As HBD keeps getting better some might want to add some more on their position especially in the savings account with 12% on an almost stablecoin . Now the question is where to get some HBD?

HBD is known for the extremely low liquidity. It is listed only on two exchanges Upbit and Bittrex. Bittrex has been down in the last period, and on Upbit can trade only Korean KYC users. This leaves most of the Hive user base with almost zero options for buying HBD on a CEX, and at the moment it is mostly available on the internal Hive DEX, where users can buy HBD with HIVE or on some of the pools on Hive Engine.

Here we will be looking at the historical data for liquidity and the trading volume for HBD on the different platforms as:

- Upbit and Bittrex

- Hive DEX

- Hive Engine Pools

For Upbit and Bittrex we are using the data for Coingecko. More then 95% of the trading volume for this data is from Upbit. For the trading volume we will be using the records from the transactions recorded on the blockchain, same as for the Hive Engine pools.

The period that we will be looking at is Jan 2021 till Feb 2022.

Liquidity

First let’s take a look at the liquidity, or the available supply on the different platforms.

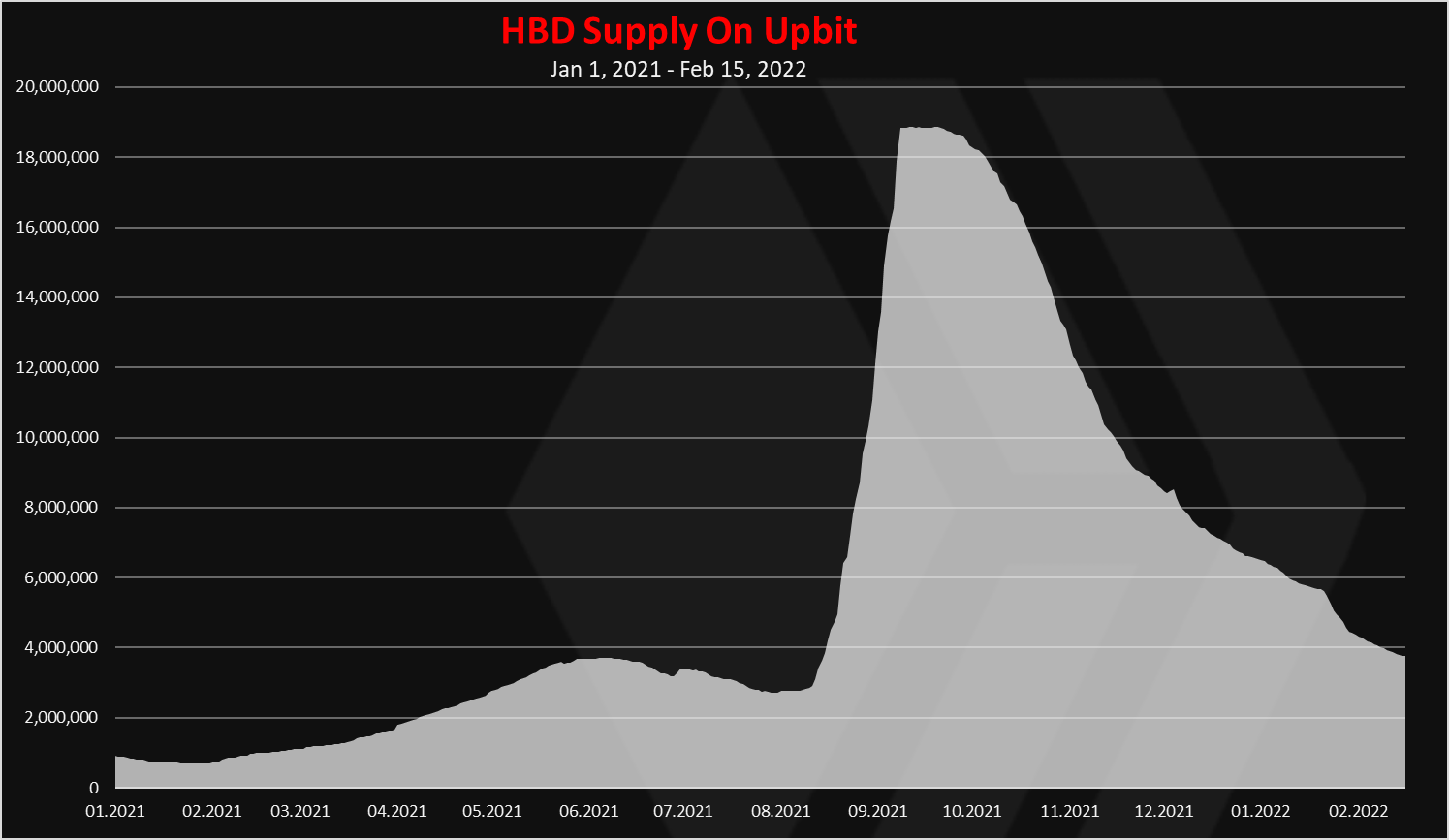

HBD Liquidity On Upbit

First the chart for Upbit.

This is quite the ride for the HBD supply on Upbit. At the end of August 2021 there was an increase in the price of HBD on Upbit that caused a lot of HBD to be transferred there. More than 15M was transferred to Upbit in a period of few weeks reaching 18M HB supply on Upbit. Since then the HBD supply on Upbit is in downtrend and the current supply is around 3.7M HBD.

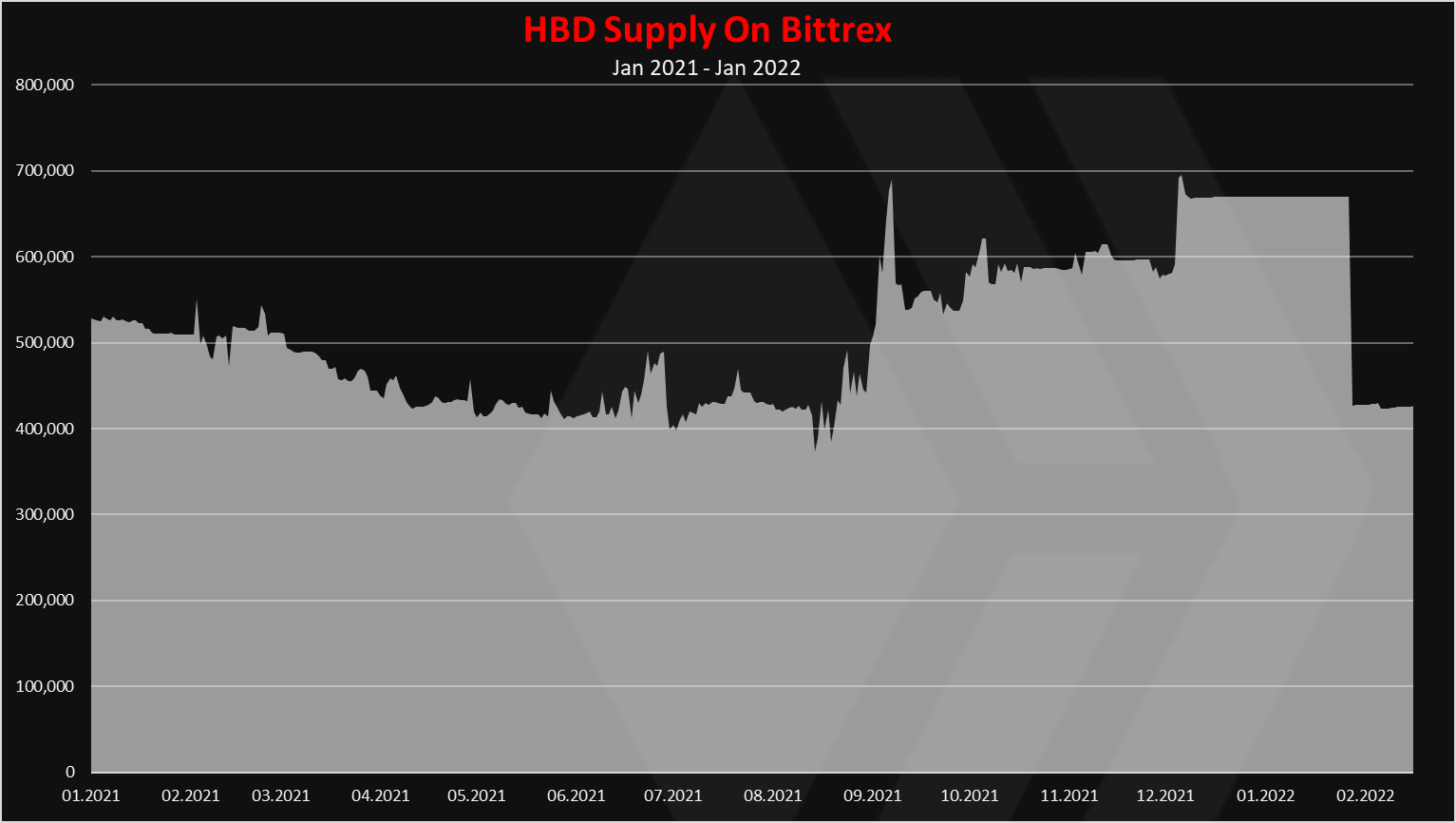

HBD Liquidity On Bittrex

Next lets take a look at the second CEX where HBD is listed, Bittrex.

A steadier numbers here with the supply in a range of 400k to 700k HBD. Less then 1M.

Starting from December the withdrawals and deposits for HBD on Bittrex has been on pause and there is almost no activity there now.

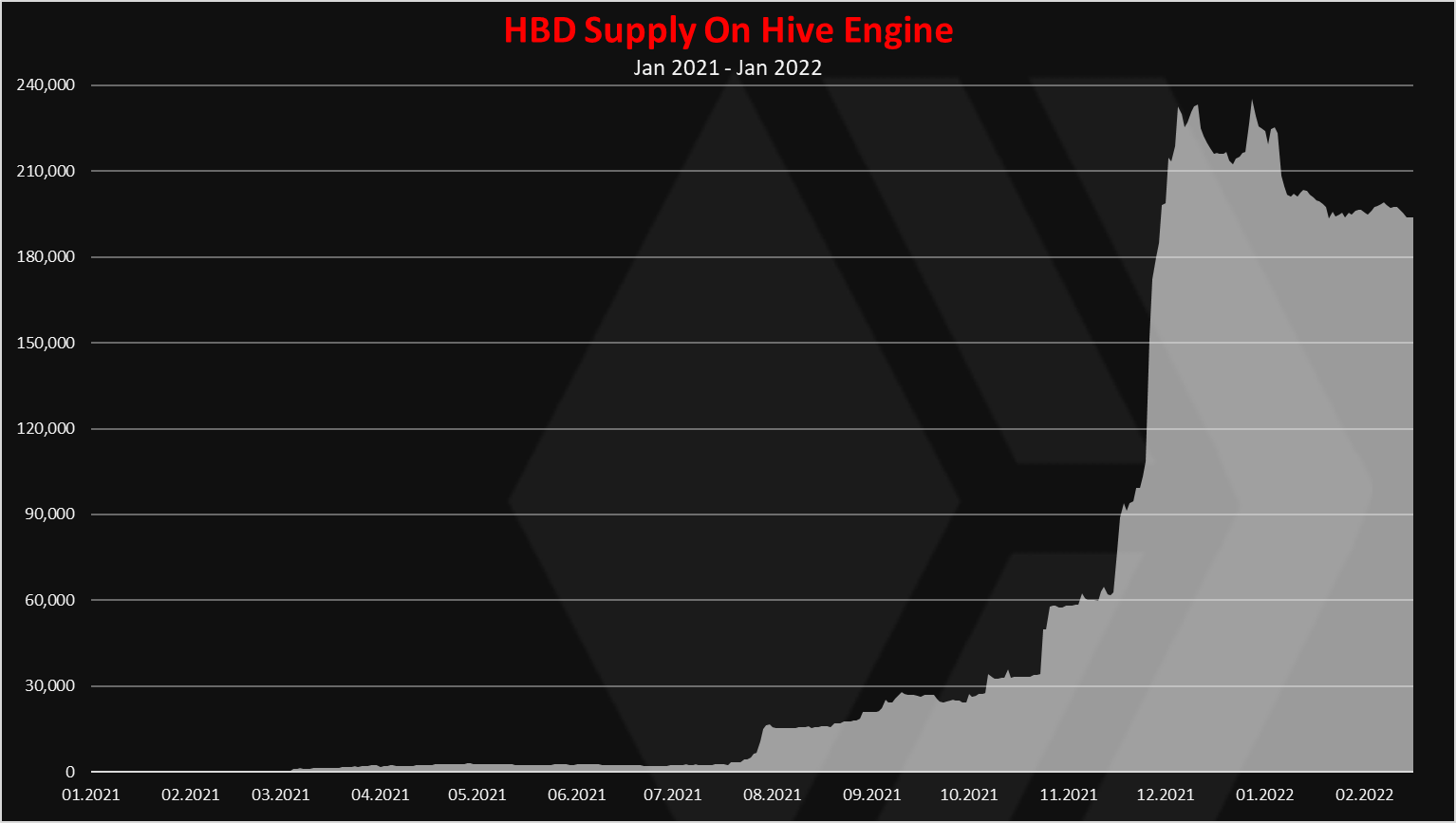

HBD Liquidity On Hive Engine

Now lets take a look at the Hive L2.

The Diesel pools on HE have been active for some time and have increased the overall activity a bit.

As we can see the HBD supply on HBD started increasing in August 2021 and has especially increased in November. This seems to be connected with the launch of Splinterlands SPS token, and then later with the launch of the BeeSwap BXT token that incentives the HBD pools on Hive Engine.

The BXT token has especially improved the HBD liquidity on Hive Engine. While the liquidity has improved it is still low with around 200k HBD in all the pools with the HIVE:HBD and HBD:BUSD some of the bigger ones. There is a proposal to furthere improve the HBD liquidity on Hive Engine with incentives from the DHF. You can check the proposal here.

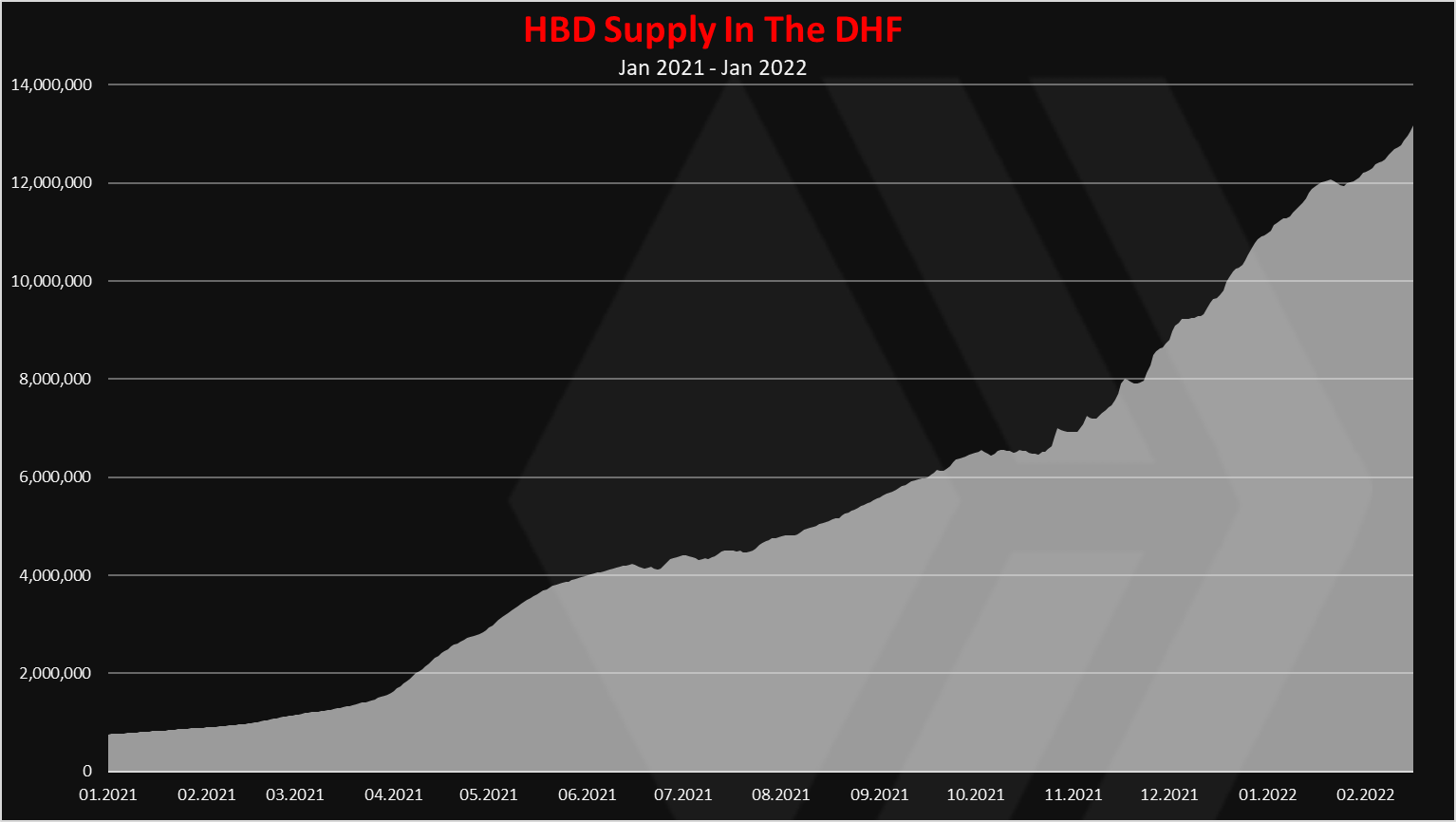

HBD Liquidity In The DHF (@hive.fund)

In theory this HBD is not for sale, but if the price of HBD goes above $1 on the internal DEX, the @hbdstabilizer will start selling some of it on the DEX.

Here is the chart for the HBD in the DHF.

The HBD supply in the DHF keeps increasing and we are now at 13M HBD. This makes the @hive.fund the biggest holder of HBD. As mentioned not all of it can be used for trading, and in theory the DHF can pay a max of 1% of its holdings per day, or 130k HBD at the moment. The stabilizer is now at 76.8k HBD daily so this is the amount it can provide on the market now.

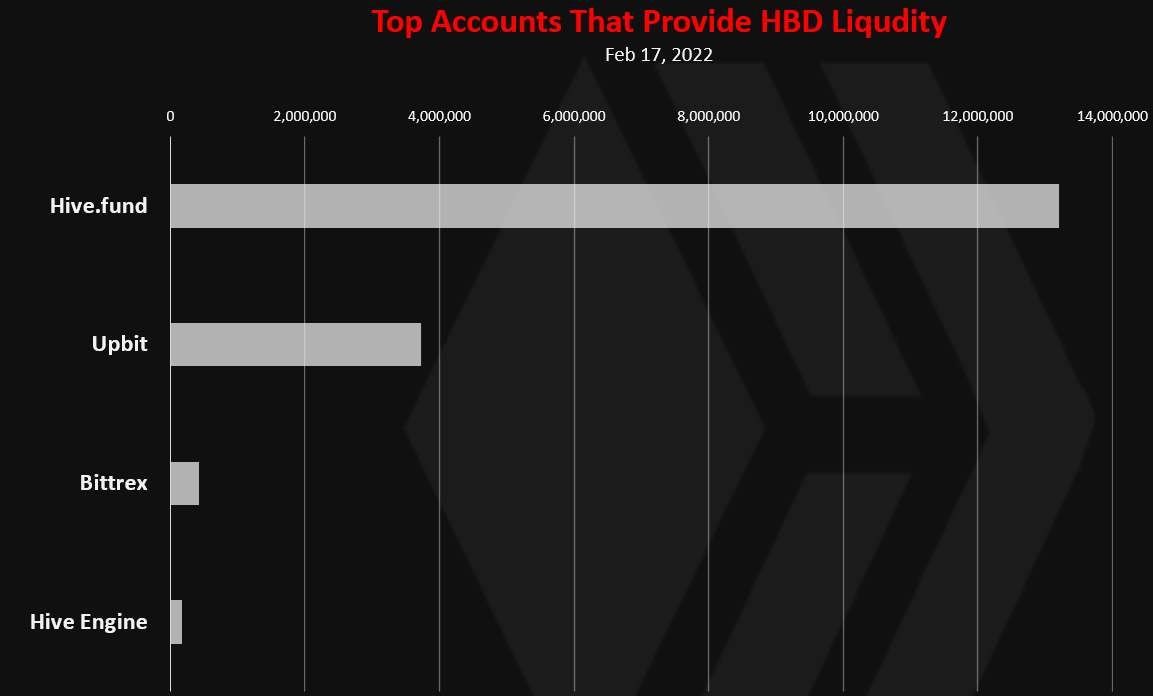

When we rank the above, we have this.

The @hive.fund is dominant now, followed by Upbit, Bittrex and then Hive Engine. A year ago Upbit was no.1, and Hive Engine was non existence. There has been some small improvements in the HBD liquidity.

Trading Volume

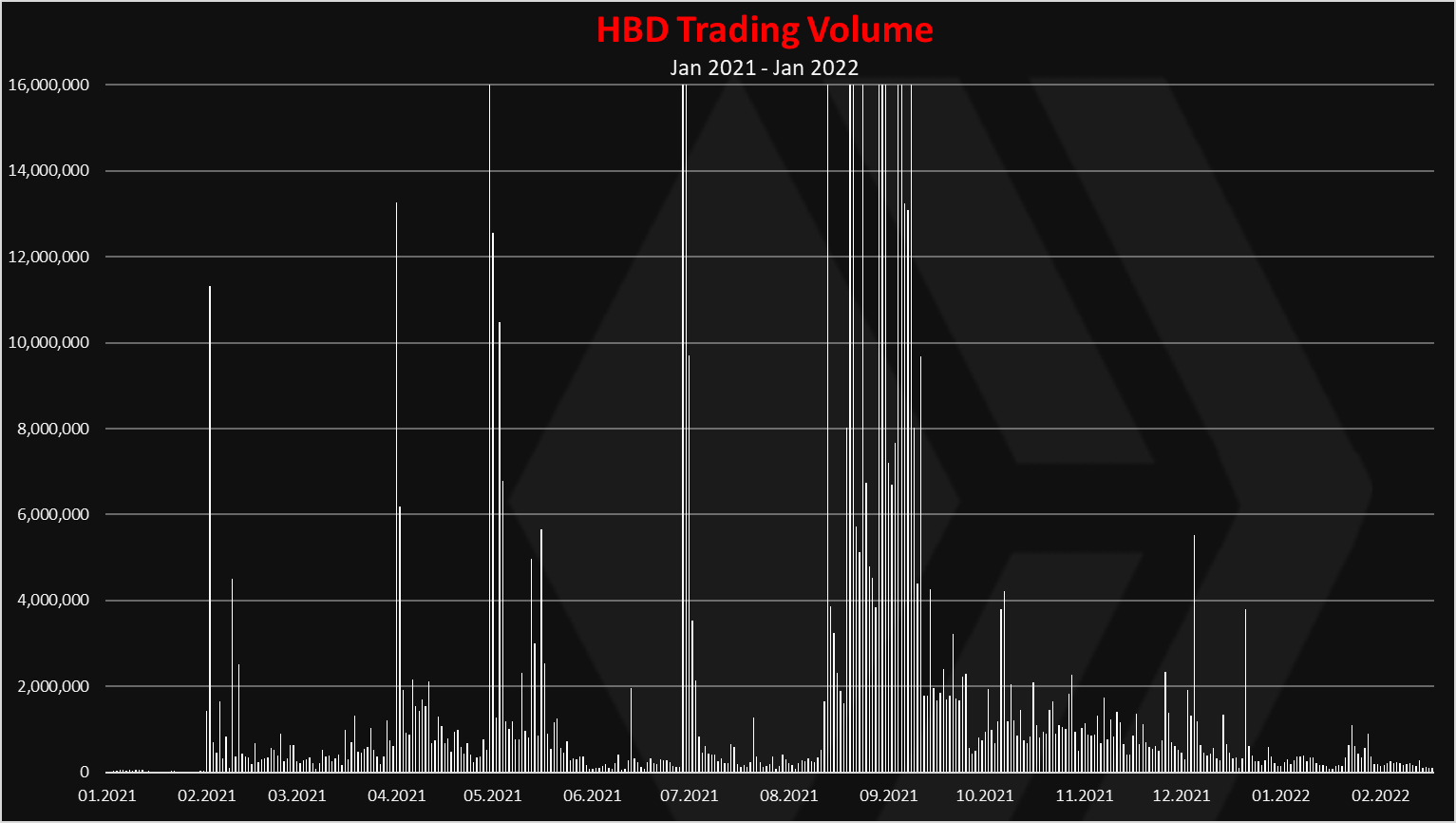

The data above was about the HBD holding on the different platforms where it can be bought. What about the actual trading volume. Here is the chart for the overall daily trading volume for HBD.

A lot of spikes in the chart. We can notice the large daily volume at the end of August 2021. Again, this is the period where there was an up pressure on the price of HBD on Upbit. On some days there is more then 15M daily trading volume. In the last period the trading volume is less then 1M HBD per day.

On average in the last 30 days the trading volume on the Hive DEX has been around 90k HBD daily, on Upbit around 180k and on Hive Engine around 6k.

Where does the trading volume comes from?

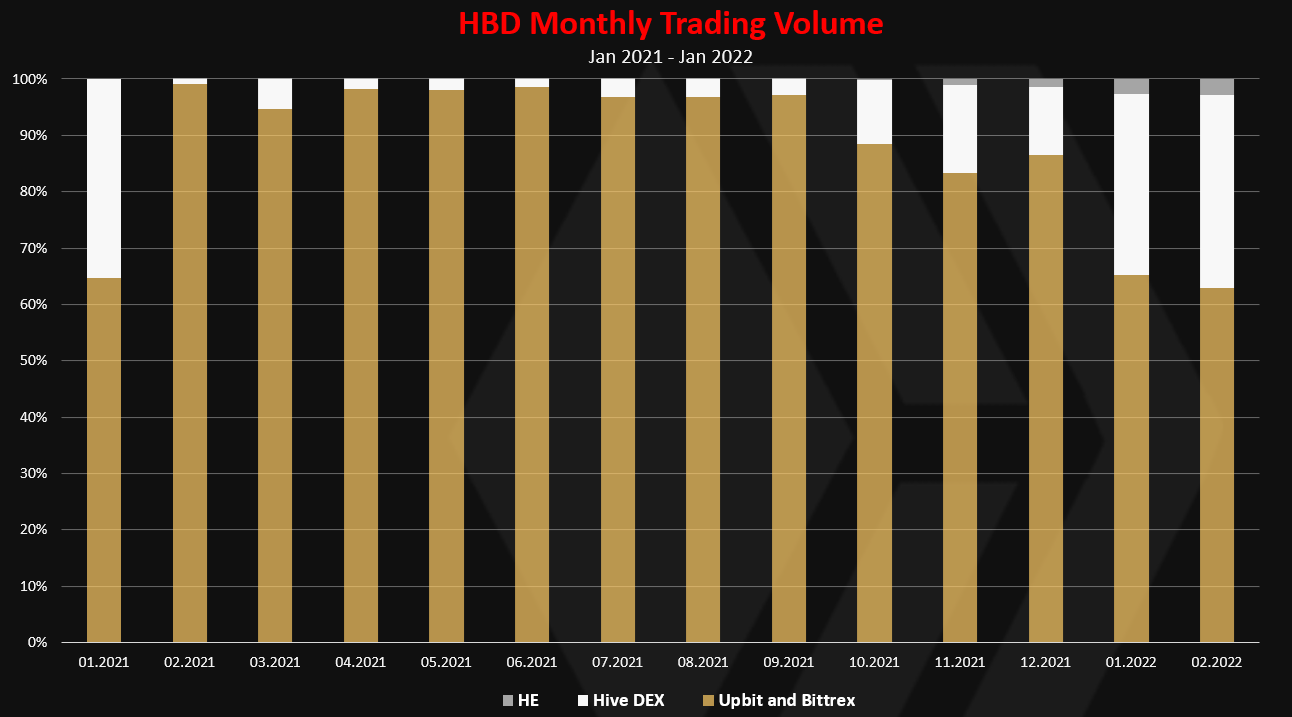

Here is data for the monthly trading volume share.

We can notice here that in the last months, the share for the trading volume for HBD has increased on the internal DEX, that now accounts for more than 30%. The trading volume on Hive Engine has also seen some growth, but overall the share is still small there with less then 5%.

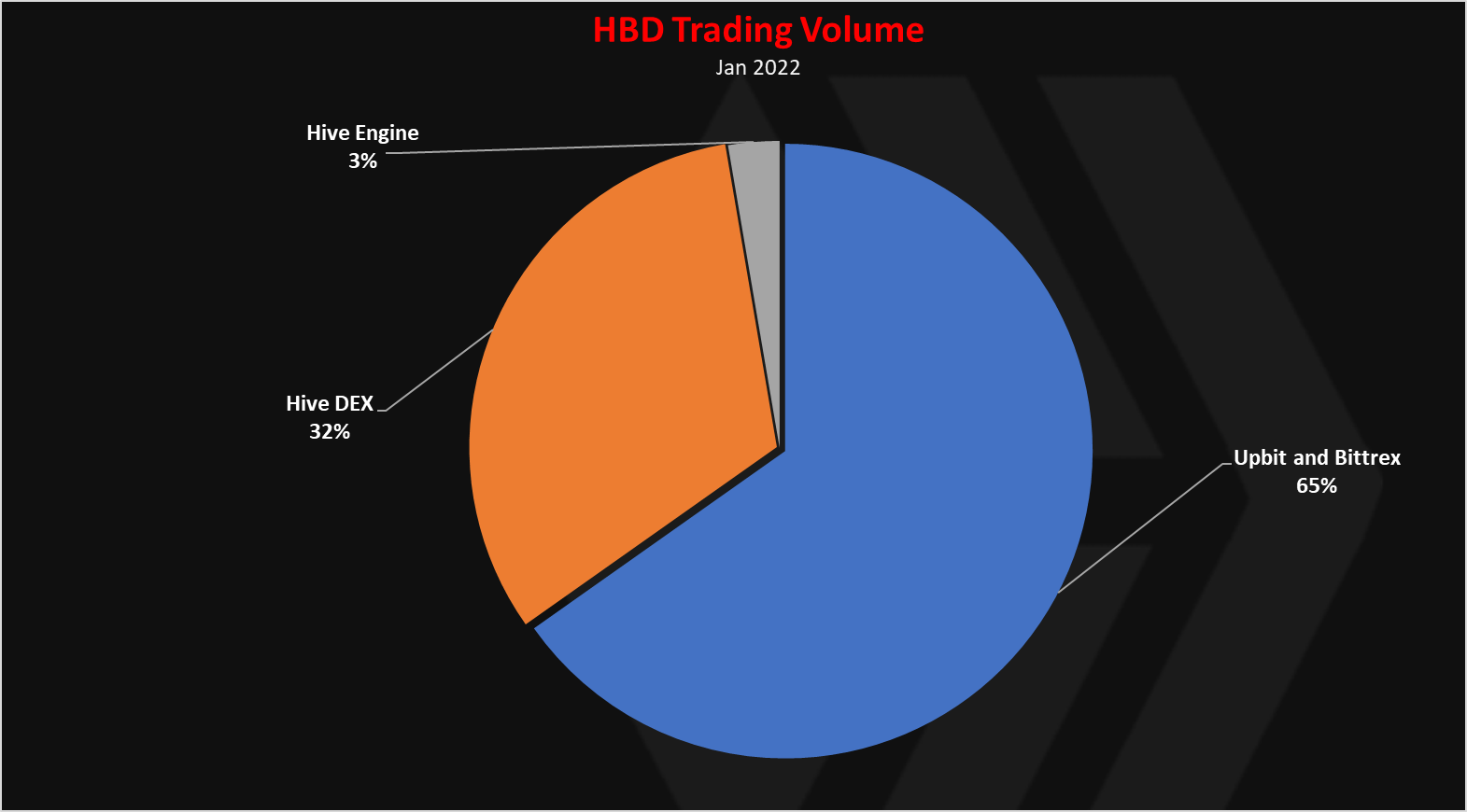

For January 2022 we have this pie.

The internal Hive DEX is 32% for the trading volume of HBD, and Hive Engine at 3%.

Upbit is still dominant with 65%, but the trend has been in favor for the DEX.

At the end to answer the question from the title.

What Is The Best Place To Buy HBD?

If you are Korean, then that will be Upbit.

If you are not Korean that will be the internal Hive DEX, and then Hive Engine. Just a note on the internal DEX, to be careful with large buys, because the slippage can be big, since it depends on the order book. In some cases, it is better to buy on the Hive Engine pools. Buying 10k HBD in one transactions can cause big slippage on the DEX and Hive Engine. For amounts like this it will be better to do it in multiple transactions per day on the internal DEX.

Finally, to add HIVE to HBD conversions on the list.

For large HBD buys, say 100k or a 1M HBD the most practical way would be to buy HIVE first and then convert it to HBD using the on chain conversion. Note that the blockchain has a price of $1.05 when making this conversions or a 5% fee. Still for large buys this will most likely be the best way in a short period of time. The other way for a non Korean user will be multiple buys over a long period of time on the internal Hive DEX.

All the best

@dalz

Posted Using LeoFinance Beta

If you break up your transaction you can often buy a lot on HBD on the internal DEX without much slippage. The stabilizer buys (sometimes sells) tens of thousands often in order to stabilize and still doesn't move the price very quickly.

Yes, with multiple transactions the internal dex is providing a nice liquidity.

with a liquidity tree, it would be much deeper. But the 3 days hurt that a bit.

So we could at the end get liquidity from hive pair if needed for massive transactions.

But that's fucking complex with the 3 days ( in terms of risks). Because I'm sure on the other hand, with some way of "instant value" API from exchanges and some L2 smart contract could solve it :).

Yeah, that's very correct @smooth. Thanks 👍.

Have you any figures for what is in the HBD savings wallets now and is it increasing?

Posted Using LeoFinance Beta

You can find it in my financial stats (section 3).

Will be looking thank you.

Posted Using LeoFinance Beta

This gives a good indication, not precise since some interest is unclaimed.

https://hive.blog/hive-167922/@geekgirl/hbd-interest-payouts-for-january-2022

I think we should add on blockexplorer savings rate for an easy lookup.

Like total supply and % in savings.

Would be a good indication.

Thank you as just a ballpark is enough info plus next month seeing if the trend continues.

Posted Using LeoFinance Beta

3.4M at the moment

Here is an report I have done two months ago ... was 2.4 .. so yea its up

https://peakd.com/hive-167922/@dalz/hbd-savings-are-up-or-data-for-transfers-by-date-and-users

Ionomy. The spread between the best buy and the best sell price is brutally high. I could put some HBD on there and a limit orders of 0.98 and 1.02 BUSD/HBD and see what happens.@ecoinstant There is a direct trading pair between HBD and BUSD on

With @blocktrades you have three stable coins: USDC, USDT and HBD. But one is unable to trade directly from the other two to HBD. And not vice versa either. That's probably the worst of it.

Ahaha I was about to write the same comment ^^

It would be awesome if someone with more coding skills than me (i.e. anyone, since my coding skills are practically zero...) could make a Hive app that allowed direct payment by fiat to buy HIVE/HBD. Although I appreciate the hardest part of this is likely to find ways to get legacy banks and credit card companies to allow it.

I think there are already services like this ... check peakd wallet

Thanks - I'll have a look :) I guess because I go into Hive through Ecency or Leo Finance, I haven't explored peakd enough yet.

Hmm I need to check that out too!

Posted Using LeoFinance Beta

That would be an awesome service

I was not aware that there was a Hive/HBD pair on Hive Engine. I'm struggling to see the point though, why not just trade it on internal market where there are no fees?

Yep there is ... more then 100k in liquidity ... reasons to trade there would be lower slipadge... if there is one, and just for convinience if someone want to hold funds on HE in hbd without withdraw/deposit

It appears to me that you'd have much worse slippage on Hive-Engine than the internal market. I could see it worthwhile if there were other SWAP.HBD pairs available on Hive Engine.

not order books, the swap pools.

https://beeswap.dcity.io/swap?input=SWAP.BUSD&output=SWAP.HBD

And slippage is terrible on the internal market because there is no pool.

There are 6 pools with swap.hbd

https://beeswap.dcity.io/swap?pools&search=hbd

Slippage isn't terrible on the internal market if you are smart about trading. The stabilizer often buys and sometimes sells tens of thousands (sometimes hundreds of thousands) per day and barely moves the price.

The small liquidity pools that exist are okay for convenience and instant execution on moderate-sized orders only. They'd need to be much bigger to offer a real advantage on large orders, and it's not clear at all that the volume can support that.

I agree, I set my orders and watch the bots eat away at it, and tell my friends to do the same. I don't think that is the same thing as 'slippage' tho, that's market making.

I am still thinking and campaigning that we can test a postive feedback loop on one of the small liquidity pools, using the following method: https://peakd.com/me/proposals/206

I continue to campaign as strategically as I know how, its not at all necessary to get a whole year, with two months we will have the data. Look in the graph above how the Swap.HBD:Swap.BUSD pool grew after BXT was introduced. This method in the proposal WILL have effects, and I really hope we can get some evidence and thus determine whether its worth it to keep funding or adjust levels up or down.

You can do market orders and still not have much slippage as long as you don't do too much at one time. 100 HBD repeatedly for hours/days = very little slippage. 100000 HBD at once = lots of slippage (if even possible).

great info! Can swap.hbd be converted to hbd?

@tipu curate

Yes using... tribaldex withdraw

Upvoted 👌 (Mana: 0/87) Liquid rewards.

There is a swap.hbd?

Yep

The key is still liquidity. We do not have a lot of HBD available.

Without getting a lot more in circulation, this is going to continue to be a problem. We have the problem of use cases but it is going to be an issue until we get more out there.

Perhaps after the Hard Fork with the haircut being raised, we will see some changes.

Posted Using LeoFinance Beta

With a pegged asset there is no point in having more supply than there is demand to match the $1 price point, or they would simply get converted back to Hive anyway.

The mechanisms we have allow for dynamic expansion of supply, so in truth if we need more supply then what we need is more demand. That would mean either giving people more reasons to hold it, or making people more aware of the benefits of holding it.

That is true that supple will equal demand and that we need more reason to hold/utilize it.

Of course, the problem is we do not truly have a pegged asset since the range is still too large. Therefore, I believe we need more HBD to tighten the trading range. A lack of liquidity always creates volatility, not what we want in a stable coin.

Posted Using LeoFinance Beta

Putting more supply in circulation will not automatically provide liquidity. Likely just destablise the price unless the demand for hbd also grows. We need a two pronged approach.

Certainly their needs to be an increase in demand. However, while there is a lack of liquidity, the likelihood of exchanges picking it up are very low. This is a problem since we know most still go through those.

Posted Using LeoFinance Beta

Getting out large amounts is the other "problem". Sure you can internal swap it onchain, but the 3 days adds a "huge" price risks for a stable coin to it.

Works both way :)

I normally use Leo dex to trade in hbd, sometimes tribaldex if Leo dex is not working. I use to buy at market price so I get it straight away. But recently placing a limit order is better, get good deals. Bittrex is an exchange so I can't trade on it, as I don't have account. But I'm happy using he as it's all I need !

Better use the pools

https://tribaldex.com/dieselpools/pools

https://beeswap.dcity.io/swap?pools

Just a question, why we can't build a bridge to directly SWAP HBD to USDT & other hard pegged tokens at 1:1 ratio via DHF or other fund base?

So it might be easy to secure the peg price.

$WINE

Cheers~

Proper decentralized bridges are not easy, there are some already centralized.

Overall I agree we need more bridges from Hive to EVMs, fort both of the curencies

The @ecency platform has a commercial hive/HBD market and I find it very easy to use, of course I don't know if there is high volume, but for those who want some quick hbd it is an option.

I think that is the Hive DEX

For those buying SWAP.HBD and moving it to savings on the main chain, it would be nice if the swapping services besides those from HE (Beeswap, Leodex, HivePay) would include HBD in their offer. They currently support SWAP.HIVE <-> HIVE swaps, but not SWAP.HBD <-> HBD. Of course that makes sense for small amounts, for larger ones HE/tribaldex is still the only option.

I was just in doubt of buying a million HBD 😆 Thanks for the advice 😉

You welcome

liquid analysis, excuse the pun!

!1UP

Posted Using LeoFinance Beta

Tnx :)

~~~ embed:1494825318175096845 twitter metadata:RWRnZXJfS3x8aHR0cHM6Ly90d2l0dGVyLmNvbS9FZGdlcl9LL3N0YXR1cy8xNDk0ODI1MzE4MTc1MDk2ODQ1fA== ~~~

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Am really appreciate you for your advice.now I know the place to buy hbd now.

You have received a 1UP from @revisesociology!

@leo-curator, @ctp-curator, @vyb-curator, @pob-curatorAnd they will bring !PIZZA 🍕 The following @oneup-cartel family members will soon upvote your post:

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

Thanks for the great work and enlightments @dalz 👍. Highly appreciated.