The markets are absolutely crazy now with FUD out of control. The overall situation in the economy seems to be the major thing to blame, and then we add some crypto specific things on top of it like LUNA and UST to make things even worse.

Meanwhile the Hive witnesses have made a bold move to increase HBD APR to 20% a month ago. The Leofinance team has embraced this and made a bridge to Polygon and the Polycub app.

HBD has been know as a notoriously hard to get with a low liquidity on the both sides. This has made it easy to move in the both direction with just a small amount of capital.

Has the situation improved in the last months. Lets take a look!

HBD is known for the extremely low liquidity. It is listed only on two exchanges Upbit and Bittrex. Bittrex has been down in the last period, and on Upbit is only for Korean KYC users. This leaves most of the Hive user base with almost zero options for buying HBD on a CEXs. At the moment it is mostly available on the internal Hive DEX, where users can buy HBD with HIVE, Hive Engine and since recently Polycub.

Here we will be looking at the historical data for liquidity and the trading volume for HBD on the different platforms as:

- Upbit and Bittrex

- Hive DEX

- Polycub

- Hive Engine Pools

For Upbit and Bittrex we will be using the data for Coingecko. More then 95% of the trading volume for this data is from Upbit. For the trading volume on the internal DEX we will be using the records from the transactions recorded on the blockchain, same as for the Hive Engine pools.

The period that we will be looking at is Jan 2021 till May 2022.

Liquidity

First let’s take a look at the liquidity, or the available supply on the different platforms.

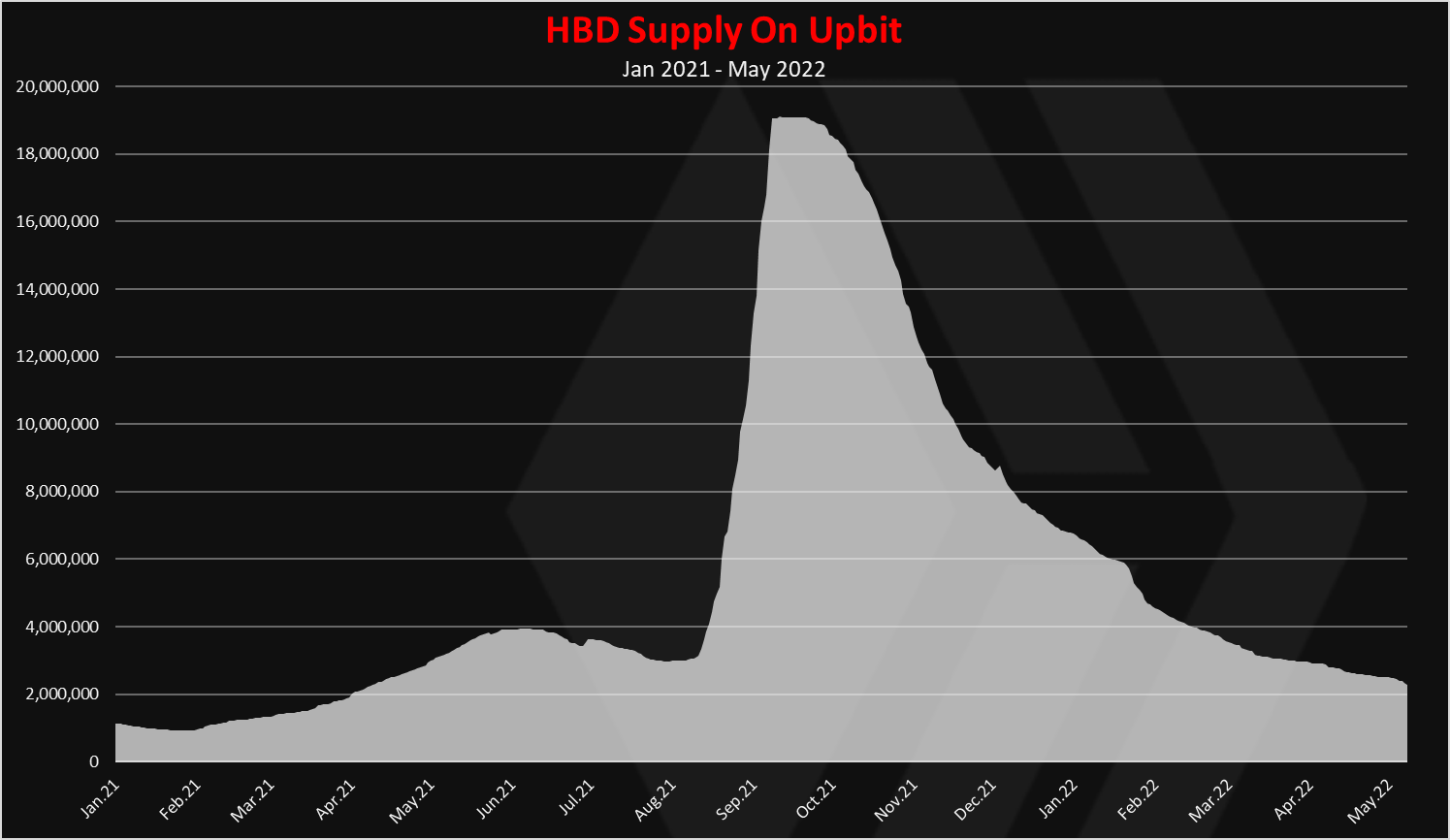

HBD Liquidity On Upbit

First the chart for Upbit.

This is quite the ride for the HBD supply on Upbit. At the end of August 2021 there was an increase in the price of HBD on Upbit that caused a lot of HBD to be transferred there. More than 15M was transferred to Upbit in a period of few weeks reaching 18M HB supply on Upbit. Since then, the HBD supply on Upbit is in downtrend and the current supply is just 2.2M HBD.

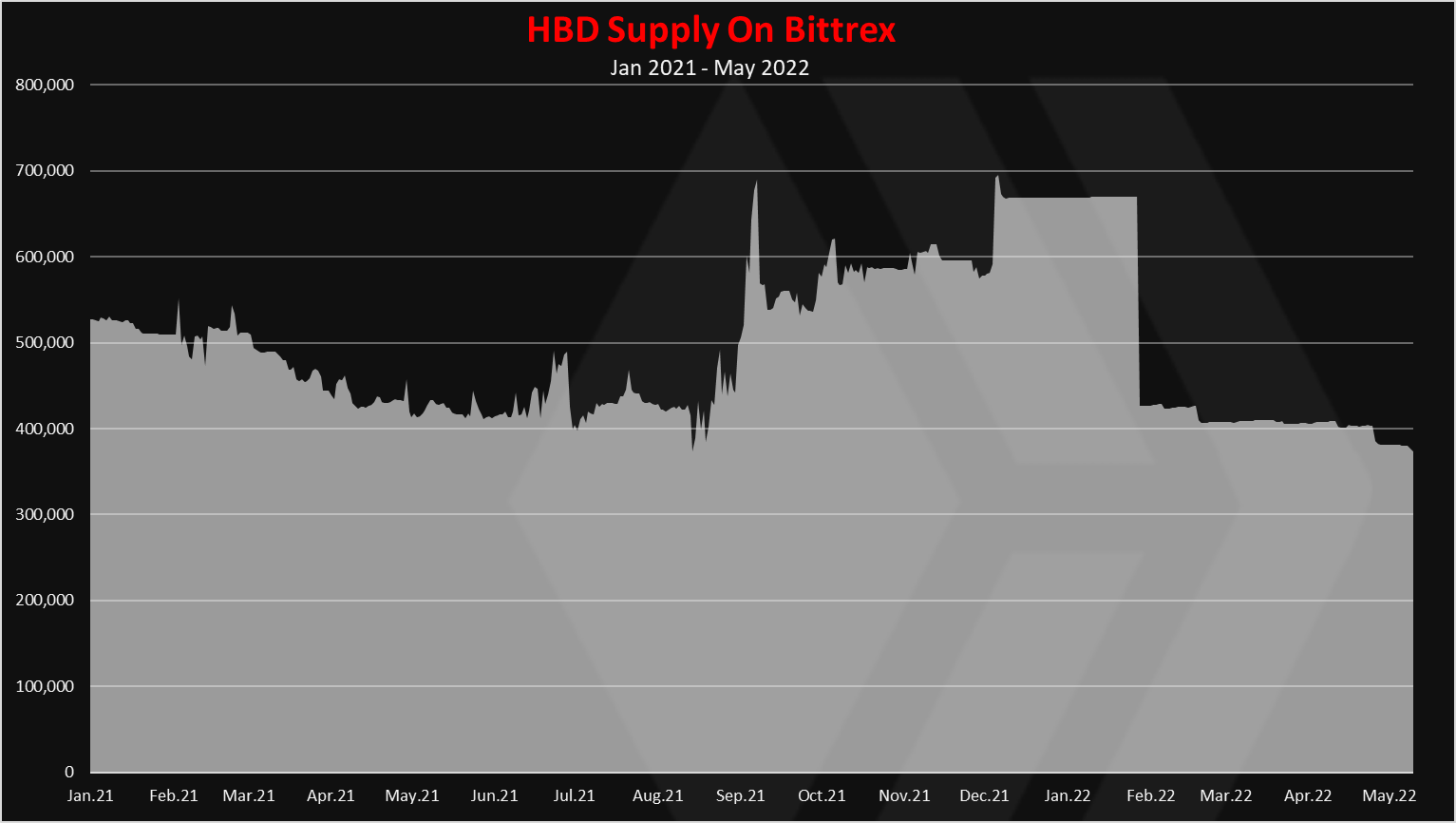

HBD Liquidity On Bittrex

Next let’s take a look at the second CEX where HBD is listed, Bittrex.

A steadier numbers here with the supply in a range of 400k to 700k HBD. Just bellow 400k now.

Starting from December the withdrawals and deposits for HBD on Bittrex has been on pause and there is almost no activity there now.

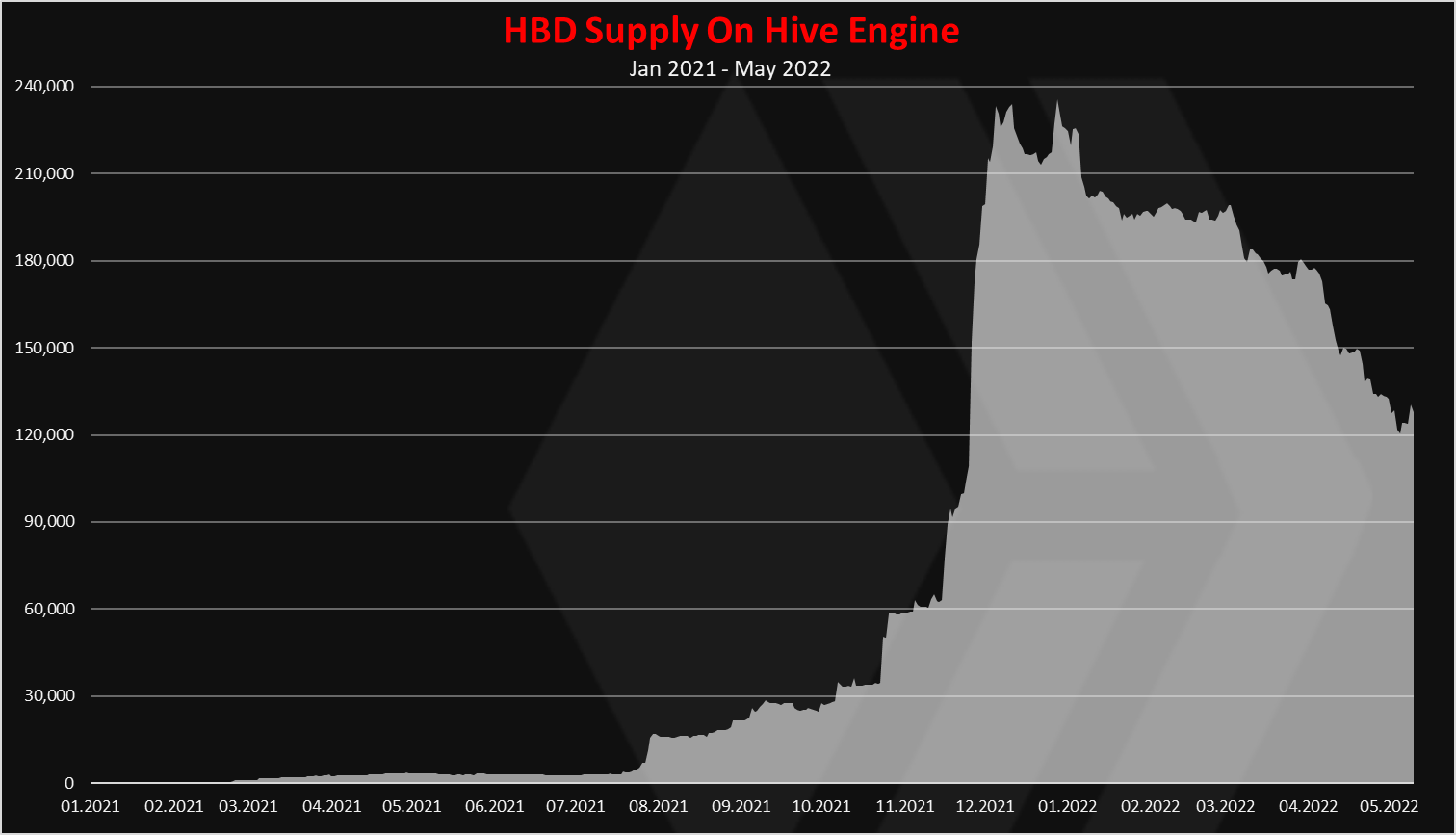

HBD Liquidity On Hive Engine

Now lets take a look at the Hive L2.

The Diesel pools on HE have been active for some time and have increased the overall activity a bit.

As we can see the HBD supply on HBD started increasing in August 2021 and has especially increased in November. This seems to be connected with the launch of Splinterlands SPS token, and then later with the launch of the BeeSwap BXT token that incentives the HBD pools on Hive Engine.

The BXT token has especially improved the HBD liquidity on Hive Engine. While the liquidity has improved it is still low with around 120k HBD in all the pools with the HIVE:HBD and HBD:BUSD. In the last period there is a downtrend for HBD on Hive Engine, most likely because of better APR on savings and Polycub.

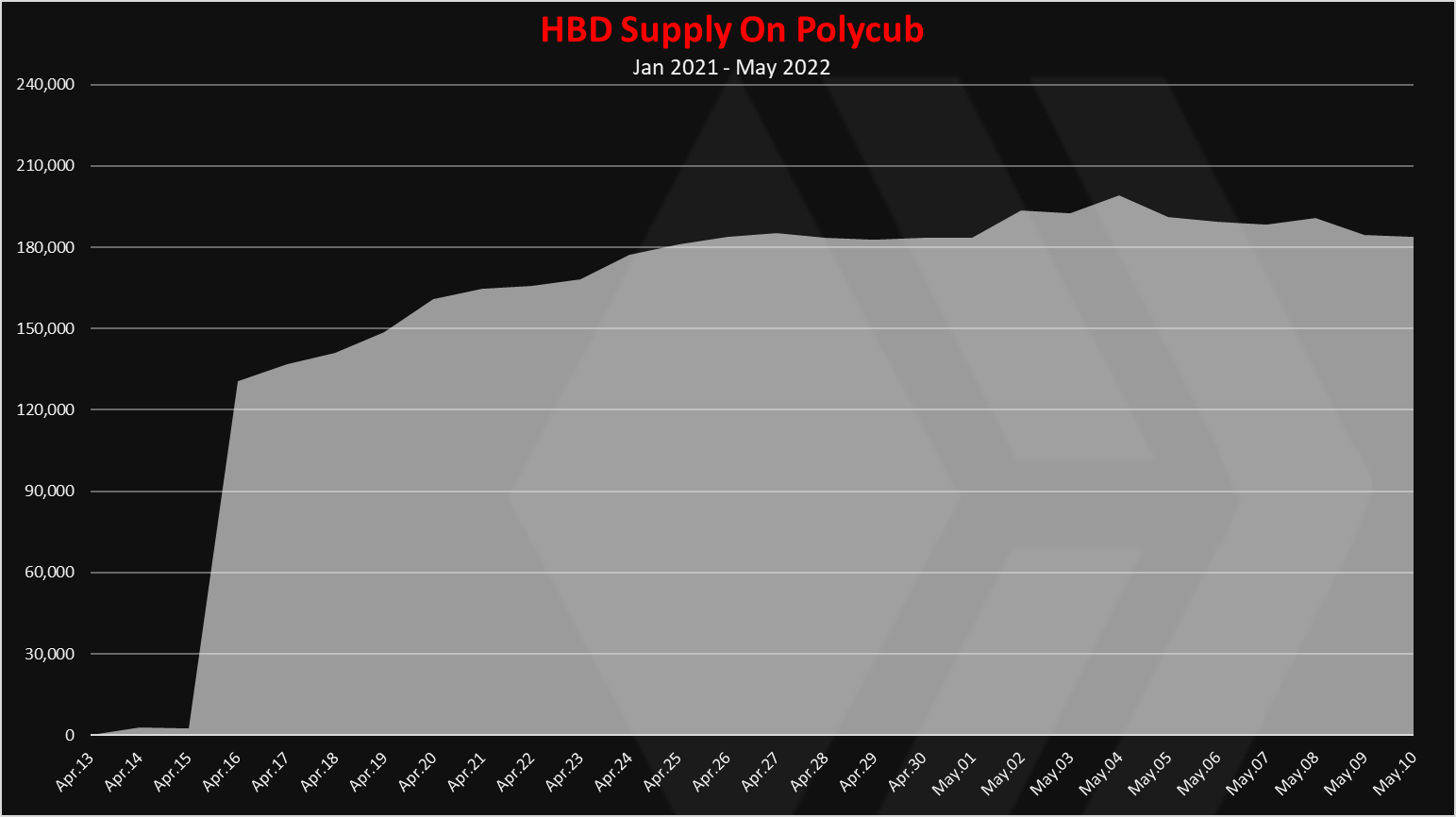

HBD Liquidity On Polycub

The pHBD:USDC was created on April 15th. Here is the chart since then.

We can see that the amount of HBD converted to pHBD grew fast at first, but then slowed down. At tg moment there is 185k HBD on Polycub.

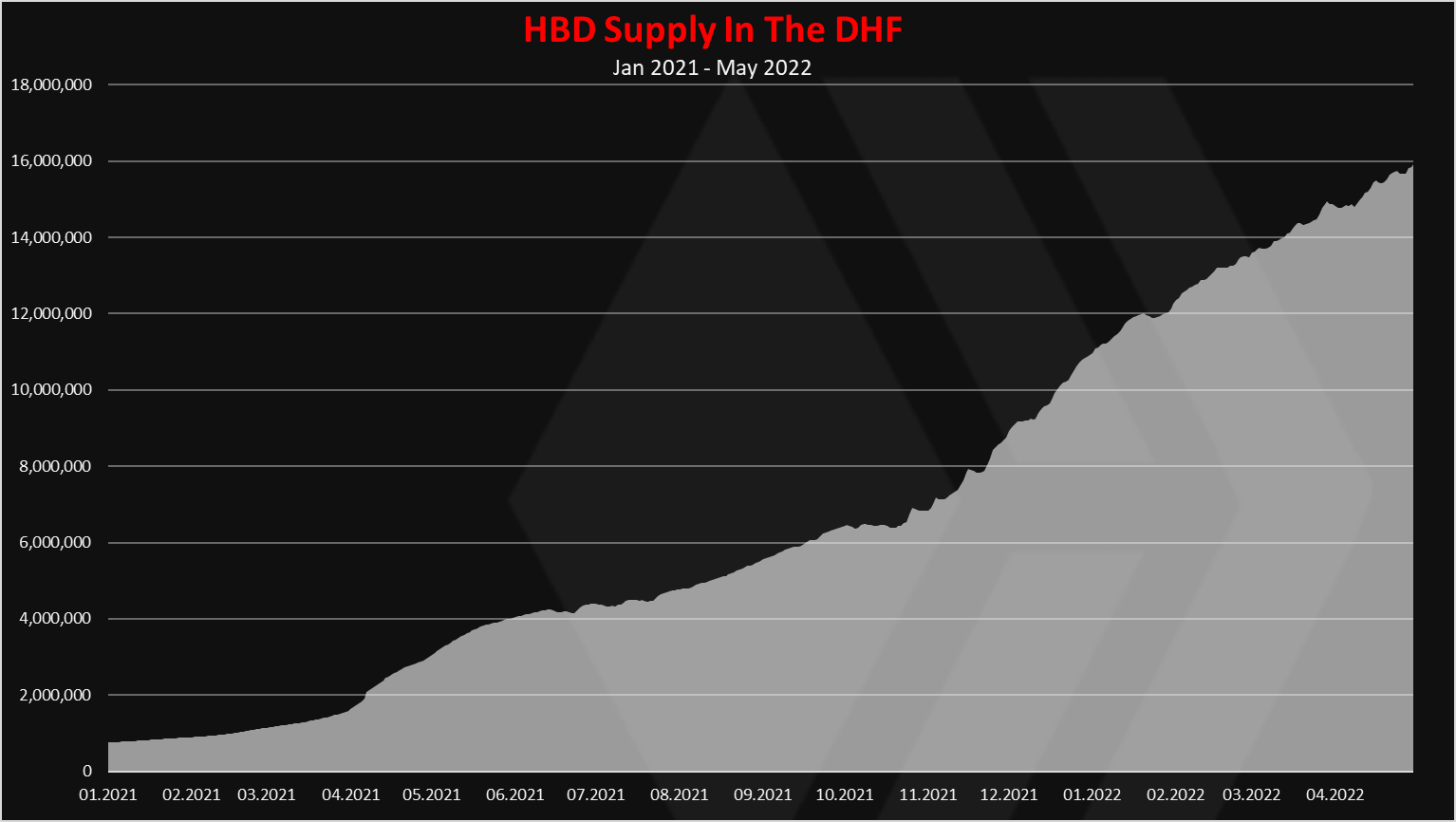

HBD Liquidity In The DHF (@hive.fund)

In theory this HBD is not for sale, but if the price of HBD goes above $1 on the internal DEX, the @hbdstabilizer will start selling some of it on the DEX.

Here is the chart for the HBD in the DHF.

The HBD supply in the DHF keeps growing and now we are now at 16M

Last year this time the DHF had around 3.5M holdings and 35k daily budget, while the stabilizer budget was less than 10k. HBD. This makes the @hive.fund the biggest holder of HBD. As mentioned not all of it can be used for trading, and in theory the DHF can pay a max of 1% of its holdings per day. The stabilizer asks for 240k HBD daily, and since the budget is around 160k, it receive the maximum minus the sum for the other funded projects.

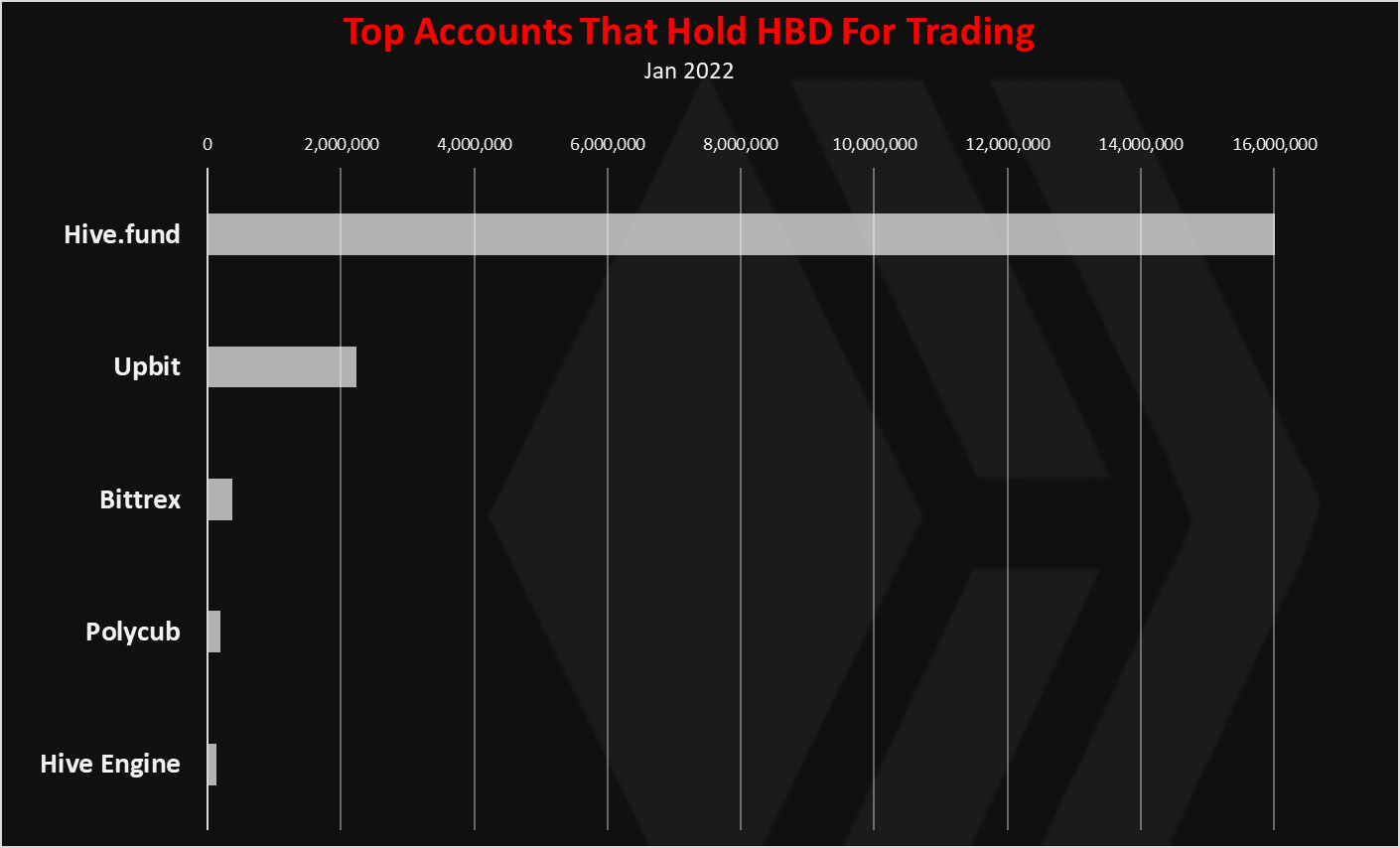

When we rank the above, we have this.

The @hive.fund is dominant now, followed by Upbit, Bittrex and then Hive Engine. A year ago Upbit was no.1, and Hive Engine was non existence. There has been some small improvements in the HBD liquidity.

Trading Volume

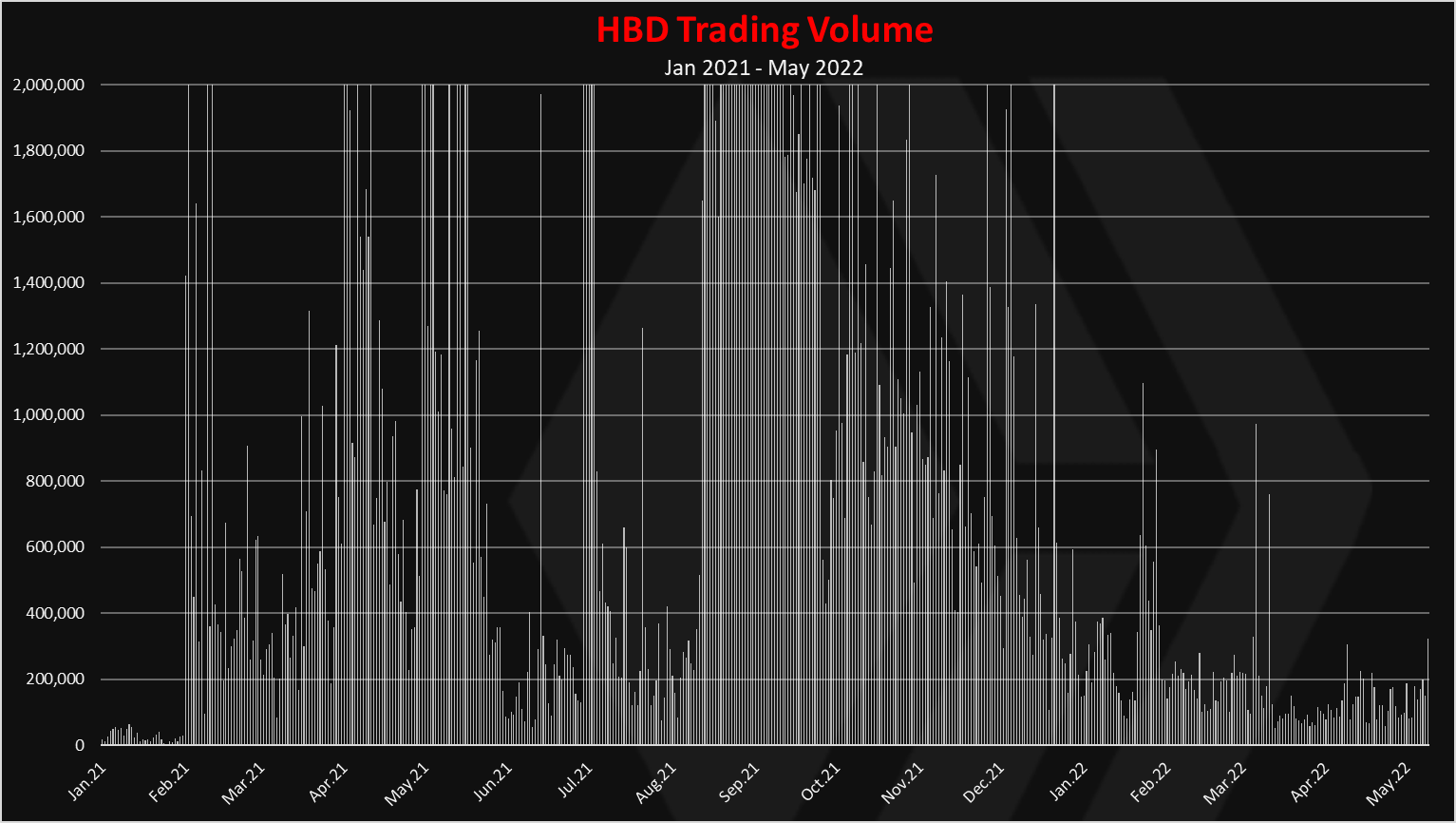

The data above was about the HBD holding on the different platforms where it can be bought. What about the actual trading volume. Here is the chart for the overall daily trading volume for HBD.

A lot of spikes in the chart. We can notice the large daily volume at the end of August 2021. Again, this is the period where there was an up pressure on the price of HBD on Upbit. On some days there is more then 15M daily trading volume. In the last period the trading volume is less then 1M HBD per day, and we can notice a slight increase in the last days.

Where does the trading volume comes from?

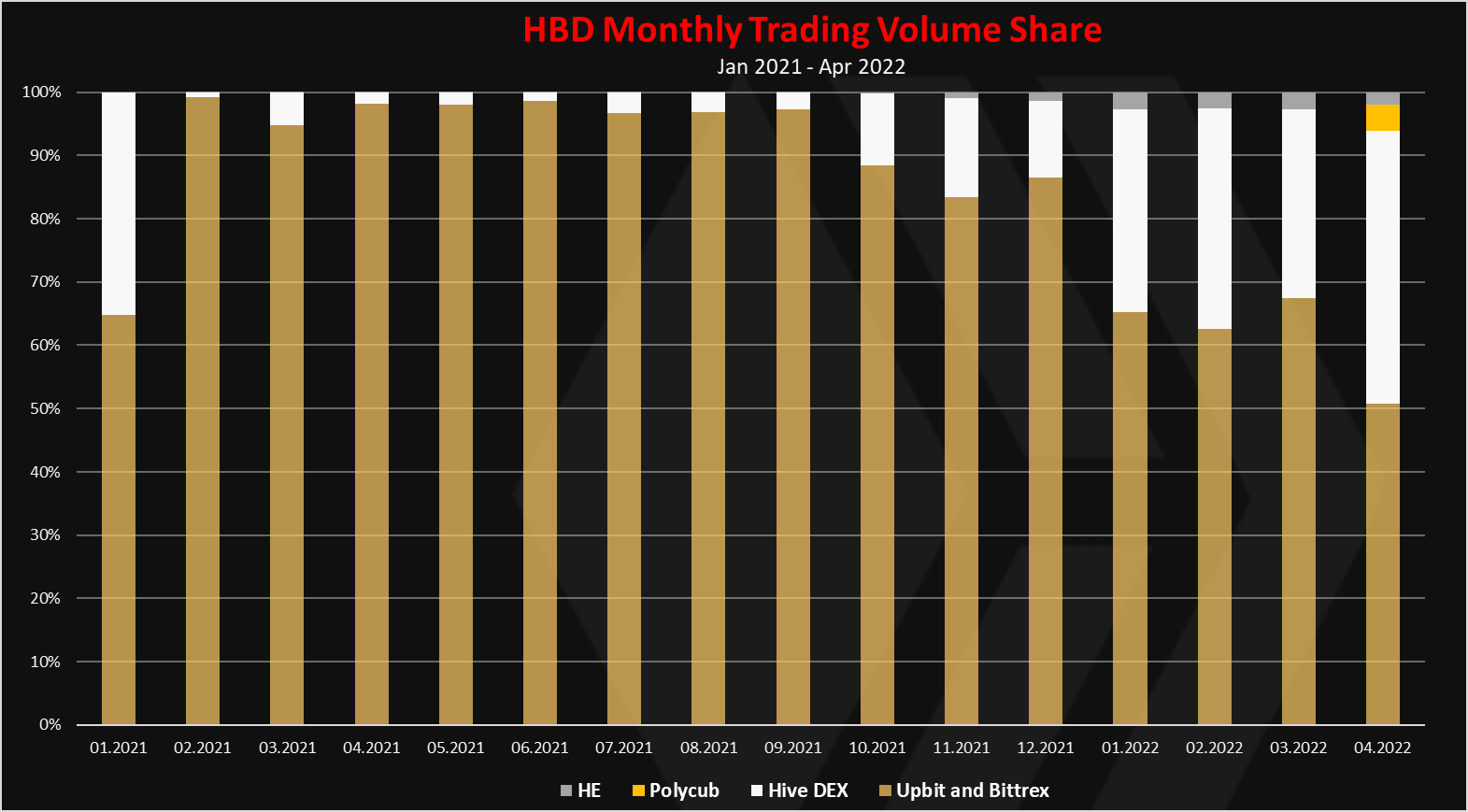

Here is data for the monthly trading volume share.

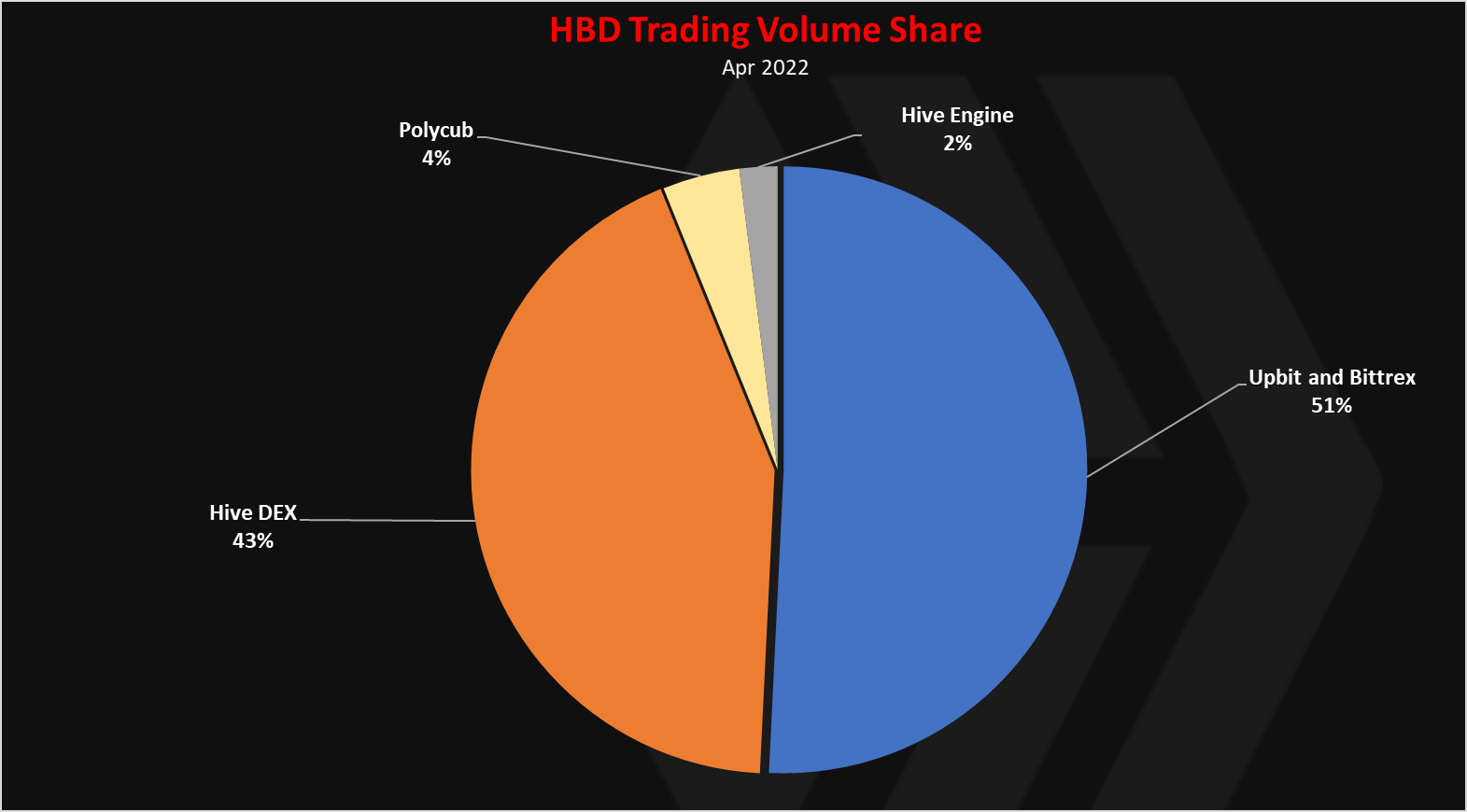

We can notice here that in the last months, the share for the trading volume for HBD has increased on the internal DEX, that for April 2022 accounts for 43%.

We can notice the Polycub emerging in the last month, but the share is still small. Also HBD on Polycub was live for half the month. Hive Engine also has small volume.

On average in the last 30 days the trading volume on the Hive DEX and Upbit has been around 65k HBD HBD daily, each.

For April 2022 we have this pie.

Upbit is still dominant in April 2022 with 51% share, followed by the internal DEX and then Polycub. However in the first days of May, the internal DEX has more volume then Upbit and it will take the no.1 spot for trading HBD. It is worth noting that Upbit speculators seems to lost interest in HBD in the last months, and the supply and trading volume keeps going down, while the numbers on the internal DEX keep going up, especially with the increased holdings and the budget of the DHF.

The internal DEX now is positioning as the no.1 HBD liquidity provider as the DHF holds dominant position for HBD and the @hbdstabilizer has more than 150k HBD daily budget. Upbit is on a downtrend, but you can never know with that exchanges, as sometimes massive volumes in millions per day seems to come from nowhere. Polycub is the new kid on the block for HBD and it has a decent volume, but still has a room to grow. For a regular user it might be the easiest way to get some HBD and with a 400k liquidity pool, one can make swaps in a few k, without big slippage. Hive Engine pools are on the downsides as competition from the savings account and Polycub is taking HBD in.

All the best

@dalz

Posted Using LeoFinance Beta

What is your opinion on the proposal to back HBD with bitcoin, after what happened with UST?

I think aditionaly backing HBD with external funds should be done with some mix between usd reserves, btc and maybe something else

HBD is not dollar backed or bitcoin backed, it is Hive Backed Dollar- or Hive Blockchain Dollar. Here is what should happen. If the dollar drops, the value flows back to HIVE. If Bitcoin rises, Hive also rises, either because users sell HBD or because inversely BTC rises when the US dollar falls. Either way, the internal swap mechanism is for "a dollar worth" either direction now.

If we back with USD are we not closer to the regulators?

Right :|

Not with usd in the bank, but some other stable like USDC or maybe preferebly DAI

Slow growth has a more consistent approach than quick growth, adding on top how many perceive the situation with UST.

HBD has the community support.

I wish not to see what I saw next door.

Great to see more DEXes will give it a home to thrive.

!BEER

Posted Using LeoFinance Beta

Man timing on the dump for the growing HBD interest wasn't great, but we'll probably hang in there, Hivers are no strangers to down times.

Posted Using LeoFinance Beta

Yea the timing was not as great :)

Eh we will scramble on...

.

To my knowladge no, but HBD has such a low marketcap its probably not worth it to go to them ATM.

Maybe at some medium sized ones. As for Coinbase it would be nice if we get HIVE there first.

So how bad will the current price of Hive be affected, considering the stabilization mech.

Also, at what value of Hive will the peg become unsustainable?

Posted using LeoFinance Mobile

Keep in mind the haircut is going up in the next hard frok.

Posted Using LeoFinance Beta

When you day "going up", does this mean that Hive requires a higher market cap to maintain the peg?

I mean, currently total market cap of Hive has to be at least 10X HBD, so does going up mean Hive market cap has to be higher than 10X?

Posted using LeoFinance Mobile

Check this

https://hive.ausbit.dev/hbd

Interesting. We're still safe for now then.

So many dynamics with crypto, HBD be doing most now. Some people are converting to take advantage of the dip using their HBD, another benefit of having HBD saved 😊

Posted using LeoFinance Mobile

It is really nice seeing HBD maintain it stability despite the dip in the crypto market.

Posted Using LeoFinance Beta

Nice seeing HBD healthy and doing just well amidst the dip. This times are really revealed true stable coins. As for PolyCub, I hope to see the liquidity improve much further as it concerns pHBD

Posted Using LeoFinance Beta

Hopefully we get to see more trading volume on Polycub, maybe in another 2-3 months Polycub will be hosting much bigger trading volume than it is now.

Posted Using LeoFinance Beta

Need to get more liquidity in there. It is growing and will take some time.

Give it another month and it will be interesting.

Right now, the first target is $500 in the LP.

Posted Using LeoFinance Beta

"In theory this HBD is not for sale, but if the price of HBD goes above $1 on the internal DEX, the @hbdstabilizer will start selling some of it on the DEX."

So it's for sale. :-)

What is the mechanism for sustaining the HBD price around the dollar? Do they sell HIVE and buy HBD when HBD <1$?

Yes from the hbdstabilizer and the dao funds. Additionaly there are the conversions. The blockchain will give you a 1$ worth of hive when converting.

But this goes only until the debt limit is reached ... after that hbd is no longer worth 1$ by design

Just that crypto currency and stock market are really selling now. We should understand that what ever that bull will still come down. What we need now is patience.

Posted Using LeoFinance Beta

Very lucidly written. Thank you.

Are you saying this is a trip?

Timothy Leary was ahead of his time.

And so was every acid tripper in the 1960s.

Posted Using LeoFinance Beta

With more liquidity and the growth on poly i can foresee a jump in the native token Hive. I mean that's the goal right. If we can have HBD easily obtained and in the hands of the end user it would most likely make things a lot easier for the ecosystem to garner more attention. Thanks for the post @contentisking 🤩🤩🤩

Posted using LeoFinance Mobile

~~~ embed:1524715356149133313 twitter metadata:a2l6dW5hc3BvcnRoaXZlfHxodHRwczovL3R3aXR0ZXIuY29tL2tpenVuYXNwb3J0aGl2ZS9zdGF0dXMvMTUyNDcxNTM1NjE0OTEzMzMxM3w= ~~~

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Good to know that the liquidity is still healthy on chain. And you are right, it has more room to grow especially with the pool on Polycub.

Posted Using LeoFinance Beta

It definitely have a room to grow which it is really showing that stability to stay strong

Posted Using LeoFinance Beta

Great analysis.

!1UP

You have received a 1UP from @luizeba!

@leo-curator, @ctp-curator, @vyb-curator, @pob-curatorAnd they will bring !PIZZA 🍕 The following @oneup-cartel family members will soon upvote your post:

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

I see that the stabilizer budget last year for HBD was under 10k. Now it's 160k even thought it's asking for more. Increase volume is due to Polycub and HBD hodl !

View or trade

BEER.BEERHey @dalz, here is a little bit of from @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.I have had nothing but problems from Bittrex trying to trade HIVE and HBD, from disabling withdrawals to locking me out of my account. I would rather keep my HBD on chain where we can use it for the benefit of the Hive.

Wow, that actually didn't give me a headache to understand so thanks for the information in data mine.

If the internal DEX is the way to go then I best keep my play in the internal then. I think if the trade volume is predominantly in the internal then Hive as a platform will be strengthened. Of course I think it will eventually trickle out but at a slow consistent rate is better for stability and sustainability of HBD.

I think Upbit Indonesia allows non-Korean customers. But for HBD there is no point now, other options are likely better.

Wanted to check with you one idea regarding liquidity. What do you think about the hbdstabilizer becoming a market maker? So it would monitor the price of Hive and always place large HBD buy orders for slightly under $1.00 and large HBD sell orders for slightly over $1.00. This way, people going to the internal DEX would see that there is liquidity and they can always buy or sell their HBD, essentially paying a fee just like they would if they used a liquidity pool. By providing the liquidity at a slightly disadvantageous price, the hbdstabilizer would essentially fulfill the functions of a liquidity pool, and bring the profits back into the network.

This would also have the effect of pulling Hive out of circulation, helping it maintain price and essentially helping HBD maintain the peg. The more HBD bought and sold on the DEX, the more profit for the network, upward pressure on the price of Hive, better backing of HBD.

I guess the hbdstabilizer already makes profit for the network, I am just thinking that only expert traders are able to use the DEX for any larger amounts, whereas if large buy and sell orders are always there, ease of use increases greatly and far more people would be able to make a trade and have their order fulfilled right away.

By the way, congratulations on HBD maintaining the peg during the market downturn, an incredible achievement. Thank you for doing this work.

I'm not thrilled with the idea because: a) market making has risk, I'd rather not take risk with DHF funds (but someone else can make a proposal to do so and perhaps it gets approved); (b) market making requires keeping capital while the stabilizer returns the funds to DHF as quickly as possible; (c) market making done right should make a profit, so there is no reason why someone can't do it with their own funds, particularly with stabilizer as a regular customer.

I do run a small market maker with my own funds (@teamsmooth-mm), but the order size is only 500 HBD. It keeps about 1% spread and makes a little, but it's not the smartest possible market maker by far. It's actually quite dumb, just smart enough to not systematically lose (hopefully).

Still looking for a better way to exchange HBD, but after the LUNA accident, 20% APY looks vulnerable.

I am thinking this is how it should be. Either way, this is showing the power of the internal exchange. The numbers the last couple days on there went nuts. So it will be interesting to see how things pan out for the month of May.

Posted Using LeoFinance Beta

No bridges to HE for HBD atm.

As for the BXT token, it has helped that one pool. Without it even that pool woudnt be there.