We can say that Uniswap has been the mother of all DEX’s and it is probably the number one protocol to blame for all the defi expansion that we have seen in crypto. Its code has been copied, modified and build upon, over and over again.

The defi boom is behind us now, and the market has filtered out the most used and powerful protocols. Uniswap has kept its position, although there is a fierce competition. Things can change fast, but for now Uniswap seems to be handling the competition quite well.

Let’s take a look at the data.

May has been a rough month for crypto, with Bitcoin correction for more than a 50%. Still the Uniswap protocol and defi in general keeps going and trading on DEXs is running smoothly.

Here we will be looking at:

- Total value locked

- Trading Volume

- Uniswap V2 VS V3 in trading volume

- Number of users

- Top Pairs

- Price

The period that we will be looking at is September 2020 to April 2022.

The UNI token was launched in September 2020 and it had a big effect on the platform. Prior to this there was some trading going on, but not on a scale as when the token launched.

The data has been colected from differen sources like Dune Analytics, Defilama and Coingecko.

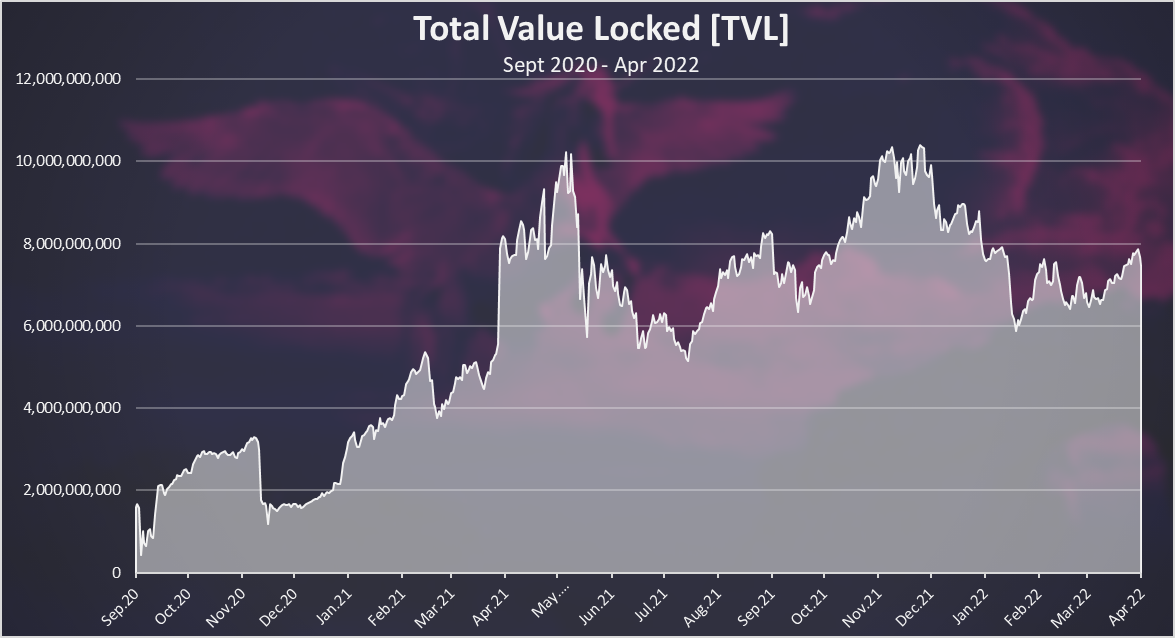

Total Value Locked

Here is the chart for the TVL on Uniswap starting from September 2020.

We can see that there was a big spike in the TVL at the start, reaching 1 billion very fast. In the first months when the UNI token launched there was incentives for liquidity providers in UNI. That lasted short and we can see the drop in December 2020 when the incentives ended. But the platform kept improving and the TVL kept increasing.

A fast growth was achieved in April and May 2021 when the overall crypto market was in a bull run. At that point the TVL on the platform reached more then 10 billion. Going forward we can see some up and downs, that in most cases follow the overall crypto market. Uniswap seems to reached some stability in terms of TVL and the number is in the range of 5 to 10 billion. At the moment this number is around 8 billion.

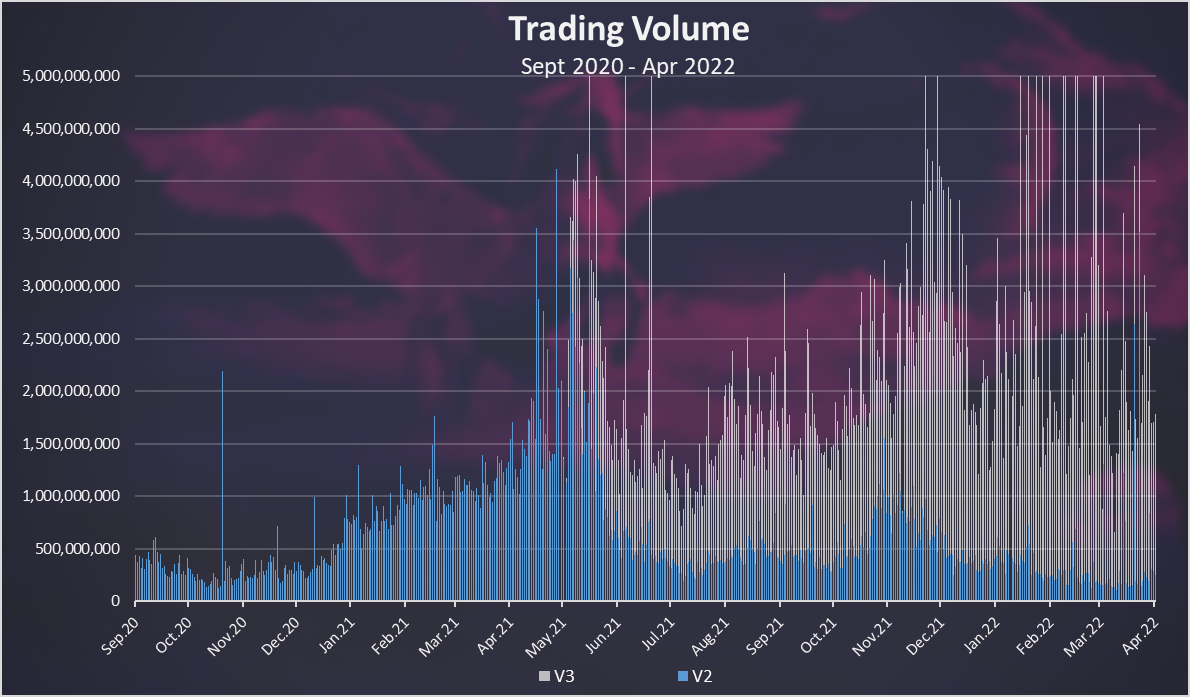

Trading Volume

Trading volume is extremely important. That is where the fees come from and the APR for liquidity providers. No trading volume means no fees and no capital in the protocol.

The chart for the trading volume looks like this.

Uniswap launched the V3 version back in May 2021 and because of this we are tracking both V2 and V3. There is a V1 version as well but the numbers there are very small.

The overall trading has been up in the period. There is a lot of volatility especially in the last period. At first the daily trading volume was bellow 1B, but that was reached in the spring of 2021 and it is above that number ever since. On occasions the daily trading volume is above 5B, usually when there is volatility in the markets.

The average trading volume in the last period has been around 3 billion USD per day.

In terms of V3 vs V2 we can see that the V3 has overtaken the V2 by a lot and the trend is in a direction that this will continue in the future as well.

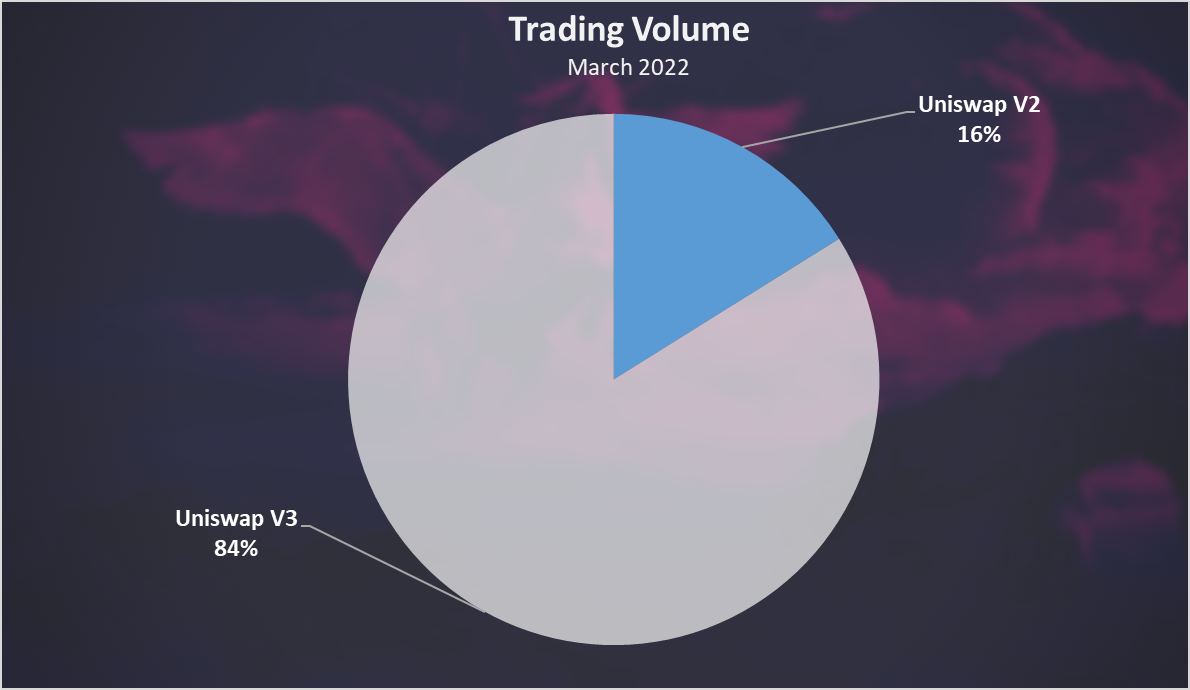

The trading volume share for V3 vs V2 for March 2022 looks like this

An overwhelming 84% to 16% in favor of V3.

DEX VS CEX Volume

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

An example for the last 24 hours:

- Binance 22B

- OKEx 6B

- Coinbase 4.5B

- Crypto.com 4B

- MEXC 3.8B

- Gate.io 3.2B

- KuCoin 2.8B

- Huobi 2.7B

- FTX 2.5B

- Kraken 1.2B

If we plot Uniswap against the volume of the CEXs it will rank somewhere around the 6 spot. Not bad for a DEX.

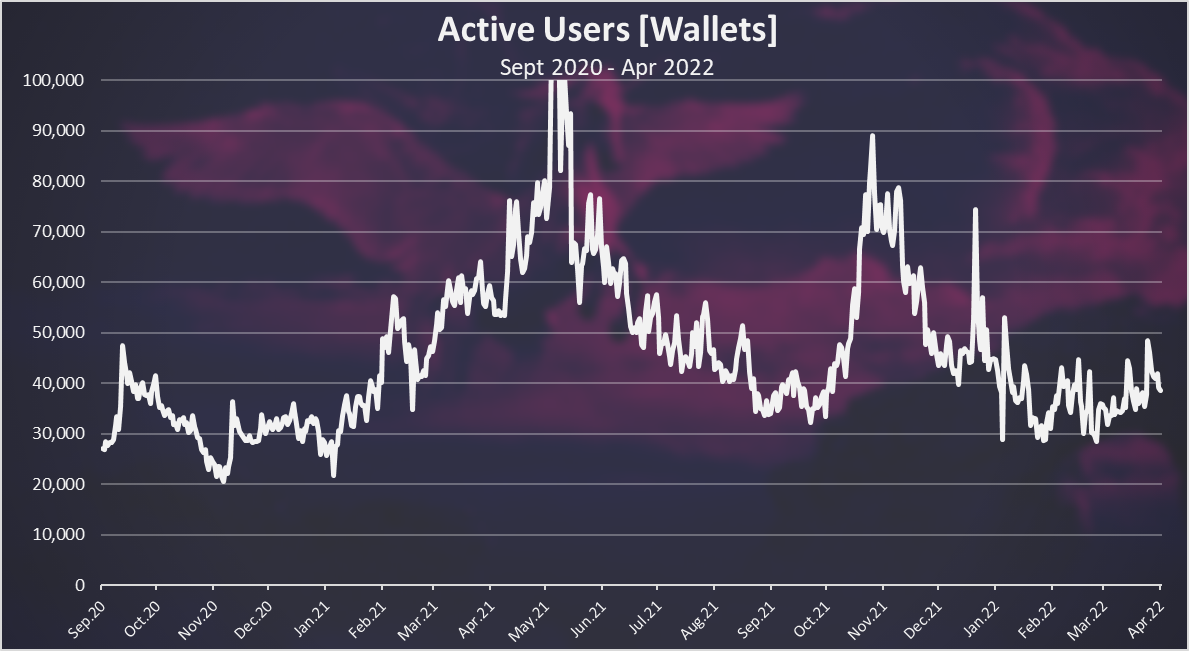

Active Users

How many users Uniswap has? Here is the chart.

As we can see the numbers have been volatile here as well. In the peak Uniswap reached more then 100k DAUs, while in the last period the numbers have been around 40k daily active users. Uniswap is based on ETH, and a lot of users have been avoiding it because of the high fees. But even with the high fees, Uniswap still has the highest volume from the DEXs based on other chains.

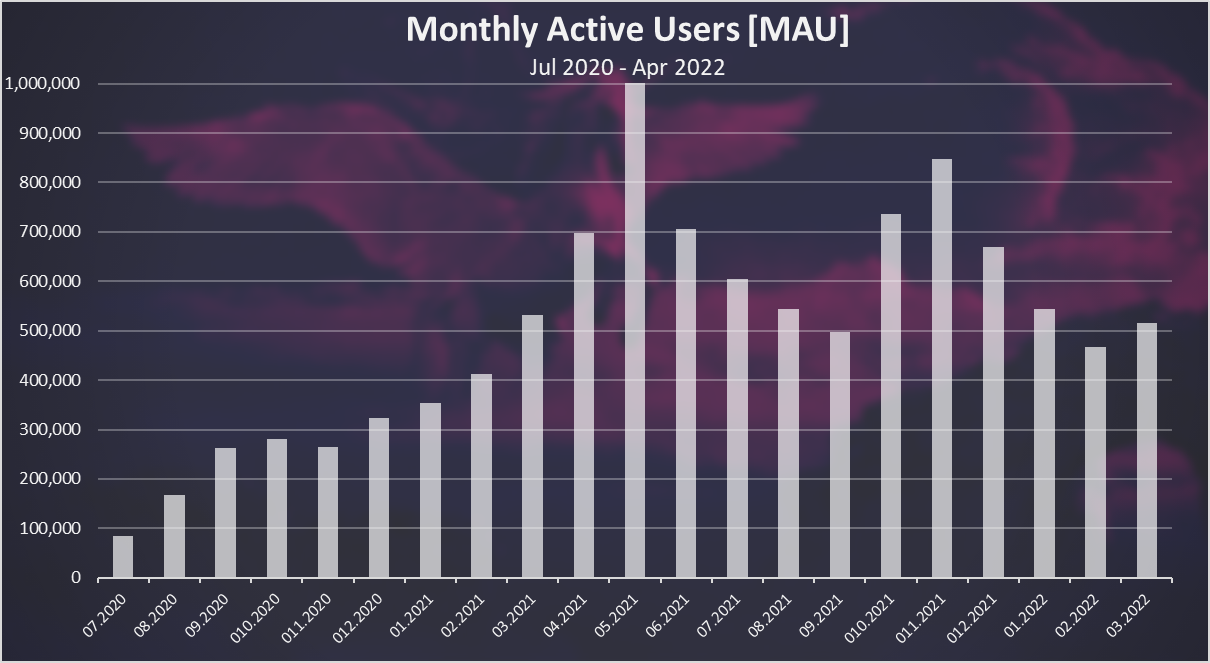

On a monthly level the chart looks like this.

A similar pattern here with the top reached in May 2021, with more then 1M MAUs. In March 2022 this number is around 500k MAUs.

Top Trading Pairs on Uniswap

Here is the chart for the top trading pairs ranked by liquidity.

Most of the top pairs are paired against ETH.

The USDC – ETH pair is on the top here with more then 600M in liquidity. What is interesting is that this is a pool with 0.3% swapping fees and there is another ETH – USDC pair in the top 10 with 0.05% swapping fee. Both of them combined and the V2 liquidity included, and we have more then 1B for this pair.

The Bitcoin vs Ethereum pair is second with almost 400M in liquidity, followed but yet another ETH vs stablecoin pair ETH-USDT. The stablecoins only pair USDC-DAI is ranked no.4 with 350M in liquidity.

Price

The all time chart for the UNI price looks like this.

UNI started with an airdrop and had one of the most valuable airdrops in crypto. The price started with around 3$ per token and spiked at first, but then started to decline. The top was reached in May 2021 with the token reaching more then 40$. Since then, the token has been in decline and now it seats around 10 $.

Uniswap has remained a major player in the defi space with 8 billion in TVL at the moment. The trading volume on the protocol is also healthy with an average around 3 billion per day, proving an incentive from the liquidity providers from the swap fees only without any additional incentives in the UNI token. The number of DAUs has been around 40k in the last week, with a top of 100k. MAUs has been 500k to 1M. The top pairs have a liquidity between 300M to 500M.

All the best

@dalz

Posted Using LeoFinance Beta

Surprising that the decline isn't sharper, considering the surge in tx fees for uniswap. Uniswap is even more expensive than regular ETH tx.

Yea it is .... smart contract operation is more expensive then just a transfer

Binance has remain the no1 in volume. $22 billion is way ahead of it's nearest competitors by a wide margin. Uni price is steady now, although down from previous highs.

Yep Binance is still on the top by a lot.

They are doing quite well and established themselves as a major DeFi player. I wonder when Ethereum 2.0 will kick in if they will see an influx of users as well if the gas fees will be lowered.

Posted Using LeoFinance Beta

It might be .... although I think the app will follow the broad crypto trends

I would say that currently there are all signs to think that users will increasingly move towards decentralized platforms. so there will be a migration from centralized to centralized platforms, in my opinion

Posted using Proof of Brain

Thank you for this great analysis, you did a great work.today now I learnt a new things from this post.

Thannk you for all this data! I'm still trying to understand, but you've done a great work!!

I'm a trader,on which wallet I can get the token

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next payout target is 32000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz: