Coming to a blockchain near you.

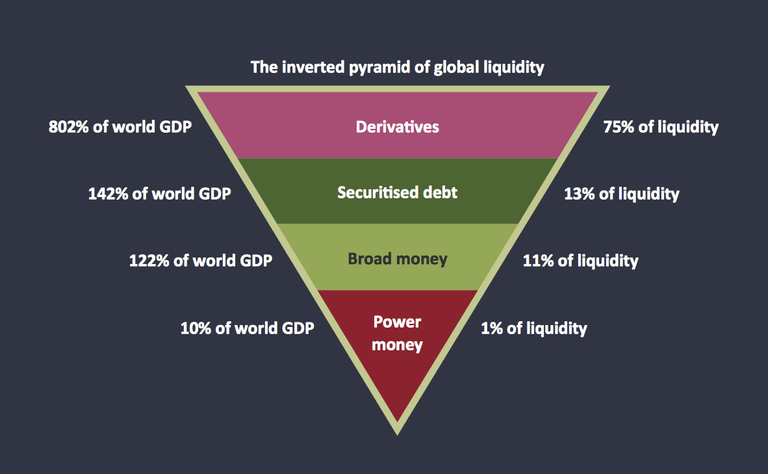

Rumor has it that Blackrock is working very diligently on staying competitive with their record-breaking Bitcoin ETF. The futures market is coming, and as someone who has never used the futures market (except for perpetuals) I need to figure out what that means. Why? Because derivatives rule the world and account for the vast majority of liquidity within the global financial markets.

Imagine that

Imagine pumping trillions of dollars of funny money into the best performing ETF of all time. It's only a matter of months before this happens. The fractional reserve fiat monster just can't wait to get a taste of little ol' BTC. And when they do they'll be dangling those greenbacks in front of all the HODLERS soon enough. How many will sell their soul to the enemy? Judging by what I see on social media most users are going to fall into this trap to some extent.

Bitcoin isn't a security.

What is this weird thing?

As someone who has never actually exercised an option I've always found them to be a little confusing at a cursory glance. A call option is the right, but not requirement, to buy an asset at a fixed price. This price, called the strike price, can be exercised anytime before expiry.

So the first question any rational person would ask given this information is pretty simple. If a call option gives me the right to buy an asset for a set price anytime I want to... then how can I possibly lose money? Seems like a free win, does it not? If number goes down, no problem, I won't buy. After all it is by definition an "option". I have the option of buying if I want to, or not. So it would seem that if the price goes up I would make money and if the price goes down then I would just break even.

No so fast, tiger.

The thing about these contracts is that they cost a premium. In order to purchase the right to buy an asset at a fixed price one must give the issuer some money to sweeten the deal, otherwise they have nothing to gain. This is how market makers take their cut and everyone gets what they want.

The premium is the cost of the contract and represents the total risk to the buyer. The seller of the contract will always profit from the premium. That is... if their position is actually hedged. Imagine what would happen if the market maker sold you this contract but they didn't actually own any of the underlying asset at the time. If the price went up they'd have to buy it off the market themselves just to pay you back or simply take the loss on paper.

Example:

So lets say I want to buy a call option on Bitcoin. For simplicity let's say Bitcoin is trading at $100k and I'm bullish. Send it higher, fam. I want to purchase a call option at $100k so that I have the option to buy Bitcoin at $100k anytime I want before the contract expires.

Let's also assume that I have a payday coming up in 1 week and the plan was to put $1000 of that paycheck into Bitcoin. However, I'm quite worried that Bitcoin is gonna go up and I'll have to pay a higher price. This is a great time to buy a call option. Even if it costs me a 1% premium to buy the contract ($10) this might be worth it to me if I'm worried about Bitcoin being 10% higher in a week.

So I buy the contract for the $10 premium and now I own the rights to buy Bitcoin at a $100k price within the next 7 days. What would happen if the very next day Bitcoin posted a 30% god candle and spiked to $130k? This is unfortunate, is it not? We have the right to buy Bitcoin for a much cheaper price but we don't actually have the money to buy it because our payday isn't for another 6 days. What do we do?

Instead of actually taking possession of the underlying asset we can instead liquidate the position entirely. We still have the right to buy BTC at $100k but BTC is currently worth $130k. With our $1000 contract we can still buy 0.01 BTC, which is currently worth $1300. The fact that we don't actually have $1000 to buy the asset is irrelevant; we can simply ask the market maker to cash out our position entirely. The position is up $300 so they owe us $300. We never have to front the initial $1000. That's the entire point of the contract.

If the market maker is hedged and they actually bought Bitcoin at $100k when they sold you the contract... well this is not a big deal for them. They can just liquidate their hedged position, sell BTC on the market, and give you your $300 without taking a loss. In fact, they are up $10 because that was the premium paid for the contract in the first place. This is how market makers who sell options are supposed to run their business.

So basically when Blackrock starts offering these contracts to their ETF customers they are going to have to buy a metric shit ton of BTC to hedge against their own clients betting on Bitcoin going up in price. There's no other way to play it. If investors want to buy call options then the position must be hedged in case the client is correct and the price goes up. This kind of flywheel can astronomically moon the price of BTC to absurd valuations because ETF providers have to hold a big enough basket to be comfortable offering the deal in the first place.

In addition, the ETF position itself can be used as collateral for the contract. So let's say Grandma has $10k in the ETF and she wants to bet on it going higher... she doesn't have to bring money in from the outside to place this bet. There's already $10k in the account to gamble with.

Because derivatives are an expansion of the money supply, it takes a very small amount of collateral to make a very big bet. It is in the best interest of the ETF to keep those bets hedged to they are constantly guaranteed to make money no matter what happens, just like any other casino or gambling house.

Conclusion

Futures contracts are very weird, but I think I'm starting to get a much better understanding of how they work, and more importantly how the market makers who sell them to their clients must hedge against them by doubling down on the bet in real time.

In a very real sense the purpose of these contracts is to pay a wealthy entity a small fee to make a bet in advance for us before our money becomes available to us. It then evolved into this gambling game in which the player often never takes possession of the underlying asset in the first place but rather just liquidates the contract before it expires for cold hard cash. A strange concept to be sure. Suddenly the overnight lending repo market is beginning to make a lot more sense. Only in finance.

The market will perform well in the same way for some time but those who bought at 20-25 thousand now is the time to sell.

Yep.

Not that it's ever going to change at this stage, but if there were some way to de-financialise the global economy, would you support that happening? Would it be a worthwhile thing to occur at all? Purely hypothetical, but figured why not ask...

The top 10 ETFs already accumulate close to 4%, (which is already a large amount) I think that the more they have, the more dangerous it is, although seeing it from the aspect that you tell us in the post, perhaps it is better to keep them permanently, for that reason. way to constantly earn from futures trading, whereas if they sell everything and crash the market they would only make a one-time profit.