The Hive stabelcoin has been around for a long time, a total of six years when we include the previous version. Since the creation of the Hive chain, March 2020, it has been continuously improved and tweaked. Some core features still remain though, like the haircut, meaning there is a cap on the amount of HBD the chain can support and in extremely bad market conditions HBD can loose its dollar peg. Something that every HBD holder should have in mind and adjust their positions accordingly.

2022 has been a challenging year for the crypto market, as the prices kept going down, and the supply of the stablecoins with it. All the major stablecoins lost market cap in 2022.

Let’s take a look at the HBD supply and its evolution in time.

Background generated with Midjurney

HBD is being created and burned in multiple ways. Like many things on Hive, it has its nuances. The main mechanics for expanding and contracting the supply are the conversions, but there are also the author rewards, proposal payouts, interest payouts etc.

For better visibility we will be grouping the HBD created/burned in the following categories:

- @hbdstabilizer

- Conversions

- DHF Payouts

- Author rewards

- Interest payouts

The HBD in the DHF is treated differently than the rest of the HBD. HBD in the DHF is not considered as freely available HBD on the market, so it is excluded from debt calculations and similar.

The focus here will be on freely circulating HBD, excluding the HBD in the DHF.

We will be looking at the different HBD allocations here as well.

The period that we will be looking at is 2022.

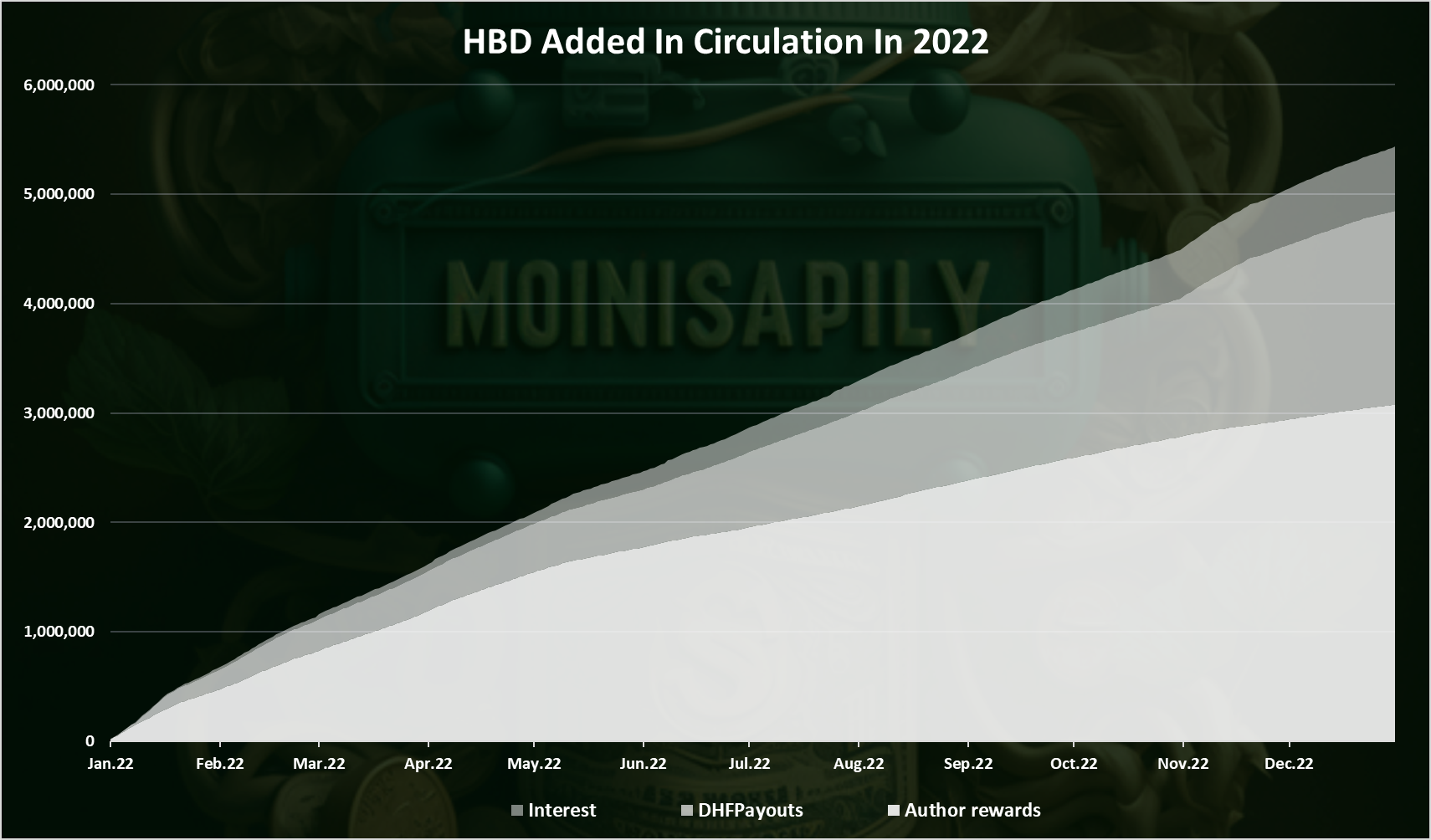

HBD Added In Circulation

HBD enters circulation via multiple ways, like author rewards, DHF payouts and interest to HBD held in savings. HBD is added in the DHF as a share of the inflation, but we will be looking at the HBD that only leaves the Decentralized Hive Fund, the DHF payouts.

Here is the chart.

The chart includes the following:

- Author rewards

- DHF Payouts

- Interest

As we can see the authors rewards are the number one source for HBD created in 2022. HBD in theory can be created trough conversions as well, but in 2022 those are negative, meaning more HBD has been burned with conversions then created.

A total of 3M HBD was created as author rewards, then a 1.7M as payouts from the DHF, and 600k HBD as interest. A cumulative 5.3M HBD added.

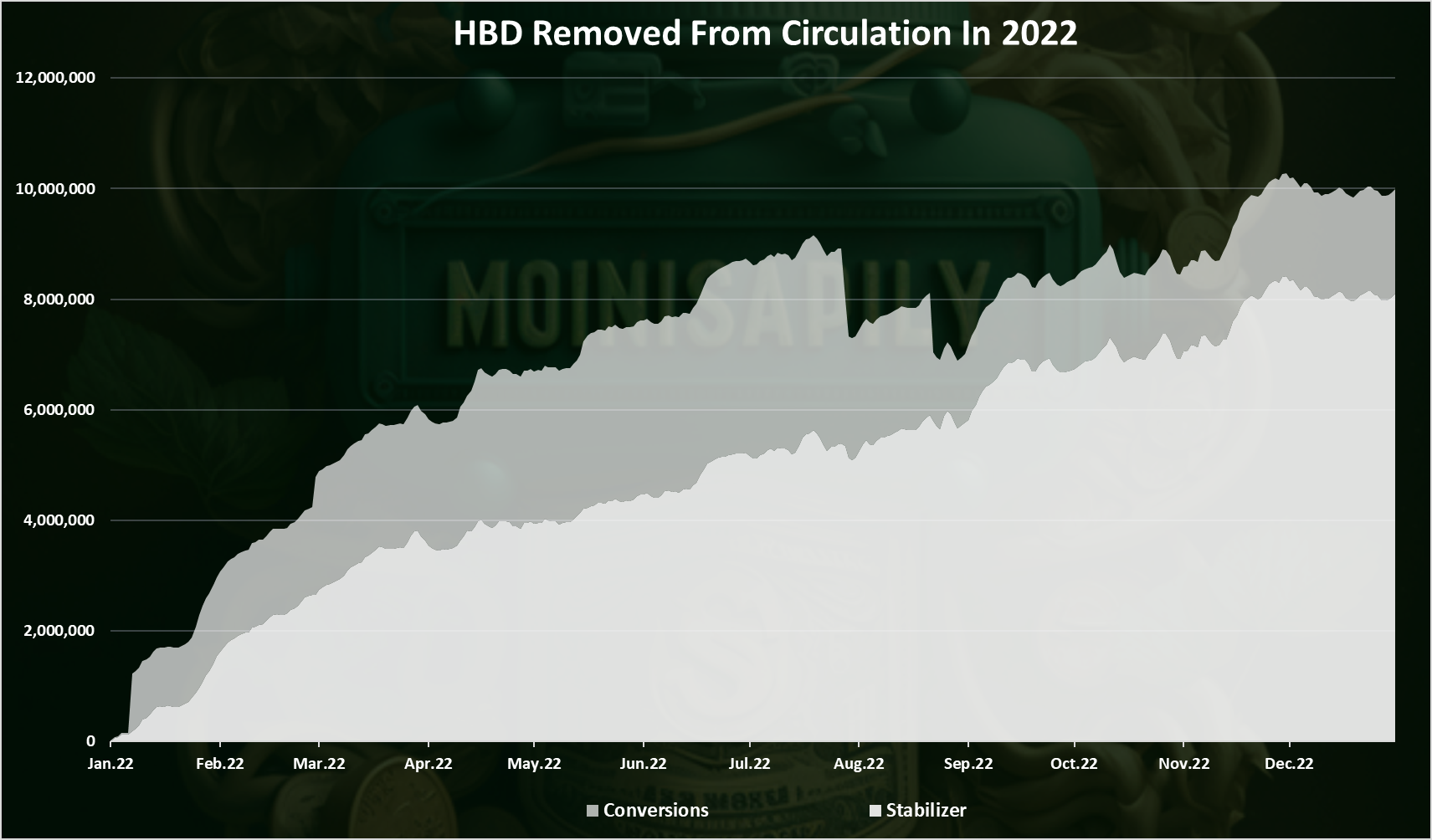

HBD Removed From Circulation

Now let’s take a look at HBD removed. Here is the chart.

The @hbdstabilizer has been the number one method for removing HBD from circulation. A total of 8M HBD was removed from circulation by the stabilizer. The conversions from the other users’ accounts to 1.9M HBD. There are a few other methods like HBD sent to null, null as beneficiary, DHF as beneficiary, but the amounts there are small and adds up to around 40k HBD in total.

The stabilizer is providing support for the HBD price on the internal market, buying HBD with HIVE if the HBD price is bellow the dollar. The above chart tells us that HBD needed some support in 2022, and this is why most of the contraction came from the stabilizer. This was mostly in relation with the HBD price on the external markets, mainly Upbit, where the HBD speculators traded HBD under the dollar. The HBD supply on Upbit has dropped massively in 2022, from 9M at the begging of the year, to just 1M at the end of 2022. This means a lot of the speculative HBD supply has now exited.

A total of 10M HBD was removed from circulation in 2022.

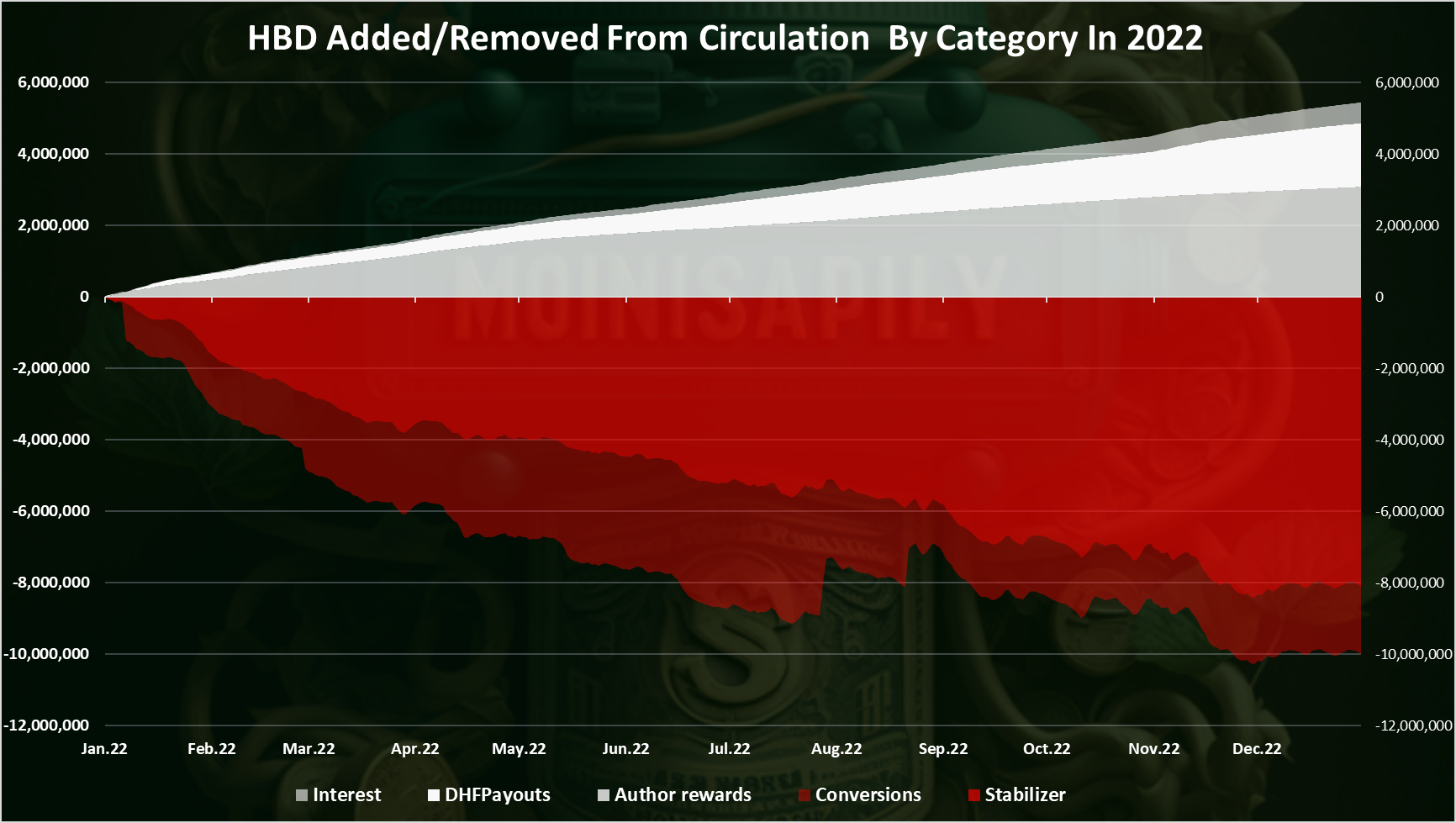

Cumulative HBD Added/Removed From Circulation

When we add the two charts above, we get this.

As mentioned already the authors rewards are the main category in the positive, and the stabilizer is dominant in the negative.

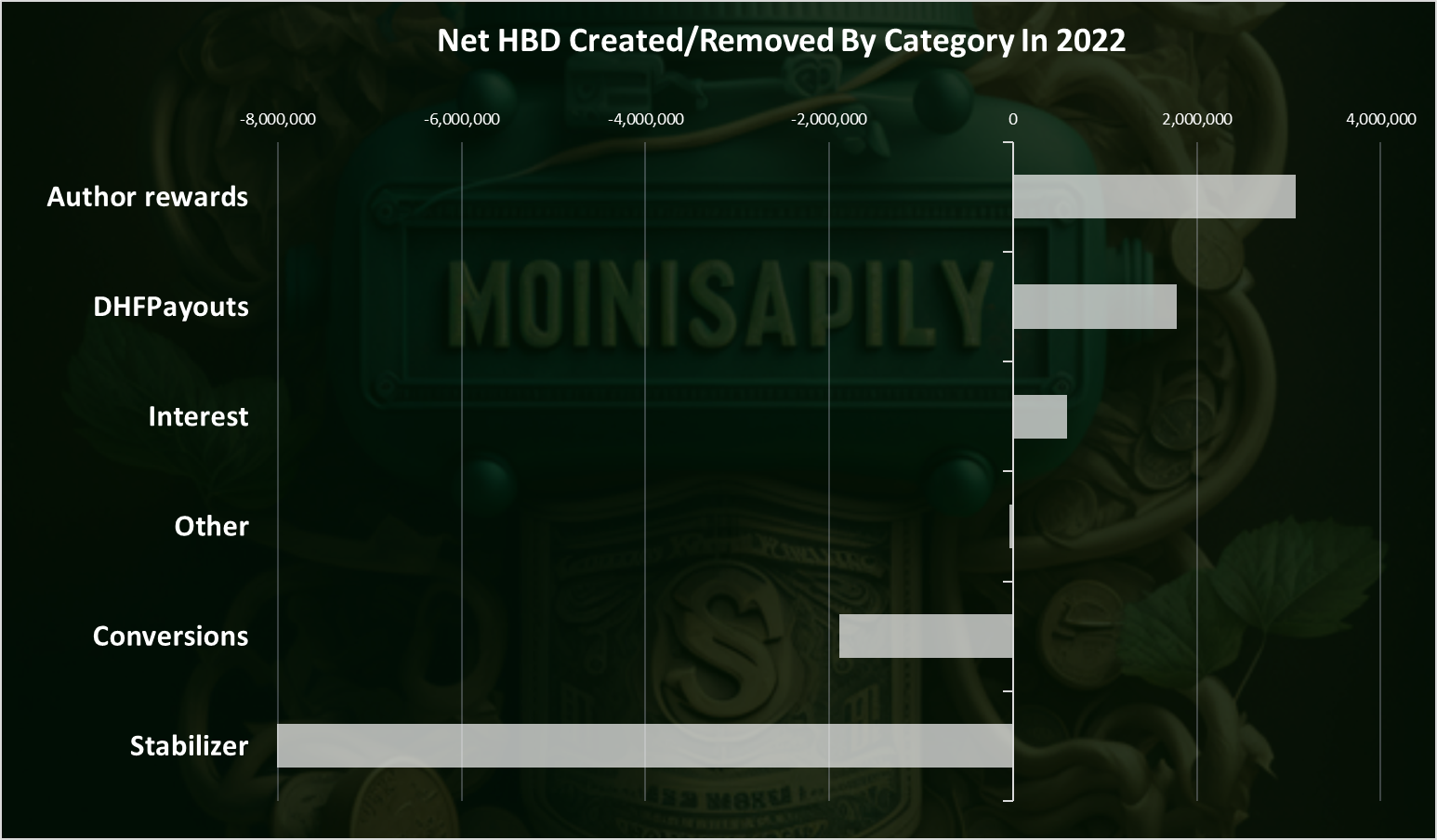

When we collapse the positive and the negative values from the above we get the final chart for NET HBD removed in 2022.

We can see that 4.5M HBD was removed from circulation in 2022. Most of this trend happened in the first half of the year, up to July, when the process was reversed for a short period of time, and then the removed HBD supply remained around in the range of 4M to 4.5M for the second half of the year.

HBD Supply

Finally the HBD supply for 2022 looks like this.

The HBD in the DHF is represented with the light white.

The freely circulating HBD supply started the year with 13.7M and ended with 9.2M HBD supply, or a 4.5M reduction in the supply. As we have seen from the above the main reason for the contraction of the HBD supply is the HBDStabilizer that is maintaining the HBD peg.

On the other side the HBD supply in the DHF has increased from 10M to almost 20M in 2022.

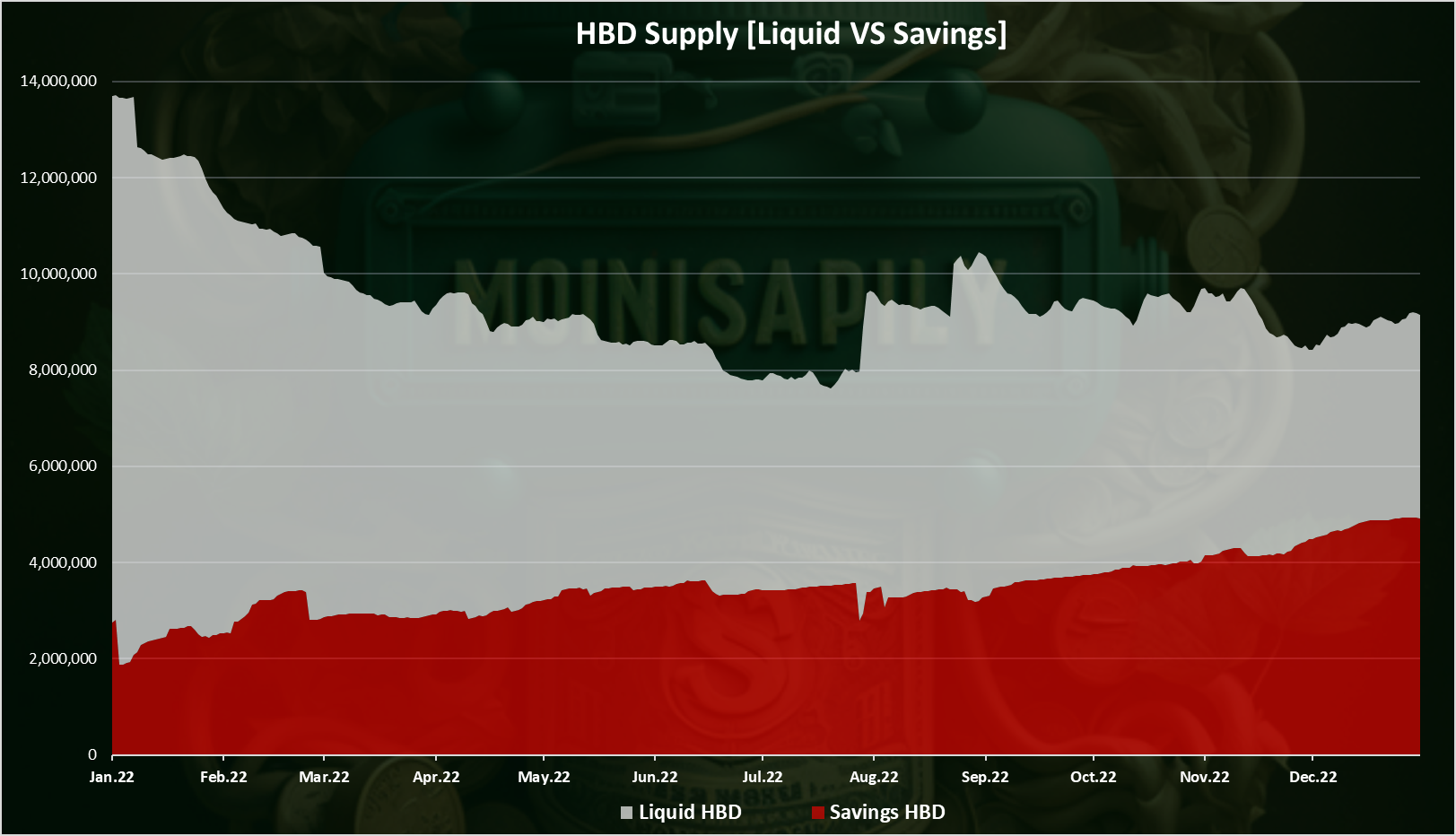

HBD Liquid VS Savings Balance

The HBD held in savings has increased through the year, starting from 2M and going up to 5M at the end of the year. It has increased both in absolute and in relative term. While the overall HBD supply has contracted, the HBD in savings has expanded.

In terms of share, the HBD supply held in savings was around 20% at the begging of the year, and at 55% at the end of the year.

Liquid HBD

The chart for the liquid HBD supply, excluding the HBD in DHF and in the savings looks like this.

We can see that the liquid HBD supply has dropped by a lot. From almost 12M at the begging of the year to 4M at the end of the year. In terms of share, from 80% to 45%.

Summary For HBD Added And Removed By Category In 2022

When we sum it up, all the above, and check what has caused the HBD supply to expand or contract we have this.

The authors rewards are on the top in terms of new HBD added in circulation with 3M HBD, followed by the DHF payouts 1.7M (excluding the stabilizer), and then the interest for HBD 600k.

The stabilizer as previous mentioned is the number one method for contracting the HBD supply in 2022, and then are the conversions from the regular users. From the recent post about the stabilizer we have seen that it has made profit for the DHF in 2022 for about 600k while trading and removing HBD from circulation. It has been a massive improvement for the HBD stability and liquidity.

We are entering 2023 with a strong HBD fundamentals. The excess of speculative HBD has been removed, a large share of the HBD supply is in savings now, the debt is around 5%, far from the 30% limit, and we have a stabilizer with more funds to work with then even before. This means it should be a safe ride for HBD in 2023 😊.

All the best

@dalz

Posted Using LeoFinance Beta

It is great to see. I agree the fundamentals for HBD are stronger going into 2023 as compared to a year ago.

This is the evolutionary process of Hive.

Posted Using LeoFinance Beta

Yep, much better now.

Insightful post as always, master dalz.

Do you think the fact that more HBD was burned through conversions than created is correlated with the 2022 bear market in any way?

Posted Using LeoFinance Beta

Yes it is absolutley corelated with the bear market and the speculators on Upbit, that is the only exchange listing HBD.

As mentioned in the post, the hbd supply on that exchange dropped from 9M to 1M in 2022.

Bittrex also has a HBD-BTC pairing:

https://bittrex.com/trade/hbd-btc

Although the volume is so small it's not worth mentioning. I am filled with regret.

Yes Bittrex is almost non exsisting now

So bear markets are good for HBD and bull markets are good for Hive. Did we just invent perpetual motion on the blockchain over here?

Posted Using LeoFinance Beta

Yes, you just need to know what to hold and when ;)

Excellent information with stats to mull over understanding the balance in stabilizing HBD, explanation given to sudden drop and what transpired.

@tipu curate 2

Upvoted 👌 (Mana: 11/51) Liquid rewards.

HBD is sticking to it's peg, which makes it different from SBD, and other stable coins available in the market. these initiated started by community making it more stable and healthy coin. HBD stabilizer is doing it's job amazingly, and due to this amazing initiative we can have our saving in the form of HBD for sure.

The way Hive's stable coin of hbd has been performing in the bear market proves that its demand supply is being managed very well. And the way you have shared their plan, it will not come down by a dollar in the coming days because it is being done very well. Thanks for sharing this great and valuable knowledge about hbd.

I was initially worried about 20% APR given by HBD. It is great to see that there was nothing to worry about.

!PIZZA

!LUV

Posted Using LeoFinance Beta

(1/1) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

Great post on the outlook of HBD in 2022 and its journey. I think when the market starts to recover there will be less liquid HBD and more HBD will be put into savings.

2023 is looking good so far :)

loving it

The rewards earned on this comment will go directly to the people( @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Good info, thanks ...

I gifted $PIZZA slices here:

rzc24-nftbbg tipped dalz (x1)

(1/5) @vimukthi tipped @dalz (x1)

Please vote for pizza.witness!

Thanks for the report! I was betting that we had a higher inflation, due to the savings, but as I see, it is quite the opposite.

Posted Using LeoFinance Beta

That 20% apr on HBD worked really well...