For generation Z, or what is commonly called the millennial generation today, the word "investment" is a label attached to them and a standard that must be done. Investor growth in 2020 has increased significantly, especially from young people who have started to think about the importance of an investment.

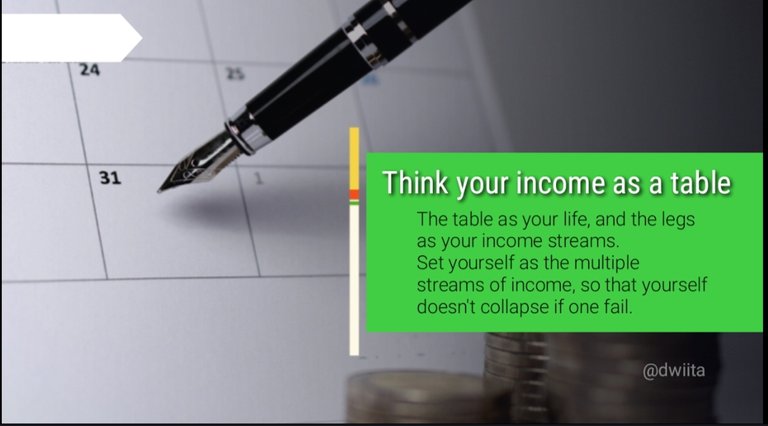

When talking about investing, of course, there are risk factors that accompany it and that must also be considered. Starting from investing in precious metals, stocks, property, cryptocurrency, mutual funds, etc. Experiencing losses on investment is a natural thing. However, we still have to keep updating information about these investments, in order to avoid continuous losses. Then is investment only for those who have a lot of money or earn more?

The answer, of course, is no, it's not an outdated story about zero to hero. Success figures of people who invest from small capital and even capital of courage steps. Small or mediocre income is no reason not to start investing. At least 20% of our income is allocated for savings and investment. Investments also do not need large funds, because it is better to start than nothing. Today, even investments such as gold, mutual funds, cryptocurrencies and stocks can start with the smallest capital under USD $ 10.

It takes the right strategy to manage finances from a limited income and set it aside to invest. For example, when we receive a monthly income, we must calculate how much free net income we can use after deducting the costs of primary living needs, bills, debts, taxes, insurance, etc. Scheme 50-20-30 can be a reference that we practice. A popular method from US financial expert, Elizabeth Warren. The explanation is that 50% of the net income is diverted for basic needs, 20% for savings and investment, and 30% for lifestyle. Everything must be arranged, sorted and set aside at the beginning of the month.

Costs of expenses that are not planned properly will be our failure to have an investment. Secondary and tertiary needs such as buying clothes, accessories, hanging out, go to restaurants, weekly trips, watching movies, etc. are often the biggest expenses of the salary earned. There is happiness in itself, but it must be remembered that these things are not the main needs. Hence, since the beginning of the month we have to make a shopping schedule and what items will be purchased to other spending plans. The point is self-control when it comes to spending!

We are the skipper in managing and planning our finances. If we aspire to create prosperity for ourselves and our families in the future, then investing is a good start. Even though our investment funds are still very limited. However, if you do it regularly, it will definitely give good results. Because an effort never betrays results, failure is also not an end, there is a series of processes that provide us with many lessons and valuable experiences.[]

Posted Using LeoFinance Beta

What has helped me most in investing is spending less and saving more, then being able to put the savings to work to compound the growth, has been working for me over two years now and I'm not stopping any time soon.

Posted Using LeoFinance Beta

I learn much for my investing for 2 years that failed, so start from this new year I build my investation so carefully. Thank you so much for stopping by. Have to your nice day.

Posted Using LeoFinance Beta

Youre welcome. I wish you all the best