The last bull run brought us DeFi. It started small but then a ton of new apps and protocols emerged. A lot of them copycats with just small tweaks. The bear market has been especially brutal towards these protocols. A lot of them died. But a few remained and are still around. They provide vital services to the crypto industry that were not possible a few years ago. Lending, trading, staking etc, the basics of the financial industry.

Let’s take a look at the top DeFi protocols and compare them.

We will be looking into the following protocols:

- Uniswap

- Lido

- Curve

- AAVE

- MakerDAO

- PancakeSwap

- Compound

- Balancer

There are different types of applications above, like DEXs, lending protocols, staking protocols etc. It can be a challenge to find a common denominator for all of them to compare them to each other, but we will be looking at the following parameters:

- TVL

- Trading volume

- Users

- Top trading pair on each platform

- Fully Diluted Valuation / TVL Ratio

- Market cap

The data is extracted from multiple sources like Dune Analytics, DeFi Lama, protocols web pages etc.

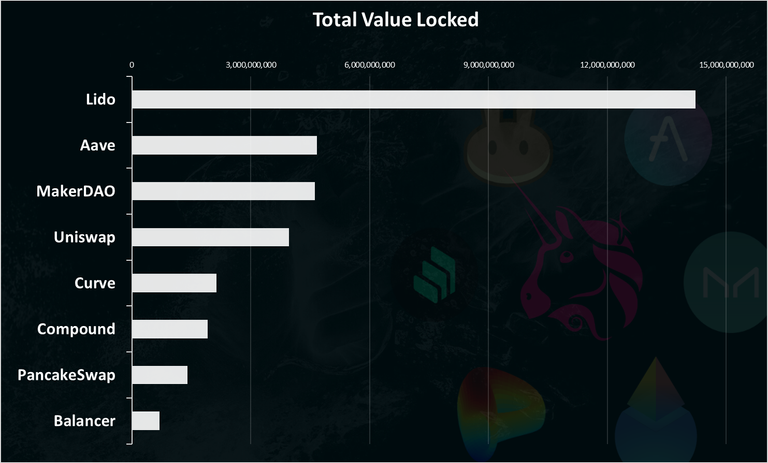

Total Value Locked TVL

One of the key metrics for the defi protocols is the total value locked TVL.

Here is the chart.

Lido comes on the top here with 14B. For those who don’t know it is a protocol for staking Ethereum. Lido has been a dominant protocol providing this service. Users stake any amount of Ethereum and get a return on it from the Ethereum staking rewards. There are multiple protocols that provide this service, but Lido is on the top.

After the first one, that has a special use case, Aave the lending protocol is on the second spot with 4.6B, then comes MakerDAO with the DAI stablecoin, followed by Uniswap as a DEX.

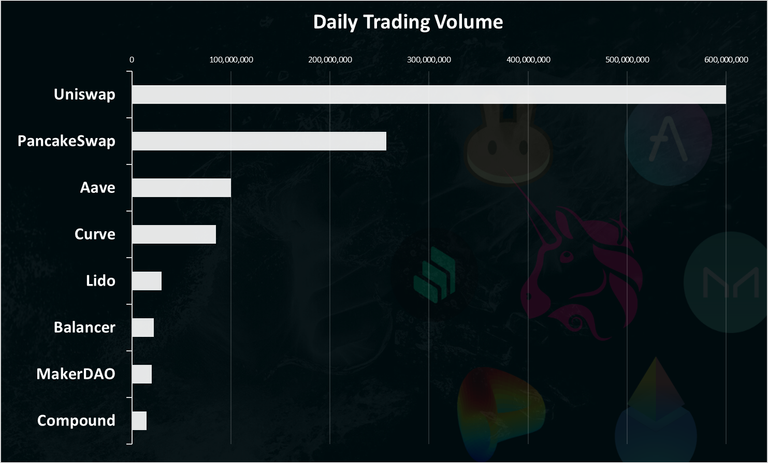

Trading Volume

The trading volume is not 100% applicable for all the apps above, as it is most a DEXs parameter, but we can have a look at the lending protocols as well, in terms of deposits and withdrawals of collateral.

Here is the chart.

Uniswap comes on the top here with 600M daily trading volume. Next is PancakeSwap. These two are both DEXs, and as already mentioned these types of applications due to their nature have more volume than the lending protocols. Aave is on the third spot with close to 100M daily deposits and withdrawals, then comes Curve, the stablecoins DEX.

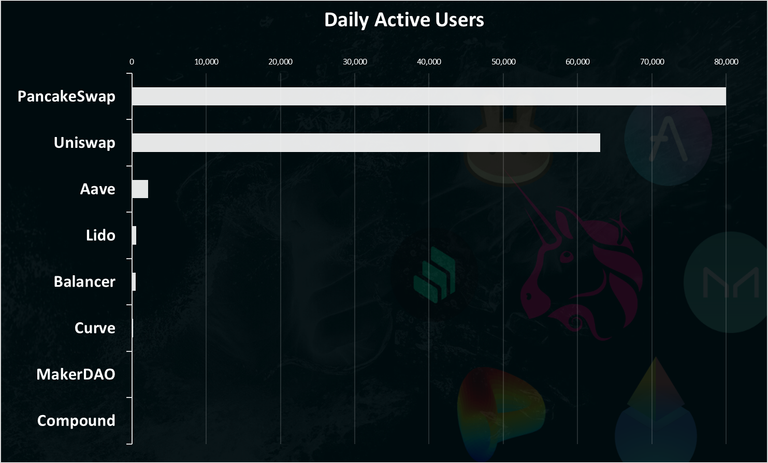

Numbers of Users

Here is the chart.

Pancake is on the top here with 80k DAUs. Uniswap follows with 65k. The other Defi apps have a significantly lower number of DAUs in the range of few hundreds. The lending apps usually have a smaller number than the DEXs.

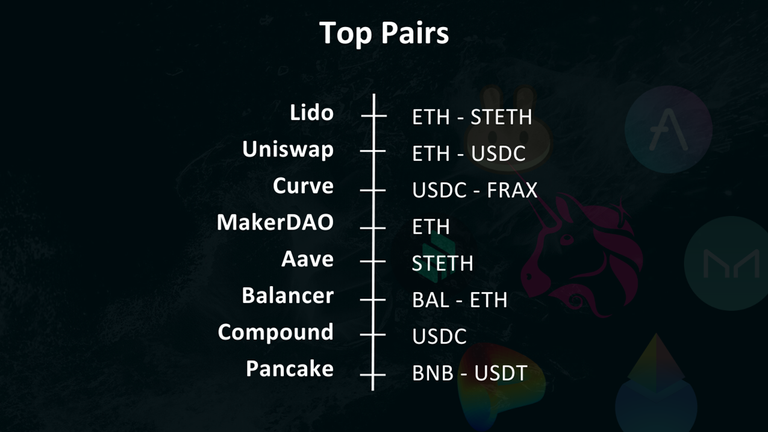

Top Pairs

What tokens are traded/used the most on each platform? Here is the chart.

As we can see most of the platforms have Ethereum and staked Ethereum (stETH) as the most used/liquid tokens, followed by the stablecoins. This is of no surprise since Ethereum is the platform where most of them are built, and it is the second largest crypto.

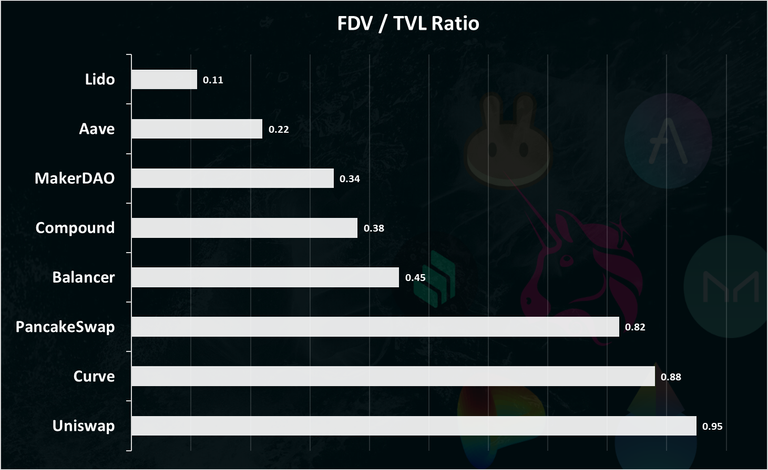

Fully Diluted Valuation / TVL Ratio

This is one of the most used metrics for DeFi apps. It shows the ratio between the value of the project and assets under management so to speak (TVL). When this ratio is small it could mean that the project is undervalued and the opposite. For example, if a project has a 1B valuation and is managing 10B in assets (TVL) the ratio will be 0.1, that is considered low.

Here is the chart.

Lido comes on the top here, since it has a lot of assets under management, but it also has a specific function for staked assets.

Aave, with a broader use case with lending, is on the second spot with its FDV / TVL ratio, followed by MakerDAO. Uniswap has the highest ratio with market cap, almost the same as the TVL.

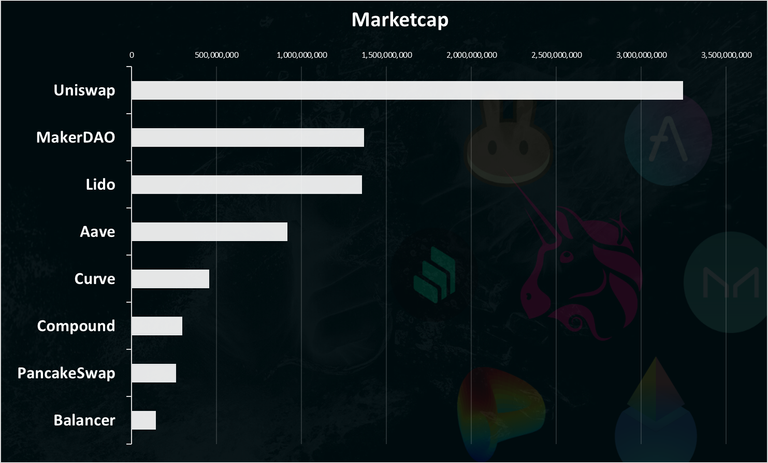

Market cap

At the end the market cap. Here is the chart.

Uniswap remains the strongest Defi application in terms of market cap. It is now valued at 3.2B. MakerDAO is in the second spot, followed closely by Lido. These three are all valued at more than 1B. Aave is in the second spot with close to 1B valuation. Curve is now under 500M.

All the best

@dalz

So few users on Lido but so much TVL lol I believe they were the first ones to roll out ETH LSTs Liquid staking tokens and a ton of money was dumped into that. Also kind of crazy to see how many active users are on cake yet there still suck little value in the tokens there now.

Yep ... pretty much tells you how important whales are :)

What about Thorchain and Synthetix Network? They are not among the top 10?

Thorchain is an interesting one, but it is still not in the top 10 ... it has around 120M in TVL now, while the lowest on the list above Balancer is close to 700M. Also I'm not exactly sure how to categorize it, as a defi app or a L1 chain ... Synthetix has higher TVL but still outside the top 10

In your opinion how far do you think uniswap will go? I want to buy a few but I have this feeling it's going to die somewhere along the treacherous road were traveling

Lido and Balancer are actually sounding new to me but I'd make more research and thanks for the information

#hive #posh

Got any information on hive engine statistics?

I am wondering why it's my first time hearing about Lido while the names of the other five are familiar.

Uniswap has really fallen. I was thinking uniswap will be the first

Tienes mucha razón el mercado bajista está brutal hermano..

Los panqueque 🥘 están por el piso... subterráneo..