I remember being a kid when my parents had to go through a financial crisis. It was back in 2008 and it was caused by the American housing bubble. Back then I only felt it partly because my parents made sure that I and my sister were well-taken care of.

Today it is different. I am the one who has to tank the car, I am the one who needs to pay the bills and I am the one who has to buy the food. I can see the expanses growing, month by month.

If I was not worried about it 15 years ago, I am now.

And you should be too.

Not because of the financial crisis, because it will pass like any other.

But because we are so dependent on the American economy.

Here I must state that I am merely expressing my opinion on how unfair it is that the mistakes the USA does affect the entire world.

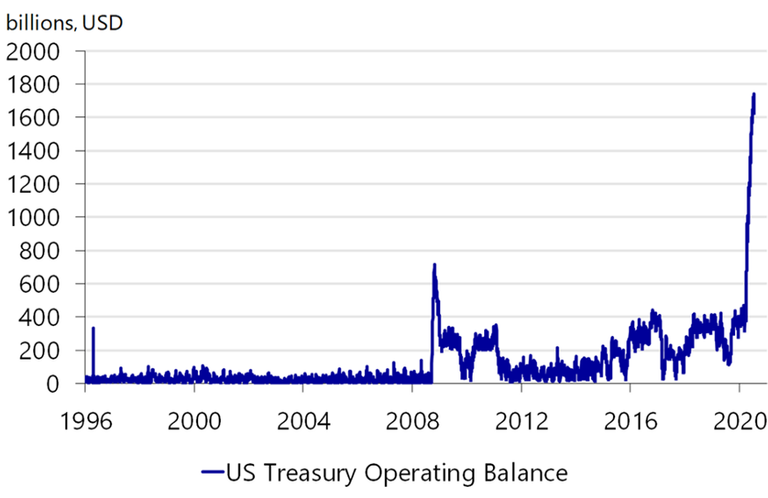

The following image is something that will decide our future once again.

Source: Macrobond

The graph shows just how MUCH money was printed in the USA as a response to the pandemic. 20% (and a bit more) of all the USA dollars ever created was printed in these two years. 20%.

The result is inflation.

Naturally, measures must be taken to counter inflation. And the result of that?

Stagnation.

No further economic development. If it continues this way, it will lead to a financial crisis.

Seems like there are two options.

We either embrace the inflation, where people will not be able to afford the basics or we go for stagnation, where people will lose their jobs and will not be able to afford the basics.

There is a third option, called stagflation, where you will not have a job, but even if you did, you would not be able to afford anything because it would be so expensive.

Stagflation, like a boogeyman used to scare children, is brought up by economic forecasters now and then to warn of how horrible things can get if we’re bad. And yes, we were bad.

“We now have the worst of both worlds; not just inflation on the one side or stagnation on the other, but both of them together” - Mr. Iain Macleod