The stablecoins arena has been heating up in the last years as the marketcap of all stablecoins keeps growing.

USDC has gained the status as the most transparent stablecoin issuer, having in mind its number one competitor Tether USDT, that has been controversial around his holdings.

For those unfamiliar with these two tokens, they are digital dollars issued as tokens on blockchain, by central entities that claim that have the same amount of USD in the bank.

Let’s take a look at the growth of USDC through some data.

USDC is issued by Circle in cooperation with Coinbase. It is a US based company that is regulated and has regular audits on its holdings. Just recently there was annoucmnet from Circle that it has raised 400M in partnership with BlackRock.

According to this BlackRock should be a primary asset manager of USDC cash reserves. BlackRock is one of the biggest assets manager firm with investments in a lot of public companies.

Some of the crypto community has expressed concerns about BlackRock entering one of the biggest stablecoins, since it might serve as a gateway to enter different crypto projects and have a majority vote in a lot of them. It looks like the traditional financial giants don’t want to be left behind with crypto and we might see some big moves soon. BlackRock involvement with USDC is no doubt a big deal.

With this said, lets take a look at the data for USDC.

Daily USDC Printed

USDC started at the end of 2018, but here we have a data from 2019, for simplicity.

Here is the chart for the USDC printed per day.

As we can see in the first years there was not a lot of printing for USDC. The larger amounts started to come in 2020 and increased significantly in 2021.

On times there is more then 500M USDC issued per day.

What is interesting from the chart above is that there is also days when there was burning of USDC, reducing the marketcap. It is good to see that there is two ways conversions, since a lot of the other stablecoins, the numbers seems to only go up.

Monthly USDC Printed

Here is the monthly chart.

The record for USDC printing on a monthly level is in May 2021, when almost 8B was added in one month. January 2022 has also seen a big number for USDC printed, while interesting in March 2022 we have one of the biggest contraction for USDC supply with 1.5B removed from the marketcap.

USDC Supply

The chart for the USDT supply looks like this.

We can see that prior to 2020, the marketcap of USDC was negligible, with under 1B in supply. Then a huge increase in 2020 and 2021 especially. In 2021 only USDC added almost 40B more of its supply.

We can notice the decrease in the USDC marketcap in the last two months. After a long period of time when the marketcap for USDC just kept going up, we now have some cool of.

If we zoom in we have this.

Here again we can notice the uptrend in 2021 and the downtrend in the last two months.

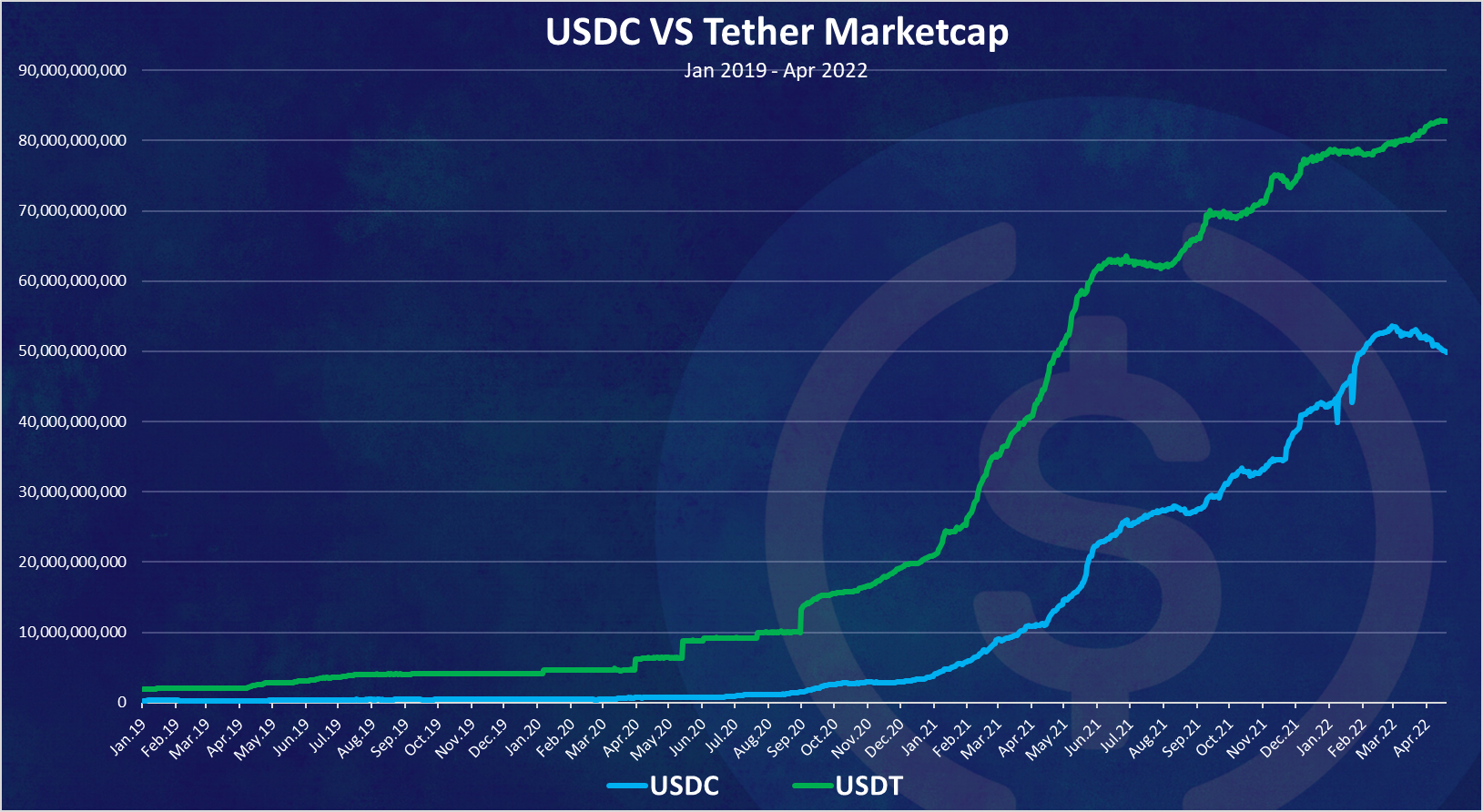

USDC VS USDT

How is USDC doing against the number one stablecoin Tether? Tether was funded three years before USDC, so it has some head start. Is USDC managing to catch up?

Here is the chart.

There seems to be a similar pattern for both of the stablecoins when we take a look at their marketcap.

Tether is leading from the very start, and it seems to started increasing its supply a bit more earlier in 2022 then USDC. USCD seems to outperformed Tether in the second half of 2021, when the Tether supply was decreasing while USDC kept growing.

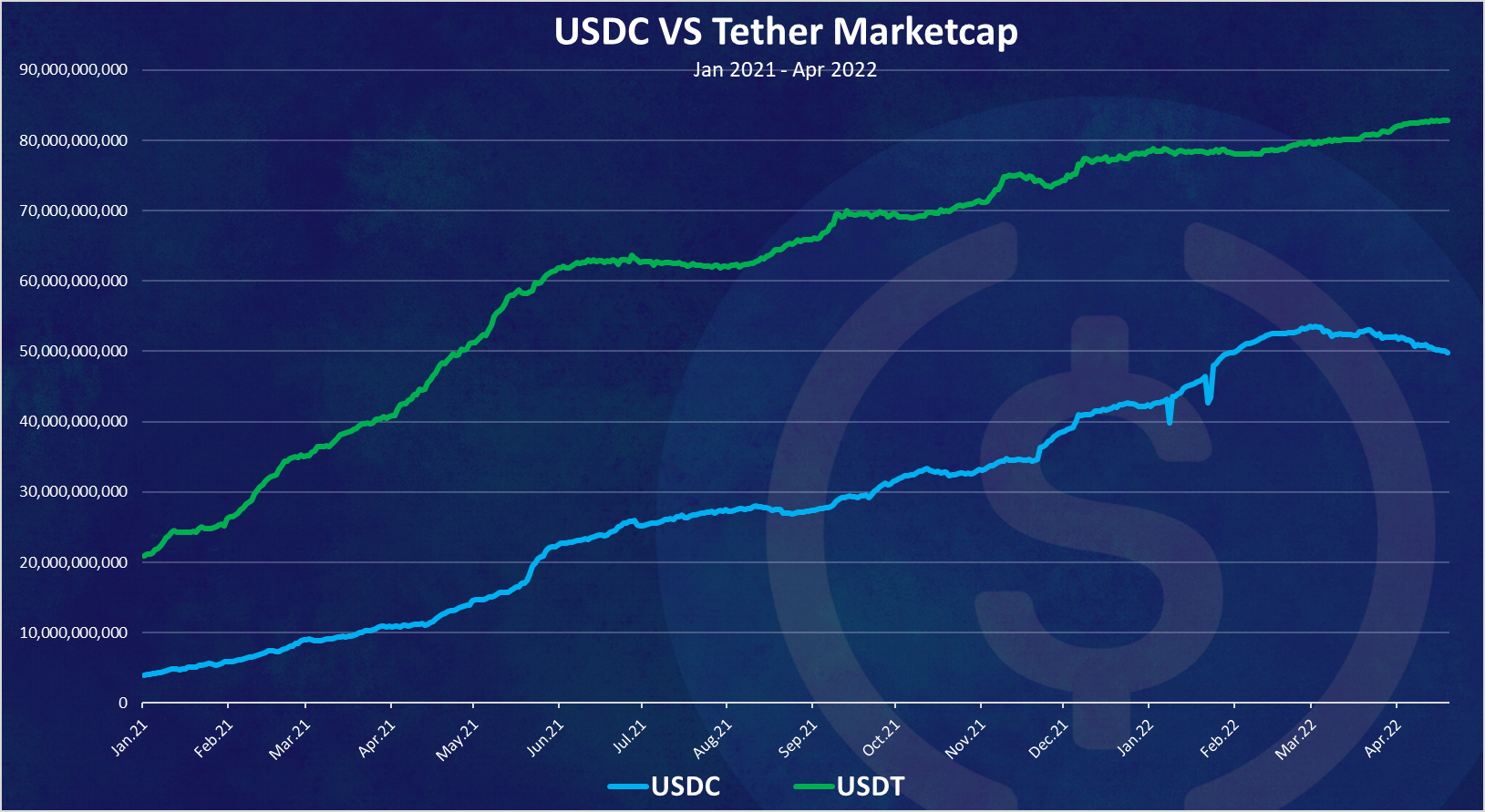

If we zoom in we got this.

Up until February 2022 USDC was growing faster then USDT and it seemed that is on a track to close the gap further. But then starting from March the USDC supply decreased, while Tether USDT kept it supply quite contants and even managed to add a bit more on top of it.

Because of this in the last two months the gap between this two increased again and Tether is in the lead by a wide margin again.

At the moment the USDT marketcap is 82B while the USDC is 50B. In February 2022 the USDC marketcap was 53B, meaning a decrease in the supply for 3B.

Well, it seems that Tether has managed to keep its no.1 position for now. USDC had a great run up until February 2022, but then it seems it lost some of its fuel in the last two months. Still with the latest involvement from BlackRock in USDC and if we see some regulatory framework made soon, there might be a lot of institutional capital going into USDC, that might lead in expansion of its supply and becoming no.1 It all depends on the big boys now and the US regulators 😊.

All the best

@dalz

Posted Using LeoFinance Beta

I am very sceptical about Tether - there is highly likely a bubble forming there. I just hope for the sake of many investors that it doesn't pop, ever.

A lot of people have been in the past, and there have been controversy around it, but yet it managed to go on till this day.... yet being caution always help

The funny thing about this is that many people have the same (or very similar) feelings about cryptocurrency in general. We can only hope for the best. Anything can happen, but there is no guarantee for nothing.

also true :)

It shows the huge upside for HBD, Hive's stablecoin.

We could have 50% growth for 2 decades and not get to those numbers considering where we are now. In time, perhaps we will be able to expand in an easier fashion. For now, we just have to keep plugging along.

Focusing upon the stablecoin market is smart. It is going to enter the trillions of dollars within a year or two is my guess. It is simply needed.

USDC is certainly a player and Circle is already filing to be a bank and in compliance with the US regulations.

Posted Using LeoFinance Beta

Yep I think the same ... not sure about those regulations though .... stablecoins seems to be on the no.1 list for regulators.

As far as for HBD, even we attract a tiny amount of the numbers above that will be explosive growth around here.

Both Tether and USDC are US centric. UST is the first one outside USA laws, is very interesting to see further developments. UST, Ampleforth and HBD are some nice examples of stablecoins that can somewhat resist US laws.

Thats very interesting,

Crypto becomes more and more connections to classic finance. So the correlation should become bigger too.

But that's nothing bad.

Tether on the other hand knows only 1 direction, print more tokens. Like nobody ever cash out.

Many people claim "Tether fud is out for years", but 2017/2018 Tehter had a really low market cap compared to today.

The tether would not bust if there is no alternative, but if there is one, it could be. Simple because people want to store their value in some dollars.

What do you think, will exchanges make USDC to the tether replacement in a long run?

Tether has had periods of declining supply. It doesn't necessarily mean people cash out. Tether itself can buy back its tokens from exchanges.

I think this is what is happening in most of the cases, same with USDC.... maybe some exceptions with large players, no regular user will acctualy go to USDC and cash out

82 Billion and no major player in Finance ever have heard of it? :D I don't know they have backed it, even in particular,

Probably mostly bitcoin, tbh, perhaps with a bit of hedging, and effectively bitfinex fee revenue too. It was a leveraged bet on crypto that paid off huge. It crypto collapsed their business wouldn't be worth much anyway whether or not they kept the peg, so they YOLOd it and won.

True, But last Bullrun 2018 was the MC around 2,8 Billion and drops to 2 Billion year after.

At this time we are at 82 Billion and it doesn't stop rising. Tether printed in 3 month close to 60 Billion USDT.

I mean they won for sure for $$$.

But somebody hold that token now under the promise its worth x.

if trading activity decline, they have 2 choices. print more to keep the party on or the peg will bust,

Because so they only need new capital flow in for trading bitcoin/ other stuff and can arbitrage it.

Every Tether starts with Tether is a very interesting concept. There are no user funds.

Tether release and sell and after that user can hold.

Tether doesn't allow deposits. So we cant just simply send fiat for Tether.

Tether is deeply integrated in the crypto market, and the OG exchange will support it I think... it also seems to be used more from the east.

The question is how much will it blow up more? :D

People dont want to "Store value in dollars" But on a stable Unit of Account. And Tether is not "printed" is created after a collateralization effect, like USDC.

Meanwhile, HBD or UST are "algorithmic stablecoins" which means they are created after automatic burn/lock of other assets. Lots of grow ahead, if you ask me.

did you ever see an audit from tether assets?

No?

Did you know how to put Real money into Tether over the Tether LDT?

Also No?

Exactly that's the problem with tether.

They use their own exchange as collateral ( Bitmex).

And that is itself a ponzi.

Tether was more closely associated with bitfinex than bitmex, but maybe has some affilation with bitmex too (not sure).

my mistake! It was bitfinex.

Tether uses Bitfinex for the distribution. And tether minting is for institutions and OTC deals, not for normies. If tether is a ponzi, it is a way smaller ponzi than the FED,ECB,BOE and BOJ, so its fine for me at this point.

Posted via D.Buzz

Interesting,

I wonder how UST will evolve during this year after the 4pool has been implemented in curve finance.

By the way, you misspelled the paragraph title

I look at UST as one big experiment. Things like this have never been done before so we are in uncharted territory now.

They seem to have big funding, so they keep the momentum.

Thanks, corrected!

Posted Using LeoFinance Beta

USDC is having a good run. The chart shows that tether is way ahead, almost double. That's still a lot of money. I think in crypto terms, it's not a massive difference !

While USDT is used more frequently for trading and payments, USDC is often described as a safer stablecoin since Centre (circle and Coinbase)makes a greater effort to comply with audits and governmental regulation, and has more transparent, fully-backed reserves.

Furthermore , both USD Coin (USDC) and Tether (USDT) have emerged as the leading stablecoins, consistently leading the market and appearing in nearly every major cryptocurrency exchange, wallet, and application.

This is definitely nice coming from the USDC maintaining that spot

I see a lot of good reasons to not get involved with any of those two. Dragging the crypto world back into the fangs of the tyrants.

Posted Using LeoFinance Beta

#BlackRock :)

yeah exactly

It's ridiculous to look at the reasoning about an asset that can be blocked from you for any reason.

Posted Using LeoFinance Beta

it actually is, building so many of the important DEFI LPs with centralized stable coins is B-O-N-K-E-R-Z

Great post! Thanks very much for taking the time to put this all together! I'm fascinated with these stable-coins. They very much remind me of the 1837–1863: "Free Banking" Era... I mean I'm not that old LOL... but the history of it all, what was behind it all, and how it's all repeating itself with more sophisticated technology.

https://en.wikipedia.org/wiki/History_of_banking_in_the_United_States#1837%E2%80%931863:_%22Free_Banking%22_Era

!LOLZ

lolztoken.com

Outlaws are wanted.

Credit: lofone

$LOLZ

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (1/4)@dalz, I sent you an on behalf of @cryptokungfu

Investors are looking into stablecoins now may be because of the uncertainty prevailing in the financial space across the globe or because of the crypto prices crashes or some other reason.

While both tokens represent dollars, they play different roles for different users. USDC is mostly used for DeFi, which explains why it started growing only two years ago. Tether is the stablecoin for large traders, experienced whales who like the liquidity, who may know more about its shady backing than the public, and who trust it because they have redeemed or created millions or billions of USDT. USDC being more regulated doesn't mean it's safer for traders. It means your USDC tokens are more likely to be confiscated by the US government for some reason.

I always prefer the stablecoins that are backed by crypto assets like DAI or HBD but, interestingly, I feel secure while holding and using USDC rather than BUSD or USDT.

"Circle" has a good reputation in crypto ecosystem. I would not mind fast adoption of USDC on all blockchains 😏

Posted Using LeoFinance Beta

Can anyone suggest some good USDC pools? Hopefully have APR around 10%... 🙂

I use beefy to look for farms

It is true that the USDC is growing, but I think that the stable coins algorithmic as UST will also achieve great milestones in this year, mainly because of the increased transaparency and cryp investment.

Posted Using LeoFinance Beta