One of the advantages of computing using cryptocurrencies is that they are immune to your country's inflation rate. The danger is that the cryptocurrency you invest in may devalue; the upside is that anything you invest in now is probably undervalued.

I don't know how good this site is for predictions, but looking at BTC is very promising.

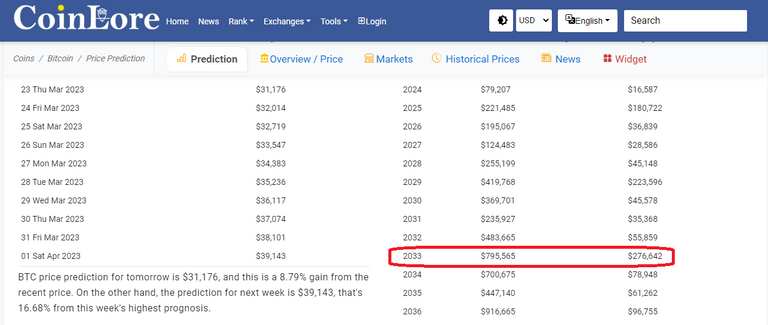

According to their prediction, BTC will have a price range of $16,587 to $79,207 by next year. This places it in the possibility of achieving a new high. Let's say you want to retire in 10 years; the possible range in price will be $276,642 - $795,565. That would put it at over ten times its current price in ten years.

Using that as a benchmark for your investments, attaining 23 times your current cash flow should be easily attainable in ten years.

I'd pick my country's inflation rate if it only took one law to repel any cryptocurrency used. The reality is that by a whim of the government, most people who are into crypto here would have a hard time accessing their funds and would just prefer fiat over risking it.

True to the first sentence. I'm not really into believing projections and relying too much on history since it's already in the past and it's information that other people can also access. Trading mindset just says don't get sold in the news because someone else has already in profit from you as soon as you received it. All this projections from a platform that has their best interest against retail traders or investors may not be the best indicator to rely on your future, but that's just me.

Learning from the hype from the last bull run where people say 100k BTC is happening, we know how it ended there so I'm just cautious with my money and take the present information as is as more important than a future or past.