In the modern world, traders can make large amounts of money, but unfortunately, they often miss out on high-quality tools for working with assets. The asset management segment is in dire need of significant modernization, because there are too many problems we have to deal with today. At present, only big players can earn, taking into account all available services, novice traders cannot properly manage assets and participate in highly qualified transactions. Solving this problem was the original goal of the developer of the system of smart contracts on the Ethereum blockchain, MoonDefi. The platform is designed to provide equal opportunities for all traders. There are no problems with asset management, transparency and quality of work.

Request for the MoonDefi project

Given the popularity of cryptocurrency, traders are starting to actively work with tokens. But there are too many dubious programs and structures designed to cheat. Today it is difficult to find a platform that will allow you to properly, quickly and safely manage assets and take the necessary actions on the exchange.

More details about what MoonDefi actually is

This article describes some of the planning options behind the core MoonDefi contract.

It includes a new option contract - along with discretionary pairs between ERC20s, a strengthened value oracle that allows different contracts to estimate a time weighted average value over a specified interval, a "flash swap" which allows traders to accept assets and use them elsewhere before pay for it later in the transaction, and protocol fees that can be activated in the future. It also redesigned the contracts to reduce their attack surface. Dan describes MoonDefi's "core" contract mechanism including joint contracts that hold the liquidity provider's funds - and therefore factory contracts are used to create joint contracts.

MoonDefi (beta) is an on-chain association system of sensible contracts on the Ethereum blockchain, implementing an automated liquidity protocol supported by a "constant product formula".

MoonDefi (beta) will combine the accumulated storage of 2 asset reserves, and provide liquidity for the 2 assets, keeping the merchandise reserve from being reduced. Traders pay a 30 basis point fee for trading, which matches the liquidity supplier. Contracts cannot be upgraded. MoonDefi may be a new implementation supporting the same formulas, with many new options that are very desirable. Most importantly, it allows the creation of discretionary ERC20 / ERC20 pairs, instead of only supporting pairs between ERC20 and ETH. It also provides a strong forecast of value which accumulates the relative value of 2 assets at the start of each block. this allows different contracts on Ethereum to estimate the time weighted average value for 2 assets above arbitrariness. Finally, wherever the user will freely accept the asset and use it elsewhere in the chain, only paying (or returning) the asset at the end of the transaction. Although contracts are not normally upgradeable, there are private keys that have the power to renew variables in the factory contract to display on the associated 5-basis-point cost of trading. This fee can initially be turned off, but can be activated in the future, after that liquidity the supplier will get twenty-five basis points on each trade instead of thirty basis points.As mentioned in section three, MoonDefi also fixes some minor issues with MoonDefi ( beta), as well as redesigning the implementation, reducing the MoonDefi attack surface, wherever the user will freely accept the asset and use it elsewhere in the chain, only paying (or returning) the asset at the end of the transaction. Although contracts are not normally upgradeable, there are private keys that have the power to renew variables in the factory contract to display on the associated 5-basis-point cost of trading. This fee can initially be turned off, but can be activated in the future, after that liquidity the supplier will get twenty-five basis points on each trade instead of thirty basis points.As mentioned in section three, MoonDefi also fixes some minor issues with MoonDefi ( beta), as well as redesigning the implementation, reducing the MoonDefi attack surface,

and make the system easier to upgrade by minimizing the logic in the "core" contracts that hold the liquidity provider's funds.

features

ERC-20 pairs

Price oracle

Precision

Flash Swaps

Protocol fee

Meta transactions for pool shares

Currently moonDeFi is in progress token seller directly through their network

following sales details

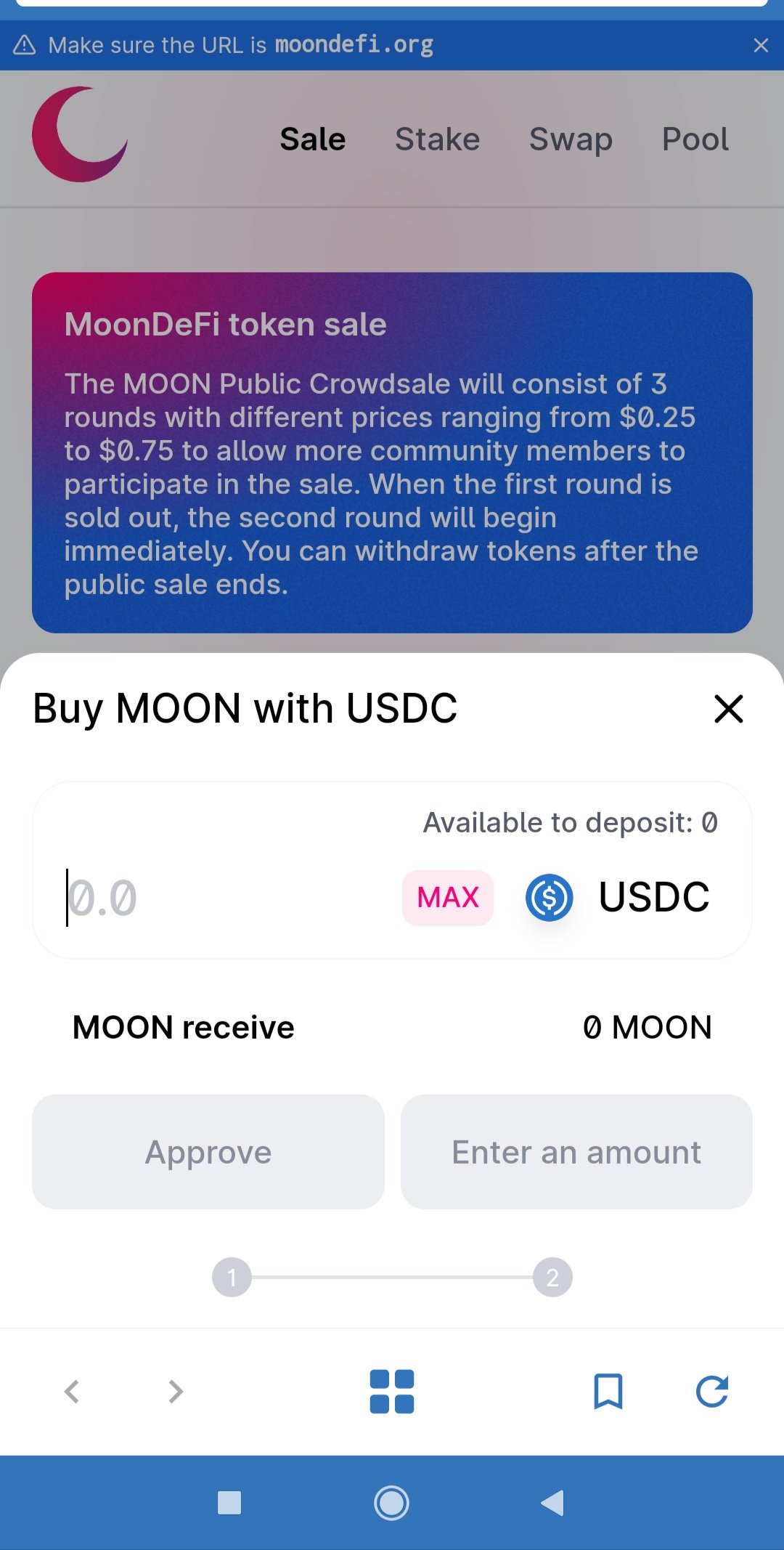

You can go through the dapp and log in using metamask or web3.

The Public Crowdsale moonDeFi token sale can bring with it three spins at radically different fees ranging from $ 0.25 to $ 0.75 to allow multiple community members to participate in the sale. once the main sale is sold the second sale can be started instantly. You will be able to withdraw tokens when the general public sale ends.

★ WEBSITE ★ TELEGRAM GROUP ★ MOON ★ TWITTER ★ WHITEPAPER ★ ABOUT/ ★

Disclaimer

This article is intended for general information purposes only and does not constitute an invitation or offer to buy or sell Emodot(EMO).

This document should be used for general research purposes only. This does not constitute an endorsement of professional investment advice, recommendations or independent analysis, and should not be construed as a commitment to the pursuit of the goals and objectives outlined herein, that is to those of the staff. to change from time to time at the discretion of the Emodot(EMO) team. therefore, the information contained in this Article has not been prepared in accordance with the relevant governing rules and regulations such as publication in various jurisdictions.

By: douglasyukanov

Posted Using LeoFinance Beta