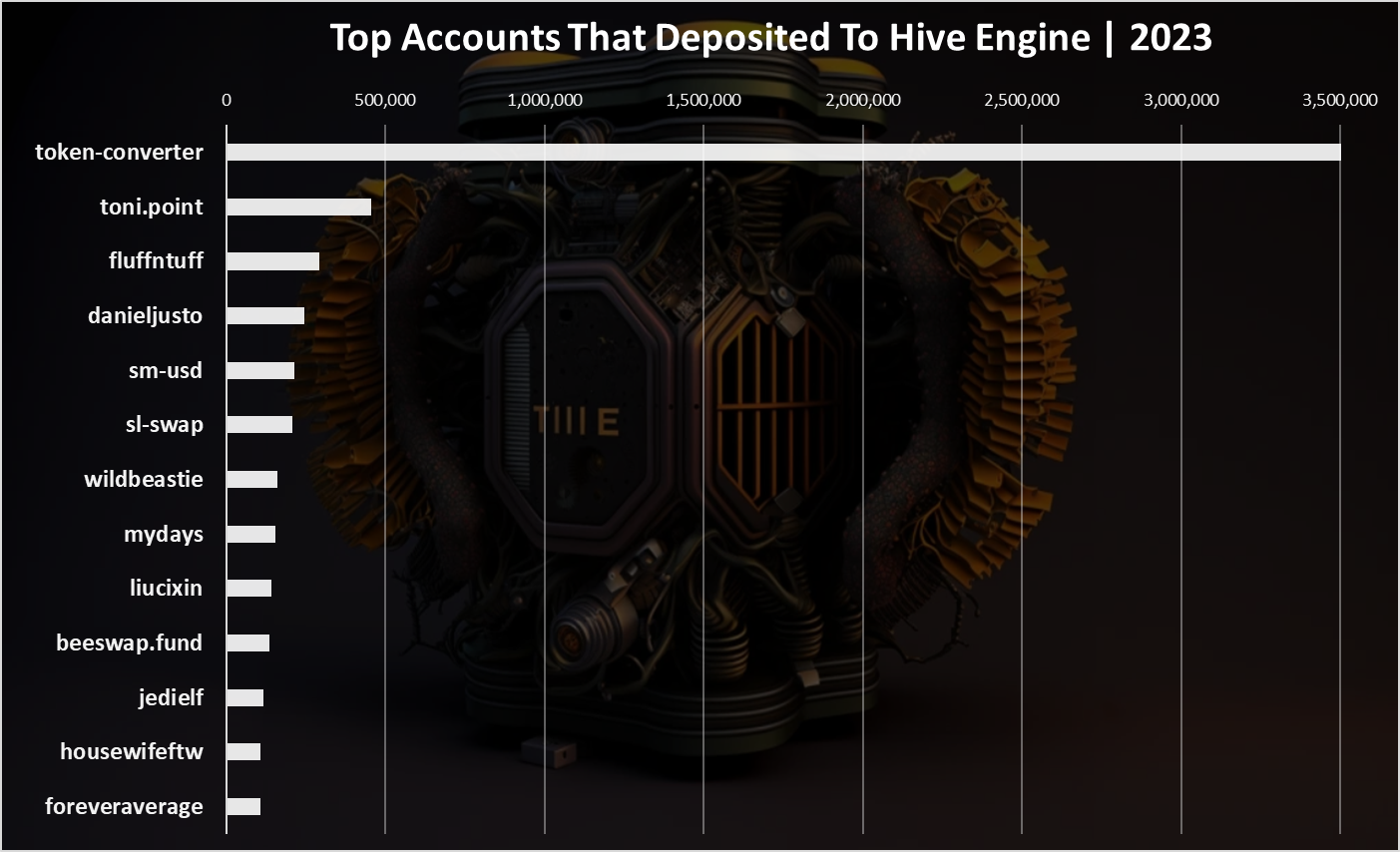

Top Accounts That Deposited

Here is the chart for the top accounts that deposited in 2023.

Note that these are not net deposits.The @token-converter account is on the top with more than 3.5M HIVE deposited in the period. This is an account that is connected with Splinterlands and their inner workings.

The @toni.point on the second spot with more than 450k HIVE, taking care of arbitrage 😊.

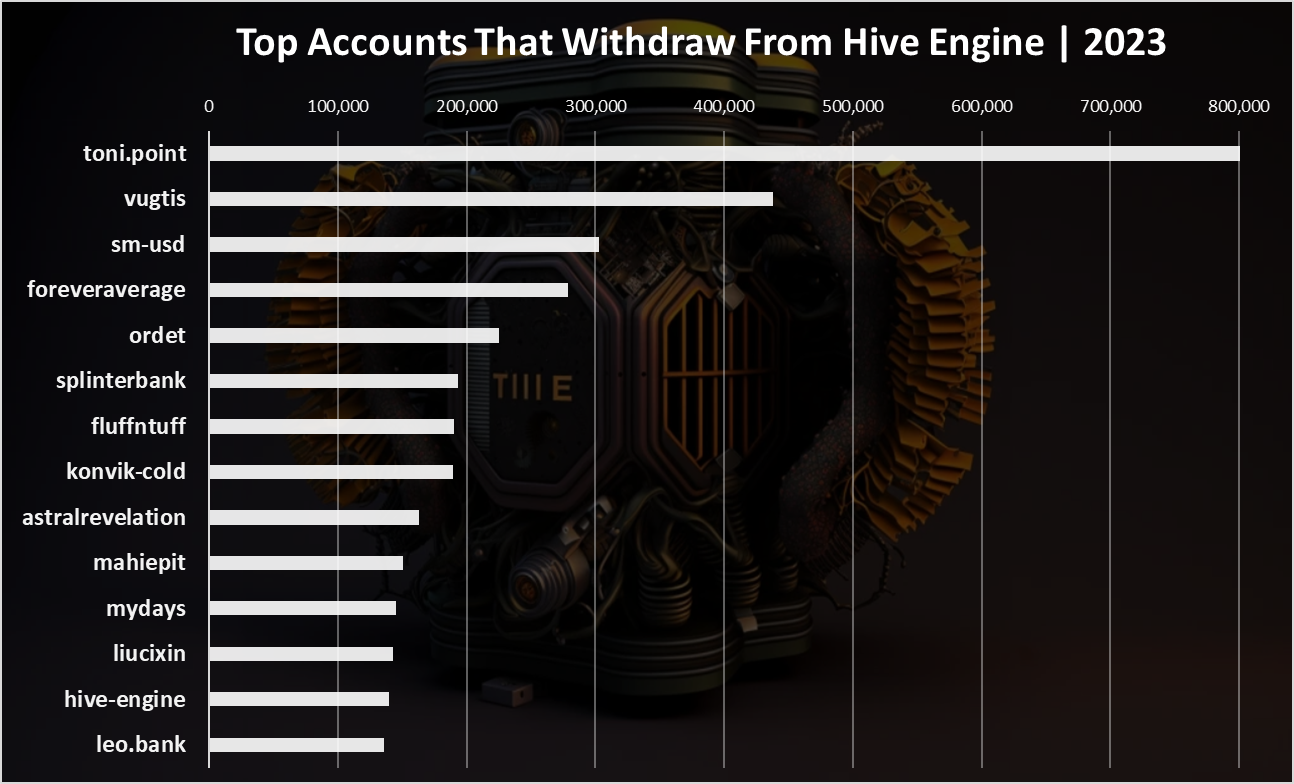

Top Accounts That Withdraw

Here is the chart for the top accounts that withdrew in the period.

@toni.point is on the top with 850k HIVE withdrawn in the period, making arbitrages. The @vugtis account follows closely with 440k HIVE.

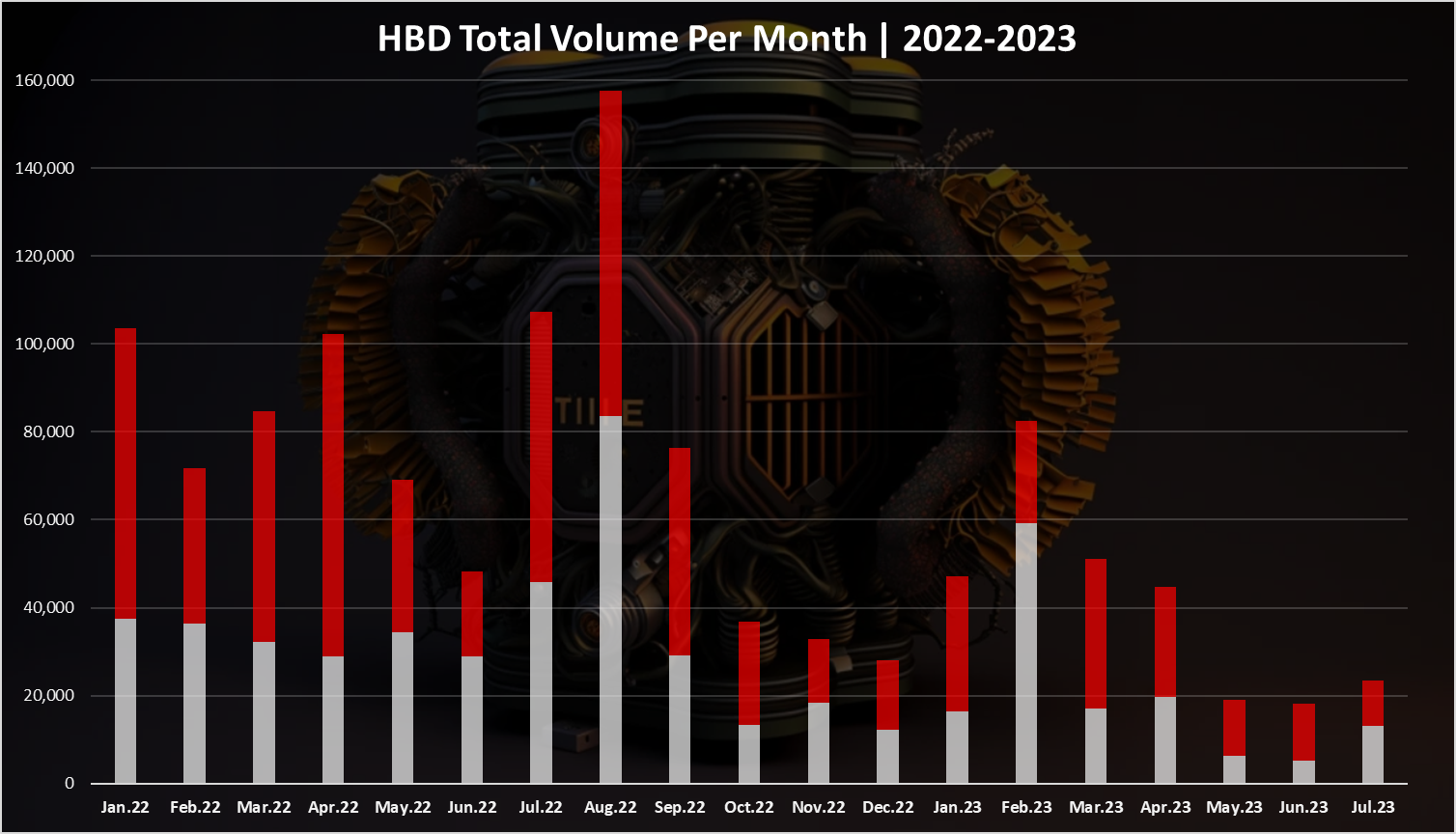

HBD

What about HBD? HBD has been growing in adoption recently. How is the volume for HBD?

Here is the monthly chart.

Some ups and downs in the period with ATH were reached in August 2022 with a total volume of 160k HBD.

In the last months the HBD volume on Hive Engine is low, with around 20k HBD monthly.

There are few HBD pairs on Hive Engine with a decent liquidity like the HIVE:HBD, BEE:HBD and HBD:BUSD.

All the best

@dalz

Posted Using LeoFinance Alpha

Thanks for the great overview Dalz. Things looking pretty steady there. Do we know the total $ value of all tokens currently on the HE?

I also use uswap,app which has dynamic fee structure, do they have much volume?

Uswap has quite nice volume. Unfortunately, a lot of swap accounts were not included in the post.

This is the HIVE/SWAP.HIVE volume of major swap accs in the last 30 days.

hiveswap: 1,238,730.937 (4777 txs) kswap: 1,023,747.938 (2946 txs) uswap: 601,120.156 (2308 txs) bswap: 200,017.455 (580 txs) leodex: 27,032.846 (543 txs)I know the fees used to be quite favourable at 0,1%, but seem to have increased now. Thanks for the overview.

Interesting :)

What is the diffrence between kswap and uswap?

Kswap has dynamic fees and behaves like a liquidity pool with fee being in the range from -0.5% to 0.5%. So if there is low balance of Hive, users are more incentivized to provide HIVE liquidity and more discouraged to take HIVE liquidity.

Uswap now has fixed fee&reward. If there is low balance of Hive, users receive fixed 0.32% for providing Hive and pay 0.43% for taking Hive.

Thanks!

Care to share links to these apps?

https://kswap.app https://uswap.app

Tnx!

Just used them .... will add them in future post

Hello, there is enough HP in your account. Why don't you consider this?

Hey, just wondered how much profit are you making from all your accounts ?

The pools only are around 4M in TVL. The value of all the tokens is more.

Seems like it's going pretty well and I was actully surprised with some of the top liquidity pairs being BTC and LTC wasn't expecting that. I'm curious did you run into any data with Axie? I though that was their largest pool with a few million bucks worth in it last I checked?

As always appreciate the charts and insight!

The data for that one was bugged and it was showing a huge ammount. There was never that much liquidity in that pool

The Hive.Pizza team manually curated this post.

Please vote for pizza.witness!

It seems that Beeswap is gaining market share.

I think one of the reasons why they got market shares was because they were giving out BXT to people who swapped using their swap.

They have stopped this and is now giving swap.hive instead.

Not sure if this have affected the market share

The overview looks great. Thank you for sharing this

Interesting to know. Hive's second layer with dex is really offering great utility and use case on the blockchain. Hive is a hidden gem.

I guess a lot of people deposited in the Hive engine

Kudos to you and thanks for sharing this!!!

Awesome overview here but seems the fees have increased now

Thanks for this

You have shared always very great and important posts for the hive community. Every attach with each other. I am not using these exchange's but in future i would like to use it soon.

My HIVE Engine rewards in terms of HIVE decreased last month.

Wow such a busy analysis over the period..things are really growing especially with various deposit

I have been struck by the fact that the supply of Hive in HE has decreased in recent months, indicating either a lower demand for tokens or a greater reliance on the mainnet. I have also been surprised by the large volume of deposits and withdrawals being made each day, which demonstrates the usefulness and functionality of Hive Engine. Excellent work!

Damn, toni.point is killing it :D