Send the markets higher?

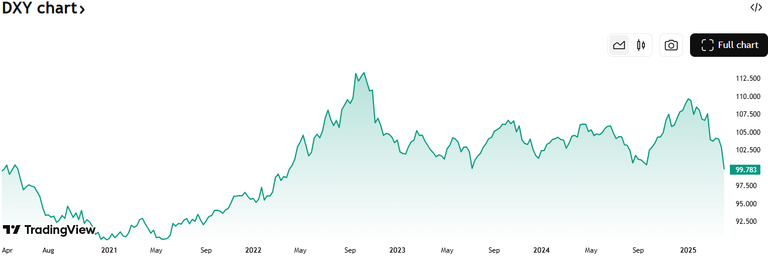

Well Trump wanted a weak dollar and he seems to be getting his wish... in one of the most toxic ways possible. I would expect nothing less from the biggest clown in Clown World. The value of the dollar is falling against other currencies... not because money printer go brrr because of our volatile foreign economic policy (aka tariff tariff tariff everyone gets a tariff). We haven't seen the relative value of a dollar this low since May 2022, and we have to expect even lower going forward.

For those who need a reminder (I know I always do), the DXY is a basket of assets:

- Euro

- Japanese Yen

- British Pound

- Canadian Dollar

- Swedish Krona

- Swiss Franc

It's an interesting list...

I'm always surprised to see Sweden and Switzerland up there. Those are very small countries with very small economies but are seemingly famous for how powerful their banking system is. In any case the USD is falling against this basket. Why? Presumably because entities all around the world are dumping our "safe" investments like Treasuries, Bonds, T-Bills, etc. This tends to flood the market with cheap debt and increase the interest rates by proxy (because they are being dumped at a small loss vs their maturation value).

This puts a huge amount of stress on the banking sector. Something is going to break. Printer will go brrr. Infinite QE will continue, and that's exactly what Trump wanted all along. So not only can he and his cronies insider trade all the chaos that's been created, but also they get to buy the bottom and long all the way up to the top. Hell, we are less than year into the term. Will be comical to watch this administration claim victory when bags get pumped when all they did was manipulate it artificially.

The world doesn't respect America.

Many Americans do not understand this simple fact. Most of us living in the "best country in the world" have very little perspective and often believe what we are told because there is little local evidence to the contrary. USA has always acted as the self-righteous World Police at the center of an empire. But rather than take over a country outright we do it very sneakily with economics and political backdoors.

There are many reasons to not be a fan of the good ol USA, and current events exacerbate all that and make us look like even more of a joke. Clearly a lot of powerful people have had enough and are looking to divest from all this nonsense. It was always going to happen sooner or later. Unclear how it will all pan out; guaranteed to be quite the clusterfuck.

Remember the last banking colapse?

It could be argued that it was specifically an attack on crypto via Operation Chokepoint 2.0, and yet Bitcoin and crypto did just fine even though all the biggest banks that served crypto got completely wrecked and restructured. I'm curious to see if another banking collapse would trigger similar results. That would mean that crypto actually does what claims to do, even though sometimes is seems like it doesn't act as a hedge very well in the moment. We need to remember that this isn't a battle being waged in the short term. This is a war of attrition that lasts decades. Price action across a few bad months is completely meaningless.

I already did analysis yesterday and pointed out we are at or very near the bottom. Current price action flirts at confirmation. We needed to trade above the 25 DMA, and one day later we are. Now we need to hold this position for about a week. We can also see we got a bounce off the top of that dotted bearish trendline. We are very close to seeing a reversal. The next step is busting out of the liquidity void above $85k. All the death crosses have already happened except 100/200, and those lines are parallel enough to have a glancing effect that trips off the next rally in early/mid May.

Of course I hope we dip one last time so I can max long BTC. $72k would be an ideal x5 long position as the liquidation point would be just under $58k. Probably make that an x4 just to be sure there's no funny business. Unfortunately I don't think that will happen and I'll have to make a move at a higher level or not at all. We are running out of time to catch the bottom before the next move. Hopefully the next top will be so high it won't even matter in retrospect where we enter here.

Conclusion

The more volatile and unpredictable legacy finance gets, the better Bitcoin looks as a risk-off hedge against any and all fuckery. Trump has done a very good job of throwing the entire world economy into a tailspin in record time. It's no COVID 2020 but perhaps that's a good thing, as this is a much more easily controllable scenario that can reverse whenever the administration decides to back down.

Other countries are starting to realize that the assets they thought were save no-brainers are no longer as rock solid as anticipated. There's going to be a capital flight into alternative forms of wealth management, and crypto will undoubtedly have a roll to fill in this future.

He in the office TRIPPING! Wild times we’re living in…

!BBH

I think it was Max Keiser the one that said. We think Bitcoin will be valuable because it's going to have high dollar valuation. But what we fail to understand is that the dollar is more likely to get eaten up by Bitcoin, implode into it.

Trump seems to be helping Keiser's point.

Gold is even pumping, as you know... I mean...

I'd like to see one more dip too, but then nothing but up until the end of the year after that. I'm still hoping to pick up some cheaper HIVE.

That seems to be more China's strategy, meanwhile America has been more openly aggressive with their "shock and awe" campaigns. Of course, it only comes to that if the CIA cannot take control in a more subtle manner.

I think crypto will change the power dynamics substantially though.