CUB is around for just two days now, not much of a timeline data to show, but lets take a look at some numbers as they are at the moment.

We will be looking at:

- Total Value Locked [TVL]

- Individual pools liquidity

- Inflation

- Price

Total Value Locked

The total value locked is one of the key metrics for these platforms as it shows the amount of capital locked in the vaults of the platform indicting the trust in the project. In the case of CUB it also has a fee on the deposits that is used to burn CUB and LEO. The highest the TVL, the more CUB is burned.

At the moment of writing this the total value locked is standing at just above 7.2M!

The growth of TVL has been amazing. The first million was reached in just a few hours after the launch, then a day later a five million and it looks like we are heading for the 10M in TVL soon.

Individual pools liquidity

I find this part a bit more interesting, since there is a lot of options where to pool. What are the most popular pools? Which pair holds the highest liquidity? Let’s take a look.

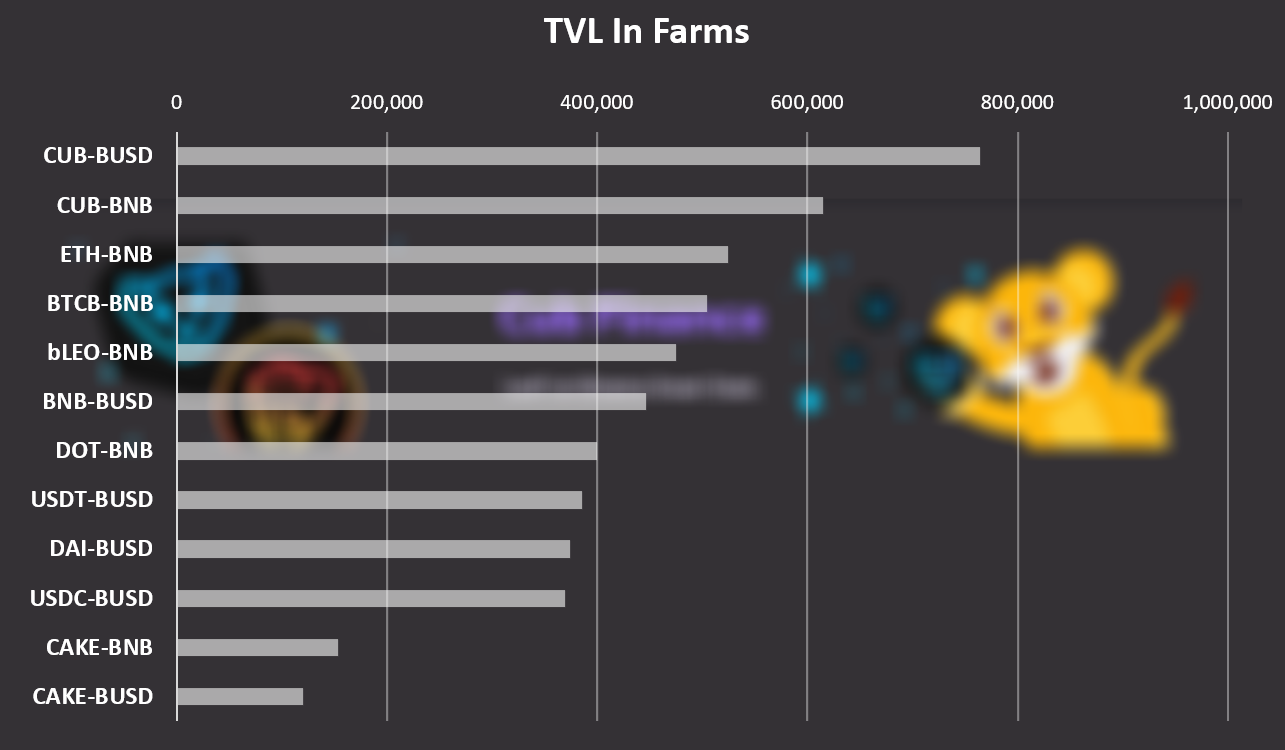

First the farms.

Note this numbers are at the moment of writing this, they can change fast.

There is a total of 12 farms.

At the top are the two CUB farms, CUB-BUSD with almost 800k liquidity, then the CUB-BNB with more than 600k.

Combined from these two pools CUB now has around 1.5M in liquidity.

Outside of CUB pools, next is the ETH-BNB pool, followed by BTC-BNB pool. BTC and ETH rule 😊.

Interesting bLEO-BNB pool comes fifth, although it has a great incentives. I expect for it to clime the lather to no.3.

One other thing is that a of people were mentioning the stable coins pools, but obviously they are not in the top. Somewhere around the middle. The CAKE pools are on the bottom.

A total of 5.1M in the farms.

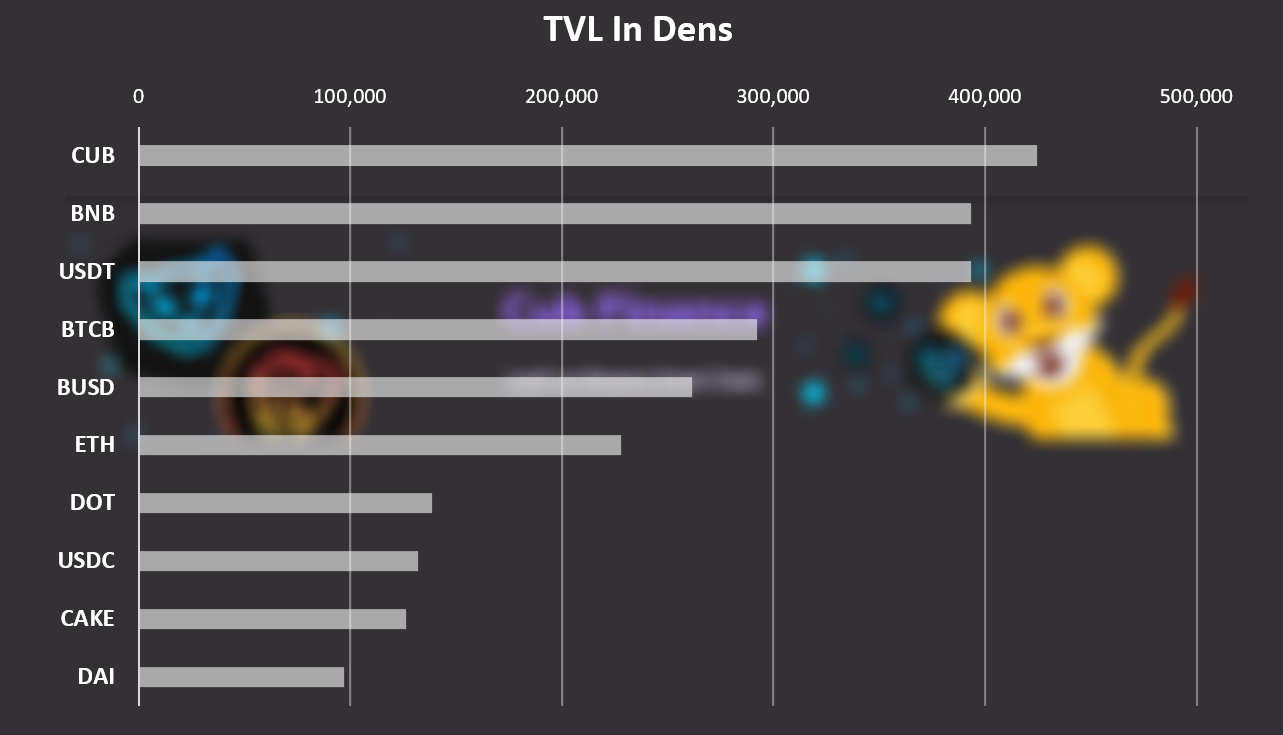

The Dens

Here is the chart for the dens.

Dens are single assets pooling, if you want to avoid impairment loss. You stake your asset and earn CUB.

CUB is on the top here, basically stake CUB earn CUB. BNB is second, but very close to USDT. BTC fourth.

Interesting BTC and ETH are not as high here as in the farms.

A total of 2.5M staked in the dens.

Inflation

CUB is starting with a low initial supply and high inflation and no presale.

What this means that going forward most of the token supply will be mined by liquidity providers.

As stated in the docs the inflation goes like this:

Emission Rate

Week 1: 3 tokens / block

Week 2: 2 tokens / block

Week 3: 1 tokens / block

Note: Week 1 starts on March 8th (launch day) and ends on March 15th. Emissions rate is reduced on the 15th to 2 tokens / block until the following week where it drops to 1 CUB / block.

At 3 tokens per block this is around 86.4k tokens per day, at 2 tokens per block, 57.6k and at 1 token per block 28.8k tokens per day and this will stay until the community decided otherwise. If the 28.8k tokens per day stays in the first year, there will be around 10M tokens minted.

Price

At the end the price.

I found this tool for BSC token, but not sure about it legitimacy and wont share the link here.

CUB started at $3, went up to 14$ and a pull back to around 7$.

These are early days, and the token is in a price discovery mode, so volatility is expected. There are buybacks from the fees as a support mechanism and not a lot of those funds have been used yet, so all organic price discovery. Also, a lot of development are planed going forward and integrations with other BSC projects.

Interesting times 😊

@daz

Posted Using LeoFinance Beta

I'm glad I can upvote this post as it deserves. Thanks!

More info why you see this.

Posted Using LeoFinance Beta

Thanks alfa!

Appreciated!

Posted Using LeoFinance Beta

Pretty amazing times to be alive and aware of what's happening in this space!

Posted Using LeoFinance Beta

Pretty good numbers, we need to get CUB to show on Yieldwatch and Autofarm to get more attention.

Congratulation to everybody who is farming since day 1.

Posted Using LeoFinance Beta

Need to complete audits this week then good to go

Posted Using LeoFinance Beta

Give it a week :)

Posted Using LeoFinance Beta

And this is all before the CUB tokens have been airdropped to Leo holders?

Posted Using LeoFinance Beta

It's stats time with @dalz! Thanks for the info, always presented well👊

Posted Using LeoFinance Beta

I am farming that CUB hard right now XD

so much great info as i am brand new to the LP and learning so much thru the process, making mistakes, bumping my head some hehe

Posted Using LeoFinance Beta

Thank you for putting all the data in one place. Some of the numbers have changed since your report. It shouldn't be a surprise to anybody:

Posted Using LeoFinance Beta

how do you promote your post on leo?

Posted Using LeoFinance Beta

Hit the three dots ... promote

First check what is the highest bid in the null account

https://leofinance.io/@null/wallet

Posted Using LeoFinance Beta

I just bought a few days ago when it was around $6. Now, it is $3.60. Probably should have waited longer to jump on the CUB train. Since the staking didn't make up for the loss in price.

Posted Using LeoFinance Beta

What are single asset dens used for? Is it used automatically for liquidity? And in that case, doesn't that incur big risks due to impermanent loss?

For instance, if everyone withdraws usdt from the usdt den at the same time, where does that usdt come from? It probably has to be unstaked from liquidity pools, otherwise where does the return come from.

Dens are copy from other platforms as goose ... they, as farms are basicly vaults ... how are funds used for liquidity, arbs ... dunno

Posted Using LeoFinance Beta

Also, there seems to be some mistakes with the data. There is only 120k of value locked in the USDT den, not 400k as shown. Some other imperfections too but this is the biggest I found.

is this price chart is available at some url?

Yes its available, but as I mentioned in the post, the link looks spamy so I dont like to share it

You can try and look for bsc tools for tokens

Posted Using LeoFinance Beta

Super helpful as usual.These numbers ae purely impremssive. i mean think about $7.2 Million locked up right when the project lunch. That's just epic!

Posted Using LeoFinance Beta

I wonder what the ratio of Leopower:CUB token will be when airdropped.

Posted Using LeoFinance Beta

Thank you, your appearance on the Leo Finance video got me started with providing liquidity pools and boy does it ever seem like the right time for it!

Posted Using LeoFinance Beta

This Cub Finance is very

exiting to deal with.

Just me saying it is more fun

than the one on Ethereum.

Low fees and when you get the hang of it

you should be cruising.

!BEER

Posted Using LeoFinance Beta

This is one of my issues, i cannot check the price of Cub, unless i am at the PC, logged on website. Do you know any other way? How can we introduce it to coingecko?

Posted Using LeoFinance Beta

the inclusion of the coin being on coin market cap & coingecko are both "coming soon"

not sure why the info for the chart wasnt included or at very least the name of the tool so we could do our own research. but it all apart of the game of defi.

but if youre on the go you can download the pocket token app, go to the browser, type in https://cubdefi.com/ and you be able to use it like you would on the pc (with another wallet though) or at the very least keep an eye on the price

Coingecko is coming ...

Posted Using LeoFinance Beta

Nice infos. Thanks for them.

Posted Using LeoFinance Beta

Nice report @dalz. Many people hopped on the opportunity as soon as it was launched. I invested a few tokens myself. Let's see how it all plays out in the long run. Quick question: How do you acquire this data? Is it publicly available? Can we also determine the rate of CUB yielded as per the amount of Tokens/Dollars invested?

Thanks in advance!

Posted Using LeoFinance Beta

Very good stats. Can you tell me how you generate the chart on tradingview? :D I want it too! :)

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next payout target is 18000 HP.

The unit is Hive Power equivalent because your rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPView or trade

BEER.BEERHey @dalz, here is a little bit of from @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.