As expected

I always said that the SEC would get slayed in court by Coinbase, but I did not realize it was going to be this definitive. Not only did they not have to settle ($0 fee) but also Coinbase will not change the way they do business in any way. Brian Armstrong is now celebrating; which is fair. He's also reminding everyone that the SEC under Biden was engaged in an almost overt illegal war against the industry for the last 4 years; which is also true.

I will say it irks me somewhat for him to act like he is some champion of the space; he is not. He runs a centralized exchange. There are many complaints. He does not produce open source code. Michael Saylor was able to acquire more Bitcoin than him almost immediately even though Coinbase has been around since 2012. That's not dedication; he's larping.

Of course none of this is official yet but the likelihood of it happening is close to 100% so might as well just report on it now. Add it to the list of bullish news that isn't pushing the price up. The liquidity gap at $77k beckons.

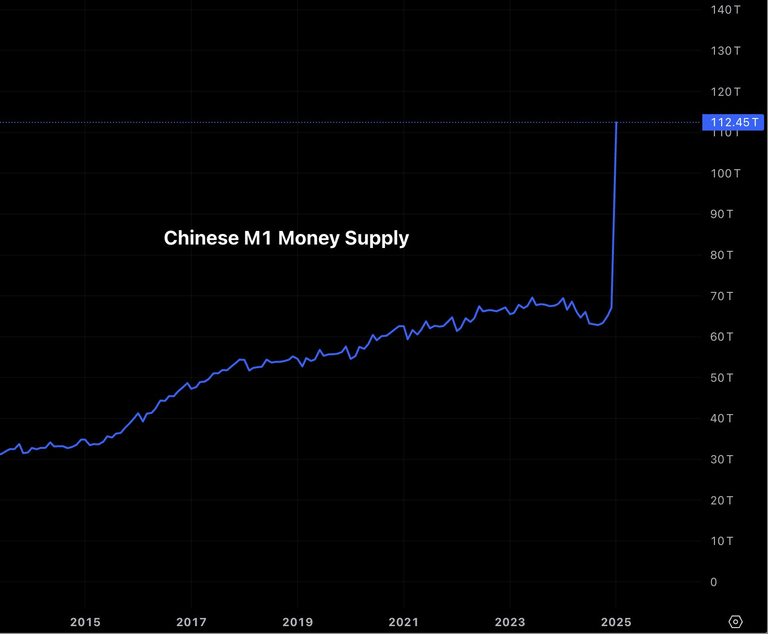

https://tradingeconomics.com/china/money-supply-m1

Uhhhh, wut?

Some people seem to be reporting that China just doubled their M1 money supply in less than a month. Upon further digging others are saying that China simply changed the way the number is measured... so no money was actually printed they are just counting more of it.

Of course this drums up even more discussion like... why didn't you retroactively change the previous data as well? An obvious answer for that is they don't have those numbers, which makes perfect sense but is still alarming. And also there was just a shit-ton of money lying around that you were acting like it wasn't part of the money supply? They're probably just changing the definition of which assets are highly liquid, which is what the M1 measures. Not sure why they would do this though.

The reason to report on this like "money printer go brrr" is obvious. Altcoiners want to believe that an alt market is coming and a liquidity event like this would definitely pump risk-on assets with weak money. Cope cope cope. Just be patient and wait instead of reporting on nonsense.

~~~ embed:1893019485100970094 twitter metadata:amNvbm9yZ3JvZ2FufHxodHRwczovL3R3aXR0ZXIuY29tL2pjb25vcmdyb2dhbi9zdGF0dXMvMTg5MzAxOTQ4NTEwMDk3MDA5NHw= ~~~

Massive Bybit hack

The market is bleeding red today, but not as much as you'd think given the severity of this situation. Can't say that I'm too bullish on ETH now that North Korea perhaps owns more tokens than Vitalik :D. Others are saying that this hack is bigger than 15% of all crypto hacks combined. Unclear if that's accurate, kinda sounds like BS. But also it's funny to think about how Binance was fined $4B by the USG which is obviously a much better number than this $1.4B ETH figure.

Altszn canceled?

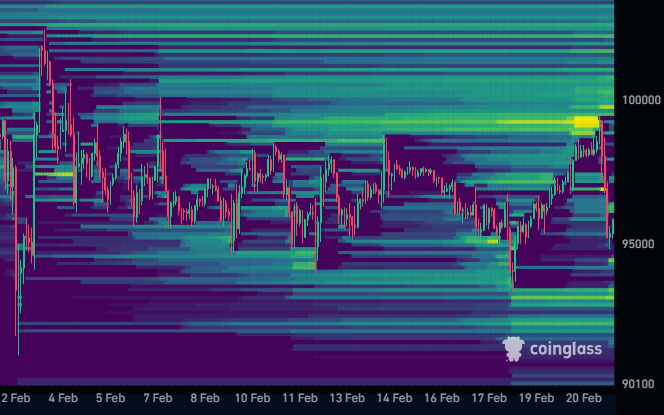

The market does look pretty screwed right now... but honestly I don't think this hack has anything to do with it. I've been telling everyone to lookout for a hard rejection near $100k, and we just got it. Death-cross is locked in. A 30% retrace is firmly in the cards, and that's fine.

I thought the bearish megaphone had unwound... but lol it's still going strong after getting hard-rejected at the trendline currently sitting on $99.5k. Feb 22 is tomorrow, which was my guess for a high-volatility occurrence. Looks like it may have started a day early and there's no telling how long it will continue. We are still very much trapped in a declining channel with no end is sight.

As we can see here I've decided to start day trading again and am placing an x10 long bid at $91.7k at the bottom of the channel. This region still has multiple supports so it's a good bet if we crash that fast we will for sure get an immediate bounce in the short term.

We can see from the heatmap that this hard rejection near $100k should have been completely expected (and it was expected by me). It's a shame I didn't bet on it I've been sidelined for a couple days thinking there weren't any edges to be found. Or maybe I just didn't like that the edge was bearish... shorting the most powerful asset in the world is not exactly a fun bet to make.

What we are looking for now is the final death knell: something like Bitcoin grinding near $92k support for the final plunge back into the liquidity gap. Obviously we hope it doesn't happen... unless you're buying. Said it before and I'll say it again if BTC is $77k that's just free money right there. BOLO

Conclusion

Every time crypto gets good news the price does nothing and every time we get bad news we get punked. Not a great sign and I hope it turns around soon, but swings like this usually last a month or two. Brace yourselves for disappointment in the short term. The groundhog has seen his shadow.

The rewards earned on this comment will go directly to the people( @blkchn ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

It is getting a little bit concerning. I am still hopeful, but this really doesn't feel like it is playing it the way a lot of people thought it would. I don't really understand the negative sentiment on ETH either. It's still a major player even with SOL minting millionaires.

I don't find it concerning at all.

It is honestly playing out how it always does.

Everything moons at some point during the bull market year.

It happens out of nowhere.

Parabolic phase is quite short.

I remember it was just about this time last cycle that I started taking a couple big gains in my NFTs.

The Bybit hack has to be one of the most quiet hacks I've come across considering just how renown the exchange is.

So many people in my space didn't even know anything was up with Bybit.

Only reason I noticed was because I was locked out of my account 😂😂

30% retrace in traditional stock market is a bear market, in crypto it is merely a correction :)

Now thats some white crypto savior 🤣lolzz when you least expect it it does wonders

nice article. i enjoyed reading it.

77k?

OMG!

Look out below!

I am hoping that the alt season can still bounce back

It is high time we start to get some win in the fight for crypto but it is disheartening that these wins are not bringing in the bullish momentum for investors and adopters.

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

hmmmmm, sounds like another win for crypto. but ye,, always the growing pains.. ☺️👊

!PIZZA

$PIZZA slices delivered:

(4/10) @danzocal tipped @edicted

Trump has recently threatened to tariff the crap outta the BRICS if they attempt to put forward a new currency to flog against the dollar. He's also been calling China a 'threat actor' and pushing all sorts of tech restrictions against it.

Brics need a currency, and China is showing the depth of it's pockets, is my guess. The Yuan isn't a new currency, and the US can only tariff China so hard without cutting it's own throat, which I believe is why he threatened Canada and Mexico with 25% tariffs but China only 10%, which, correct me if I'm wrong, is actually being imposed - at least I've heard no action against fentanyl production or provision of precursors by China - while the tariffs on Canada and Mexico were able to be dropped.

If China can drum up commerce using it's Yuan across the BRICS, it can turn that tariff into a much more powerful position in the BRICS, despite Russia's apparent turning to redemption in the US market. Perhaps even more if Russia's sanctions in the West are dropped by the US and China can stop turning away their tagged tankers and bank xfers. I won't pretend to be able to reckon whether that can make up for a 10% hit on exports to the US, but I suspect it could, particularly if it doesn't have to dodge sanctions on Russia anymore.

Thanks!