Overview

Majority of the world’s currencies are losing value due to inflation. And with this sad reality comes reduced purchasing power for everyone whose wealth is domiciled in these currencies.

This also means that if you have any savings in the bank, it is losing value as each day passes. And if you’re hoping to earn some interest from your savings, your hope is being dashed.I gave up on saving money in the bank with hope of earning interest a long time ago and so should you.

Majority of banks nowadays offer laughable interest rates and what makes it even more ridiculous is that they offer you pennies for the huge amounts you save in your account and also lend out your money to businesses and individuals at high interest rates.So continuing to save money in the bank is playing a losing game.

What then is the solution to this problem?

Most banks offer interest rates of 0.01% to 2.00% on your cash savings. But you don’t have to stick with that anymore, as you could make an average of 8.6% interest on your savings by using a service which we highly recommend.This service is offered by a company known as BlockFi, which is a global leader in the cryptocurrency world.

BlockFi offers a straightforward and hassle-free way for anyone anywhere to earn interest by lending out their cryptocurrencies. You can even take out a loan if you want.All you need to do is deposit your crypto into your BlockFi interest account, they lend it out and pay you back a percentage of the interest they earn on your cryptocurrencies.

In this review, you can learn everything you need to know about BlockFi and how you can earn up to $250 bonus on your deposit.

We also welcome individual reviews about BlockFi and will do our best to publish them for the benefit of all.

Key Features:

• Earn up to 8.6% APY on crypto holdings

• Accrued interest is paid monthly and compounds

• Higher interest rates than traditional bank

• Borrow fiat using a crypto-backed loan

• Advanced crypto trading platform

• Purchase stablecoins using wire transfer

• Regulated and licenced financial platform

GET UP TO 250 USD BONUS WITH A DEPOSIT OF 25 USD OR MORE

You need to deposit the required amount within 30 days after registration. Check out the page below for more information.

What is BlockFi?

BlockFi is a wealth management company based in New York, USA and it has its office address at 201 Montgomery Street, Second Floor, Suite 263, Jersey City, New Jersey 07302.

BlockFi was founded in August 2017 by Zac Prince and Flori Marquez, and the duo successfully raised over $60m in funding over four investment rounds, with the last round taking place in December 2018.

BlockFi has successfully secured investment from well known companies such as ConsenSys Ventures, Kenetic Capital, SoFi, Mike Novogratz’s Galaxy Digital, and Anthony Pompliano’s Morgan Creek Capital.

BlockFi is a secured non-bank lender and offers USD denominated loans that are backed by crypto assets and operates under Article 9 of the Uniform Commercial Code which governs secured lending.

BlockFi mainly works with cryptocurrencies such as Ethereum, USDC, GUSD, Litecoin, and Bitcoin.

Products and Services

BlockFi’s main products and services are three in number, including:

Crypto trading

Users can trade different cryptocurrency pairs such as GUSD, BTC, ETH, LTC, and USDC in a secured environment and seamlessly too.

Crypto Interest Accounts

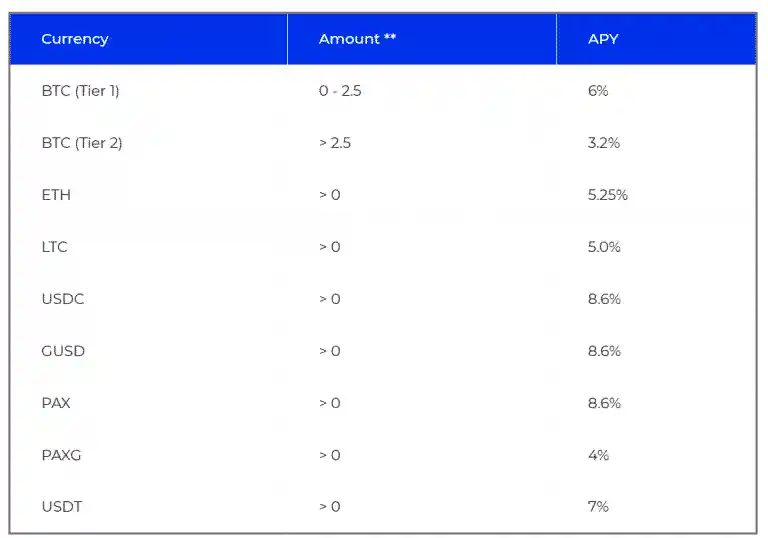

BlockFi offers crypto interest accounts to its users. BlockFi users can deposit their crypto and then receive a certain amount of interest every month. However, the interest rates are determined by the crypto coins a user deposits.

Crypto-backed Loans

BlockFi offers crypto-backed loans to its users. So, instead of selling your cryptocurrency holdings, you can get a crypto-backed cash loan for it. With BlockFi, you receive up to 50% value of the crypto asset you have in USD. And the best part is that BlockFi has such an awesome team that helps to facilitate everything.

Why Choose BlockFi?

BlockFi operates in compliance with US federal laws, and the core team are experienced professionals with significant experience in digital finance and lending. BlockFi’s main selling point is that it allows individuals to put their crypto holdings to use and deposit them into interest accounts or use them as collateral for loans.

BlockFi offers a quick and easy signup process.

You can get started in just a few minutes thereby allowing you to earn your interest, borrow money, and also access your portfolio through a seamless platform.

How does BlockFi work?

Users can either deposit cryptocurrencies into an interest account, or use them as collateral for a USD loan. The interest account pays a variable interest rate of around 8.6% annually, (which compounds monthly) with returns paid out in Bitcoin or Ethereum.

This works in a similar way to a bank giving a customer a mortgage while using the property as collateral, in the event that the borrower stops paying off the loan, the bank can then repossess the property. With BlockFi, once a user has been approved for a loan, their assets are transferred to a wallet controlled by Gemini, and remain there until the loan is paid off.

As soon as BlockFi receives the collateral, the user’s account is credited with US Dollars, and they are expected to pay interest on the loan monthly before using their final repayment to pay back the loan amount in full using either fiat, Bitcoin or Ethereum.

If any issue arises, BlockFi may take possession of the equivalent amount of cryptocurrency needed to pay off the rest of the loan, and borrowers are expected to make a crypto deposit worth a minimum of twice the value of the loan as collateral.

The application takes only a few minutes, and users can specify their desired loan terms and submit their application and also receive a response within a few hours after it is received.

Who is Eligible for a Loan on BlockFi?

If you want to apply for a loan, you just need to sign up on the website, input your requested loan amount, select the crypto you want to deposit, and enter your KYC/AML information in order to complete the identity verification process.

However, BlockFi does not perform any hard or soft credit checks, which means that using the platform does not affect your credit score in anyway.BlockFi operates without having to do credit checks on its users, as crypto assets are sent over to Gemini and held as collateral before loan proceeds are issued therefore mitigating any risk.

The Loan Eligibility Criteria

Before taking out a loan, you will still need to provide your personal details, social security information, and financial history. In order to be approved, you will need to meet the following requirements:

• A minimum of $15,000 in crypto assets

• No liens on assets (including tax liens)

• No bankruptcies

In addition, the BlockFi Interest Account is generally available to anyone over the age of eighteen. However, the BIA is not available to the residents of countries sanctioned by the US or on any watch lists. Furthermore, the Interest Account is not available to anyone in the European Union or the states of New York, Connecticut, and Washington.

How the Loan Process Works

The BlockFi team have outlined the following 9 step process:

Create an account at https://app.blockfi.com/signup

Click on the Loan tab

Click Apply and fill out the application.

You will receive a decision in less than 24 hours

Review your loan offer and sign the loan agreement

Transfer collateral to BlockFi’s secure storage wallet.

You then receive your loan the same day in USD via a wire to your bank account or stablecoin to your wallet address of choice.

Make interest only payments monthly using USD, BTC, ETH or LTC

Pay off the principal in one payment at the end of the term or refinance at current rates.

How do you create a BlockFi account?

Getting a BlockFi account is relatively easy. It only takes a few minutes. To begin, follow these steps:

Go to the BlockFi Website.

Click the Open your account option on the homepage or Get Started in the menu.

To create your account, enter your email and a strong password.

Enter the verification code sent to your email.

Verify your identity by entering your personal information.

You need to upload an identification card such as a national ID, passport, or driver’s license.

Verify your identity with a selfie.

Checking and verifying your data does not take more than a few minutes. It appears to be an automated system. After verification, you can immediately start lending your cryptocurrency or borrowing crypto via the platform.

The Withdrawal process

One thing that people complain about BlockFi is the tedious withdrawal process. They don’t offer instant withdrawals like other platforms.

With BlockFi, it could take between 0-7 days for your withdrawal to be processed.

This is, in fact, one of the biggest con that has been putting away a lot of potential customers from BlockFi.

Other platforms don’t seem to have such strict withdrawal restrictions. They ought to allow instant withdrawals of a certain amount for accounts that have done their KYC. And for the more massive withdrawal amounts, the platform could be following the manual verification process to maintain the high-security standards.

Is BlockFi Suitable for Newbies?

Due to the eligibility requirements attached to taking out a crypto backed loan, the platform appears to be suited to more savvy individuals with some experience of business and investing. However, there are no minimum deposits for the BlockFi Interest Account which is quite attractive to newbies, although only deposits over 0.5 BTC or 25 ETH actually accrue interest. This may actually prove to be too steep a minimum for a newbie unless they have recently purchased cryptocurrencies specifically for this purpose.

Inspite of this, BlockFi attempts to cater to newer entrants to the market by providing a lot of resources on their website and these include a Resource Center, Blog, FAQ page, and Loan Calculator.

BlockFi’s signup process is quite straightforward, and anyone opening an interest account can soon earn compound interest passively, however, the loan accounts are more complicated to understand with regards to mitigating risks.

BlockFi fees

• Bitcoin: Up to 100 per 7-day period with a fee of 0.0025 BTC.

• Ethereum: Up to 5K per 7-day period with a fee of 0.0015 ETH.

• Litecoin: Up to 10K per 7-day period with a fee of 0.0025 LTC

• Stablecoins: Up to 1M per 7-day period with a fee of USD 0.25.

• PAXG: Up to 500 per 7-day period with a fee of 0.0025 PAXG.

Bearing this in mind, you can make necessary adjustments that will prevent you from amassing unnecessary charges.

BlockFi Account Security

To protect user funds on the platform, the following account security measures are in place according to the BlockFi website:

• Two-Factor Authentication (2FA) to login to your account and withdraw funds.

• Hardware Security Keys and WebAuthn support to secure your account.

• Whitelisting to block all cryptocurrency withdrawal activity for your account, or restrict cryptocurrency withdrawals a single crypto address that you add to the list.

• Encryption to secure your passwords, personal information, and other sensitive information.

BlockFi bonus

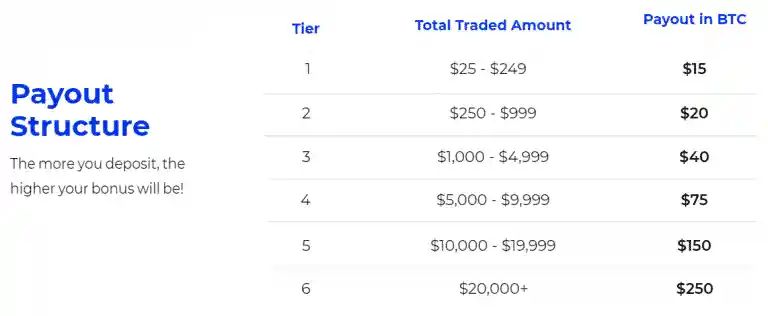

BlockFi has a special bonus for users. New users can receive up to 250 USD bonus and this is calculated based on their deposit.

The more you deposit, the higher your bonus will be. The bonus is only applied when a deposit is made within 30 days after registration.

Check out the table below for the current bonuses.

GET UP TO 250 USD BONUS WITH

A DEPOSIT OF 25 USD OR MORE You need to deposit the required amount within 30 days after registration. • Earn interest on Bitcoin and Ether deposits • Fast liquidity without cashing out of cryptos • Loan approval without traditional credit checks • Loan eligible for US tax benefits • Large loans available • Centralized service • Interest rate not fixed • Fractional reserve business model BlockFi provides a useful service for anyone who has large amounts of cryptocurrencies and institutions or early adopters who have been able to garner large crypto holdings are well positioned to benefit from the service. Please share this article with your network if you find it useful! Drop your review on ThankSwap Franklin Uloneme is the author of The Theology of Fruitology - How To Bear Fruit That Will Last For Eternity, a content writer, editor and cryptocurrency enthusiast who loves God, people and nature.

Check out the page below for more information.Pros

Cons

Conclusion

Got something to say about BlockFi?