Regulators all around the world as still scrambling to put a lid on crypto.

- Even after losing the Ripple case (secondary sales are no securities) the SEC has declared they will take the case to appeals court.

- It's come to light that the SEC told Coinbase they should delist everything except Bitcoin before sending them a Wells Notice

- The Nigerian SEC has accused Binance of illegal operations within the country.

Today this is the bombshell news that finds itself front and center.

There are quite a few implications to be drawn here, the first of which is that Brian Armstrong was clearly feigning surprise when Coinbase got issued a Wells Notice from the SEC with the intention of being sued by the regulator. Seriously how are you going to act surprised if they tell you beforehand that they think everything but Bitcoin is a security... and then when you ask a followup questions they just tell you to shut up and do as they say. lol. Okay then.

- Ignore

- Laugh

- Fight

- Lose

But on another real level it's quite clear that the "Fight" stage of this crypto battle is ramping up into high gear. The gloves are coming off, and real punches are being thrown. Of course punches like this can only land on centralized agents, which are exactly the agents that crypto doesn't want around, so it's somewhat ironic and funny when looked at in the long run. The SEC is doing us a pretty big favor by forcing decentralization across the board.

Crypto banks were never meant to exist, which is why "be your own bank" has always been a thing. On the same side of that yin-yang coin is the fact that crypto is for everyone; it doesn't discriminate. So we must accept that crypto is also a tool for banks and even governments as well. Whether that tool is utilized correctly is up to the people to decide. It's no secret that citizens are willing to trade freedom/privacy for security/convenience (or even the illusion of them).

Why are the SEC maximalists?

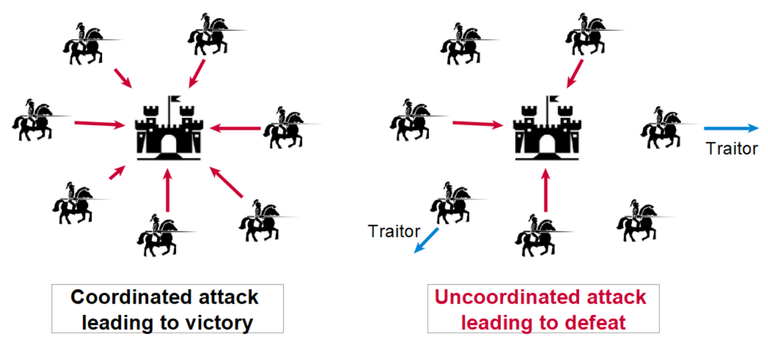

Why only Bitcoin? On a personal level I think the answer is quite clear. Looking at these things globally and using intuition presents the answer instantly. It is not possible for the SEC to vet every single crypto asset, nor is that in their best interests.

Normally in cases like this the SEC would come up with a plan and some kind of clear-cut regulatory framework for crypto, but they can't do that either. Crypto is simply too complex and downright smarter than anything the SEC could throw at it. As soon as the SEC laid down the rules: hundreds of tokens would find a way to loophole around it like swiss cheese. The SEC understands this, which is why they've chosen the regulation by enforcement path for so long.

So why Bitcoin? Because the SEC (and the government) need crypto to be as centralized as possible to control it. So while all the maximalists are cheering that hash rate is going up while price is still low... this does not point to higher security like they espouse, but rather a centralization of hash power and the threat of 51% attack.

However even the 51% attack is a red herring

Bitcoin will never be under threat against such an attack, even if regulators actually do end up capturing it. The real threat is centralizing mining so badly that most (if not all) of the blocks that Bitcoin mints are whitelisted by the regulators. Don't be surprised if one day it's deemed illegal to post a block to the chain without using the appropriate blacklist to sanction the baddies.

With all this in mind it makes perfect sense why the SEC would say something like "only Bitcoin". Bitcoin is already a difficult enough beast to handle. Allowing anything else into the mix makes the situation completely unmanageable.

But again all these points are moot in the face of eliminating the banks in the first place. If people are accepting crypto for goods and services directly the banks become completely circumvented and meaningless. Perhaps even the vendors become mini-exchanges in this regard, with the ability to allow people to exchange value right there directly in store (kind of like a cashback program now that I think about it).

But will the regulators try to make that illegal as well? I mean probably, but again it doesn't matter. At a certain point the law no longer makes sense and people just ignore it because of how absolutely ridiculous it is. Look no farther than prohibition of alcohol in the United States history books to see what happens when you try to impose such Draconian bans. You can't police the people if the people are the police. Perhaps that's why they need robot/AI police going forward, which is a whole other can of worms.

In other news

Nigeria has accused Binance of illegal activity in the country, which of course is true. Nigerian citizens are not allowed to really engage with crypto at all. You can literally get picked up off the street and carted off to interrogation if the cops simply suspect you might be using crypto or refuse to unlock your phone. There are many tales of this happening directly on the Hive blockchain if you care to look them up.

The fact that Nigerians are still able to use Binance's P2P trading system is kind of hilarious and obviously also against the law. However being to actually enforce such a law seems to be quite difficult. Such is the nature of decentralization and the Internet.

The SEC said the post reiterated a June 9 warning that referred to a company called Binance Nigeria Ltd.

That's funny because...

Binance told CoinDesk at the time that the company was not affiliated with it.

Looks like we've got a classic case of the he said she said finger pointing game. CZ loves these games, and seems to always win them. As an American citizen I still use Binance non-KYC. It's called Mandala and it uses the Binance cloud tech and all their liquidity pools. Mandala hard IP-blocks any country with crybaby regulators, which gives Binance two ways to deny any wrongdoing: one with the IP-ban and the other with the fact that technically Mandala is a completely different incorporated entity and they should take it up with them. Hilarious.

You lost. Get over it.

The fact that the SEC is hinting at taking the Ripple case to appeals court is such a slap in the face on so many levels. First of all they disrespected the judges on that case multiple times, and this call for appeal is further disrespect; saying the judge on the case literally "got it wrong". Wow. These people have no shame.

At the end of the day this is simply what happens when you try to apply hundred year old laws to crypto. Everything breaks. Good thing the entire point of crypto is to regulate itself. Certainly there will be growing pains along the way, and the centralized regulators moving in to try and control everything is just a part of the normal process of decentralization.

Conclusion

The frantic nature in which regulators are poised against crypto points to one thing: mainstream adoption. None of this would be happening if more and more people weren't jumping into crypto. It is the regulators job to pave the way for such events so that it has a minimal amount of disruption to the status quo. Will they actually succeed in accomplishing this goal? I highly doubt it, but it would be foolhardy to assume that they wouldn't even try. However, the "We're not going to explain it to you; just do what we say," angle can only work for so long.

The latest one is that fat guy from Hex getting sued by the SEC for selling unregistered securities. If the SEC loses the cases with this one to, it's clear they are utterly useless.

Richard Heart is getting sued? lol

Too bad it's too late to add that here.

I read about it on twitter a couple of hours ago. Man, if you check this guy's website and twitter profile he presents himself like he's some sort of Gandhi or Jesus. He has 380k followers on twitter, all of them living proof of how dumb and easily manipulable humanity is...

Yes, the SEC is accusing him of pulling a SBF FTX type of crime, using the money of his investors to live a lavish lifestyle as the narrative.

The irony is Hex is over 5 years old, according to the SEC, so basically they let them do this for 5 years. That is the question no one is asking the SEC.

The rewards earned on this comment will go directly to the people( @acidyo ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.https://reddit.com/r/CryptoCurrency/comments/15f7yhx/crackdown_smackdown/

Only Bitcoin is laughable. Bitcoin isn’t a security but Litecoin is? The SEC is clearly clueless, just pulling stuff out of their butt.

I don't think they are clueless at all I think they know exactly what they are doing.

They've proven a dozen times over that they have malicious intent.

Like sending back to back Wells Notices to Coinbase and Binance within the same 24 hour period.

Anyone with half a brain cell knows this increases market manipulation.

Which is exactly the opposite of their job description.

"Protecting investors" is off the table for sure.

I agree they have malicious intent, and while it's popular to call Gensler an idiot, I have to think, he is worth millions of dollars, which he earned teaching and consulting for people with much more money. I suspect he knows exactly what he is doing, and the secretive nature of cryptocurrency could allow both him and his overlorads to make plenty of money through market manipulation and other tricks.

Well put, I think its easy to overlook this, because banks and governments are not larger than life, but people as well.

Thanks for this. I'm going to look into it.

https://peakd.com/@edicted/mandala-exchange-binance-bridge-shutting-down-november-25th

Here's my post from 2021 about Mandala.

It gained a lot of popularity back then when the regulators were going hard.

Man I swear, the corrupt shit they try to pull - and often do pull - it makes my blood boil.

I will humbly point you to Canada to rebut your claims of victory. The truckers honked and Castreau didn't like it. Canada told the banks to seize the accounts donating money, so people got robbed and then turned to crypto. Canada shut off BTC too. All that has to happen is the government order the people that own the internet to quit letting us use it.

Even if the government doesn't bother, the owners can just do it whenever they want. We aren't the owners, and we depend on their permission to use their network. If I wanted to force everyone to use my CBDCs, I'd let them all dump all their assets into crypto that my personally owned network allowed them to transact over freely. Then, when my CBDC was ready, I'd quit transmitting their data unless they exchanged their crypto for my shiny CBDCs. I might not even bother to exchange them fully, but let all the poor get 'reset' to parity with the crypto billionaires. Depends on whether I liked the cut of your jib or not, the phase of the moon, or how I held my tongue.

And that would be that. Everyone would accept my CBDCs or be reduced to utter penury.

There is a defense against this rugpull. We need a physical infrastructure we own that enables us to network at will, that no one but us can censor or turn off if they feel like it. We don't need >50k satellites to do it. Even a dozen or so in geosynchronous orbit would enable wireless networks to be secure from the gnomes of Zurich, and keep our crypto worth something.

Thanks!

Do you also make the argument that life will cease to evolve and the Earth itself will die forever? How many times are we going to rehash the same conversation? The count is already higher than a baker's dozen.

People will adapt to the rapidly changing environment just like they always have. CBDC is a huge nothing-burger not even worth paying attention to. I know because I've been paying attention and it's been a complete waste of life. Repackaged enterprise blockchain that's dead on arrival. Pointless.

Humanity has seized the reins of evolution, and you can have it in the palm of your hand and undertake it on your kitchen table today. CRISPR, and better tech, has been released into the wild. The-odin.com will provide classes, consumables, and whole labs at reasonable costs, as well as turnkey experiments to demonstrate how to make your own bespoke species of glow in the dark frogs, yeast for brewing unique beer, or mushrooms suitable for use as building materials, for example.

The Earth will die forever, but long after humanity has moved on to greener pastures.

When we are no longer defenseless, our fortunes forfeit at the whim of oligarchs, and our words able to be spoken without fear of censorship, the problem will not exist, and I will no longer note that no encryption, protocol, or currency has any security whatsoever and every one is utterly dependent on the whim of our overlords to have value.

I cannot fathom how you can expect a currency that facilitates total surveillance and control of your personal wealth by vile banksters to be pointless. Last year I was able to pay my rent 1/2 the months using goodwill, and I have been working on doing that for more than a decade now. It is difficult to limit transactions to people that merit such trust. Almost no one has such facility that hasn't worked so hard at it, and if CBDCs are pushed on them very few could refuse them, because the alternative is to be unable to transact at all.

I do not see any means you have, or propose, that is nominal to surmount this challenge and secure your wealth, so cannot understand how you could call it DOA. Perhaps if you enlightened me how you would secure your wealth in events such as are predictable, I would no longer fear that you, as I have been in the past, would be utterly stripped of your assets and left without anything.

There are ways to prevent that from happening. I'm not just bitching because I like the tappity tap sound of the keyboard. I see no movement, no effort or expense being undertaken to address the problem, and if that is the situation when the imposition of CBDCs are mandated, everyone I know will lose every bit of their financial freedom, and even I will not be able to use the means I have developed because I am dependent on transacting with others that remain vulnerable. Why is there no movement to secure assets of the vulnerable from a threat that has been publicly stated by those with the ability to carry it out?

Very interesting view, thanks for sharing this information, have a great day 👏

the SEC is definately acting like a drunk bully, and I am almost embarrassed for them, but I am not, because whatever happens, they brought it on themselves, .

i hadn't thought about their efforts actually making crypto stronger, by cutting out the centralized exchanges, but you make a good point. They may unwittingly make crypto stronger by incentivising decentralized networks, where there are no individuals to arrest and charge, and perhaps make dexs more popular. Time will tell.

Edicted what do you think about the Twitter/X app integrating crypto? People are speculating and saying Elon will integrate Doge or XRP! I’m saying it’s not possible, regulations won’t let them breathe, also, infrastructural difficulty. But I want to be sure I’m right. Thoughts?

I agree this appears to be a planned operation to hurt crypto, and manipulate the market. I think a lot of money is being made off volatility.

But the interesting thing is if this paradoxically makes us stronger, by forcing us to develop decentralized rails.

Crypto is like a toddler, who thinks its a teenager. But ever hack reminds us of how immature we are, and vulnerable to exploits on so many levels. Market manipulation is just one of many things in the crypto ocean which seek to eat us alive.

definately not an envirnment for the weak or faint of heart.