Polycub launched on March 5th and we have seen a lot of big moves in the first days.

The platform itself has some interesting mechanics in place and some more to come in the next period. A defi 2.0 protocol as they call it 😊. Let’s take a look at the data for these first days.

Here we will be looking at:

- Inflation

- Supply

- Individual pools liquidity

- pLEO

- Price

The high APR at start is what everyone looks at and is excited. Those usually come from high initial inflation of the token. The thing is Polycub is designed with a lot of inflation going at first and then cutting that down by a lot. Some other mechanics are also put in place like penalty for early claim on rewards that are going the xPOLYCUB staking pool. Bonding and protocol controlled value PoL are yet to come. For those unfamiliar with bonding in defi it is basically selling POLYCUB at premium, lower than the market price, but giving out those tokens to buyers in a days or weeks.

The total value locked TVL is also one of the keys metrics for a defi platform.

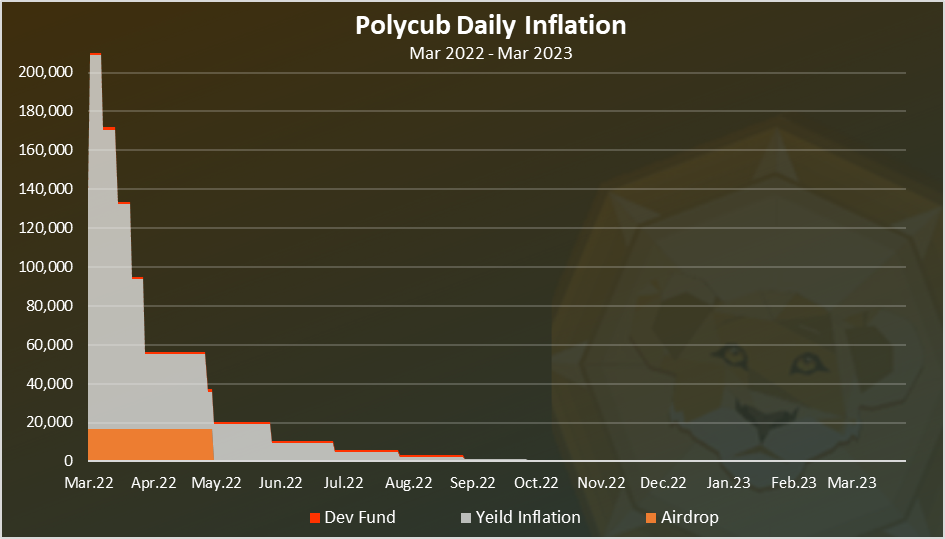

Inflation

There is an initial od 1.3M tokens reserved as follows:

- 1,000,000 airdrop to CUB holder over a period of 60 days (16.6k per day)

- 200,000 dev fund locked for six months (1111 daily)

- 100,000 initial seed liquidity

The regular inflation is set as follows:

- Week 1 – 5 tokens per bock (approx. 192k tokens daily)

- Week 2 – 4 tokens per bock (approx. 154k tokens daily)

- Week 3 – 3 tokens per bock (approx. 115k tokens daily)

- Week 4 – 2 tokens per bock (approx. 77k tokens daily)

- Month 2 – 1 tokens per bock (approx. 38k tokens daily)

- Month 3 – 0.5 tokens per bock (approx. 19k tokens daily)

- Month 4 – 0.25 tokens per bock (approx. 9k tokens daily)

- Month 5 – 0.125 tokens per bock (approx. 4.8k tokens daily)

- Month 6 – 0.0625 tokens per bock (approx. 2.4k tokens daily)

The data for the daily number of blocks is applied as 38500, taken as an average from https://polygonscan.com/chart/blocks for the last few months.

I’m not totally sure will the halvening continue after the first six months or it will stops at 2.4k tokens daily. Here I have continued with the halvening for the first year.

When we take into account the above, we get this.

The inflation per day drops fast!

In the first week there is around 210k tokens cumulative issued daily including the yield and airdrops. The airdrop for CUB holders is finishing at the end of April and at the same time we have another halvening then. Starting from May we will have only 20k daily tokens issued down from the starting 200k, or a 10x reduced inflation.

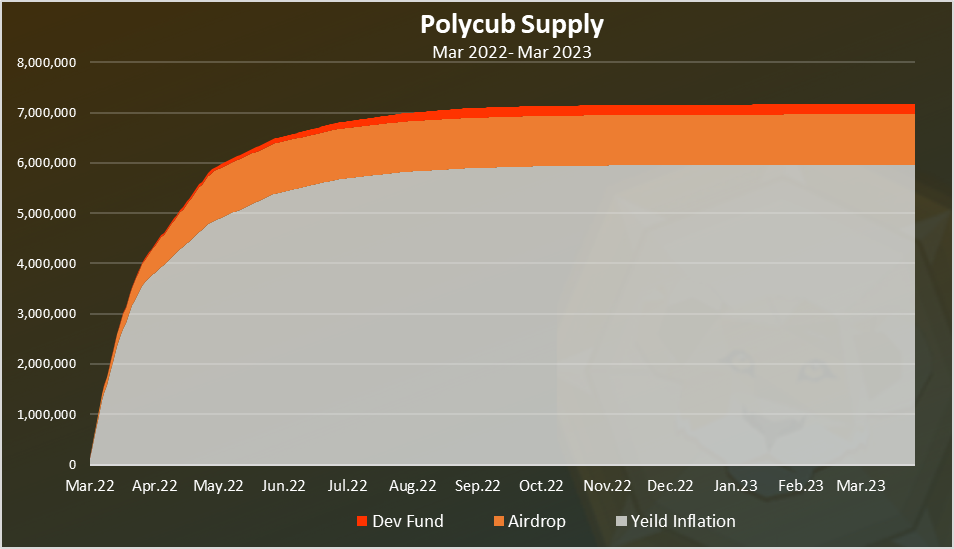

When we plot the supply chart, based on the inflation above we get this.

We can see the steep increase in the supply in the first months and then flattening out.

- 60% of the supply will be minted in the first month

- 80% in the first two months

This distribution tries to mimic the Bitcoin mining but in a turbocharged way with halvening happening on a monthly basis instead of four years.

This aggressive reduction in the supply has its pro and cons. The pros are obviously a non inflationary asset that incentives long term hodl, while the con would be a reduction in the APR’s. The thing with Polycub is that it is a yield aggregator so it doesn’t depend solely on its inflation but it stands on top of other protocols inflation, so there will always be some APR. The other mechanics for a long term sustainability will be the protocol owned value and the bonding. This is yet to come and we will see how it goes.

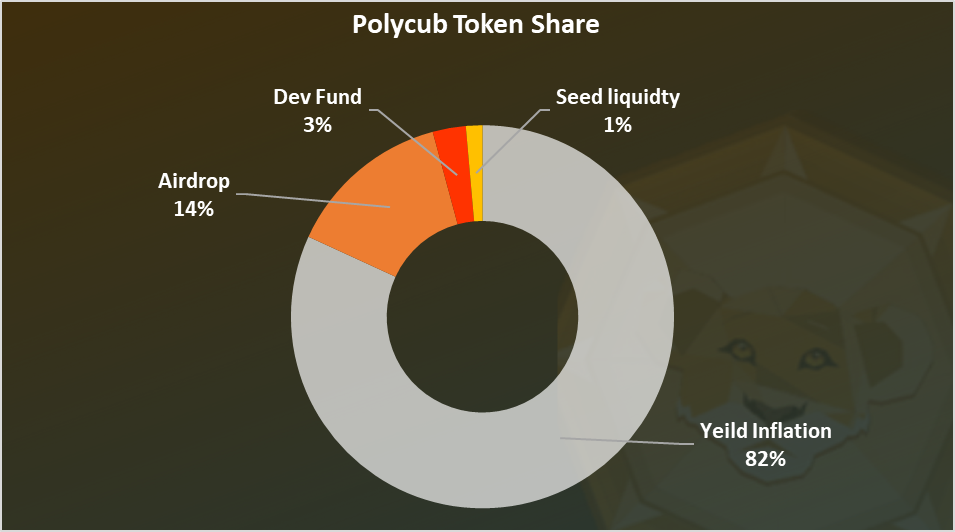

Tokens Allocation

After the first year the tokens allocation share will looks like this.

We can see that the dominat share of the tokens 82% will come from the yield inflation. Next is the airdrop to cub holders with 14% and then the dev fund and the seed liquidity with cumulative 4% share.

Total Value Locked TVL

This is another important metric for the platform. Here how is the TVL distributed in the different pools.

Note this numbers are at the moment of writing this, they can change fast.

A total of eight pools.

The stablecoin pool is on the top here with 1.7M deposited there. Next is the the BTC-ETH pools and then all the other pools with a similar liquidity in the range of 700k to 900k.

The two POLYCUB pools cumulative have around 500k in liquidity with 250k in each.

The xPOLYCUB is high in the ranks with around 800k value at the moment and the ratio of xPC/PC is close to eight.

Cumulative, with all the farms, kingdoms and the xPOLYCUB there is a total of 6M TVL in the Polycub platform. Now if we compare this with the launch of CUB on BSC, the TVL there surpassed 10M in the first week. The thing is there was a lot of momentum in new defi apps then, as it was the hot new thing at the moment. Also, the overall crypto market was on a first leg of its bull run.

After a year CUB is still around, although a lot other defi apps are long gone. The overall crypto market is now in a three-month semi bear mode. Polygon is a smaller platform than BSC, but yet the app managed to gain more then 5M in TVL.

Overall, it has been a success, but it remains to be seen how will things develop in the following months. The first two months will distribute most of the token and the APRs will be lower afterwards. Then it remains to be seen how the overall tokenomics will work.

Price

At the end the price with data from dextools.

https://www.dextools.io/app/polygon/pair-explorer/0x5aefd5c04ed6dbd856a5aeb691efcc80c0ab7472

An immense increase in the first day from $1 to $6 and a slow drop back to $1 where it is now.

There was some short lived floor around the $4, but then it broke and kept falling to $1. This is somewhere to be expected, as the initial inflation is huge. As comparison the CUB starting inflation was 86k tokens per day, while POLYCUB is 210k. The thing is this will change fast, and the PC inflation will reduce a lot. It remains to be seen where things will be after few months from now.

All the best

@dalz

Posted Using LeoFinance Beta

Nice chart and analysis!

I will continue holding pCUB for several months.

So the current price does not make me worried a lot :)

Posted Using LeoFinance Beta

HODL ftw!

Understanding this project is vital to what is rolling out in the future. There is something things that are being overlooked.

Posted Using LeoFinance Beta

The problem of such high emissions at the beginning encourages large purchases by investors at the beginning and then massive sell offs to make money.

We will see the real value of Polycub at least from week 5 and it will be interesting at the end of 2022 😳

Posted Using LeoFinance Beta

This is a long term project. It is the anti-thesis of what is normally out there in DeFi.

Posted Using LeoFinance Beta

You have been a constantly reliable place to get statistics on many of my favorite projects. Thank you for all your work. As I'm heavily invested in POLYCUB, I found this post to be very useful.

!PIZZA

!LUV

Posted Using LeoFinance Beta

(1/1) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

Tap to help.

Yes it is project with good perspective.I’m in

I learnt a lot from this post, it really interesting . thank you for the analysis

This is one important part to look out for I love this project because is really organized thanks for breaking down the data analysis of this coin it really helps a lot

So it could make sense to borrow USDT/USDC, stake here for the high yield and then repay the loan!??

Posted Using LeoFinance Beta

That is for you to decide ... a lot factors are in play

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

The articles taught are very useful

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 6500 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

PIZZA Holders sent $PIZZA tips in this post's comments:

(3/5) @vimukthi tipped @dalz (x1)

Learn more at https://hive.pizza.

There's great, there's alot of supply in the market. Polycub is supplying steady

Posted Using LeoFinance Beta

Have you managed to work out the risk free value?

I'd love to see a daily update of this in the @leomarkettalk blog.

Posted Using LeoFinance Beta

Nice graphics to help us all get a grip on this new PolyCub platform.

This says it all for me:Hi @daltz

I understood the protocol owned liquidity, but I mys admit I completely missed this xPolyCub featuire...bummer...a missed opportunity, I got in late at xPC/PC 4.0, but now it's 12 I don't feel terrible, but still could have profited more.

Posted Using LeoFinance Beta

Pelaku pasar menyambut baik resolusi diplomatik tersebut karena bisa segera menyelesaikan konflik antar kedua negara. Tensi geopolitik yang kian adem niscaya bakal membuat prospek ekonomi ke depan terlepas dari ketidakpastian

Sorry ... cant understand you

I speak in Indonesian