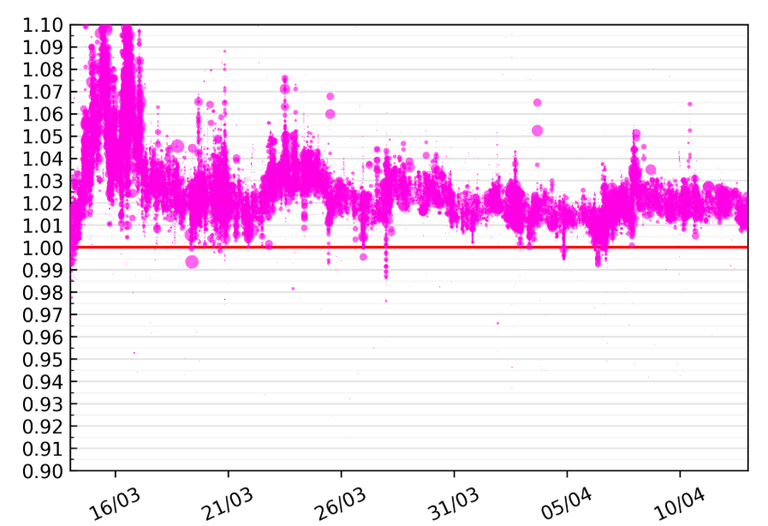

Despite numerous attempts by MakerDAO voters (lowering the stability fee to 0.5% on all collateral coins, adding USDC as collateral to the system) the DAI stablecoins has been trading above $1 since Black Thursday (March 12).

https://dai.stablecoin.science/

Under normal circumstance, such low interest rates would incentivize speculators to lock up their ETH and BAT in Maker to mint DAI and use it in the market, which would exert downward pressure on the peg, but that hasn't been happening for the past month!

In my opinion there are two main reasons: nobody wants to go long now with leverage now; confidence in MakerDAO and DAI has been shaken.

A lot of traders are scared to open vaults because some vault owners lost all their ETH on Black Thursday when MakerDAO's oracle malfunctioned.

As a result of the crash, some malicious liquidator bots were able to bid $0 for the ETH collateral of the affected vaults, thus causing 100% losses to vault owners. There was a vote recently held by MKR voters for a special compensation package for affected vaults, but it remains to be seen what comes of it.

It would seem that confidence in the MakerDAO system has been questioned by a large portion of the defi community. Despite the rock bottom interest rates, the DAI monetary base has shrunk over the past 30 days by about 26 million DAI.

Mar 12: DAI market value 106M

Apr 12: DAI market value 80M

Over the same period, the USDC stablecoin has added 300 million to its coin supply! It's clear the demand for stablecoins is there, especially during periods of heavy volatility, but it has also become clear that traders are picking USDC over DAI right now even though USDC has bank and censorship risks.

Should Maker add other collateral types with a bigger safety buffer to stimulate the creation of new DAI?

Hi Defimoon, this is a very interesting set of observations. I agree that investor confidence is shaken when you find out that a total loss is possible and a month later noones funds have been restored. I also think there is competition with other stable coins and in time for the MakerDao. The fact they lockup Ethereum, which is highly rated has always been in their favor, but as the DeFi options increase the investor community becomes less forgiving of mistakes like this and failure to make people whole or partially compensate them 30 days after the event suggests no compensation is coming and it's time to risk ones investments elsewhere.

Once the stakes get so big, mistakes are not easily forgiven.

A lot of people that lost their vaults on BT have swore they will never use Maker again, but if they get some partial compensation....who knows, maybe they might reconsider in the future.

I hadn't used MakerDAO up until recently (about 2 weeks ago) which was right after the Black Thursday events.

I opened a vault, collateralized ~19 ETH and decided to do a test run of how the system worked.

Personally, I see the risk there if the vault gets liquidated in another BT-like event. I wonder if they could add more solutions for vault owners to stay ahead of this risk (maybe something like this already exists in the form of private scripts, etc.) --- I would love to be able to have a set price drop in x time frame that refilled my vault to recollateralize in the event of a flash crash to avoid liquidation.

I'm not sure how the liquidations look, maybe you know more than I do and could educate me -- does your vault get immediately liquidated if it reaches the liquidation price or do you have time to refill your vault with more collateral before it's liquidated?

The system is very easy to use, but the big issue is eth volatility to the downside and Maker's oracle, which should have been working but froze up.

When you open a vault the system will tell you at what price liquidation gets triggered, so you have time until then to either pay back some of the debt or deposit more collateral.

Defisaver.com has great tools for Maker vault management. a lot of vault owners that used Defisaver got saved on Black Thursday.

They even made a liquidation dashboard which makes it easy to do collateral liquidations if you're into that sort of thing. https://defiexplore.com/liquidations