I decided to look into liquidity provision on Uniswap to see if there were any pools that would satisfy my requirements: steady 90-day returns above 1% APR with respectable daily volume.

As it turns out, and much to my surprise - most of the pools, even those with quality coins - had very erratic 30 and 90-day return charts.

After sorting by volume and looking through about 50+ pools, I found just three that fit my criteria:

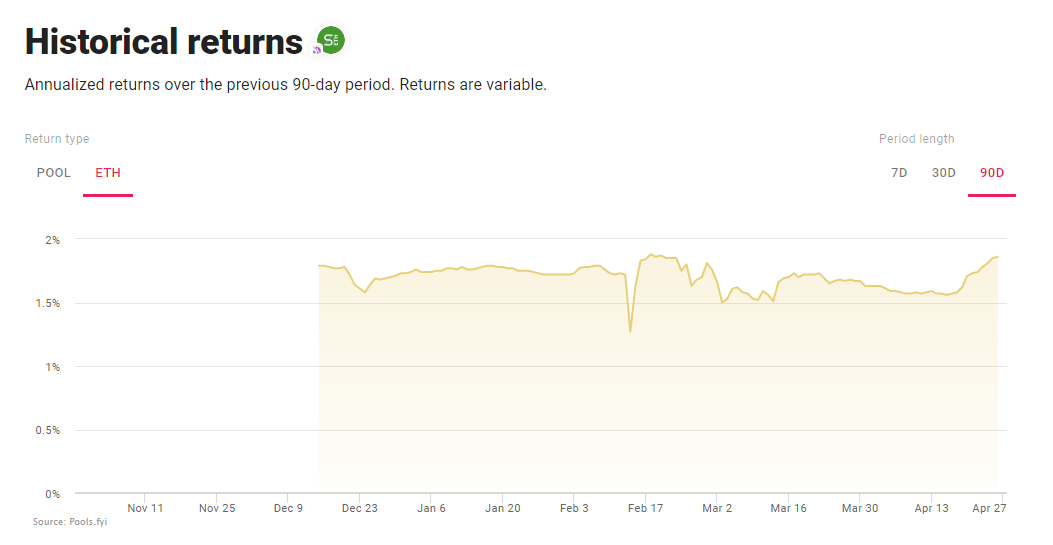

ETH-LINK https://pools.fyi/#/returns/0xf173214c720f58e03e194085b1db28b50acdeead

ETH-LINK https://pools.fyi/#/returns/0xf173214c720f58e03e194085b1db28b50acdeead

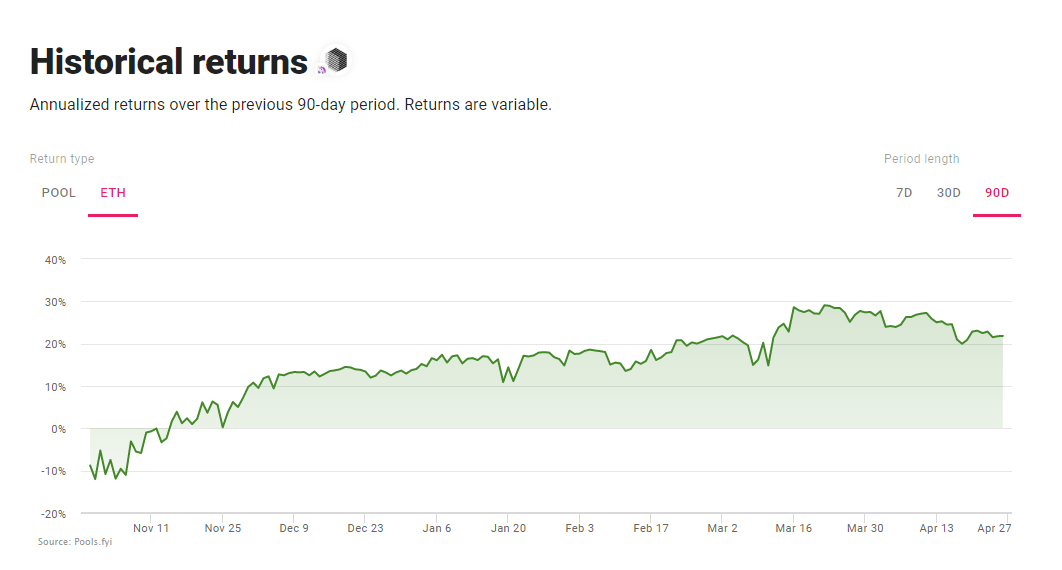

ETH-sETH https://pools.fyi/#/returns/0xe9cf7887b93150d4f2da7dfc6d502b216438f244

ETH-sETH https://pools.fyi/#/returns/0xe9cf7887b93150d4f2da7dfc6d502b216438f244

ETH-REN https://pools.fyi/#/returns/0x43892992b0b102459e895b88601bb2c76736942c

ETH-REN https://pools.fyi/#/returns/0x43892992b0b102459e895b88601bb2c76736942c

These three pools were the only ones I could find that had steady returns over the past 90 days with little to no dips into the negative.

Of course you can still make money with other pools, but you will have to wait for longer periods of time and hope there isn't any adverse market events that could kill your returns over a few days.

Please keep in mind that past performance is not in any way an indication of future performance. These charts just show that pool returns have been fairly steady over the past 90 days. There could be disruptive events that could drastically alter expected returns, so you're in no way guaranteed profits.

The problem with Uniswap pools right now is that every pool is locked to ETH. However, with Uniswap V2, scheduled for main-net sometime in the next two months, stablecoin-stablecoin pools become a reality.

Such pools almost eliminate the risk of impermanent loss that comes with ETH-only pools.

Posted Using LeoFinance