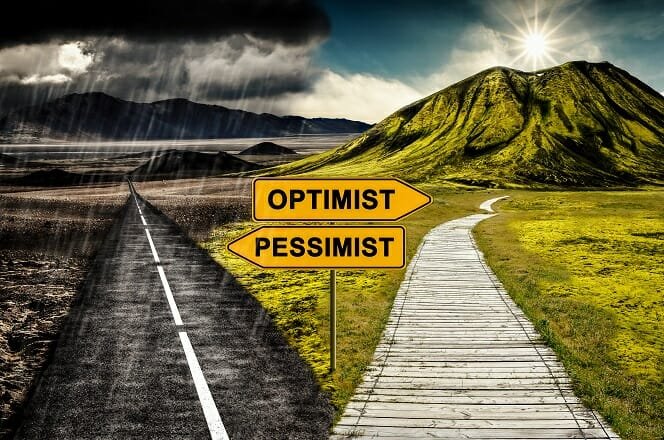

If you believe that the future is a disaster, you're probably a financial pessimist. A financial pessimist tends to see the glass as half-empty, and their decisions are based on that fear. This attitude can inhibit growth and stall financial progress. Fortunately, it's possible to avoid becoming a financial negative by learning to see the world in a more optimistic light.

Those who are pessimistic tend to focus on bad news, which means that they are more sensitive to bad outcomes. While it may not be helpful to a financial pessimist, the fact is that you can save heavily if you believe that the future will be good. This attitude can actually help you make sound money decisions, as it prepares you for unforeseen obstacles.

Optimists focus on the positive and tend to save money for emergencies. Financial pessimists, however, are more likely to put money away for major purchases, while pessimists set aside money for future purchases. In fact, pessimists are more likely to save money at the beginning of the month. Optimists, on the other hand, are more prone to build emergency funds.

A financial pessimist's optimism isn't always good, as it can limit one's financial growth. Optimists have greater self-awareness and more money in savings, and they're more likely to share their fears about money with others. As a result, they have a better financial mindset than pessimists. The financial health of a financial pessimist is better than that of an opportunist.

The truth is, if you're a pessimist, you're less likely to invest than an optimist. Optimists, on the other hand, save more, while pessimists invest. This mindset is important, but it's not necessary to let the financial pessimist take over your life. Rather, it's important to develop a financial attitude that balances your optimism.

When it comes to investing, a pessimist should consider the long-term financial consequences. In contrast, a pessimist should invest in stocks and real estate. Both types should invest in stocks, though the latter tends to spend more than the former. But remember that you don't have to have high expectations to make a good decision. A pessimist's optimism is more risky than a pessimist's.

The financial pessimist is more likely to invest in stocks than an optimist. It's also more likely to invest in the stock market. This is because a pessimistic investor's goal-setting will result in higher savings than a positive-thinker's. When it comes to the stock market, an optimist will save more than a pessimist, which means that he'll be more confident in the future.

An optimist will focus on the positives in life, while a pessimist will focus on the negatives. The pessimist should be more optimistic than a pessimist. A good investor will invest in both types of stocks. If a market is going to stay up for a long time, it's better to hold on to your stocks.

If you are an optimist, you have a different mindset. Optimists believe that the future is more important than the present. If you're an optimist, you can expect that your finances will do well and that your investments will make a profit. If you're a financial pessimist, you have a tendency to see the bright side of everything and to see the bad in it.

An optimist's perspective is more optimistic than pessimists. They believe that they can achieve anything. Optimists tend to believe that they are not capable of succeeding. While they're more likely to be successful in other areas of their lives, they don't see the bright side of investing. When they focus on the negatives, they often choose the less optimistic option.

It's normal to have a pessimistic outlook when investing. This mindset can lead to irrational actions. As an investor, it is essential to have a healthy balance of optimism and pessimism. A financial pessimist believes that failure is the road to success, and the road to success is filled with obstacles. If you are a financial optimist, the odds are that you will be an optimist in the future.

Posted Using LeoFinance Beta

After reading this post I feel happy because it confirm that I’m a financial optimist.

Posted Using LeoFinance Beta

I’ve had these thoughts before. But I decided to resolve to the idea that being both has its advantages. For me, I prefer to be an optimist in a bear market when everyone is fearful and reluctant to invest, the bear market presents opportunities to invest in genuine projects at infancy, unlike the bull market where there is so much noise and it’s hard to pick out legitimate projects, I reserve my pessimism to the bull market. I’m still experimenting though, eventually I’ll see what works best.

Posted Using LeoFinance Beta