What is DeFi and what does it offer its users?

Decentralized Finance started to become mainstream in late 2020 and came to be through the instantiation of a specific type of smart contract known as hybrid smart contracts. These contracts combine the on-chain code together with off chain-proof that something happened.

What DeFi is, is one specific type of hybrid smart contract that is taking on some contractual agreements that you would typically find in the traditional global financial system. This is basically the world of lending, yield generation (you give someone some money and sometime later you get more money. Such as bonds, treasuries, and global financial markets), and the ability to gain exposure and protection from different types of events and risks.

Gaining exposure and protection is a lot of what derivatives do. Right? Derivatives allow us to say hey something’s going to happen and I’m either going to protect myself by getting paid if it doesn’t happen or I’m going to benefit from it happening by basically saying it’s going to happen then putting money down on that where the prediction will provide me a return. That’s a very large part of the global financial system excluding all the stuff for global trade and letters of credit and all the stuff that facilitates international trade.

So excluding that at least for now… And if we look at what decentralized finance does; it takes all of those agreements about generating yield, lending, and all of these types of things you find in global finance and the world of derivatives and a few other types of financial products and it basically puts them into a different format.

So the format you have for centralized financial agreements is that you go to a bank, even if you’re a hedge fund, even if you’re like the richest person, you go to a bank, they make a product for you, and you hope that they honor the product that they made for you.

And then a number of very freaky things start to take place. One of them is people don’t have clarity about what the agreement is so a lot of people don’t know exactly what the agreement is between those parties because they can’t actually see it. Sometimes agreements are kept very private or parts of them are kept private and that keeps you knowing other counterparties other people in the system from understanding what’s going on. This is actually partly what happened

with the mortgage crisis in 2008. Basically, there were a lot of agreements and there were a lot of assets but because the centralized financial system worked in such an opaque way it was so unbelievably difficult to understand what was going on. So that lack of understanding for the global financial system basically led to a big boom and then a, correspondingly, very very big bust which amazingly enough had a huge impact on everybody even though they didn’t participate in the boom part of the equation.

3 Things DeFi offers

In any case, what decentralized finance does is it takes these financial contracts that power the global financial system and it puts them in this new blockchain-based format that basically provides three very powerful things:

1

The first thing that it provides is complete transparency over what’s going on with your financial product.

So this means when you use a financial product in the DeFi format you can drill down very deeply and can understand where the collateral is and how much collateral there is. You can understand what format it’s in, you can understand how it’s changing, and you can understand this on a second to second or block to block basis. So you have complete transparency into what’s going on in the financial protocol that you have your assets in which is because blockchains and the infrastructure all of these things are built on force that transparency whereas the centralized financial system is very good at hiding it. It’s very good at hiding it and packaging things in a glossy wrapper creating a boom then a bust. Decentralized finance is built on infrastructure that forces transparency such that everyone can understand what the financial product does from day one and in fact escaping that property is practically impossible or if someone tries to escape it, it becomes immediately obvious and people don’t use their financial product. So that’s number one

2

Number two is control. So if you look at what happened with Robin Hood everybody thought the system worked a certain way. Everybody thought “I have a brokerage account, I can trade things under a certain set of market conditions” and then the market conditions changed within the band of what people thought they could do and everybody was fascinated to find out that “oh my god I thought my band of market conditions in which I can control my assets is x but it’s actually y”. It’s actually a much smaller band and the reason it is a much smaller group of market conditions is that the system doesn’t work the way people think it works. The system is wrapped up in a nice glossy wrapper and given to them to get them to participate in the system because their system requires and needs their participation. But if you actually look at how the system works underneath you will see that it does not work the way people think that it works and this is actually another reason that DeFi is so powerful.

DeFi and these blockchain contracts give people the version of the world they think they already have which is why they don’t beg for it. Everybody thinks they’re in a certain version of the world that works in this reliable, transparent way. When in reality they’re not, they don’t realize it and so they’re confused when you tell them I’m going to make the world work this way because they think they’re already in that world but then things like robin hood make it immediately painfully clear that that’s not how the world works

So the second real property of DeFi is control which means that YOU control your assets, not a bank, not a broker, not a third party. YOU. You control your bitcoins, YOU control your tokens in the finance protocol. If you don’t like how something’s going in that protocol YOU can remove it and YOU can send it to another protocol or YOU can use a feature of the protocol to do something it’s supposed to do.

Comparing DeFi to centralized institutions: nobody can just say “oops you know that feature we are allowing you to use, that isn’t so good for my friends over here, so actually you know what, we’re just going to pause that feature so my friends don’t suffer” in turn taking the control away from the users.

3

Thirdly, DeFi is inherently global and actually right now provides better yield globally than traditional financial systems.

So if you go to a bank right now with the US dollar you get one percent or less. If you go to DeFi with the US dollar you get seven or eight percent so if we think about that in a world where there’s a lot of inflation coming down the road and we think about “well you know a lot more systems might be failing soon” and they might be highlighting these types of problems that were there for or as a result of the type of control that you see in Robinhood and people are more and more concerned about both transparency and control and they’re looking for yield to combat inflation. That’s what defy is about; in a practical sense it is this clarity about your risk, it is control over your assets, and amazingly at the same time as having those two unbelievably useful properties it is actually superior yield which

Ok enough about what DeFi is and what it can offer...

How do I actually use DeFi to participate in these hybrid smart contracts and are there any specific examples?

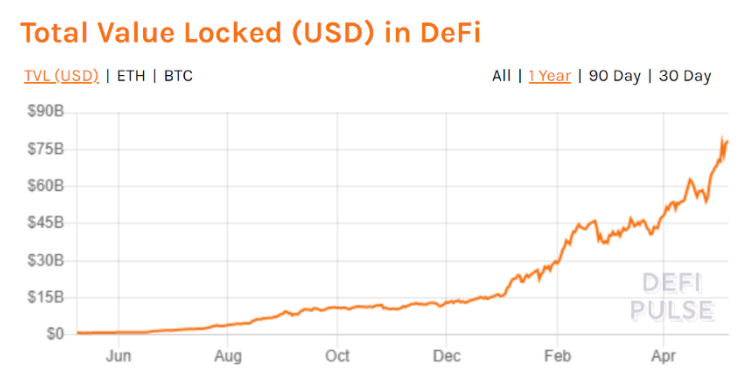

Before we get into the specifics let’s just make note of the amount of value flying into DeFi over the past few months…

Since January the value locked in DeFi has gone from ~15b to almost 80b now. That’s over a 530% increase in just 4 months. I do wonder though, is this a bubble? Or is this the next thing? Only time will tell…

The DeFi ecosystem has a plethora of different protocols. A great way to skim the surface of the DeFi ecosystem is to check out https://defipulse.com/ and scroll through the lists of companies, click some, read their docs, click around their protocols, and explore! There isn’t an exactly defined way to break up the DeFi ecosystem into smaller more categorized components. Because it’s being created! DeFi Pulse has split up the DeFi landscape into Lending, Dexes, Derivatives, Payments, and Assets but I highly suggest trying to create your own framework for understanding as no one really knows what’s happening right now…

Ok so let’s talk about some unique protocols that exist within DeFi.

Disclaimer, I am not affiliated with any of these platforms. Do your own research. Remember, when interacting with Decentralized Platforms, you have no one to go to and the only thing you can trust is the smart contracts. Because if those fail, you don’t have any central entity to deal with any protocol issues. Sure you can go to the DAO forums, but good luck with that… So be careful!

One type of service decentralized finance can offer is self-repaying loans.

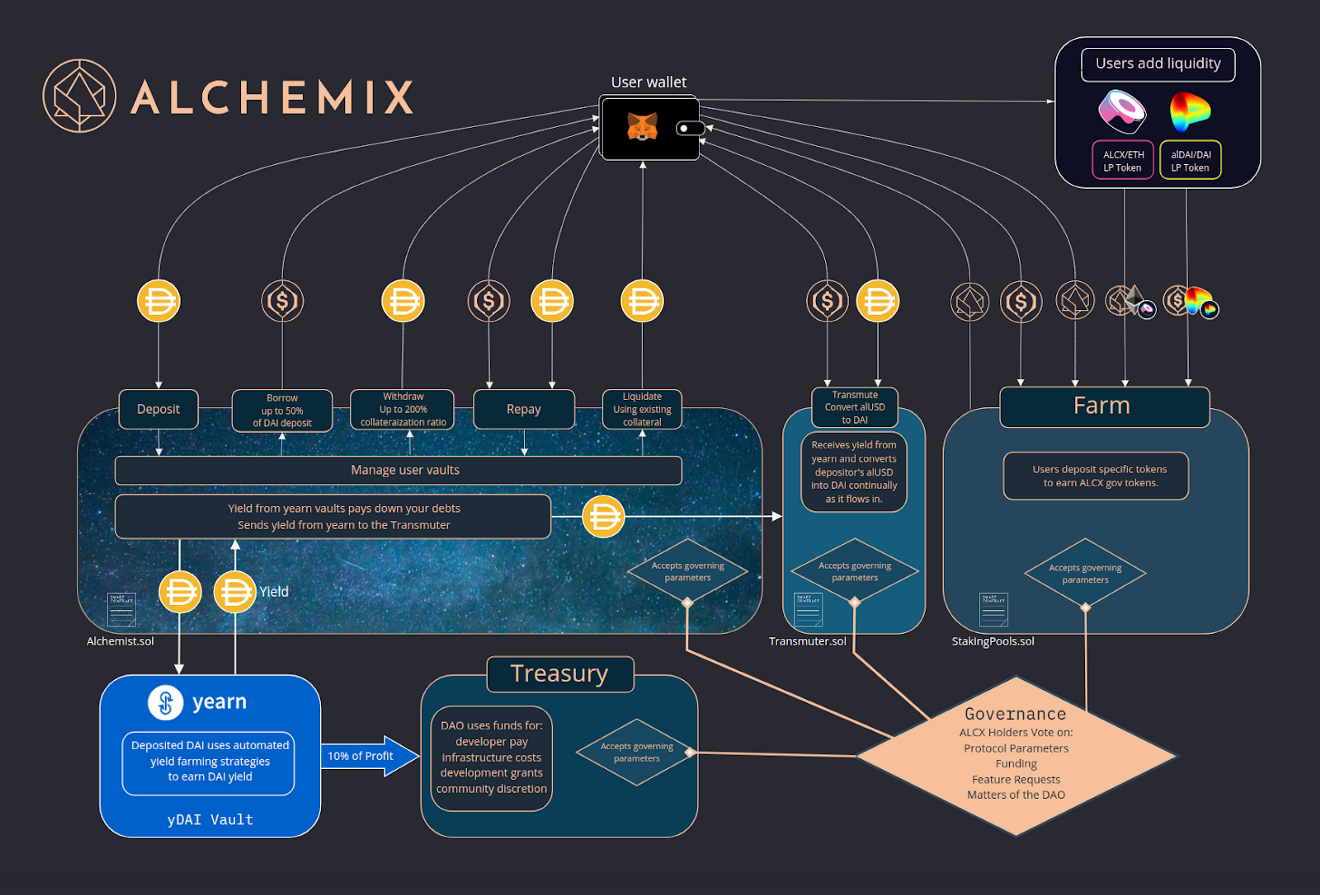

See Alchemix. This is the Alchemix protocol…

Yeah, a lot of stuff happening there. The user experience is quite simple though. Let’s imagine you are wanting to get a self-repaying loan on $10000. What you do is,

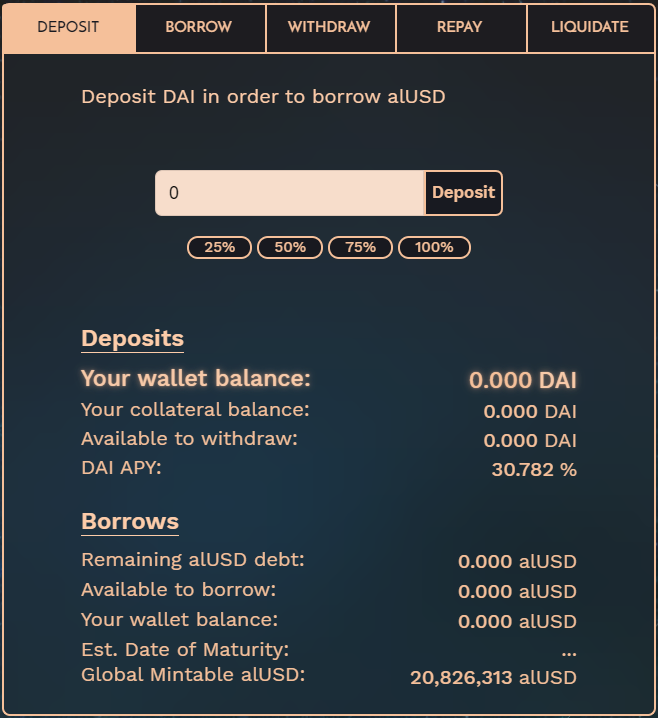

1. Log in to https://app.alchemix.fi/ with your browser wallet

2. Deposit 10000 DAI into the vault tab

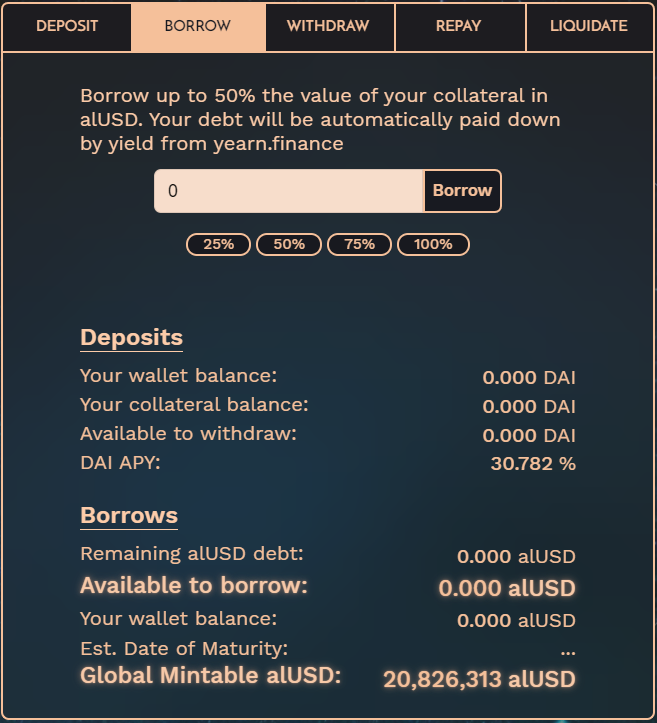

3. Borrow up to $5000 in alUSD

4. That’s it

Now you have $10000 earning 30.782% APY which is paying off the $5000 loan as time goes on. It will take around 3 years to fully repay the loan back. And once it’s repaid you can withdraw another $5000 alUSD. The reason why this is possible is because of the partnership with Yearn Finance. The DAI deposited into the Alchemix vault is sent to the DAI v2 Yearn Finance vault which earns interest. This interest is what pays off the loan over time.

DeFi is unique as it offers these money-lego-type pieces that allow for new protocols and functionalities to emerge depending on how the money-legos are connected.

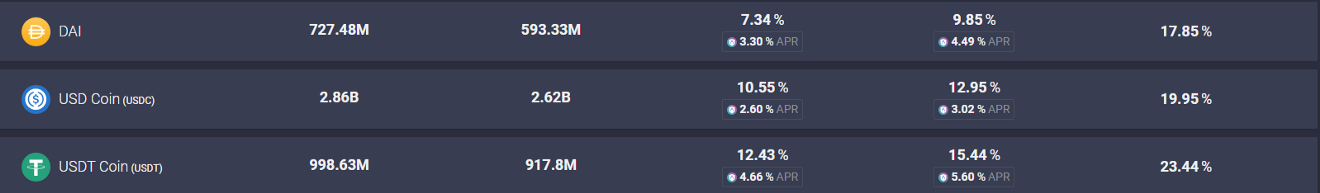

Another unique DeFi protocol that is very widely known is AAVE. For those of you who don’t know, AAVE is an open-source, non-custodial liquidity protocol for earning interest on deposits and allows the user to borrow assets against their collateral deposit. As we can see here; you are able to earn up to 12.4% APY just for depositing USDT:

You can perform a variety of interactions with AAVE. You can just deposit an asset to earn a deposit APY. The deposit APY is sourced from other users borrowing the underlying asset. The more demand in borrowing the token, the higher the APY. You could also borrow funds against your deposit if you wanted to, essentially entering a collateralized debt position.

NOTE: You have to be careful of your collateralization ratio. If the value of the asset you are borrowing drops more than your collateralization ratio allows, your position could be liquidated!

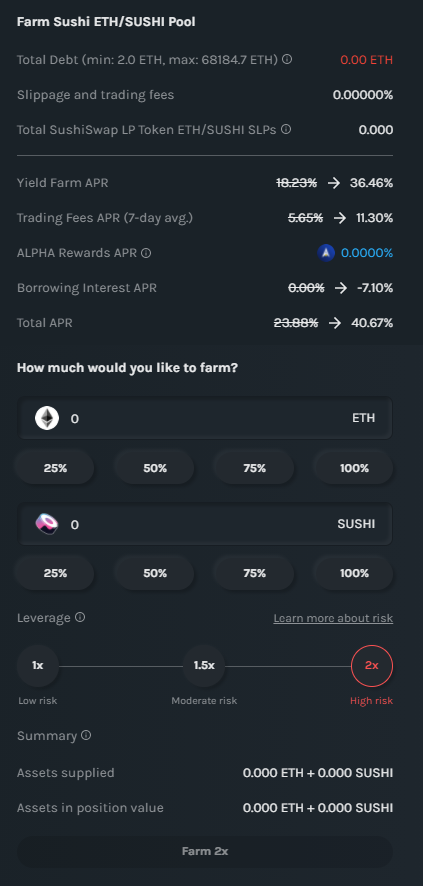

Going back to the idea of money-legos, AAVE has partnered with a leveraged yield farming protocol known as Alpha Homora to increase yields on their interest-bearing ETH token ibETH.

Alpha Homora can also be used for leveraged yield farming positions. Alpha Homora allows users to leverage their position in a single screen providing a seamless user experience.

Users have a desire to leverage their yield farming positions to earn higher trading fee’s APY, and farming rewards.

The DeFi ecosystem is large and the advancements are happening at a rate faster than the ability to keep up. Here I only touched on 3 different protocols but there are hundreds of unique projects and protocols that provide different functionalities and this is just the beginning. The fascinating thing about DeFi is that it’s open-source, it’s up to the user if they want to interact with it, and it’s up to the user to take full responsibility for the fund management.

You see, you don’t have to invest in DeFi, you can just utilize it.

That’s all I have to say about DeFi for now…

The future of DeFi should be interesting and I want to ask you, do you use DeFi? What protocols are you using?

Let me know in the comments! Thanks for reading 😊