How are the smart contract platforms doing these days?

In the last bull run in 2021 there was an explosion in the smart contracts platforms. More and more kept coming online and a lot of them did well. A lot of them are EVM (Ethereum Virtual Machine) compatible and users can switch between them using the same wallet as Metamask. Some are unique and have their own wallets like Solana, Cardano etc.

Let’s see how things are standing during the current market conditions.

We will be looking at:

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

The period that we will be looking is the latest data from September 2023.

We will be looking into the following blockchains:

- Ethereum

- Polygon

- Solana

- BSC

- Cardano

- Avalanche

- Fantom

The data for the chains will be extracted from their blockexplorers or some other data providers.

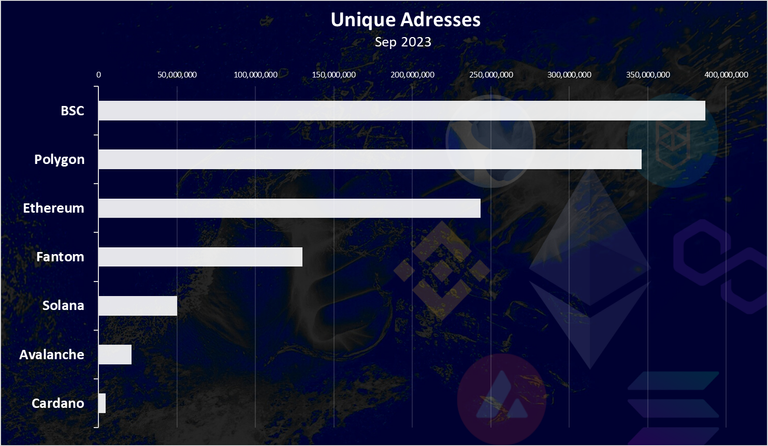

Number of Addresses

One of the key metrics for crypto projects is the number of wallets.

Here is the chart.

In the past Ethereum dominated this chart, but that is no longer the case.

Ethereum is now in the third position in number of unique wallets. The big three so to speak consist of Binance Smart Chain, BSC, that is now in the top spot with 386M wallets, followed by Polygon with 346M wallets and then Ethereum with 243M.

After the big three we have Fantom, Solana and then comes Avalanche and Cardano.

Note that the Solana data is approximate.

Obviously BSC and Polygon have grown faster than Ethereum in this metric and have outperformed it in terms of wallets.

One thing to note about these types of wallets is that they are free and there is no cost for creating a wallet, like for example on Hive. Because of this there can be a lot of wallets created and even spammed.

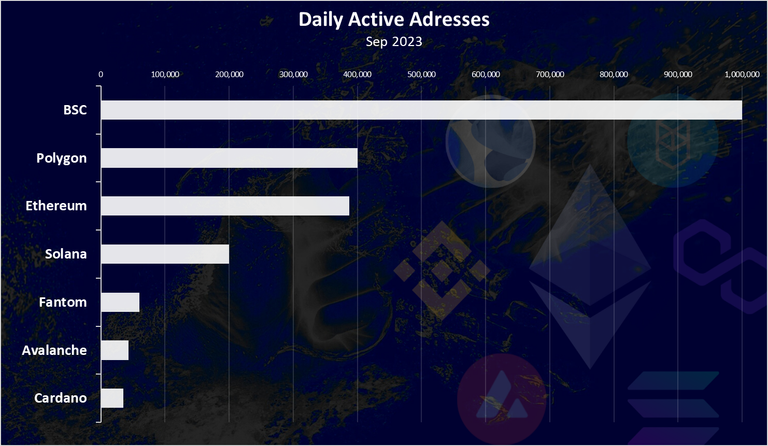

Active Addresses

What’s more interesting in times like this is how many wallets are transacting. How many of those addresses are actually active?

BSC is on the top here with 1M DAUs.

Polygon and Ethereum are next, close to one another with around 400k DAUs.

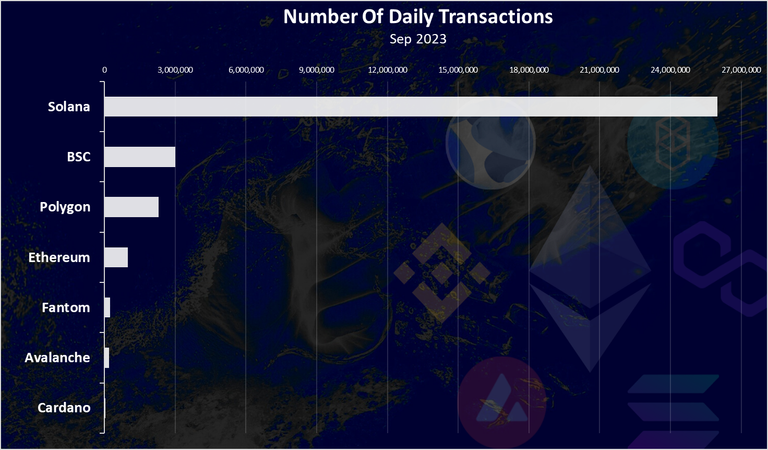

Daily Transactions

The activity on the networks is mostly represented by the number of daily transactions. Here is the chart.

Solana is holding the number one spot by far here. It has around 26M daily tx in the recent period. That is what the blockchain is known for. Its speed.

BSC is in the second spot with around 3M transactions, followed by Polygon. Ethereum is on the fourth spot here.

When looking at the transactions, the cost of them should be kept in mind. Solana has the lowest fees per tx and is on top. In the case of BSC and Polygon it is interesting that Polygon is cheaper than BSC, but BSC still outperforms Polygon in the number of transactions.

Ethereum is obviously the highest fees, and it comes lower in the ranks.

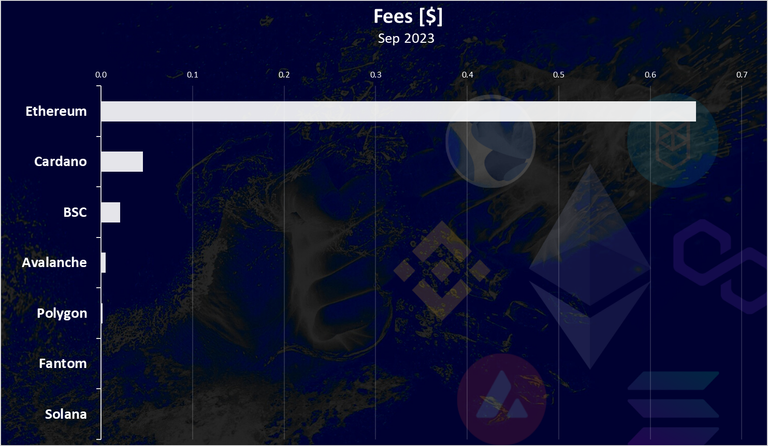

Fees

Fees are quite the unpopular topic and one of the main reasons for the new EVM chains, as users are trying to find a way to escape ETH high fees.

Here is the chart.

The fees here are in dollars.

While ETH is on the top here, these fees are nothing compared to the fees in the bull run. At times ETH fees were going up to 200$ per transaction especially if it was a smart contract transaction.

The other blockchains now have low fees, with BSC at 2 cents, is in the third spot, while Solana is the cheapest.

All the other chains, Polygon, Fantom, Solana, have fees lower than one cent. Solana is the cheapest blockchain to transact on.

Contracts

These three are smart contract platforms so here is the chart for verified contracts per day.

Cardano with its unique smart contracts is on the top, followed by Ethereum and then BSC.

There is no data for Solana to compare against.

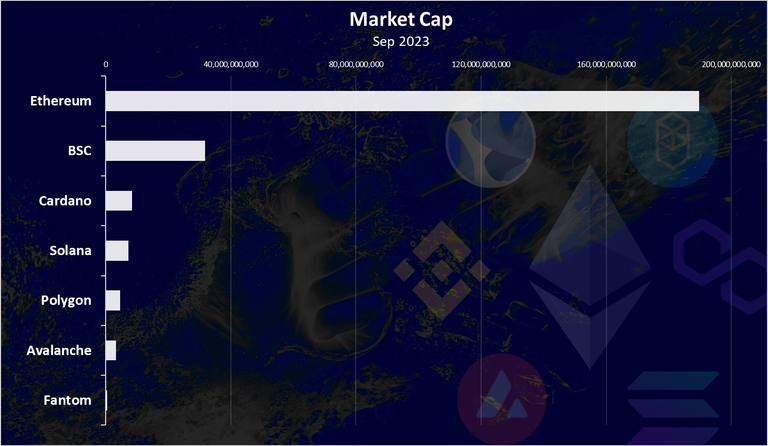

Marketcap

At the end the most important metric the market cap.

Ethereum is still dominating the space with 190B market cap at the moment. BSC is in the second spot, followed by Cardano. It’s interesting how Cardano ranks so high in the market cap, but it lacks in all of the other metrics for network activity. Solana and Polygon are next, while Fantom is now on the bottom in terms of market cap.

There are other smart contract platforms out there, like Polkadot, Cosmos, Aptos, but due to their specifics, or just lack of data I still haven’t been able to include them here.

All the best

@dalz

Thanks for the great overview. It will be interesting to see which ones do the best in the next alt bull run! Fingers crossed for Polygon! lol

Or Hive? 😅

😅 goes without saying lol

Why Polygon?

Just bcos I bought some. Lol

If ethereum explodes tomorrow I wouldnt be bothered at all :)

lol

Love the stats as always!

thanks for sharing.

It's interesting to see that BSC has overtaken Ethereum in terms of the number of wallets. This is likely due to the fact that BSC is a more centralized platform, which makes it easier for users to get started. However, Ethereum is still the leader in terms of market capitalization, which suggests that investors still believe in its long-term potential.

We all know that when the market goes down, the number of people using it decreases and the way we see it, the news was bad, which caused the market to go down again. And now we will see that within a short period of time it will start to go up again and as soon as the bull market comes, people will once again get into it and start working.

Thanks for sharing this. Nice overview.

Great analysis specially knowing details about transaction fees

Thank you so much for this piece of information

Share with my twitter friends to get more visibility.

nOthing could beat Eth when it comes to high fees :P

Thanks for providing value to the platform.

Those fees in etherium is quite the roadblock.

I really need to re-look at Cardano.