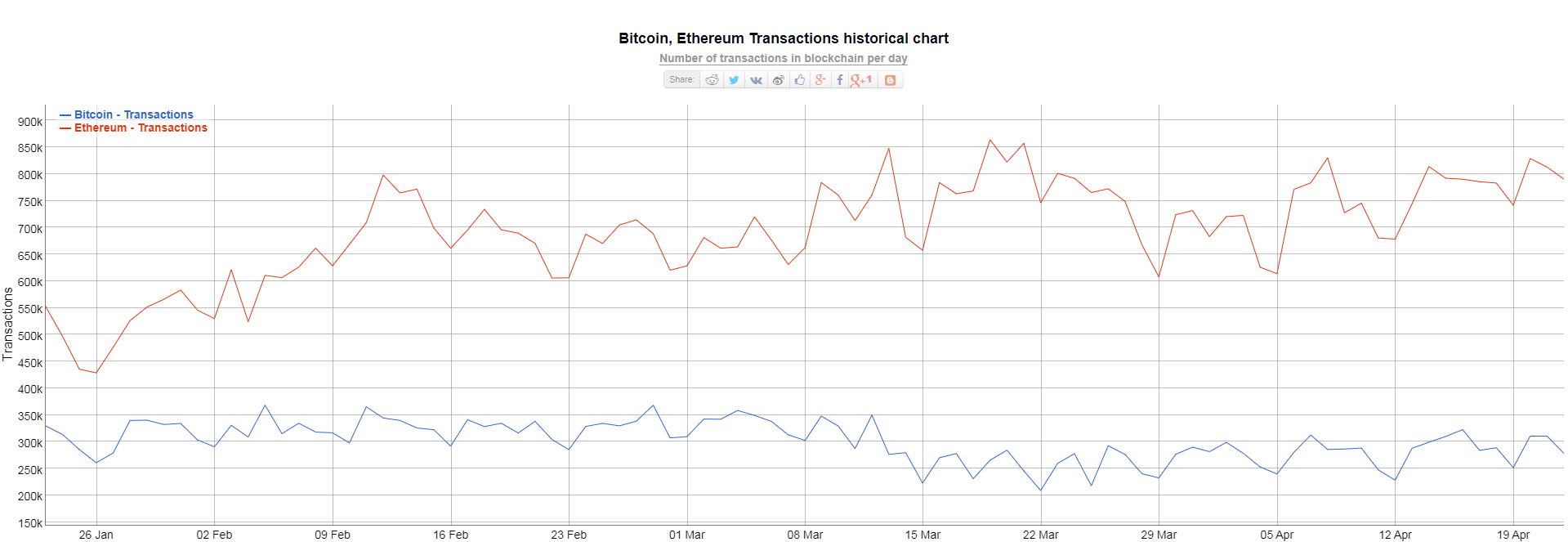

A clear divergence between transaction growth on ethereum and bitcoin emerged in late-January.

TXs on etherem began to grow rapidly after the 26th, while bitcoin daily transactions counts have not made it back above the 350k mark.

So where is this growth coming from?

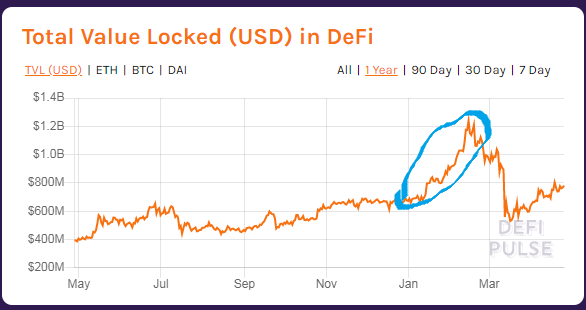

There haven't been any specific events, but decentralized finance really started picking up steam around January. Between January 11 and February 14, total value in DeFi on ethereum doubled from $670M to $1.24 billion.

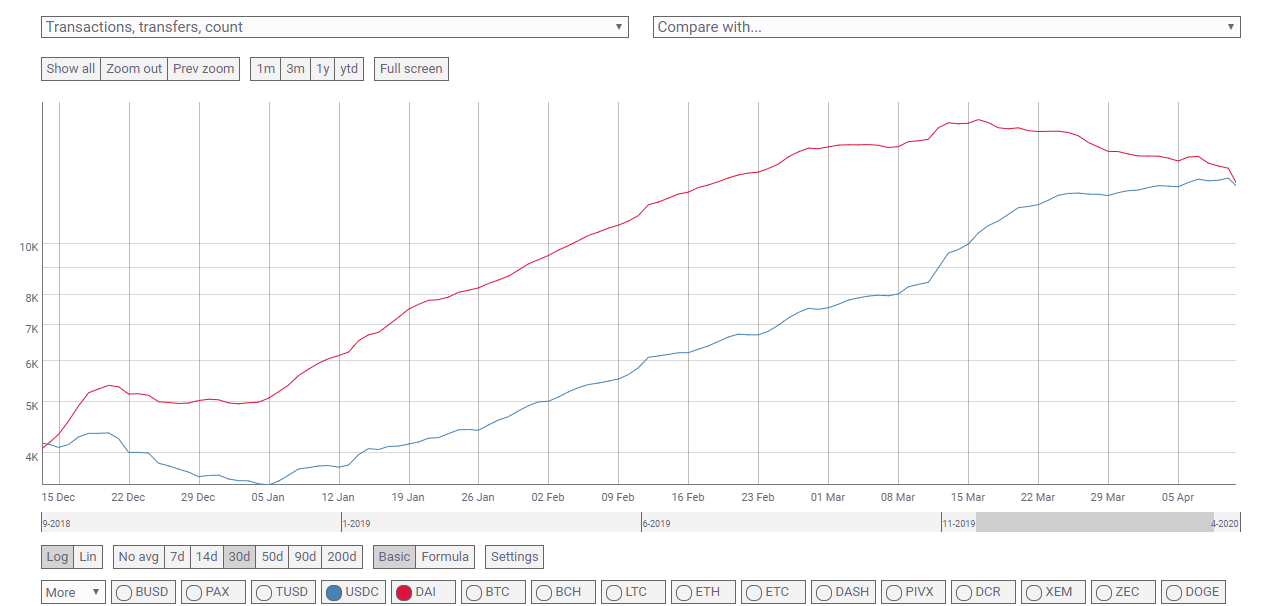

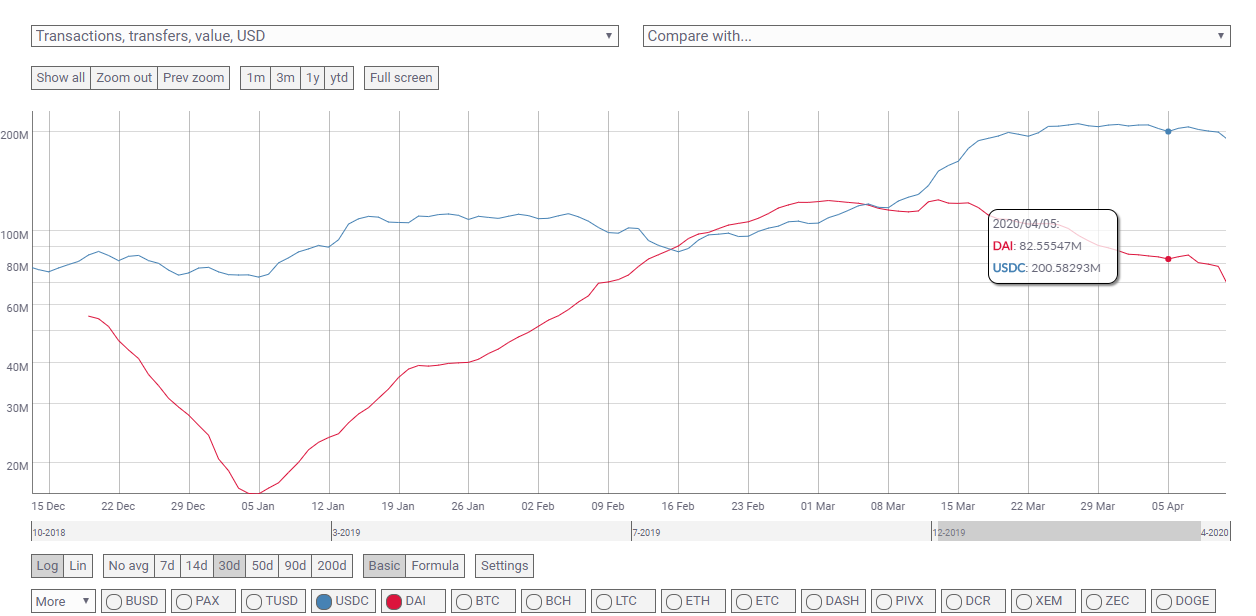

Since USDC and DAI are the two stablecoins most used in DeFi, I isolated those 2 on the chart so you can see the growth in value and tx numbers ramping up during that time period.

The really big growth though is still coming mostly from Tether. This graph is really stunning: daily USDT txs have grown without interruption since the start of February, while value transferred has plateaued just under $1.1 billion in April.

Tether really wasn't a part of the defi scene at the start of the year as there weren't many protocols supporting it due to perceived risk, but with the launch of protocols like AAVE, DDEX and Curve, USDT's share has steadily grown.

If we use CoinMetrics data, on average about 160-180k txs per day ($1.2-1.3 billion in value) are a result of defi and stablecoins.

Posted Using LeoFinance

Putting excess funds into USDT and DAI just makes sense... negative interest rates are going to hit sometime or another, probably sooner rather than later. And if one already has funds sitting on the blockchain, it's very easy to move it to various investment coins or platform coins for payment/purchase of hedges, services, or goods.

At this point, anyone with zero USDT or DAI is probably not paying attention.