Most of the Hivers by now have seen that the witnesses are going for 20% APR on HBD. But what this means? Where does the new HBD come from? Is it sustainable?

I have been following the Hive inflation and supply for a while now, with a special focus on HBD. Let’s take a look at some numbers.

First to answer the question where the HBD interest comes from? It is a new additional inflation on top of the regular one. The thing is the Hive inflation and supply have always been a challenge to follow because of the dual token system and the conversions between them.

At the moment the regular inflation is around 7.3%, but for example Hive inflation for 2021 was deflationary -2.7% because of the conversions. In the past conversions have also pushed the inflation above the regular one, like in 2019 when the regular inflation was around 8%, but with conversions it ended more than 12%.

How Much HBD Is Created From HBD Interest Payouts?

HBD is created from HBD in savings. To get the data we need two things. The amount of HBD in savings and the interest rate that is paid.

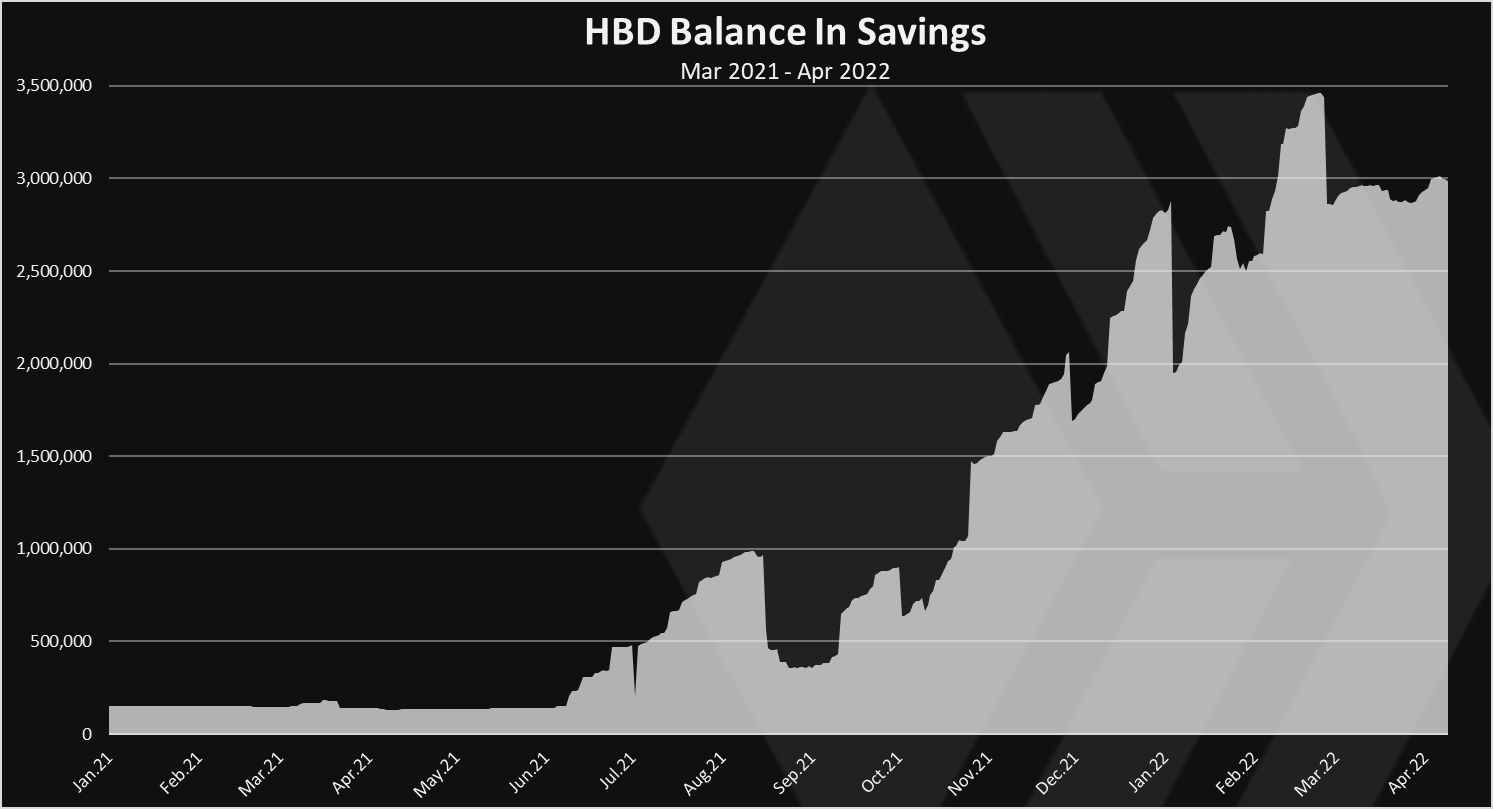

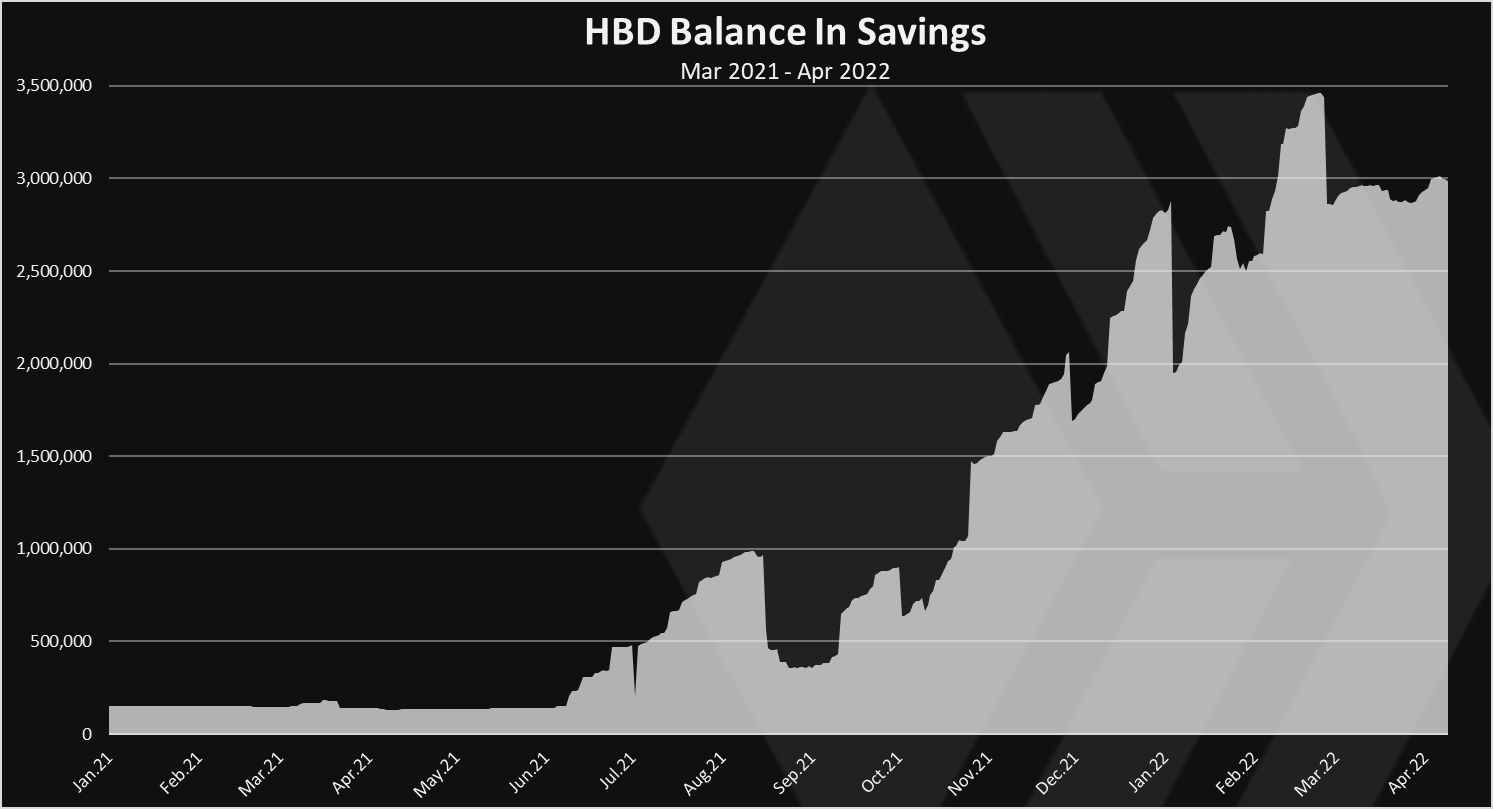

First the chart for the HBD balance in savings.

As we can see the amount of HBD in the savings has increased overtime and now it is almost 3M HBD, with a tendency to grow. Note that in the past a few large accounts were holding a lot of HBD and when they moved it created disbalance and sharp moves.

The above is the principal for the HBD interest.

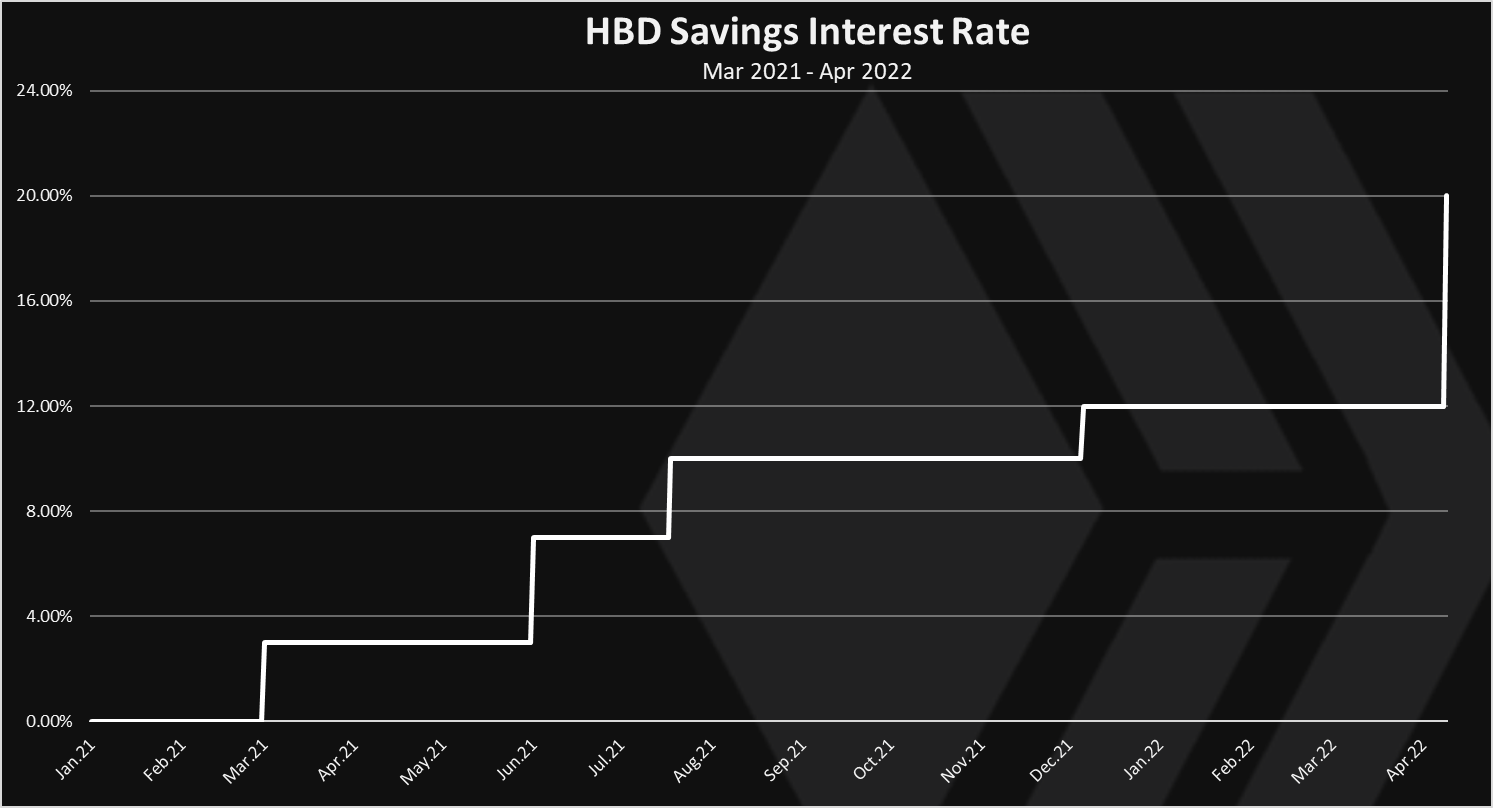

What about the HBD interest rate?

Here is the chart.

The changes for the HBD savings interest rate:

- Mar 2021 – 3%

- Jun 2021 – 7%

- Jul 2021 – 10%

- Dec 2021 – 12%

- Apr 2022 – 20%

The latest change is by far the most significant increase in one step. For just a little while it was at 15%, but this didn’t last even one day.

Now that we have the principal and the interest rate, we can calculate the interest in HBD.

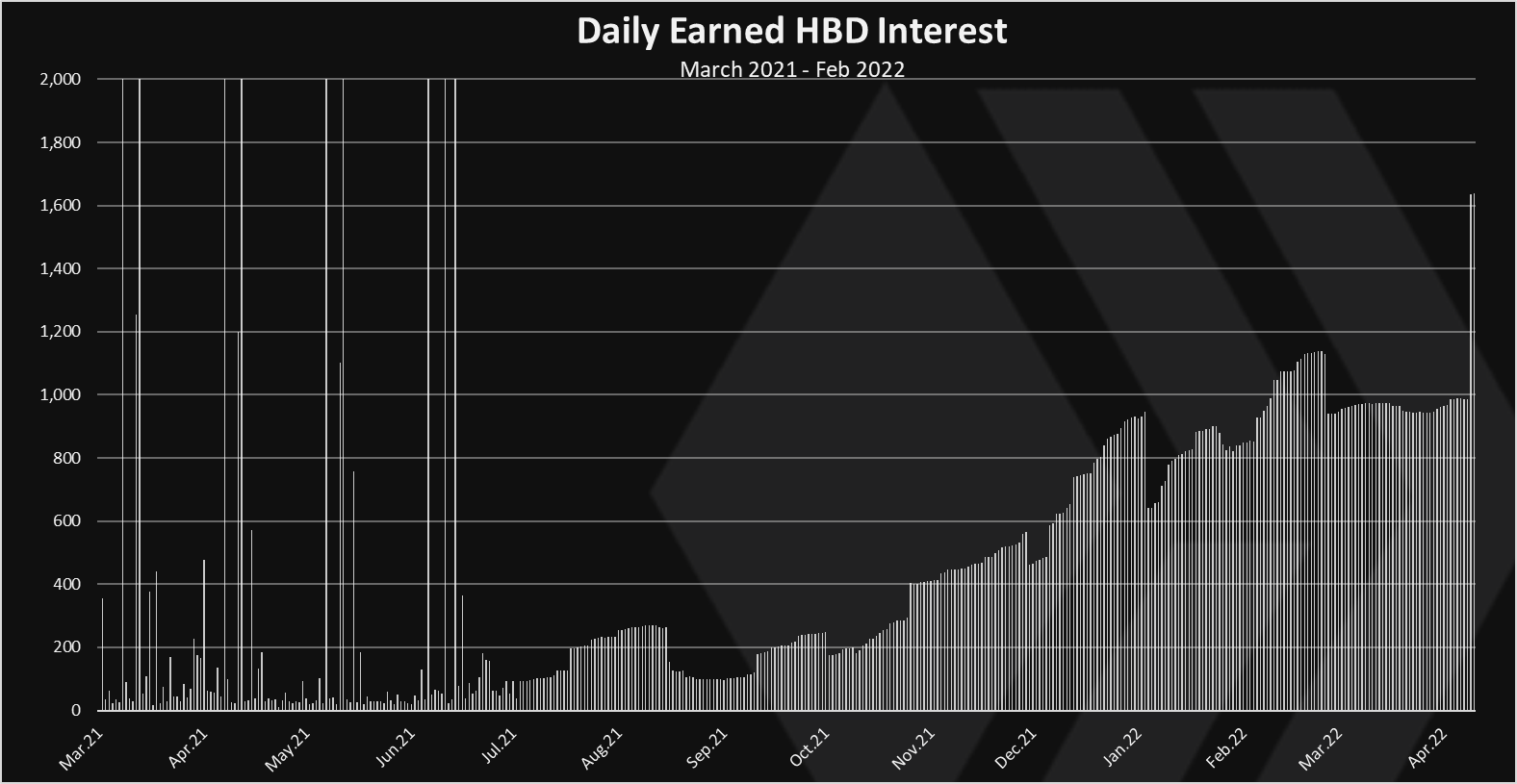

Here is the chart for the daily HBD interest.

Note that prior to July 2021 all HBD was eligible for earning HBD interest and there was some big amounts paid in that period.

After July 2021 only the HBD in the savings is eligible for HBD interest and we can see that the amounts were small, at first with a few hundred per day and in the last period it has reached a 1000 HBD interest per day. I have added one day with the HBD interest rate and we can see that the number is now at 1600 HBD per day. As more HBD is put in savings this will grow and I expect for it to reach 2000 soon.

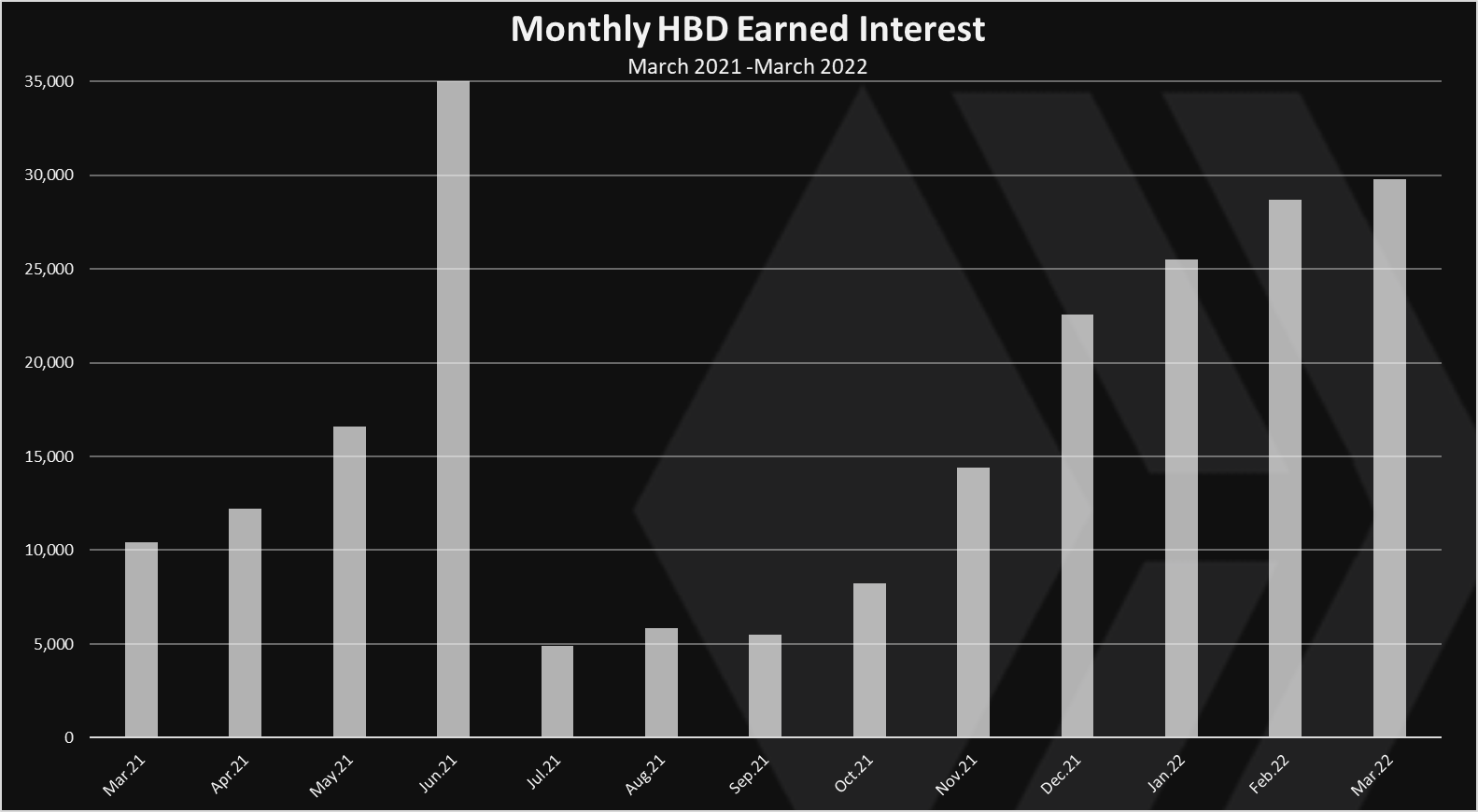

The monthly chart looks like this.

Again, we can see the large amounts of HBD paid at first due to all HBD receiving interest and then smaller amounts gradually increasing in time. In the March 2022, there was 30k HBD paid. This number will be above 50k for April most likely.

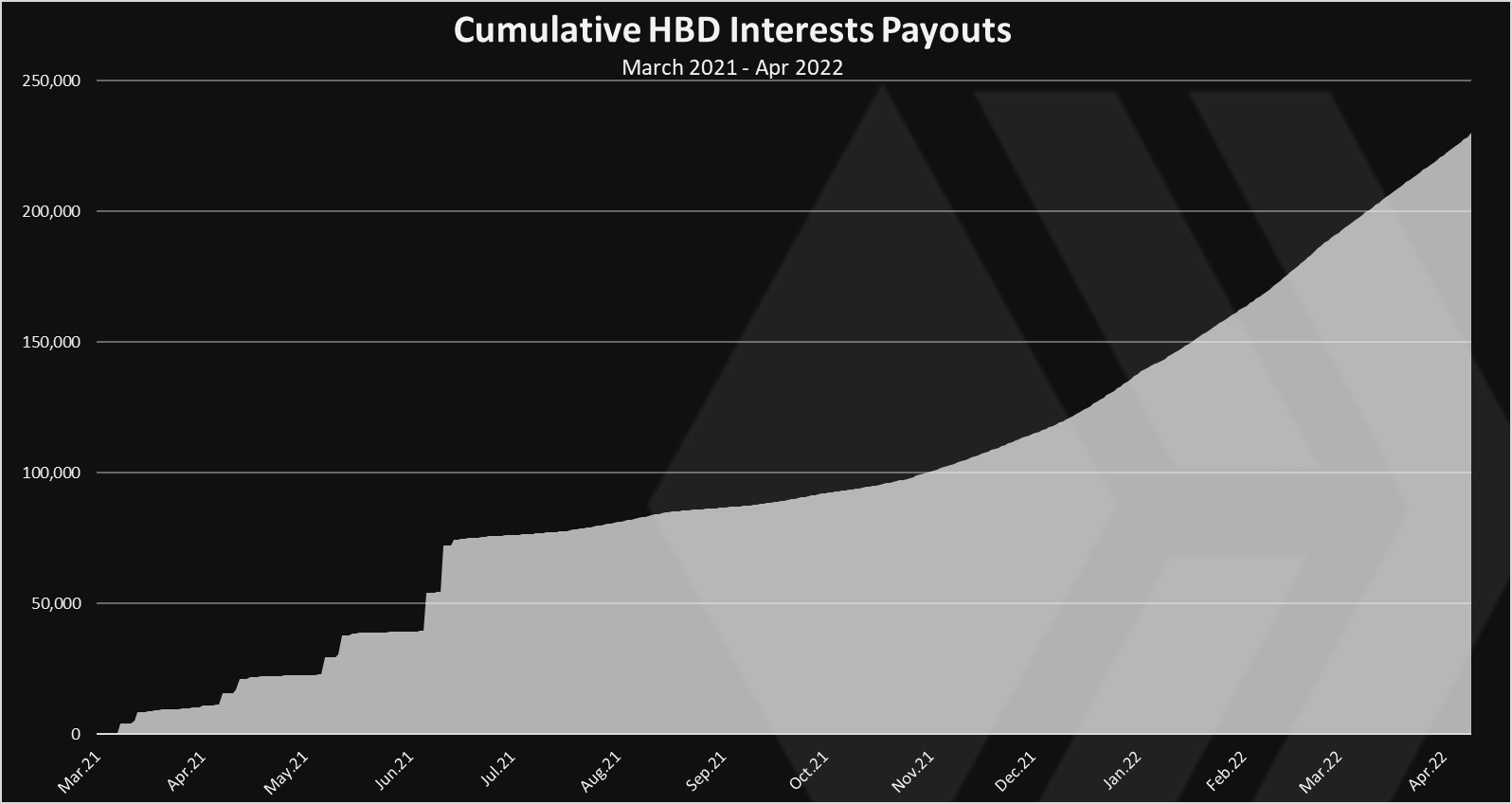

This is the all time chart for the HBD created from HBD Interest payouts.

A 230k in HBD was paid in a period of a year. In the first months there was more HBD interest paid at once because all the HBD was eligible for interest, and after the introduction of the savings accounts HBD interest only the payouts were more gradual over time.

Inflation From HBD

Ok so we got the absolute amount of HBD paid daily, monthly and overall. But what this means when we compared it with the overall HIVE supply and inflation.

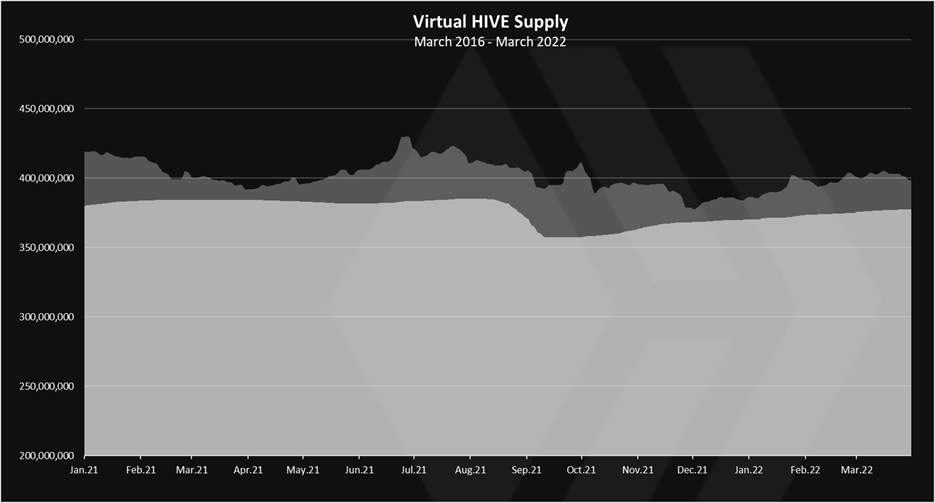

Here is the chart for the HIVE supply starting from Jan 2021.

Hive is still deflationary at the moment if we compared March 31, 2022 with Jan 1, 2021. A 380M HIVE back then to 377M now.

We can take that the HIVE supply at the moment is 377M. The 235k HBD interest is equivalent to around 200k HIVE when converted in HIVE with the feed price at the day when earned. 200k in 377M is equal to 0.04% more inflation added in the past year.

A 0.04% inflation from HBD interest in one year

This is obviously insignificant number, but it is for the past year. What about the next year? Especially now when we have 20% APR.

The main thing for this will be how much HBD will be put in savings. At the moment there is around 3M, with the total HBD in circulation 9.5M. Not all the HBD will magically move to savings that is for sure.

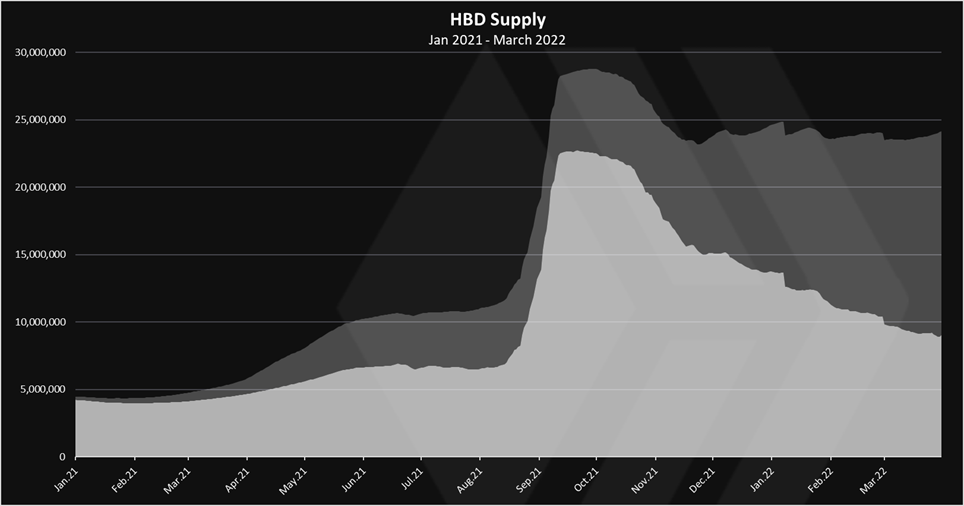

The white is HBD in circulation, the light transparent is HBD in the DHF.

While it seems that the HBD supply has been constant with around the 24M in the last months, the available HBD supply was actually decreasing all the time, while the HBD supply in the DHF/DAO was increasing.

Because of this we now have just 9.5M in circulation, out of which 3M is in the savings, another 3M on the Upbit exchange and 3M more in other places.

Is This Sustainable?

The regular HIVE inflation at the moment is 7.25%, or around 80k HIVE equivalent daily. It is equivalent because not all the inflation is paid in HIVE, 50% authors and DHF inflation is paid in HBD. The only HIVE inflation is around 50k daily and all of it is paid as HIVE power.

So 80k HIVE equivalent daily inflation and now additional 2k from HBD interest. Since the price of HIVE is around $1 this is approximate atm. If the price of HIVE drops to 0.5, it will be 4k more HIVE daily, and if it increases to 2$, then it will be 1k more HIVE daily.

Right away we can see that at the moment these are insignificant amounts. But how high they can go and at what levels it will be sustainable. This is a dynamic process with more then one variable, but for the sake of simplicity lets just look at the amount of HBD in savings.

If the HBD in savings increase to 6M (double) from where it is now and everything else remains the same, especially the HIVE price, that will mean we will have an additional inflation of 1.2M HIVE per year or 0.32%.

If the amount of HBD in savings goes 10X to 30M HBD then we will have an additional inflation of 6M, or 1.6%. 30M HBD in savings is not that far away. At the peak in September 2021 there was 23M HBD in circulation outside the DHF.

How will this affect the HIVE price? 30M in HBD savings will mostly have an effect of the HIVE price. Not sure how significant it can be, but there will be some affect.

The 10X scenario is still in the reasonable numbers and something the blockchain can handle. What happens if we push it for another 10X, or a 100X from where we are now?

This means 300M HBD in savings, or around 160k HBD/HIVE more daily on top of the current 80k. This is a more then X3 for the inflation, or in total 22% inflation.

What is remarkable is even in this scenario, the inflation doesn’t spiral out of control even with the same price for HIVE.

But, for a 100X for a HBD in savings, the impact on the HIVE price will be very visible. A big share of it will need to come from HIVE conversions, this will most likely significantly push the price of HIVE, that will reduce the inflation in HIVE terms, because the conversions will most likely make HIVE deflationary at that point.

Conclusion

What can we see from the above is that in the past year the inflation from HBD interest was 0.04%. But now the amount of HBD in the savings has increased and the interest rate as well. With the current amount of HBD in savings the added inflation will be around 0.16%. If the HBD in savings increases double then 0.32%, and if it goes a 100X, then we will se a 16% more inflation a yearly basis, if everything else remains the same, especially the HIVE price. The thing is a 100X increase in the savings is impossible without increasing the HIVE price and reducing the HIVE supply with conversions. There are more variables to consider.

On a daily basis at the moment there is around 1.6K more HIVE added on top of the 80k HIVE equivalent regular inflation. The numbers are extremely low, meaning there is a lot of space for expanding the HBD supply. It will be nice if this expansion happens at some moderate rate and not to be so volatile. But this is crypto, and we will see how things go.

When printing new money, one should be always careful not to overdone it, but at the same time it is an extremely effective way to incentivize growth. Interest rates are one of the basic tools that the FED has in the traditional economy. Now we are applying some of it here. Still early days, but we will see how it goes.

Hive Debt

Another very important thing to look at is the hive debt and the debt limit. If the Hive debt increases above the allowed debt limit of 10% that is now, the blockchain doesn’t guarantee the HBD price anymore when conversions happens. We are now incentivizing the expansion of the HBD supply, and if it grows fast (without the HIVE price increasing) it can hit the debt limit and HBD will no longer valued at $1. The debt limit should be increased at 30% with the next HF, somewhere in May, and this will give us more safe zone. The current debt is around 2.5%, so most likely it won’t go to 10% till then 😊, and it will be very hard to increase the HBD supply without pushing the HIVE price.

A nice tool to follow HBD and the debt data live from @ausbitbank here

https://hive.ausbit.dev/hbd

Without any extremes happening, and I mean real extremes (100X up and down), the inflation from HBD is totally manageable in the next year, and maybe the next few years. But this is crypto, and a year is a lot. If at some point in the future we come above 20% debt I would consider adjusting the HBD APR, but even this is up to debate.

All the best

@dalz

Posted Using LeoFinance Beta

Best analysis done on this topic so far.. Everybody is just happy APR increased nobody spoke much about inflation.

This is obvious, and this is also visible on the charts. With the increase of the interest rate, the amount of HBD in savings is also increasing. If the interest rate will be increased from 15% to 20%, then it is obvious that more Hive Dollars (HBD) will be transferred to savings. Probably from more people. And probably more people will sell their Hive (or other cryptocurrencies. maybe even some of their fiat money) for Hive Dollars (HBD). We will see. This will certainly be interesting to see.

Thanks!

The inflation is meaningless if the ecosystem grows. This is the digital world. We have plenty of use cases developing for HBD.

That is key.

Posted Using LeoFinance Beta

It isn't that meaningless to be not even mentioned was my point.

We need to keep that in mind before increasing yields up from 20% now.

Many people have mentioned but since most do not even realize what inflation is and the impact it has, it really is best to be overlooked. It is one of the most misunderstood topics there is.

Posted Using LeoFinance Beta

My question is why have debt at all? Also I agree that onboarding is still the main issue.

Debt/credit, used in a proper way is great! This is true in traditional economy as well. Just look the ultra rich no.1 scheme ... buy-borrow-die ....

The trick is to use it in a good way, mange it well and dont overdone it.

I thought we were getting away from traditional finance lol. Where is this debt even being used? Who is borrowing, who is lending?

The Hive debt in the case above reffers to the debt of the chain as a whole. All HBD is a debt on top of the HIVE marketcap.

Its not a traditional borrow/lend.

Basicly the chain allows for conversions HIVE<->HBD, expandind the supply. Its very similar to what LUNA-UST is doing, just differnt words. And they dont have a haircut rule (debt limit) that is quite dangerous.

P.S. I cover the haircut rule and the debt here

https://peakd.com/hive-167922/@dalz/the-haircut-rule-the-biggest-risk-for-the-hbd-price-or-historical-data-on-hive-debt-and-hbd-price

great article, I didn't know Hive can be deflationary. Also it's not totally clear to me what happens when you convert Hive to HBD. Also with this high APR couldn't people just buy a lot of HBD from exchanges and destabilize the peg ?

When HIVE is converted to HBD it is burned and new HBD is created.

People can buy a lot of HBD from exchanges and push the HBD price above the peg, but that is incentive for arbitradge becouse the blockchain always give you HBD at a 1$. Meaning people will convert HIVE to HBD and sell it on the exchange where the price is higher. This is exaclty what happened back in September.

didn't know Hive was burned I thought someone was buying it. That's great to finally understand how it works :)

Cool to know about the arbitrage thingy as well, unfortunately my secret dream of seeing HBD going to the moon like "in the good ol' days" sounds more improbable the more I understand how things work.

Thanks for the explanation

The HIVE to HBD conversion was not available beffore July 2021. Since that HF, HBD can be created from HIVE, and the possibility for HBD to moon is low :)

On the internal exchange it is bought. When converted, it disappears.

Of course, there is a HBD to HIVE conversion which will create more HIVE and burn HBD.

It works both ways depending upon what community members decide to do.

Posted Using LeoFinance Beta

ok, now it's 100% clear how things work, thanks for the explanation, I feel less ignorant :)

Sorry if some of your post went over my head, but if that's the case, that means the overall Hive supply should decrease, and if demand stays around the same as it is now (assuming not everyone apes into HBD), the price of Hive should go up? Obviously whether demand stays the same or not is a different issue, just curious to know if I got this right.

I've always been more interested in Hive and the proof of brain aspect of the chain, although I can see why having the best stablecoin out there is something we should aim for. We seriously need 100k active users to sustain a hive marketplace though, I feel like that will be a turning point for Hive, decreasing selling pressure. That or a campaign to get stores in Venezuela or Nigeria accepting Hive, where the incentive to sell in those countries is high since blogging can easily earn more than the average job.

Thats the theory :)

Need different pools to get arbitrage going.

That is one of the things we need to get going on.

Posted Using LeoFinance Beta

Wow, excellent work as always dalz!

This is the most in-depth post I've read on the move to now offer 20% APR on HBD in savings.

We just need to keep in mind that from an outside point of view, we need to keep our messaging clear.

All they want to know is how and why it's sustainable.

Your numbers show that it is.

Now we just need someone to put it into a simple, easy to digest format so normies can understand.

Hello crypto journalists, this is the source you need to use when writing your article!!

Posted Using LeoFinance Beta

Sustainable because of very little HBD.

It seems like UST is being an expanded stablecoin.

HBD has a long way to go.

Posted Using LeoFinance Beta

Nothing to worry about. Plenty of room. The fact is Hive need a few billion HBD, not millions. To do that, we are going to have to see the supply explode. Having an attractive APR is the first step. Of course, as you stated, there is still no way to get there without massive conversions.

What would the ecosystem be able to do with a couple billion dollars more? Since it is a tool of collaboration, we can see how some of it will impact the development and growth of the ecosystem.

Hell, if Hive goes from 30K monthly users to 3 million (still a small number on the Internet), that will eat up all inflation that is put out there.

Posted Using LeoFinance Beta

A lot of room to grow totaly agree :)

Hope we make that onboarding a bit easier and provide a top of a class apps

Can we give that some attention please! I tried onboarding a friend yesterday and it wasn't the easiest of thing to do.

Posted Using LeoFinance Beta

try to do it from leofinace and after that try to explain keychain and keys :D

I tried from LeoFinance and generated keys but to register the account it just kept on loading, eventually hours later my friend's account was created via Ecency.

Thanks, hopefully we get better with onboarding

Posted Using LeoFinance Beta

Might want to drop a DM to khal about that.

It sucks that we have so much difficulty in onboarding people.

Posted Using LeoFinance Beta

Certainly a weak point at the moment. There is no way to overlook this. We cannot scale with a lot of users.

Posted Using LeoFinance Beta

What if the people make a cost-benefit analysis of curation reward(in percentage) Vs 20% APR in HBD, then a part of HP may be powered down and then be converted to HBD for the sake of lucrative APR. Additionally, it will have a locking period of only 3 days, so people can quickly sweep into a better opportunity as and when it needed and as merited by the fleeting dynamics.

The more people power down, the higher the APR for curation becomes. Same amount of tokens distributed to less users. Also HIVE can go up in price while hbd not. Governance, resource credits/gas is another reason to hold HP

Yes, that' correct.

But again, how robust is the pegging mechanism to shield the fluctuation as an effect of higher APR. Because DeFi is already front-running the crypto market. When the investors see HBD as a pegged token where the risk of dipping below 0.95 is fairly low considering the last one year's performance, they may not have any interest in content creation or curation, they might primarily join Hive to stake HBD for three days and let their HBD make passive income for them.

And not to forget HBD is a debt instrument, so any significant dynamics playing in HBD is going to affect Hive too.

Demand for HBD is a demand for HIVE

This is something that I think is being overlooked by many.

Outside money could start rolling in and in a big way. If that happens the price of HIVE can moon.

Posted Using LeoFinance Beta

Thank you for this great explanation! I really understand much more know. I wasn't sure what to think about this before :)

!PIZZA

This is really explanatory and thanks for sharing

Very good to understand how the hive economy works, excellent post

Great post!

Tnx!

This is interesting. You mention the hive debt and limit so brilliant. Over 10% and Blockchain don't guaranteed the price when conversions happens. explained it clearly, thank you !

We have seen what we can do with consensus in the table.

Another reason for Hivers to hold and earn for short term.

Hive is about moving forward. We need as much HBD as possible to give Hive another allure at the crypto market.

!BEER

Posted Using LeoFinance Beta

This was my viewpoint all along. We have a situation whereby the attraction will require a great deal more HBD. Ultimately, we are going to have to get it on the open market. We can now see how not have much out there is a setback with the move by the witnesses.

Of course, the opens the door to create a great deal more HBD. We can certainly increase it by orders of magnitude since it ends up being needed.

Posted Using LeoFinance Beta

I guess I was a bit scared for nothing but it does look like the 5% cut from Hive to HBD will help a lot in that regard. I guess only time will tell if there is just too much HBD being produced in the savings over time. I do think that there will be some people moving over to the PolyCUB HBD vault when it does open.

Posted Using LeoFinance Beta

What were you scared about?

Posted Using LeoFinance Beta

Whether or not it was sustainable. After reading a post by dalz, I am not that worried. It won't be trouble in the short to mid-term.

Posted Using LeoFinance Beta

Keep in mind @jfang003, that most do not understand inflation and how things really operate. We are dealing with monetary expansion. This means that growth is the big question. Of course, if we have no growth, then it is all unsustainable.

However, if we grow, then HBD will only serve to foster that growth. After all, what can you do with money? Pay people to develop, market, and build stuff. That is what we need, not only on Hive but the global economy. There isnt enough money in the economy, contrary to what most think.

Posted Using LeoFinance Beta

What a really great post covering everything we need to know and I am sure this move will be a good one. The beauty about having the witnesses is this can be changed back or adjusted if required.

Posted Using LeoFinance Beta

I agree. It will end up being a great move.

Hive is going to thrive on this one.

Posted Using LeoFinance Beta

20% APR sounds sweet but the inflation you just mentioned and explained can make the witnesses rethink the matter, however, whatever they did I think there is some solid reasons. And being a non-financial person I must not interrupt this. What strikes me the most is your notion about inflation and sustainability - let's see where it goes. 🤞

I'm kinda new arount here but I really appreciate the insight. The community is great!

This is awesome! 20% APR sounds RIGHT. Not too much and not too little. I don't really want it to increase any more though (for now).

These stats help me feel at ease. Thanks a ton! Now if we could get more people to learn about HBD it'll be a huge help for us. BTC is already looking bleak according to some TA folks. So we could really have good times for stablecoins :)

!PIZZA

Posted Using LeoFinance Beta

We could be in for a completely new era in Hive. We will see how all of this unfolds. Great things are happening.

Posted Using LeoFinance Beta

One thing to keep in mind, if HBD starts going above $1 (which it will if we see these numbers you theorize) the stabilizer will sell the HBD for Hive and then lock that Hive up in the DHF.

This will likely result in a big positive impact on the Hive token.

How long is the $HIVE locked up in the DHF? Isnt it swapped to HBD at some point to pay out?

Or is it one of those we will get to that after we burn through all the HBD?

Posted Using LeoFinance Beta

It is converted but at a slow rate. I don't know the exact rate but I think the target was converting Steemit Inc stake over 5 years, a few wanted it slower so I am not sure what the final number was

Ah okay. That is where the 5 years number came from regarding the DAO. Now I understand. Of course, we added more to it, so that might extend it out some.

Posted Using LeoFinance Beta

I had a look at hivestats.io and most people make about 5 - 8% APR from curating. Even the most efficient curators don't make 20%.

So I can see a lot of people powering down and converting to HBD to get their 20%. Which will change the Hive ecosystem.

It's not directly comparable because HIVE/HP has potential for appreciation. Within the past year it went up as much as 2000%.

The yield on HP makes sense to compare if you are considering holding HIVE instead (tradeoff between yield/curation/voting for HP vs liquidity for HIVE), but doesn't make much sense to compare it to a stablecoin.

PIZZA Holders sent $PIZZA tips in this post's comments:

(2/5)

vasupi tipped dalz (x1) @d-zero tipped @dalz (x1)

Please vote for pizza.witness!

~~~ embed:1513170600856113156 twitter metadata:aGl2ZWN1YmF8fGh0dHBzOi8vdHdpdHRlci5jb20vaGl2ZWN1YmEvc3RhdHVzLzE1MTMxNzA2MDA4NTYxMTMxNTZ8 ~~~

~~~ embed:1514393140848857091 twitter metadata:c2hvcnRzZWdtZW50c3x8aHR0cHM6Ly90d2l0dGVyLmNvbS9zaG9ydHNlZ21lbnRzL3N0YXR1cy8xNTE0MzkzMTQwODQ4ODU3MDkxfA== ~~~

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The peg could fall and this is what most likely will happen.

How?

If the marketcap of HBD goes above 10% of Hive Marketcap (currently 2,490%) or the price of Hive falls below $0,2361.

Those are the rules yes... the 10% debt will be 30% soon, while HIVE at 23 cents although possible, probably will not happen soon

If lots of speculation money comes in, we may be surprised. But I'm sure the witnesses can adjust course with any change in market conditions.

In the meantime, time to go all in on HBD.

There is no correlation between the money coming from the outside and the price of HIVE. Just become people buy HBD that does not mean the price of HIVE has to head down.

In fact to get the amount of HBD required, someone is going to have to buy and convert a lot of HIVE.

Posted Using LeoFinance Beta

Exactly, to buy HBD, they need to buy Hive which will then be burned when turned the HBD.

Will that bid up the price of Hive or will hive/hbd ratio cause the price to fall?

Or they will balance each other out?

i am never sure do i understand the connection and tokenomics fully :) but my understanding and after reading this, 20% is not a problem at the moment. the real problem would happen if the price of Hive goes down under the hbd price. if it drops to 0.20$ or something like that inflation could be a real problem, that is if people holding HBD would be willing to convert it to Hive. So as long as hive holds the price or goes up inflation is not a problem.

or did i totally missed the point? :D

The haircut goes into effect when the USD value of HBD reaches 10% of the USD value of HIVE. These are total market caps.

We will see this raised the next hard fork to 30%. The only thing the interest does is generate more HBD. If the price of HIVE stays the same, we have plenty of room. The problem could be if the price of HIVE drops, a great deal. If that happens, the HBD is not printed so 50/50 payouts will be in liquid HIVE until the ratio is restored.

Posted Using LeoFinance Beta

that i think i understand maybe :) what i was thinking and i think i remember it was talked about after the drop of steem from 4 to 0.2 was that there were some that had a good amount of SBD and they converted it to steem. so it was an "instant" boos of inflation for steem.

Posted Using LeoFinance Beta

The challenge there was that SBD got way out of whack compared to the supposed peg. So things were all over the place.

With HBD we are seeing the HBD stabilizer keeping it pegged closely. So that means the only real variable is the movement in the price of Hive.

Posted Using LeoFinance Beta

Great Post!

!1UP

As far as I see, it was reflected to the savings that has not paid out the interest amount yet.

I believe you have to take a savings action. Put another HBD in your savings account and it will change the amount to be paid out.

And you will start earning the 20%.

Posted Using LeoFinance Beta

That's great, we don't need to wait another 30 days.

I think the main reason most witnesses are supporting this is because the 12% apr for hbd works perfectly without any issues, 17% would have been better for testing but 20% is what everybody wants.

Posted Using LeoFinance Beta

20% is the rate that is aligned with some other stablecoin projects.

As for the threat, we have 9 million HBD in circulation. We need to 100x that to be a legit stablecoin.

Posted Using LeoFinance Beta

Let's wait and see how the first few months workout

Posted Using LeoFinance Beta

It is going to take a while. But the first option looks like it is going to be the Polycub LP. We will have to see how much HBD ends up in that pool.

Posted Using LeoFinance Beta

2million hbd should do for a start

Posted Using LeoFinance Beta

I hope we get it right at 20% cos I feel this is too high in my opinion for a stable coin.

However with comparison with the price of hive it looks good.

I am tired of the process of onboarding.. It is really getting tiring.

Posted Using LeoFinance Beta

You have received a 1UP from @luizeba!

@leo-curatorAnd they will bring !PIZZA 🍕 The following @oneup-cartel family members will soon upvote your post:

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

No lo he intentado, me han dicho que es mejor hacerlo cuando se tiene una gran suma de ahorros para pode ganar intereses. Peor sin duda es una gran herramienta

Now with this massive development the million dollar question is , is it sustainable?? I believe it is at least for the time being.

The money or value has to come from somewhere I guess. Having HBD added to a DeFi platfrom would actully open it up to massive and huge funds like other stablecoins witness and further allowing it to truly flourish.

Why wouldnt it be sustainable?

Posted Using LeoFinance Beta

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 8250 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

View or trade

BEER.BEERHey @dalz, here is a little bit of from @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Great one with the analysis and all. I believe it is great move increasing the APR to 20%. Exciting times

Posted Using LeoFinance Beta

I support the 20% APR increase and looking forward to see how its involve and how we can attract more projects or investors looking into Hive Blockchain. Thanks for your great analysis @dalz. I appreciate your work.

This is the exact post I was looking for to help me understand the mechanics (and math) of this move to 20% HBD APR. Thank you!

Posted Using LeoFinance Beta

Looks like there's plenty of wriggle room, so nothing to worry about.

Posted Using LeoFinance Beta

Well, till we have a 10x availability of HBD it will take some time, so no worry on inflation. There are counter measures that can be taken to reduce it, if we see that it is going the wrong way to keep the peg.

Thank you for the good analysis and explanation.

Posted Using LeoFinance Beta

The inflation rate will likely only enhance the peg since it will enlarge the market cap, hence reducing the volatility. Also, we will increase the liquidity and, hopefully, the number of places we can find HBD. This will open up more arbitrage opportunities.

That is vital for a solid peg.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Can you crunch the numbers around how much hive can be burned to create how much hbd?

At what point does the 3 decimal places decision need to be revisited?

How many hbd can be created at the current price vs how high the price would have to go to get xx b/million hbd to the market.

What happens to the inflation floating the rewards pool and witnesses when all that hive gets burned?

Upvoted and Tweeted so others will and use.

~~~ embed:1514393140848857091?s=20&t=GarxY7zg8IAY5IYUmAMIIg twitter metadata:c2hvcnRzZWdtZW50c3x8aHR0cHM6Ly90d2l0dGVyLmNvbS9zaG9ydHNlZ21lbnRzL3N0YXR1cy8xNTE0MzkzMTQwODQ4ODU3MDkxfA== ~~~ #HiveBackedDollars #HBD #inflation

Posted Using LeoFinance Beta