France Targets Bitcoin With New Tax In 2025

The other day I saw people on Xitter complaining about an unrealized tax being imposed on Bitcoin and crypto in Europe. At the time I didn't think much of it. Europe is pretty screwed economically so it only makes sense that they would try to employ ridiculous measures like forcing people to sell their investments every fiscal year to keep the Ponzi afloat.

However then I came across this article that specifically talks about the implementation in France (probably what was being referenced in the first place) and it was actually kind of interesting what they are trying to do and how they are going about doing it.

France Targets Bitcoin With New Tax In 2025

The French government proposes replacing the real estate wealth tax with an “unproductive wealth tax” that targets dormant assets, including cryptocurrencies, luxury goods, and other unused real estate.

Imagine how offended I was to hear that the French government is trying to classify crypto as "dormant unproductive wealth". Honestly that is just a mind-blowing level of mental gymnastics. Seriously a couple years ago crypto wasn't on a single country's radar. Now it seems that everyone and their mother is trying to wet their beak on this action. These people have no shame.

I mean sure it potentially makes sense for things like luxury goods and unused real estate that's just sitting around as someone's investment. Wouldn't it be nice if those types of assets were reallocated to something more "productive" to stimulate the economy? This is classic tax-the-rich rhetoric; which usually doesn't fly, but this day in age the poor don't have any money left and the middle class is gone. Cannibalizing the rich is all that's left. Good luck with that, Europe. You're going to need it.

The French tax laws apply a flat 30% tax on cryptocurrency gains over €305. However, in the proposed tax law for 2025, even unrealized gains on crypto are subject to tax. Under Vermeillet’s proposal, assets in custody over €800,000 shall become taxable.

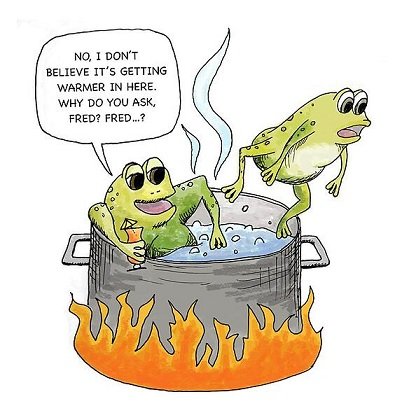

Yep, that's always how it starts!

Pick a big number, say 800k Euros, knowing full well most people are going to support this because they don't have 800k Euros: so it doesn't affect them personally. Then once the law goes through that number declines until it inevitably targets everyone. Classic frog-boils-slowly technique. We've been seeing a lot of this lately.

But here's where it gets interesting:

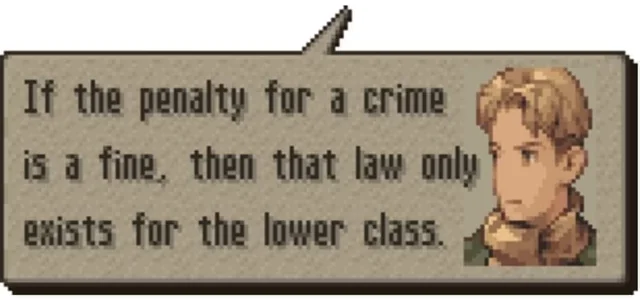

Failure to report an external account faces a €1,500 per account, but cryptocurrency-to-cryptocurrency trades are tax-free. The new tax proposal has already passed the senate’s preliminary vote, but the legislation is not yet final.

Self Custody Reporting

There's a lot of interesting analysis to be had here even from such a brief statement. The fine clearly targets the lower and middle class, as a $1500 fine doesn't seem like a very big risk to a millionaire. And yet it is the millionaires who are being targeted with the unrealized tax (aka forced realization/selling). This creates a financial incentive for the rich to ignore the reporting law, while those with less money have to obey or they'll be fined more than their net worth.

The law itself also seems to be somewhat assuming that crypto is going to keep going up. Like hey don't worry about it your wallet doesn't even apply for this tax. One cycle later all of a sudden it does. Or perhaps what the law is really assuming is that the Euro will continued to be devalued into the dirt just like every other fiat currency. These vipers will continue to tax the devaluation of their own currency as a "gain".

It also begs questions like what is an "external account"? A seed phrase can create infinite wallets. Will a court in France one day try to fine someone €1,500 a hundred times because they did 100 Bitcoin operations and every single one automatically put the change into a new wallet? I wouldn't put it past those jackals. The devil is in the details.

Wait... and also crypto-to-crypto trades are tax-free?

That's a pretty big win for traders and other degenerates.

So what happens when you tax-free trade all your crypto into Monero and then lose it in a boating accident? Guess we'll find out.

Finance Minister Laurent Saint-Martin approves the proposal, saying exempting the top digital asset from taxation while taxing other economic assets is unfair.

Oh that's so cute.

Well if we do this one unfair tax over here it would be totally unfair if we didn't apply it to even more assets. lol. These people.

Under the current proposal, there are no taxes on crypto-to-crypto trades, allowing investors and holders to diversify their holdings with tax obligations instantly. According to its proponents and supporters, the new tax law will benefit crypto trade and expand market participation.

Another thing they are clearly doing here is trying to pump their citizens for more information. By making crypto-to-crypto trades tax-free this means the reporting requirement is going to skyrocket, as degens are trading around dozens of assets from a week to week basis knowing full well they don't have to pay taxes on those trades.

Another interesting implication from all this is the 30% flat tax. This seems to imply that there are no capital gains taxes. So a 30% flat tax is better than short-term cap gains (income tax) but significantly worse than long-term (held for 1+ years). Again, the combination of these factors creates a near frictionless ecosystem for day-traders and degens, which is interesting to say the least.

Personally it's a bit ridiculous to expect people to keep track of all this stuff by hand, but from the perspective of the government I'm sure that's totally fine... as in a €1,500 fine every time they feel like enforcing their new ridiculous law. Which I'm sure will be indiscriminate and target citizens based on purely arbitrary criteria, giving enforcement all the power in the situation as is the standard.

While the new rule may seem simple, the reporting process can be daunting for some.

Crypto holders must track transactions like lending, staking, and liquidity pools.

Yeah...

The submitted amendment also requires French taxpayers to report any crypto accounts outside the country. Failure to file a report is subject to a €750 penalty. And if the account holds more than €50,000 in assets, the penalty increases to €1,500.

Again...

What is an "account outside the country"? This has to be centralized exchanges we're talking about right? Because everything on-chain exists both within the country and outside the country. I get the feeling that a lack of clarity in many of these regards will allow judiciaries to just decide whatever they want the interpretation to be. Just like with the SEC.

Taxpayers must file their tax returns annually, even if no recorded transaction is involved.

Gross.

You may not have created any tax events but make sure to report every single wallet you own every single year no matter what or we fine you. Wild.

Conclusion

Crypto is the most productive form of wealth the world has ever seen in human history. It's an insult to intelligence for France to categorize it as "unproductive" like it's uninhabited real estate. Crypto is an alive communal ecosystem that creates its own rules and regulates itself. Government doesn't seem to like that very much. They insist that their citizens are actually debt-slaves rather than free people.

Ironically crypto is the Breaker of Chains.

We must get rid of our reliance on CExes

"dormant unproductive wealth" - well that's certainly not the case with Hive!

Yeah that's a good point and the stuff you can do out here in crypto land will only get more crazy in the coming years.

Also from my understanding self custody doesn't have to be reported, I think you could argue in court that the access keys are in France and that you are interacting with the blockchain from within the country so it is internal. The reporting is for foreign bank account or finance instruments outside the country so it isn't a new thing for crypto but apply to the banking sector as well.

Good thing I don't plan on moving to France anytime soon! Hopefully the US is smart enough not to follow suit on something like this, but I kind of doubt it!

People will copy this strategy if it works... it's just guaranteed to fail is the thing.

For multiple reasons.

Imagine a crypto out there that crashes to literal zero because of low liquidity and unrealized tax implications. Now France is telling people they owe money that doesn't exist. There are so many reasons why unrealized taxes and crypto are completely incompatible. It's only going to take a little time before the layman realizes this is the stupidest idea ever... just by witnessing the results of the policy.

You have crypto friendly president now.

We will see about that...

Hopefully more and more people wake up to the fact that they need to at least be earning and building some wealth in crypto. It's one of the greatest things you can do for yourself on so many levels.

We have no tax on crypto gains until July 2025 in Romania. After that we get back to the 10% tax that we had prior to this law. No unrealized capital gain tax.

Pretty damn good I wonder if anyone will move their for the benefits.

Hope this won't pass as is, they are already talking about increasing the flat tax.

I thing it would be so unfair to users to have them report their wealth every year and just take a cut on unrealized gains, at the bare minimum it has to go both way, what will happen if you lose money during a year, will we be able to carry a loss? I really need to pay attention to 2025. It looks like Europe and France really don't want crypto to be part of the country.

It is annoying because it does create uncertainty meaning you can't plan for the future efficiently because the rules might just change next year and the year after and the trend doesn't seem to go towards more freedom for citizen which is a shame.

I like how in the US now people are optimistic with the pro business/crypto trump era potentially coming, after years of battle it must be nice to that the gouverment will work with the industry and support them instead of just passively taking their cut and finding new ways to milk people until everyone is dry.

"Every normal man must be tempted, at times, to spit upon his hands, hoist the black flag, and begin slitting throats."--H.L. Mencken

Thanks!