Kraken lists Hive...

Well... sort of. They listed Hive perpetuals... and they are geo-blocked so I wasn't even able to see them (nor do I have an account there). But I did get confirmation that users in other countries can see the listing.

Personally I think it's wildly inappropriate to list a futures contract on an asset that's not even listed on the spot market. This means that Kraken is importing their price feed and manipulating their funding rate based on information coming from other exchanges (probably Binance API mostly). That's a weird can of worms to unpack... just list the damn token on your exchange; it's not that hard.

A Hive spot listing on Kraken would be huge because it would be the first time since Bittrex that Hive had a direct USD ramp regulated in the USA. Something tells me the liquidity on Kraken would be a lot better than Bittrex as well, but maybe I'm just projecting bullishness here. A real listing would be nice either way, and with the new administrating rolling back all the regulation by enforcement I think there's a good chance we get a little attention.

But should we be worried?

Why are we getting all these futures listings?

And why are so many millions of dollars being funneled into them?

Who is benefiting from this situation?

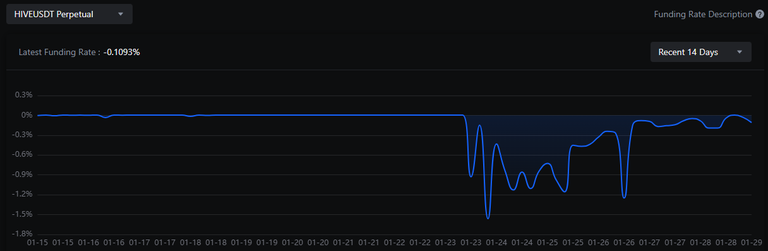

-0.12%

As of writing, Hive perps on MEXC are paying the longs 0.12%... which sounds like very little until we do the actual math on it. This tax is taken 6 times a day (bigger markets are only 3 a day) from the shorts. Assuming 365 days in a year and the ability to get this yield the entire time, the math works out to...

1.0012 ^ 2190 - 1 = 1382% APY

0.0012 * 2190 = 263% APR

Now obviously these numbers are skewed quite high because the assumption that a market maker could get these yields for a year straight is laughable. We can see from the chart above that these rates come and go. A couple weeks back it even reached the maximum -2% hardcapped level... which is 4380% and an APY that could purchase the entire world economy for a dollar. Who the hell could possibly benefit by shorting Hive that hard?

We have to think about how these markets can be manipulated.

And it's not easy because they are quite complex when they start interacting with various mechanics. For example converting HIVE into HBD is essentially going long on Hive with a 3.5 day repurchasing (repo) agreement on the short term loan. When you convert Hive >> HBD you get HBD immediately using 200% overcollateralized Hive.

If you knew that Hive price was going to spike you could convert Hive into HBD and trade that HBD back into Hive for a profit. Conversely if you knew Hive was going to dump more than 50% you could convert Hive into HBD and when the loan needed to be repaid not enough Hive would exist to pay the debt.

However, both of these scenarios are non-starters.

- If you knew Hive was going up you wouldn't underleverage 200% on-chain >> you would OVERLEVERAGE 20x on the perps market for a massive profit.

- If you knew Hive was going down you wouldn't try to juke the on-chain system by not paying back all your debt... you'd lose a ton of money doing this. Again, you'd use the perps market to 20x short the market and make a bunch of money.

- The internal spot orderbook for HIVE/HBD is thin and whales can't play these types of games with such low liquidity. Again, this is not a problem with these new perps that have millions of dollars worth of liquidity in both directions.

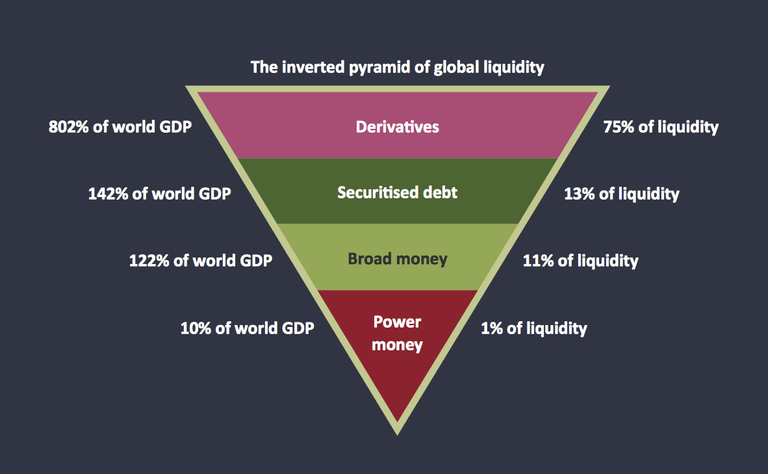

Can the derivative move the spot price?

In many cases this is true. A derivative is naturally leveraged and has more liquidity, so manipulating the derivative can move spot up or down. However with perpetuals this is more difficult than regular futures because perps do not settle in the underlying currency. Most of the time they settle in a stablecoin like USDT, so all profits gained or lost are measured and paid out in USDT, making it more difficult to manipulate the actual price of the asset when it comes to this particular type of market.

For example if a whale with access to a lot of USDT wanted to manipulate the price of Hive down, they would naturally short it for millions of dollars. However this only lowers the price of the perp market; spot is currently unaffected. Because there is a difference in price between spot and perp the platform starts paying the longs these huge APRs that we've been seeing lately. What happens next?

Permabull is the only way!

Well Hive bulls like you and me see that we can get paid free yield if we farm the perps market. Because we already willingly have exposure to Hive this can become a "risk-free" play because we already have tons of exposure to the asset already. All we have to do is sell some Hive into USDT to go long. But what happens when we sell Hive into USDT? The spot price of Hive starts going down even though we are trying to go long on Hive.

This is how shorting perps can indirectly lower the spot price on Hive. However, if Hive bulls were willing to increase their exposure to Hive and not sell Hive to go long on Hive >> then Hive spot price would not move. So it very much depends on the psychology of the market.

Normal psychology of the market is the opposite of what's happening now with Hive, which is why it's so confusing and why we should be paying attention. Normally when number goes up: the market gets extremely greedy and everyone goes long, overcrowding the trade and creating a bubble. Hive has been doing exactly the opposite of this; number goes up and shorts get extremely overcrowded. Is this because Hive has PTSD and always expects huge dumps after huge pumps? Could be. This could also be an issue of selling locked Hive that hasn't unlocked yet.

lol: Created Thursday, February 9, 2023, 6:33:00 PM

Imagine I'm a whale with 1M HBD

Soon™ amirite?

So say I've decided this is the bottom and I'm looking to move that 1M into other assets. HBD doesn't have any other market right now except for Hive, and the internal market that does exist isn't nearly big enough to accommodate the trade. I have to do a HBD >> HIVE conversion.

Now if I do an HBD >> HIVE conversion this big everyone on chain is going to see it. Some may rightfully assume I plan on dumping a bunch of that Hive for other assets like Bitcoin and whatnot. So then they frontrun me and sell before I can sell, now I've just lost money for no reason. If I was worried about being frontrun like this I could just short the perps market to lock in a price before making the conversion and announcing to the world what I'm doing. This is a 6.5 day trade. Three days to unlock the HBD and 3.5 days to convert it.

What I'm saying here is that the perps market makes it easy to sell Hive in a virtual way even if that Hive is locked in a contract. The same can be done with normal powerdowns. Lock in a price now so that the price won't be lower when the unlocks actually happen.

In essence these perps markets are in high demand on Hive because of the way the network operates. And this type of thing also proves why longer timelocks (like bonds) are a dumb idea. The timelock is irrelevant. Anyone who knows what they are doing can shimmy around the futures market to get the exact same effect as selling locked stake today.

Locking the asset on-chain does nothing; it is a net negative for the user and the network. I'm not saying we should take away the current timelocks that we have, only that doubling down on them is a losing strategy. If someone wants to sell their assets these derivative markets make it easy as pie, even if the underlying asset is locked in a contract temporarily.

Are these exchanges manipulating Hive?

No, I think Kraken listed Hive perps because it's just free money for them. For whatever reason these perps markets are getting a huge amount of liquidity compared to spot. They can list a perps market without even having to run their own Hive node and incorporate it into their security model. All Hive trading on the perps market is zero-sum PVP, so if something goes wrong and there's an exploit of some kind, the exchange itself is fully protected from any fuckery... even without any security measures in place. Thus this type of listing is very low risk and relatively high profit and low overhead cost. This is why exchanges keep listing Hive perps. It's interesting to say the least... but where is this liquidity coming from? Truly, I have no idea... especially on the short side paying thousands upon thousands to the longs. Who are these people?!? BOLO!

Final thought: Hive analysis

The Hive chart is looking damn sexy right now.

We got our classic 3 pumps up.

And now we are 2 dumps into the retracement.

33 cents is a massive support for multiple reasons

- A dump to 33 cents would be the third major move to the downside.

- The 100-day moving average is right there.

- It's acted as a resistance and support trendline in Nov and Dec.

- It's exactly double the 16.5 cent low.

If we hit this 33 level soon I'm buying in hard.

Maybe I even go x5 long if the funding rate justifies it.

Nuff said.

Conclusion

The amount of liquidity combined with the funding rates of these Hive perpetuals makes no sense to me. Perhaps I'm missing something here; I'd love to learn more. It seems like the easiest way to manipulate this market would be to push spot price to the moon because it's much easier to move than the futures price. Knowing that Hive will go up means one can 100x long the perps with the guarantee that number isn't gonna go down (with exponentially less slippage).

Maybe this is exactly what's happening, but the funding rate doesn't reflect it. Why are longs being paid an arm and a leg to make this market? Who's paying for this? Are these insane negative rates the result of the manipulation being over and such longs being closed, leaving a gaping hole on the books? Unclear, as we can't look at the books ourselves to see what's going on. It's all an opaque black-box.

Perhaps I misunderstand, but this does not make sense to me.

If Hive spikes, as it recently has, I lose money by buying HBD with inexpensive Hive and buying more expensive Hive with HBD that does not spike. When Hive was $.20 it was 5 Hive per HBD. When Hive is at $.40 it is 2.5 Hive per HBD, a loss of 50%. Had I sold my HBD for Hive at $.20 and today sold my Hive for HBD, I would double my money, a win in any portfolio.

Similarly, the following makes no sense to me.

The reverse is what I understand would be a bet on Hive rising in price. Selling some USDT to buy Hive at the low price, and then later selling the higher priced Hive for USDT that had not increased in price would result in me increasing my USDT holdings.

Since HBD is a stablecoin, I can only assume you mean Hive is at the bottom. Then buying Hive to hold it would be buying low, and rather than trading out of Hive, HODLing it until it rises as expected would then enable me to trade back in for more HBD than I spent to get the Hive.

People that hold Hive and expect the price to go down would expect to take the Long money. Seems pretty obvious to me...

Every trade you discuss here is backwards to me. Please correct my misunderstanding that buying low and selling high is how to profit, if you can. I would love to be able to buy high and sell low to profit.

Thanks!

I’m with you 💯

I was grid trading with 75x leverage before binance decreased the max leverage we can have 😡

This 💯

“ Personally I think it's wildly inappropriate to list a futures contract on an asset that's not even listed on the spot market. This means that Kraken is importing their price feed and manipulating their funding rate based on information coming from other exchanges (probably Binance API mostly). That's a weird can of worms to unpack... just list the damn token on your exchange; it's not that hard.”

Personally I don’t like these instruments at all. Just a way to manipulate.

I see people cheer for it here which makes no sense to me. Maybe I’m wrong.

Normally I would agree but the need for this market on Hive is higher than normal chains because of the way our governance structure operates. We've always had horrible liquidity and these perps are allowing anyone to get 10x more exposure than they would have been able to otherwise (for even less slip).

The biggest threat I can see is pumping the spot market on the cheap to push around millions of dollars in leveraged derivatives. This isn't a problem so much for Hive as it is all this money in the derivative market. I do view this development as a big net-positive still, but the suspect behavior is cause for slight concern and further investigation.

There has to be something weird going on that someone's making money hand over fist with what has been going on for the last month. There's nothing else to explain such a big jump in price out of no where.

I mean if you look at price action in 2021 it was a whole not crazier than what we are seeing right now.

from 13 cents to 80 in a few months.

Low liquidity on Hive is the standard.

What I don't understand is where this metric shit-ton of leverage is coming from.

On both sides long and short... we don't have this kind of money.

We poor.

very sus... They would have to own a wallet right? where is the collateral?

This smells like fish big time

Like a Hive wallet?

No, not even the Kraken exchange needs a Hive wallet to list this market.

As they are not accepting Hive deposits; everything is done in USDT.

Hive is just a unit of account pegged by a price feed (a lot like how HBD works).

How is this not the easiest thing ever to manipulate then... the feed could be off...

btw, what you describe here, the whale unlocking the HBD is exactly how it would happen.. if I saw someone doing that, I would dump as much as I could, with the idea of buying back (of course). But someone gambling in the markets could make a real good trade.

Yep and they could have dumped before you by using these futures contracts.

And they can buy back in before you do as well.

Smartest thing to do is pull an API feed from every exchange that lists Hive.

A red flag goes up if there are any huge arbitrage opportunities (or bugs).

And even if the exchange fucks up there are thousands of market participants and market makers who would see the mistake and plug the hole themselves for the arbitrage profit.

The spot feed is only needed to determine the funding rate.

Hell they could probably just COPY another exchange's funding rate and be fine in a lot of situations.

Hi, @bitcoinflood,

This post has been voted on by @darkcloaks because you are an active member of the Darkcloaks gaming community.

Get started with Darkcloaks today, and follow us on Inleo for the latest updates.

I would think if they aren't even letting people in the US participate in the futures market then they have absolutely no intention of listing it for spot trading. Unfortunately, because that would be really awesome.

I don't think this is accurate.

The geo-blocking normally exists to cut USA off from x100 leverage trading.

It has nothing to do with spot listings.

If Hive spot had good volume they would list it... but we don't yet.

We also have to consider that Trump is going to fully unlock all of these exchanges.

He's just taking time to set up his own crypto scam first.

Okay, I trust you. I don't have the money or the balls to play with that other stuff, so I don't really know.

Ironic considering nobody "has the money"

The entire point of leverage is to leverage a little into a lot.

But seeing as less than 10% of traders make money on average it's good to stay away.

Yeah, that is true. I could probably scrounge up some disposable income. For me it's more not having the balls. I don't want to risk losing everything. Plus cancer is a bummer and I am down one anyway :)

It’s true. Our volume is nothing and they can’t justify posting us.

Not 2 mention the gov pressure to stay away from truly anonymous chains/tokens. We can be anonymous if one wants 2 so they don’t like that also.

Parted my hair...

Thank you very much @edicted for providing knowledge to those new to these technologies, I saw that you may have a buy order at 0.32 and I will leave some active orders in that area in case it comes to touch in the coming weeks.

Good that Hive is expanding more in exchanges and marketing development increases, which is also important, we just need a little more incoming capital to have a new highs that we can not lose hope for long term growth.

Big greetings bro and happy wednesday !!! 😊🙏🏻😉

There is something good happening in the back when Hive is somehow pumping for a short period of time

I am not sure how many% I got from reading your post. It stretched my brain. I don't know why I am still afraid of futures, or perhaps I am just too comfortable with the spot market. Thanks!