Speculation based on the maths.

The funding rate of the perps market doesn't lie. It can't lie because lying would result in a derivative price that didn't match the spot price. No one is going to trust a market like that. If the spot price of Bitcoin is $68k but the perps market price is $69k that's a screaming red flag and signal of systemic failure. These two markets need to remain very tightly pegged to remain viable.

Supply and Demand

The derivative market almost always trades just slightly above the spot market. In terms of Bitcoin usually within $100-$200, which is more accurately described as well under half a percent of wiggle room. Why would perps almost always be more expensive? Because the market is almost always irresponsibly long... except when it isn't. I'm here to show that the highs and the lows in the fund rate are shockingly correlated to the highs and lows of the spot market. So much so that it flabbergasts me that no one is talking about this.

Buy Low Sell High!

Everyone knows this cliché expression, but the reason why it continues to ring true is that the average market participant seems incapable of pulling it off. The funding rate at its highest and most greedy levels directly coincides with tops in the market.

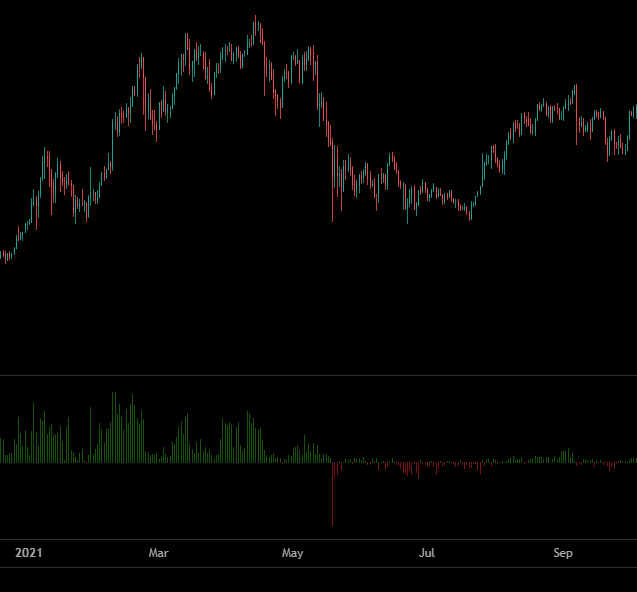

Let's take a look at the last year of trading action:

From https://coinalyze.net/bitcoin/funding-rate/

Well would you look at that.

This website is pretty amazing and I'm just now realizing the full extent of the data it provides. Looking at this all we have to do is wait for the funding rate to get above 0.05% and this signals extreme overbought danger-zone territory. Last time this happened it started on February 28th when we experienced a god-candle from $51k to $64k after a couple of days.

The fund rate at that time was a blazing 0.063%. This charge happens 3 times a day so multiply it by 1095 (365*3) to arrive at a whopping 69% APR. Meaning the longs were forced to pay the shorts 69% APR during this time and the longs took the deal anyway. Mindblowing.

Even if we as traders had pulled the trigger here on day one before the actual peak hit we'd of been taking gains at $64k on top of being paid this very high yield for our troubles. Seeing as the actual peak two weeks later was $74k this is only a 15% pump from the $64k level... meaning an x5 short wouldn't have even been liquidated. In fact there were many signals besides the funding rate that told us we should have increase the position.

Peak funding rate came in at 0.075% (82% APR) at a price point of $72k. This is where my traditional TA was confirming the top was as well. It would have been nice if I was using this metric during that time to corroborate. I sold some at $72k to pay my bills over the coming months. My only regret is not realizing that an 8-month crab market was on the table.

Wait what about that spike at EOY 2023?

We'll notice that the funding rate was also firmly telling us we were at a top right before the Blackrock ETF was approved. This time the fund rate hovered around 0.04% for a while at around the $43k level. This was also an opportunity to sell and buy lower but one would of had to act fast to capitalize on it. They also would of had to suffer a pump and hold through it so it clearly wasn't as good of an indicator... but still ultimately accurate in the end.

In addition it was also pretty obvious that ETF approval was a classic sell-the-news situation like so many others before it... so context matters. 0.04% was also what the funding rate was at the peak of the 2021 cycle. Again, that would have been a hard one to call because we all expected so much more than what we got during that time. It also hinged on multiple systemic collapses of 3AC, UST, and FTX... which could of only been predicted by someone who was really paying attention and not completely sucked into the FOMO.

Early 2021 omg...

The funding rate at the beginning of the 2021 rally was nothing short of legendary. Again notice how every single peak has an insane funding rate where everyone and their mother is longing the top like it's going out of style. The rate got as high as 0.15%... which is a STAGGARING 164% APR.

Take a minute to think about how batshit insane that is.

Imagine being so stupidly greedy that you were openly willing to pay shorts over 150% APR just to long the top of the market. How much money does one actually expect to make buying Bitcoin? In my mind the most anyone should expect is an x2 every year which is 100% APR on the average.

Therefore doesn't it only make sense that if an exchange is paying you more than 100% APR to trade against the longs... you obviously take that deal? It would be idiotic to not take that deal! And yet nobody seems to even realize that this is a thing that can be done very safely as a hedge. Degens going long are even more ignorant and probably don't even know the funding rate exists or has such insane volatility during peak FOMO. I've heard more than a few cases of people complaining about the fund rate who had no idea they'd get taxed that hard during "peak hours".

And the bottom indicators are even more accurate!

Every single time the funding rate spikes negative a bottom is being signaled. Every single time there are more shorts than longs the shorts are about to get squeezed HARD.

Just look at that insane flash crash on May 19th... holy hell talk about SELL IN MAY AND GO AWAY. From $58k to $30k in two weeks. That crash to $30k was a screaming buy signal at -0.13% funding rate... on that day the shorts were willing to pay the longs 142% APR to short the bottom and get immediately busted. In fact that entire summer was overwhelmingly negative... and would you look at that the entire summer was basically a bottom in itself. Seriously this indicator is TOO GOOD. How is no one talking about this?

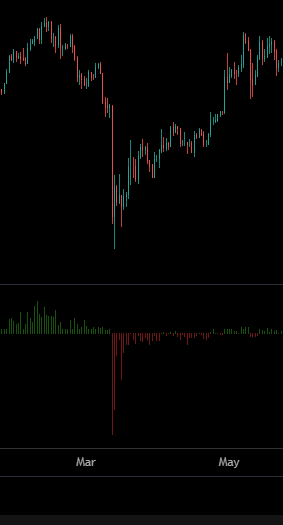

Care to take any guesses on what this move is?

Hm yep it's the FTX collapse.

Another bottom signal in which degenerates flip short like cowards.

Longing here earned a sweet yield and was literally buying the bottom at $16k.

The COVID dip was even more insane.

Within a single day the market went from longs paying shorts a small amount to shorts paying longs 317% yield. This all in the name of bringing balance to the derivative market that clearly most don't even understand but use anyway. So many players are just throwing away money by treating it like a casino instead of a responsible hedging tool. But I digress.

Conclusion

The funding rate is not perfect but it's one of the best indicators for getting inside the heads of degenerates that I've ever seen. Be fearful when everyone is greedy and greedy when everyone is fearful. Every large negative spike on the chart is a bottom. Every large positive spike isn't necessarily a top but does seem to be an excellent warning sign and a decent place to take small gains off the table.

From here on out I'm going to be following the funding rate very closely as a supplement to my current technical analysis toolkit. I'm starting to get pretty decent at this trading game and it will be satisfying if I can get some other people a few wins as well. Happy hunting.

did you just unlock the secrets of the infinite money printer?

I actually do think that paying attention to this along with moving averages and the four year cycle will give me a big enough edge to be come a consistently profitable gambler.

I use a very very basic TA... but this post will definitely have me looking at funding rate more carefully from now! Cheers! !BEER

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @pardinus for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

!PIZZA

$PIZZA slices delivered:

@danzocal(7/10) tipped @edicted