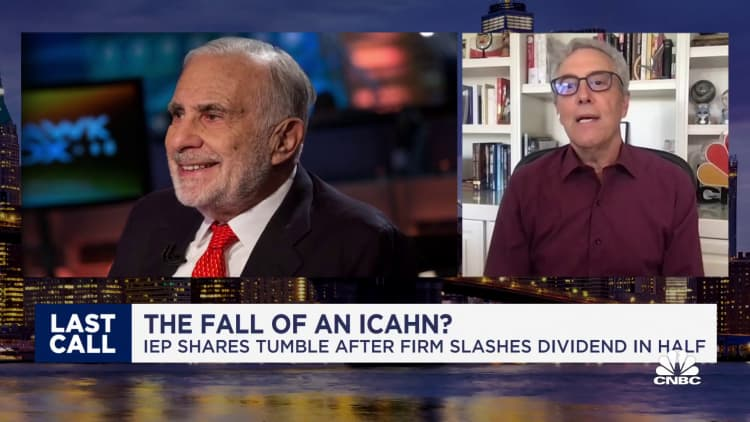

Billionaire activist investor Carl Icahn and his company, Icahn Enterprises, are facing serious repercussions. The SEC has slapped them with a $2 million fine for failing to disclose billions in personal margin loans secured by Icahn Enterprises stock. This means Icahn pledged a significant portion of his company's shares as collateral without informing shareholders.

The news sent shockwaves through the market, with Icahn Enterprises' stock plunging 5%. Adding fuel to the fire is the ongoing battle with Hindenburg Research, which accused Icahn of a "Ponzi-like" scheme. This latest SEC action certainly doesn't help Icahn's reputation.

Questions are now swirling about the implications for Icahn Enterprises and its investors. How will this impact the company's financial stability? And will Hindenburg's allegations continue to haunt Icahn? This is a developing story with far-reaching consequences.

Posted Using InLeo Alpha

Congratulations @databaron! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 50 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP