For those who don’t know Balancer is an Uniswap like platform build on Ethereum. An automated market making (AMM) platform. In a lot of ways, it is very similar to Uniswap, but it has its specifics. It is also not the latest copycat as well since it has been around since March 2020, and has been in the making since 2019.

https://balancer.exchange/#/swap

https://pools.balancer.exchange/#/explore

https://pools.vision/

Some of the specifics of Balancer are:

- More ratios between the pooled tokens, then the standard 50% : 50% (80% : 20% for example),

- More than two assets in a pool, you can go up to 8 tokens in one pool,

- Different swapping fees for each pool,

- Private pools, etc.

If you are familiar with Uniswap, you know that the standard way to add liquidity in a pool is 50% : 50% share between the tokens. On Balancer this ratio can be different, and anyone can choose as they like when creating a pool. Another thing is the number of assets/tokens in the pool. The standard is two tokens, but on Balancer you can have 3, 4 up to 8 tokens in a pool. The fees on Uniswap are standard 0.3% per swap, while on Balancer they can be also set differently when a pool is created.

You can find more info about Balance here https://docs.balancer.finance/getting-started/faq.

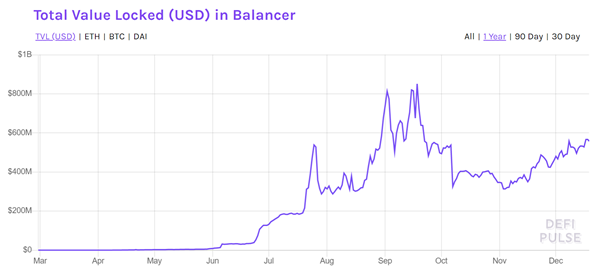

Here is the chart for total value locked on Balancer.

https://defipulse.com/balancer

Just under a 600M at this moment. Not a small amount. At the moment of writing this the Market cap for Balancer is around 150M.

My experience providing liquidity on Balancer

I posted about My experience providing liquidity on Uniswap, now it is time to check Balancer.

A very important thing to mention here before we continue. I entered the 80% BAL – 20% ETH pool. If you read the previous post on providing liquidity and lessons learned from that, you would know that impermanent loss is the biggest risk when providing liquidity. It is almost granted to happen. The only time it won’t happen if both pooled assets are moving in price in the exactly the same manner. This is not the case most of the time.

To avoid impermanent loss as a liquidity provider you can do it by pooling stablecoins or a single asset tokens.

In the case above I’m trying to go for the single asset option, since most of the assets in the pool (80%) is in one token, BAL in this case. The risk that comes with this is the token price. I’m exposed a lot on the movements on the BAL token price. If it goes down Ill lose in assets value.

Another risk when playing around with these things is hacking. Have in mind these are all new things and hacks happens a lot. Actually, Balancer had a hack incident this year already with a so called flash loans.

This said, we won’t learn new things if don’t try them 😊. So here we go.

We will be looking at the following thigs:

- Initial assets pooled and their value at the time

- Current assets and their current value

- Initial assets and their value at current prices

- BAL Incentives earned

- Fees earned

- Fees paid

Another important thing to add is that Balancer has a liquidity providers incentives program. They are distributing tokens to a liquidity providers in a certain pools. The 80% BAL – 20% ETH pool is one of them. BAL is rewarded weekly and you can claim them each week or leave them to accumulate and claim in one transaction to save on fees.

Initial assets pooled and their value at the time

I have added to my BAL-ETH pool more then once. Here is the history.

| Date | Token | Tokens Amount | Price | Value |

|---|---|---|---|---|

| 31.10.2020 | BAL | 37.667 | 10 | 377 |

| 31.10.2020 | ETH | 0.249 | 384 | 96 |

| 13.11.2020 | BAL | 36.809 | 12.5 | 460 |

| 13.11.2020 | ETH | 0.247 | 469 | 116 |

| 06.12.2020 | BAL | 20.000 | 13.8 | 276 |

| 06.12.2020 | ETH | 0.114 | 598 | 68 |

| 1,392 |

A total of 1392 USD added to the pool, 1113 in BAL and 278 in ETH.

Current assets and their current value

How are things now doing? Here is the table.

| Current Assets Current Price | Token | Tokens Amount | Price | Value |

|---|---|---|---|---|

| 18.12.2020 | BAL | 97.57 | 14.5 | 1,415 |

| 18.12.2020 | ETH | 0.542 | 653 | 354 |

| 1,769 |

Well not bad at all. The value of the assets has increased from 1392 to a 1769. But where does this increase in value comes from? Most of it is from the increase in the tokens price, both BAL and ETH, as we will see below.

Initial assets and their value at current prices [HODL Scenario]

This is the reference hypothetical scenario. What would have happened if I didn’t pooled these tokes but just hodl. It is used for calculating the impermanent loss.

| Token | Tokens Amount | Price | Value |

|---|---|---|---|

| ETH | 2.49 | 459.80 | 1,147 |

| UNI | 216.46 | 3.01 | 652 |

| 1,798 |

In summary:

- Initial investment in the pool 1,392

- Current value in the pool 1,769

- Initial assets and their current value (HODL scenario) $1798

This is basically showing that I would have the same value in dollar terms with and without pooling. Is this the case?

We need to add a few more thing to the numbers above to get the whole picture:

- BAL Incentives earned

- Fees earned

- Fees paid

As mentioned, this pool has incentives on top of the fees. Additional BAL is distributed to liquidity providers. Also, I need to separate the fees. Here it is:

- 123 USD in BAL Incentives earned

- 8 USD in fees earned

- 15 USD in fees paid

When all the above taken into calculation a net of 116 USD. Notice the small amount of fees earned. If the there was no incentives for LPs, the fees alone would not worth it at all. The average APY on those is just a few % per year. But when the incentives are added things change for the better.

Since I have been adding liquidity on few occasions, I can’t calculate all the period above with the total earnings. When I calculate the earnings from the last week alone the APY for the pool is around 76%. The extra BAL tokens included. The https://pools.vision/ tool is showing a 79% APY for this pool.

Overall, this pool has done nice, for now 😊. As already mentioned, I’m going for the single asset scenario in this example, although its not an exactly single, but 80%. With this I’m exposing myself to the risk of the BAL token price fluctuation. The value of the assets in the pool has increased for 376 USD (27%) with almost zero impermanent loss (a miracle 😊) and I have earned a 116 USD on top of it as incentives, or 76% APY.

This said, things could be very different now, if the price of the BAL token dropped in the period. I have been lucky and got an average around 11$ entry price and BAL is now more than 14$. The price of these tokens can vary a lot, and it has been going up and down in the past. If the price dropped just 10% under my entry price, those 100$ incentives would have been eaten up by the loss in the token value. There is always a big risk with these things, no matter how shiny they look at a first glance. Also, the big question is for how long these incentives for liquidity providers will last. Always be aware.

All the best

@dalz

Posted Using LeoFinance Beta

I didn't know about Balancer before I read this post.

Thanks for this, @dalz.

Posted Using LeoFinance Beta

You are welcome :)

Posted Using LeoFinance Beta

Well written and nicely explained. I believe that defi platforms at the moment are good for learning purpose or to make a quick buck to cash in the craze. With small amounts, the price fluctuation and gas fees eat up most of the profits made :)

Posted Using LeoFinance Beta

Thanks!

True this. You can try the Binance Smart Chain, less fees there ... although centralized etc ...

Realized that a month ago. I am using BSC and farming Cake. Low fees and high returns.

Interesting information and I must confess that I didn't get into any pools so far as a Liquidity Provider. Now reading your post I am not sure if doing so would benefit me as I see that the rewards as LP and those if you had just HODL are similar. Or am I wrong with this interpretation?

Posted Using LeoFinance Beta

No I have made 116 from the incenitves.

Posted Using LeoFinance Beta

DeFi looks just like degenerate gambling.. I wish I had time and knowledge to figure it out.. my track record ain't that good.. 10k to learn black jack.. 30k to learn PLO..

Posted Using LeoFinance Beta

At first it looks like this. But its not to be underestimate. Some projects will do fine, a lot not that much ... similar like crypto in general :)

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Balancers, like Uniswap or others, are exchanges aimed at speculating and making money quickly.

Obviously, whoever moves last loses. I haven't gone too far into Balancer or Uniswap as I'm quite wary and don't have much liquidity to invest at the moment.

Thanks anyway for this very informative post

Posted Using LeoFinance Beta

There are lots of projects that tried to lure in people by offering high yields, which quickly diminished by impermanent losses (IL) when the price of the newly released tokens dumped. However, in more stable projects (Uniswap, Balancer, Curve) the token incentives can cover the IL, but these incentives are only for a few chosen pools.

I'd like to direct your attention to Bancor, which is trying to solve the IL issue by offering a single-sided token deposits into a pool and insurance against IL, when you stake your tokens for 100 days. It's arguably the oldest AMM (since 2017).

On the plus side only one side wins. I think this is a good thing since that means investors have a shot of winning. Versus in an exchange there is still a house and they never lose.