A taste of your own medicine.

The Bitcoin ETF is waking a lot of crypto enthusiasts from their stupor. People are mad about it. Why is that? It's because we were all told that crypto was going to "disrupt" the legacy system. And of course we all took that to mean that it would utterly destroy central banking, traditional forms of finance, and even governments themselves. Now that Blackrock and Fidelity are adopting Bitcoin and even creating derivatives from it many more citizens of the internet are starting to wake up to the cold hard reality of the situation.

Disruption means forced adoption, not destruction

The 1990's comparison of the Internet to crypto is dangerous. We projected our own false reality based on things that have already happened. When the internet was gaining adoption back then it was a massively destructive force. It ate the lunch of all the things being made digital. Many businesses were disrupted, and in this case disrupted meant being utterly destroyed because they didn't have the wherewithal to pivot into this superior system. The change was just too big.

Crypto isn't like that at all. When the Internet said, join us or die, all of those too-big-to-fail industries just laughed at it and said no thanks. With crypto we see exactly the opposite. Crypto is like, "join us or die," and the legacy system is like hm yes I've seen this before I think I'll take you up on that deal.

How do you do, fellow degens?

At the end of the day the transition to crypto is just not as difficult as the transition to the internet. In a lot of ways this makes sense. What's harder? Taking a physical hand-written ledger and digitizing it for your business's inventory, or taking an already digital asset like stocks/securities and wrapping it with web3? Crypto does not have to bridge that chasm from the physical world to the digital world like the internet did. It's all been digitized in that first wave back in the 1990's and early 2000's

Bitcoin can not stop war and greed.

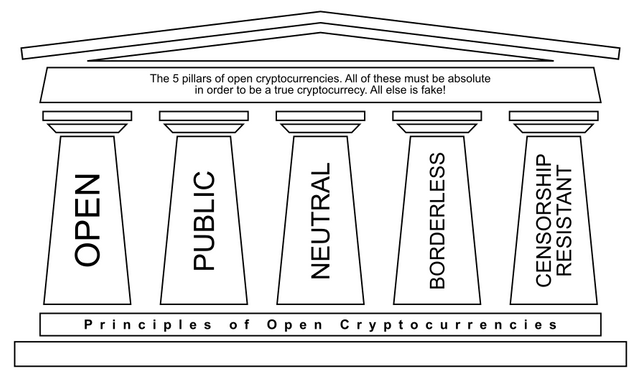

Bitcoin doesn't fix these things. Imagine saying public infrastructure can't be used for warfare. "This road can't be used to fight a war." That's a dumb statement. If the road gets used to transport the military it just got allocated to the war effort. The expectation that public and neutral infrastructure is going to stop something like that from happening is rooted in complete delusion.

With the adoption of Blackrock and Fidelity this truth is more obvious now than ever before. Grandma's retirement fund is going to get a Bitcoin allocation and she's not even going to know about it. That allocation is going to turn a profit, and that profit is going to be taxed. To assume that these tax dollars will not be syphoned into the war machine is again completely delusional.

Of course the rebuttals to these obvious facts will be nothing short of more delusion because these people have simply decided what the 'truth' is in advance. They'll say things like, "Well ETF Bitcoin isn't real Bitcoin," and, "Bitcoin isn't forcing people to pay their taxes, the government is!" Yeah that is next level cope. These people cannot be saved from their own bad takes. My only question is can I somehow profit from such ignorance and delusion. Maybe one day that opportunity presents itself.

It's honestly a very surreal experience to watch the realization happing in real time. These people who thought that crypto was going to destroy their enemies are seeing those same enemies adopt it. And what do they want to do about it? Mostly complain, but some of these hypocrites want to ban them from using it. Yeah, you know what we call that? A permissioned system that's no better than the thing being replaced. Oops. Not how it works, friends.

Conclusion

Disruption is not destruction. If you can't beat them, join them. Much like FTX, the only thing that can bring down these institutions is their own incompetence and greed. As long as they don't leverage fake paper Bitcoin derivatives to print money that doesn't exist it's hard to see how they are going to bankrupt themselves by a move like this.

Regardless of all that, we should not be rooting for the destruction of legacy infrastructure under any circumstances. Billions of people rely on it for everything. Praying that it all implodes instantly in a bout of uncontrollable systemic failure is beyond greedy and ignorant. We need a slow and controlled demolition to occur over decades to achieve real success. Is crypto up to the task? Maybe if it works as intended it doesn't even need to happen this way. All that matters is that the rules are harder to break for those who have the most power to bend them.

Like any tool, public infrastructure can be used for good or bad. Law abiding citizens and criminals have the same access to both neutral architecture and privacy. This is by design and the best possible outcome, as centralizing infrastructure to a permissioned system causes more damage than giving bad-actors access to it. Throwing the baby out with the bathwater has never, and will never, be an option. Don't let anyone convince you otherwise.

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited.

I've always been a bit surprised by the people who claim they don't do anything with traditional investments and that they are 100% crypto. That's fine I guess, but to expect that traditional investments are going to just go away is ridiculous.

I keep my group RRSP going and building as well as my smaller crypto footprint for that reason - The traditional investments like the S&P500 isn't going anywhere. It'll keep plodding on completely heedless of what crypto is doing, and therefore is a safe (relatively) investment. Crypto is my "c'mon, moon baby!" fun-investment lol

I have much the same viewpoint as you. I know we probably have a couple dips or two before I am ready for retirement, but I plan on just letting my investments ride!

I would not put it past them, we are still early!

This post is a reminder why I like reading you. You come at things from a very different angle from me and somehow reach the similar conclusions which allows I can then backwards engineer to learn something.

I (usually don't bother to) call myself an anarchist in the sense that I believe in anarchy as a final goal. To get there in less than a decade seems like lunacy to me, but I want to move closer and closer to it. I don't know how long or how to get there or what it looks like but I believe in slowly dismantling anything that doesn't serve us as both a species and as individuals, and allowing trust in other humans to grow gradually over however long it takes, to make things that once seemed impossible become reality.

I think crypto might play out like this.... at least I don't see things going well if the whole thing become the Warlord States of Crypto (Feat, Rogue Nukes)

A couple of them will but Blackrock and Fidelity won't.

Grayscale won't either.

There will likely be signals just like FTX gave.

FTX offered a lot of yield to undercut the competition.

Small outfits that offer deals too good to be true will end predictably.

Not an easy tax to disrupt the current traditional system. As you said, a lot of people depnd on it. Yet we should not fail to make known the possible advantages of crypto and Blockchain tech. It may take some time for people to adopt this new system. Making it a one time process is difficult to achieve. Tech will speak gradually.

I don't think BTC maxis have this sort of foresight to begin with, you are giving them too much credit.

I'm not quite sure what you mean.

Are you saying that maximalists don't have the foresight to realize they are being greedy and ignorant? Because that's exactly the point I'm making. I'm not giving them any credit. If they knew what they were doing they wouldn't be doing it. Zero self-awareness.

Woops, I think I misquoted. I meant that they don't have the foresight to think about the consequences of destroying infrastructure that many people are heavily reliant on. This is true for most of the maxis I've come in contact with especially during the last couple of months

Yeah I suppose it was obvious from context.

They are walking talking paradoxes.

BTC market price decoupling from stock markets seems unlikely now. What do you think?

Logically this makes sense because the money from institutions will affect the spot price.

However there are many variables to consider.

Even Trump learned to accept it. He still believes in a one strong currency of the US, the US dollar.