CUB price action continues to mirror Uniswap. Where did Uniswap bottom? $1.80. Where did CUB bottom? $1.80. How high did Uniswap pop up to after a few days? $3? Cub? $3. Eerie stuff.

$1.90 was such an amazing price and I called it so perfectly that I had no choice but to take a little bit of my BUSD in the LP farm and jam it into the DEN. This pump was the perfect opportunity to reenter the LP pool. Thanks to the diamond handed LEO crew. 53% of all CUB is in the Den again. Batty.

APR on every pool has spiked up due to the price increase.

And we are about to get another huge APR spike tomorrow.

Cannibalization

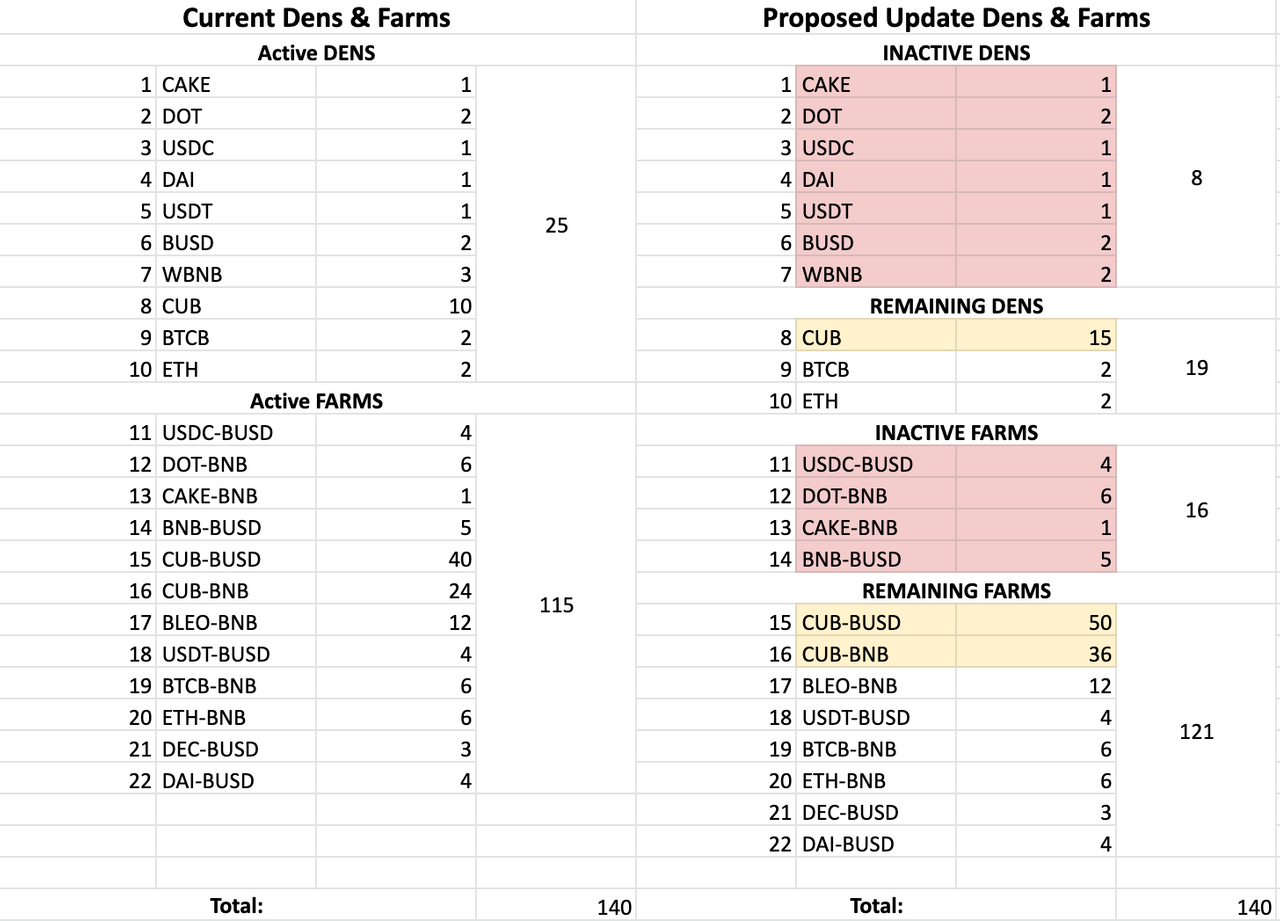

Many Dens and Farms are being disabled to add yield to the main CUB pools. The only Dens that will be left are CUB, BTC, ETH while we'll be losing the 4 farms listed above. Cutting those x24 chunks of inflation allows them to be reallocated to the CUB stakeholders.

- CUB-BUSD increasing APR by 25%

- CUB-BNB increasing APR by 50%

- CUB DEN increasing APR by 50%

IMO these are pretty awesome changes but some users are salty.

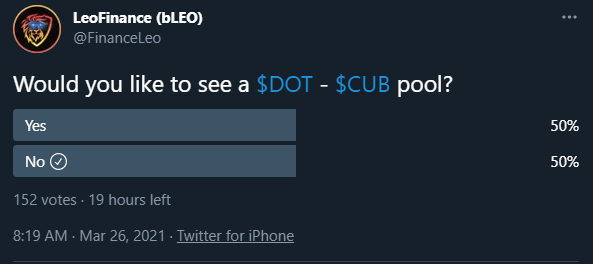

Yeah, I voted no because I don't know anything about DOT. Maybe that's a mistake, but my strategy for these farms would be to lure the strongest communities to CUB, not random up-and-comers.

I would sooner allocate CUB inflation to XRP holders before some of these other pools. Why? Because XRP is one of the craziest and zealous communities out there. Even if they are toxic as hell, their community can not be denied.

Another network I'd like to tap into is DOGE. Again, the fundamentals are shit, that's not why we are here: we're here for interconnecting strong communities.

Also the Link Marines are a prime target for CUB and perhaps Rune when that option becomes available. However, I'm getting ahead of myself.

The current cannibalization of these pools and consolidation to CUB holders are key during this time where the CUB community was getting a little nervous about recent price action. If we can trade sideways for a little while (just like UNI did) we should be able to sustainably get more bulls on board over the medium term.

What about my 4% deposit fee?

Is CUB going to steal it?

The 0% deposit fee grace period will end the following day at 4 PM CST on March 28th.

So anyone will be able to enter any pool free of charge during this transitionary grace period. Not a perfect solution but good enough nonetheless.

other developments

- wLEO Geyser - 30-60% (recently readjusted higher as liquidity migrated to Cub Finance)

- bLEO CUB Farming - 196%

- LEO POWER Curator (20-32%)

Changes to inflation need to be made to account for the new systems in place.

New Cub Kingdoms Feature

These vaults will resemble Yearn/Auto auto-compounding vault contracts.

In short, the first Cub Kingdom will allow you to pool CUB-BTCb in a separate "farm" from the "Farms" and "Dens" page.

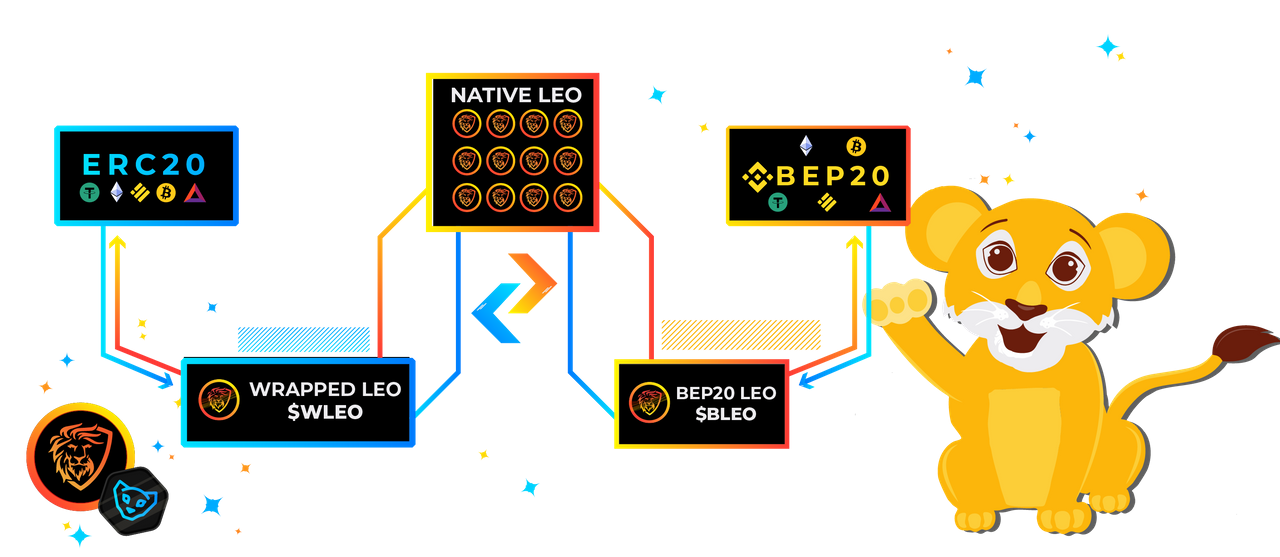

LEOBRIDGE

As a reminder, the bridge UI swaps ERC20s into BEP20s (and vice versa) by routing orders through smart contracts that are connected to LeoFinance's unique tri-token economy - LEO, bLEO and wLEO.

So obviously the bridge has a lot of hype. I don't expect it will really hit the ground running with a ton of volume, but then again we wouldn't want it to anyway. Liquidity is too thin at the moment.

It's pretty obvious what we really need on Hive is to ditch these order-books and swap them out for Automated Market Makers and DeFi yield farming. That would x100 liquidity on the network in every direction. I won't hold my breath considering Hive's utter lack of developers. Maybe we can scoop up some more over the course of the mega-bubble run.

Conclusion

The agile development of LEO and CUB continues on. This network is progressing more than x10 faster than the so-called "competition". Once we start gaining reputation on the BSC network things are really going to start heating up.

This is all possible because we are building open-source code on top of open-source code. The base layer of Hive allows for secure quick development. The pre-fabricated smart-contracts on ETH/BSC allow for these farms to be cloned with ease and modified to fit our needs. This is all happening during a mega-bubble year. Exciting stuff.

Posted Using LeoFinance Beta

In the post it says:

So I was wondering if it somehow only applies to funds withdrawn from a farm or den and new funds being added still have a deposit fee, but I don't see how that could possibly work so I'm guessing it's just that all deposits have 0 fees for that 24 hours period. If that's the case then I will definitely be taking advantage of that opportunity to deposit some more funds!

Every deposit you make during that 24 hour grace window will have zero fees. You can move your funds around...switch from farms to dens all day long without paying fees. Just a clarification.

I am expecting a big pump to TVL too because of that window....we shall see

Posted Using LeoFinance Beta

^ yep

All pools and funds can take advantage of the grace period. Just the easiest way to do this and try to make sure that people don't feel "left holding the deposit fee bag"

Posted Using LeoFinance

Agree, I think so too TVL will incrase.

Posted Using LeoFinance Beta

Yep that really surprised me. I'm doing the same as well. Really cool opportunity i guess.

add more funds. Hmmmm :)

I do maybe the same :D

Posted Using LeoFinance Beta

Yes I think the mechanics of charging some accounts deposits and not others doesn't exist yet.

"I would sooner allocate CUB inflation to XRP holders before some of these other pools. Why? Because XRP is one of the craziest and zealous communities out there. Even if they are toxic as hell, their community can not be denied."

This one I found interesting: I've been holding XRP for 3.5 years, and much of the time it was the only crypto I ever held. There are quite a lot of zealous XRP'ers out there, but in particular the communities around Coil.com and their social platforms (mg.social and gfam.live) are quite a friendly niche :).

And the SEC case... keep a close eye on that one, because it is likely that they are going to uncover some very interesting documents about BTC and ETH soon (Ripple apparently has a strong disclosure case, if I'm to believe Jeremy Hogan).

But especially, the LEO community may want to keep track of FlareNetworks (which in turn has a partnership with Gala Games btw), as they are developing and testing an Interledger-based smart contract platform that will probably give even BSC a run for its money in terms of performance and speed.

So it could perhaps become very profitable to interface to that, and all the FXRP, FLTC etc. tokens quite early...

Posted Using LeoFinance Beta

What happens if a person doesn't exit the pools, are the tokens kicked back to MM?

If users don't exit inactive pools the money just sits in those pools not earning any yield.

They can remove at any time.

Cool. Thanks.

Removing the BNB - BUSD pool is a bold move. Reducing the multiplier would have been better imo. Removing the Dens isa great move, they're just a leak in the system.

Farms generate fees. The more the inflation is concentrated on farms, the more liquidity, arbitrage, and fees. Dens are not helpful.

Are you talking about liquidity provider fees? From what i understand the fee goes back into the liquidity pool itself... at least .17% of the .2% does

When you stake LP tokens and then unstake you still have the same amount (except for the deposit fee cubdefi is charging)

At least that's how i understand it.

Yes I am talking about LP fees. And yes I know that. However, since we are the liquidity providers when they go into the pool, we are getting the money.

I forgot to talk about that stuff.

Getting rid of BNB/BUSD is fine because there are so many BNB pools.

Right but I am sure some binance users would like to provide liquidity vs usd and not vs BTC or something else.

Very interesting post and thoughts.

I am not familiar with the y-auto but I thought you bought the token and then they were investing the proceeds to generate APY.

But actually you invest a « pair » in these types of assets ? (So bBTC and CUB) in that case ?

Thank you 🙏 if you can help me out.

Posted Using LeoFinance Beta

I'll be sure to explain it in detail when the product goes live.

nice, lets hope the cubs grow up and cause some chaos!

Posted Using LeoFinance Beta

Sounds great! Regards!

Posted Using LeoFinance Beta

So many exciting changes are lined up back to back by LeoFinance Team. I am looking forward to the addition of new DeFi protocols from already existing famous platforms on ETH & BSC. Especially CUB Kingdoms where vaults/farms will auto compound your yield. So basically we do not have to do anything but sit and count our CUBs.

Posted Using LeoFinance Beta

Hard to believe #Cub Finance is not even a month old,

It is already running and causing head spinning in the community.

Your posts are like enigma for the community

to dissect and do the right thing.

!BEER

Posted Using LeoFinance Beta

Massive News!

Thanks for focusing on the positive during this volatile and stressful time of change.

Innovation isn’t easy and the Cubs are a bit salty at times, but only the passionate give a damn.

We need diamond hands and golden advice.

Posted Using LeoFinance Beta

I can't think that it will follow Uniswap perfectly, but with all the innovation going on I think we could one day pass Uniswap in terms of utility.

Posted Using LeoFinance Beta

GREAT UNISWAP V3 ANNOUNCEMENT !! REVOLUTION IS COMING !!

https://leofinance.io/@biginvestor/great-uniswap-v3-announcement-revolution-is-coming

Posted Using LeoFinance Beta

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.The other day I convinced a friend of Hive to invest more in CUB. I know it will have a bullish future, you just have to be patient.

Posted Using LeoFinance Beta

Yeah, i'd like to have Doge too but would having a coin with high inflation rate like Doge mess up the economics if it were able to earn a high interest rate as well?

Posted Using LeoFinance Beta

Congratulations @edicted! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next payout target is 39000 HP.

The unit is Hive Power equivalent because your rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Nice. I'm 90% in the CUB-BNB pool so happy with this news.

I think so too with LEO bridge supports hive, Liquidity becomes bigger and bigger.

As we all know, also free transactions, so perfect for swap. I have also the opinion, CUB should support more Hive Token.

It would increase TVL and with the bridge supports Hive, it would also add long-term value, so no leecher den/farm.

There is over 100M liquid hive out. If only 2% would support it, earn a return of investment in it. It would change a lot.

Think about it, the bridge comes in Hive dapps, people can use it, without knowing is the cub bridge. OMG Cub would moon.

I know Khal loves to add value to LEO, but with burn fees, it should add way more value to LEO as leo alone would work on the bridge.

If people want to swap 1M, fees would be too high.

With hive in the background, fees (slippage) would become much lower.

Posted Using LeoFinance Beta

Really looking forward to sinking some dollars in this once I have some spare $$ Great project!

Posted Using LeoFinance Beta

No doubt, DOGE and XRP would be the smart move.

Posted Using LeoFinance Beta

This project is growing faster, thanks for the info.

Posted Using LeoFinance Beta

I agree with not adding a DOT-CUB LP. Dot is a high inflation ghostchain and people would dump their DOTs to get some CUB and sell them for BUSD. Lets remember that anyone with 100 DOTs at $4 who entered in Kraken staking when opened in September is now with like 110 DOTs at $30 each. That is going from $400 to $3300 in six months... Dump mode.

Posted Using LeoFinance Beta

I'd think the dot APR in the CUB pool is greater than the actual dot staking chain.

Maybe wise to remove it as people would stake dot in CUB rather than their actual main chain.

Plus Binance uses Dot alot for staking.

I didn't know about these changes awesome stuff.

Where is the voting occurring?

Posted Using LeoFinance Beta