Well it took a little bit longer than expected...

But it looks like Hive has pumped off a local bottom 3 times with a week in between all of them. The volume is off the charts. CoinGecko is showing $1.7 Billion on a quarter billion market cap. And that's just the spot market. The new perps listing on Binance shows $1.6B over the last 24 hours just on this single exchange. The market-makers are going crazy and sloshing around massive amounts of Hive to each other, and I'm one of them.

4,380% yield

A -2% funding rate (which looks to be the maximum possible for perps) provides the opportunity for anyone to buy Hive on the exchange and get paid over 4000% APR for their trouble. The problem? Everyone on Hive knows we have a pump/dump pattern and nobody wants to buy the pump just to loose 30% of their money overnight.

This puts me and other Hive market makers in a unique position and a really profitable opportunity: anyone who holds liquid Hive can move it to Binance or MEXC and farm this 4000%+ yield for "zero" risk. I've already made $100 overnight since the fun started with $2500 worth of Hive.

How does it work?

Well first off when I use the term "risk free" it does not include the systemic risk of holding money on an exchange. MEXC and Binance can freeze your account and steal your money if they so choose, and there is little recourse if that happens especially for someone like me who isn't technically allowed to use MEXC in the first place (but do anyway with a VPN). MEXC pretends like they don't know but they absolutely do. They are in the business of making money after all.

x1 long is the key

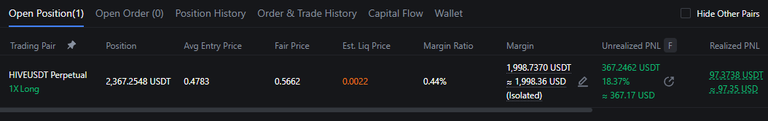

So imagine you were holding liquid Hive somewhere... wouldn't it be nice to put that money to work? That's exactly what can be done with a negative funding rate like we see here. The longs are being paid big time. Just look at what happened while I slept:

Up $500 in 8 hours.

- This is done by sending your Hive to the exchange.

- Dumping all that Hive for USDT.

- Transferring the USDT to the Futures market.

- Opening a 1xLong on perps.

Notice how my "estimated liquidation price" is $0.0022. Meaning I don't loose my money unless Hive crashes to a fifth of a penny (and probably not even then). That's the magic of going 1x long; it's 100% collateralized and the user wanted to hold liquid Hive regardless.

I closed this position about an hour ago after we pumped again and it was up $400 just from price going up. Hard to imagine we maintain this momentum without dumping again, but you never know. It's not like Hive going up could ever be a bad thing for me so there's no reason to be greedy in a position this good. Ultimately I'd like the price to come down from here (for the trade not for my bags) so I can 1x long again and continue farming this badass yield.

Further explanation:

There seems to be a lot of confusion around how this all works. An x1 Long (using USDT collateral) is almost identical to holding the underlying asset at little to zero risk of liquidation. But more than that the funding rate is a device that ensures that market makers will act in their best interest to peg the futures market to the "real" spot market.

If everyone wants to short Hive because it just pumped hard (which is usually the case) and nobody wants to go long then the longs have to be hardcore incentivized. This is where the funding rate comes in. So if you were going to hold Hive anyway and it doesn't matter if number goes down or not... might as well farm some yield from it (if you don't mind exchange counterparty risk). However with Hive because so much stake is permanently powered up it creates this liquidity problem where many users don't have anything liquid. My advice would be to always have 5%-10% of your stack liquid so have at least a little wiggle room.

I still feel like it's confusing and I'm not explaining it very well... so I guess I'll have to think about it more and simplify the logic and reasoning in some other post for the newbies. Until then Pump It Up!

Don't forget that even 60 cent Hive is oversold.

Talk again at $1.60

I need to do a lot more research into how these markets work. You make it sound easy to do but when i read the explanation it only just about makes sense.

Like most advanced things, it makes perfect sense when reading what he writes, but then when staring at charts ourselves and wondering what to do.... it's all blank. haha. Just like physics class back at university.

Yeah exactly I know there is a better way to teach this stuff but I'm struggling.

If i fully expect to see hive drop back to 40-45c over the next couple of days, what is the play to make a profit?

Not a guarantee but how it usually works even though the market is actually set with a strong resistance at the moment from buy orders.

TBH i just sold my liquid at 62c and will be waiting to buy back in the lower range but is there a better way to play the game?

screen shots and arrows.

Hm! 🤔

I've just been trying to make some money moving things around on Hive Hub. It feels like the numbers are a bit different there, but I'm afraid to take the risk moving it off the chain.

i just tried hive hub out and realised after the swap that Id effectively sold hive at 0.55 when it was priced at 0.63 so that was a bit sad. HBD was at 1.1 I think.....but I dont know. my math sucks and Im a terrible trader I shouldnt have bothered! Now I need hive to crash back to 40c so I can buy it at 50c a piece and make my 0.05 profits. lol

I really remember resembling that remark.

did you eventually learn to relax and leave it all alone, or did you master short term profits?

I mostly leave it all alone, but sometimes i bend to my own internal pressures (mostly the ones which say, OI, if you just sold some of that last pump and then bought a few days later, your hive stack would be a 3rd bigger!). But only trading can remind you why you ignore that voice...

Eventually you remember, you become that voice. I have learned that financialization is a trap I cannot slip. There is a coordination, zersetzung, that is able to focus down to a degree that is inconceivable, and can be applied across every mechanism that requires transactions, and many that do not. I learned this to my great amazement, and inconsolable dismay. If they select you out of the herd, there is nothing you can do to escape their implacable coursers.

I value Hive not as a currency, but as the measure of the esteem of my peers on Hive. I don't seek to increase it via financialization, because that would devalue it to me, causing it to no longer represent that estimation, but be inflated into a pretense of estimation comparable to narcissistic conceit for my purposes. I use over 25% of my author rewards to encourage creators that are incessantly flagged in an attempt to censor them, and to tip authors because that can't be flagged away, so my Hive fortune underrepresents the esteem of my fellows. Better to be too humble than blinded by hubris into conceit, I feel.

I have learned to transact in goodwill because that cannot be stolen, inflated, taxed, or rust. I can only transact with people capable of goodwill, and because of this my social circle has vastly improved, a prize of inestimable value.

you seem like one of the good guys. But what is it about the estimation of your peers on hive that brings you such value? Does this humble quest to increase social reputation via authentic means apply to your 'irl' community as well, or does it work differently face-to-face?

ps. what happens when you attempt to transact with people who are NOT capable of goodwill? IS there any such person?

I am availed their criticism that corrects me when I am wrong, which absolutely informs all my interactions. Little is more valuable to me, but the affection of my peers in a healthy society that enables society to be robust and skookum enough to withstand even cataclysmic events.

The majority of people have been indoctrinated into a sort of worship of financialization, and sublimate all other considerations to the acquisition of money, which renders them incompetent of goodwill, and execrable acquaintances IME. When I mistakenly transact with them I am robbed, and learn not to make that mistake again. It is not lightly said that the love of money is the root of all evil, IMHO.

Edit: note it isn't money that is evil, or the root of evil. Money is a service that facilitates commerce, but has been twisted into a weapon by malevolent psychopaths that have fully given themselves over to financialization as their primary, if not their sole purpose in life.

Yeah, you at least made a bit of profit finally, but the internal market doesn't make it easy. I don't have many options beyond that though.

Much of commerce seems to be based on mutually agreed upon fictions :) $HIVE is definitely a unique entity - with so much of it staked for Hive Power at any given moment. Given how low proportionately low liquidity is on the various exchanges the trade volume is even more astounding.

Negative funding on perps is a rare thing in a bull market. As a short term trade what you are doing might make sense, but you are facing a few big negatives/risks.

1] this is not a problem if you check in on the position once a day

2] the price isn't going to change enough in the <60 seconds it takes to do this to matter

3] fees on MEXC are almost nonexistent and huge orders can be reduced to zero using maker limit orders. My trading fee on $2400 was 30 cents.

4] Worth repeating over and over again. Counterparty risk can not be overstated.

I didn't know about MEXC. Even though I am in Japan, Binance kicked me off since I am American, so I've been simply trading these pumps using simpleswap, which I know is not the best way, but the pumps are enough that I've still gotten profit from it. I'll have to sign up for MEXC!

Good luck! This is a game I'm definitely not playing... I feel like this is one of those things that you have to study for a while to ready for these weird and wonderful opportunities... and I'm just not interested in doing all that prework - but it's fun to read about your adventures in it.

Yeah this very well may be the case that seems to be the general consensus in the comments.

No wonder I'm poor... I read this post 3 times and still...

Ah don't worry I'll just end up outsmarting my way to the poor house 🤑

hodl

I'm certainly perplexed by the situation that is being created and how it is causing that much volume.

The activity with STEEM is confusing as well. SBD collapsed back closer to a Dollar and then did a U turn back up to over $3 and then STEEM is pumping.

Do you feel that this HIVE pump has anything to do with people getting confused thinking they are buying the Fake AI play called HIVE AI $BUZZ on Solana? It had popped up in the Phantom wallet saying it was up hundreds of thousands of percent.

The reason I say that is we have had a few of these pumps and if it was pressing the short sellers I would have thought they would have already gotten their backs blown out.

It's hard to say what's going on but it seems like a combination of market makers playing games on top of the fact that Hive is very illiquid due to powerups on top of the fact that everyone on Hive knows to sell pumps

This creates massive demand to use the futures market to create liquidity but then results in these crazy funding rates because nobody is going long

Are south korean markets responsible for current 0.6 value?

I would guess it's the binance perps listing but South Korea is a huge player always.

Damn, can't move USDT to futures market for MiCA users, whatever that means.

Interesting pattern here to be aware of. As soon as the next funding cycle begins, which seems to be every 4 hours, the price immediately dumps. And look at the amount of volume on those dumps. So, once they get paid they get out and probably then get back in lower for the next round.

More info...

MEXC Funding Rate Mechanism

👆 Yep whatever they're doing it's profitable enough to keep doing it non stop, it's interesting that the pumps this time are done every week when in the past was every month (at the end of it).

Wen do we build our own?

@vsc.network take us away!

No I totally understood

I am just not a fan of centralized exchanges

I am sure everything would be just fine with binance but still, crypto empowers us to hold our own keys and step 1 being “give you hive to binance” is a no for me

However, I love how there are SO many ways to make money in this space, and people who have some play money in hive can be taking advantage of the opportunity you laid out in your post.

Just wondering, what does the liquidation price estimate look like when you take on more leverage? 2x…10x…

84% of this insane volume uses KRW as a pair for HIVE. So yup Koreean going crazy (again). The 24h volume is more than 6 times the market cap value of all the HIVE. Considering how little is liquid, imagine how many times the same HIVE is bought and sold over and over again. I'm speechless..

I wonder if this has anything to do with their ongoing political crisis. The President of S. Korea has been impeached, and an arrest warrant issued after he declared Martial law last month, but the police sent to arrest him tried for six hours and gave up. It's been busy there politically, and maybe that's sending them from the Won to Hive?

I don't see a cause-effect connection here. These pump-and-dump episodes are not new and they have come in the past regularly from the Korean exchange...

This is true.

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Not a bad option, especially with 1x leverage. Beginners need to be told that high leverage is 99% pain. But greed usually gets the better of people. On the other hand, with 1x leverage, the risks are indeed minimal, especially during this period—let's call it "conditionally" alt-season at the starting line. Very interesting, I haven’t been paying attention to the funding rate these past few days...

When trying to transfer the Hive coin to MEX, the exchange warns me that the coins will be credited within 8 hours. Think about what this means.

I got that same message but it arrived immediately. Do a test of the minimum and check what happens.

👌

I'm very happy for you.

Thanks!

!PIZZA

$PIZZA slices delivered:

(3/10) @danzocal tipped @edicted

Another year, Mr Edicted keeps going with his market tricks. Best of luck.

Anyway, it a remarkable move by hive, let's just hope we find stability and continue climbing. Happy new year.

Yeah. None of my bags were liquid for this. Par for the course, but some will be liquid very soon. Now just have to make myself figure out MEXC via VPN.

Explained it well to me...thanks for simplifying what the funding rate is and its actual purpose

Congratulations @edicted! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 188000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

I sold during the first pump weeks ago so now I'm just sitting here looking dumb. Lol

I did the same with a good amount of my liquid HIVE 😅 now I'm trying to use what I still have left to get some profits...