So it's been a bit of a tense ride as I see my RUNE slowly decrease. That's not a fun experience when you value RUNE highly and aren't too sure if THOR will go up or flop first then go up after months, or just never take off.

Holding is always a safe bet. Unless the token bombs and doesn't recover. Regardless, there are always bearish and bullish times for coins. Holding takes you through the ups and downs, until you sell on a high, and maybe buy back in on a low to keep riding it along.

DeFi is interesting for sure. There is risk, but you get returns. The question you ask and find out is: do the returns outweigh simply holding?

In my case, it's turned out to be a no, but thats only after 2-3 days of pooling.

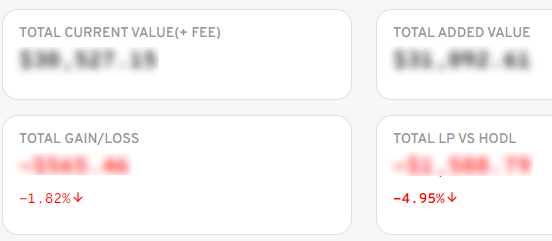

The upside the fees which are earned as part of the stated APR. This has been nice to see despite the negative I am at compared to just holding. https://app.thoryield.com/ shows

So my total loss isn't "so bad", so far... it could get worse, we'll see. But RUNE is pretty solid in my book, so eventually it will go back up... except when it does I have less and more THOR... which may be my downfall in this in the end. We'll see.

The worst part is when you compare just holding, HODL wins out since I would have more RUNE which is what is most valuable here.

The fees go up quite a bit each day though, like about $100 each day. That's quite nice. Maybe things will turn out well in the end, but that would also require THOR to go up with RUNE, as RUNE is destined to go up again.

So a 1.8% loss isn't so bad, but if I had done nothing, I would be up nearly 5% compared to what I have now. HODL for the win!

In terms of DeFi, single asset staking for yield is truly great. You don't lose out and only win. It's like holding but better. If only I could do that with RUNE... sigh...

Posted Using LeoFinance Beta