Checks notes... starting their own stock exchange?

BlackRock and Citadel Securities are backing an upstart stock exchange to be called the Texas Stock Exchange that will be based in Dallas, according to interviews

Uh, chat is this real?

There isn't a whole lot of information out there on this development, but there is an absolutely epic amount of speculation to be done. For starters, Larry Fink has already announced on national television that he intends to tokenize the stock market. Now we are hearing he's creating his own exchange. Can we expect that these digital assets will be represented by blockchain? There's better than a coinflip chance that these stocks will indeed be cryptocurrencies.

If we assume this to be true it opens up an entire slew of questioning. How in the world is that going to work? Who controls this blockchain? Is it going to be CBDC style where Blackrock and Citadel just control everything and have the final say in all matters? Could be, but honestly that's not what I would bet on. As an up-and-coming alternative I believe he needs to sweeten the deal to lure companies into the shiny new thing.

Could it be DPOS?

Sort of... but also not. DPOS would imply a governance token that rules the network. I don't think that type of model is necessary or even warranted. However, it could be DPOS-adjacent in that every company that joins this network gets to run a node within the network, creating a sort of one-company-one-vote situation. That way everyone can keep track of everything going down on the chain and everyone gets a bit of power. This would be very similar to how Facebook and Mark Zuckerberg would have operated their token (libra/diem) if the banking sector would have allowed it. Of course this is all rampant speculation, but also this news is huge within the context of everything that's been said and done up to this point.

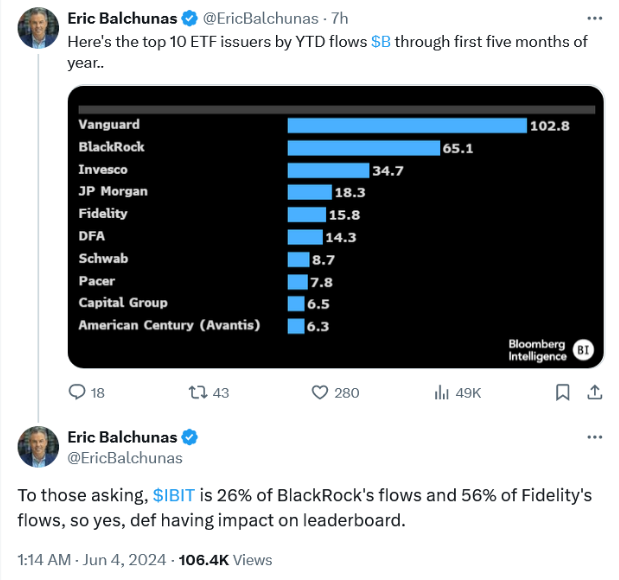

26% of inflows? Really?

The Bitcoin ETFs amount to 26% and 56% in year-to-date inflows for BlackRock and Fidelity respectively

The Bitcoin ETFs are beyond successful.

Even the most hyper-bullish individuals would have never predicted this level of adoption in such a short time. Notice how it's being framed that Vanguard still has higher inflows. LoL, so what? Imagine what happens during 2025 when Bitcoin does whatever it does (like a 10x or whatnot). The level of potential insanity brewing here is the stuff of legend. Vanguard is going to be the laughing stock of this rally. Grab your popcorn.

Although this does raise a simple question: is there paper Bitcoin floating around already? Are Blackrock and Fidelity shorting BTC by not hedging their positions properly? On a legal level they are actually allowed to do this up to a certain point but I'm not quite sure what the exact rules are.

The reason why it's all a bit suspicious is that the entire industry has been signaling supply shock for a while now but we've just been crabbing this entire time after hitting all-time-highs. To be fair hitting ATH this early was a record-breaking moment in the 4-year cycle, so that definitely needs to be taken into account.

From a logical perspective it doesn't make a whole lot of sense to assume there's a lot of paper BTC out there at the moment. The game has just started. I know if it were me I would not go full FTX degenerate and short the most valuable asset of all time right out of the gate. It just doesn't make a whole lot of sense within the current environment, but we should always understand that paper BTC has always and will always be a looming threat when custodians are involved.

The exchange, which will be electronic, has raised $120 million from an investor group. It’s aiming to launch in late 2025 and attract its first listings in 2026, targeting companies based in Texas, Oklahoma and the broader Southeast.

LATE 2025?

WHAT?!? Haha... Larry Fink out here playing the 4-year cycle perfectly. When this exchange launches there is a very good chance it will be a massive top signal. I 1000% guarantee you I'll be writing a post during that time telling everyone to take some gains during all the infinite FOMO and absurdity.

The Wall Street Journal reported on the endeavor earlier, saying the exchange is billing itself as a “more-CEO friendly” alternative to the New York Stock Exchange and Nasdaq in the face of rising regulation and a “disaffection with increasing compliance costs.”

A contested Nasdaq rule requires listed companies to disclose diversity information on their board of directors. The SEC approved the plan in 2021, but it now faces a new challenge in a federal appeals court.

There's a go-woke-go-broke element?

That's kind of ironic considering that Blackrock has been pushing ESG compliance.

Perhaps they can see the backlash and are leaning into it.

Maybe they're just ridiculous hypocrites.

Who knows?

TXSE’s website said it will be a “fully electronic, national securities exchange that will seek registration with the U.S. Securities and Exchange Commission.”

How much you wanna bet it's going to trade 24/7 with instant settlement?

Conclusion

I didn't realize that just booting up a new stock exchange was even an option. I'm quite taken aback by this news especially considering Blackrock's stated intent to tokenize the stock market with blockchain. Is this a "good" thing? I mean that's up for debate, but it certainly seems to be a bullish thing and potentially the ultimate top signal of late 2025. Thanks, Fink. This bull run keeps proving itself to be completely easy-mode. Remember that my target retracement was $58k. I said it over and over again. How was I able to guess so accurately? Because easy-mode. All we have to do is hodl to late 2025 at this point methinks. Too easy. Prepare to have your face melted by green candles.

Has the hold point always been late 2025? I thought before people were saying late 2024 early 2025. It just feels like it keeps getting pushed back further and further. I mean, I don't care really, I'm just eager to get this show on the road! You know what they say, everything is bigger in Texas, so this could definitely be a good thing. It also fits with the move of tech companies from San Francisco to the Lone Star State.

Every time; this time is not different.

Some people have been saying this time is different.

They are wrong, again.

They'll be the same ones who say we're in a super cycle when we need to be taking gains.

Dang, I could swear people were saying 2024. That throws all my plans out the window. I might not even be still alive in 2025. This blows.

I mean it's always been a 4-year cycle don't know what to tell you.

I hope all is well?

Ominous tone you've got there.

I'm getting close to 50, you just never know these days. I'm hoping to get some of these big gains while I am still young enough to enjoy them!

It’s always November or December the following year.

2012 having - November 2013 new ATH

2016 having - December 16th 2017 new ATH

2020 having - Laye fall again new ATH 2021

The idea of a Texas Stock Exchange is wild man🤔 If it includes blockchain and crypto, it could really shake things up for real. It's hard for me to actually know if this will be good or bad, but it's definitely interesting that it's happening.

What blockchain? I saw no mention of a blockchain in the CNBC article.

Fink has very much stated his intent to tokenize stocks.

I don't imagine it going any other way.

The Bitcoin Core node running on my laptop allows me full and unfettered access to the blockchain. Let Larry do what Larry gotta' do. :)

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

If it works, great. If not, it will be a good case study for future attempts.

Damn I love the feel of melted wax on my skin...

Huh, definitely didn't have 'Fink opens an exchange' on my 2024/25 bingo card, but here we are! Gonna be interesting to see how things line up in Q3/4 of '25.

No doubt things in the blockchain world will change in a few years. I'll just wait and see, and as long as I investigate, you never know what might happen, but, if we can keep up with the changes to use them to our advantage.

very soon, many adjustments or changes would be made in the Blockchain.

Yeehaw! This blog post is as exciting as a bronco ride at dawn! Keep your eyes on the horizon for the future developments ahead. Just like a trailblazer, stay positive and embrace the adventure!

Very Bullish news!

Larry FInk may turn out to be the guy who leads crypto to the promised land.