Last night was crazy

In classic Sunday fuckery fashion, crypto got absolutely wrecked by the market manipulators and psychic time-vampires of the world; unleashing hell on the crypto market. The thing that stung the most for the majority of us is that Bitcoin only crashed like 8% with a small single-digit dip, while the rest of the alts spiraled down 20%-40%. It was a wild sight to behold, as normally the worst we get is about double the dip of BTC.

The reason Sunday gets fucked with so often is that it's a very low liquid day and traders know that when the stock market and ETF opens on Monday all that money flows back into the ecosystem. Big pumps or dumps on Sunday are always highly suspect, and trading them for a profit is usually pretty easy; just bet the opposite way.

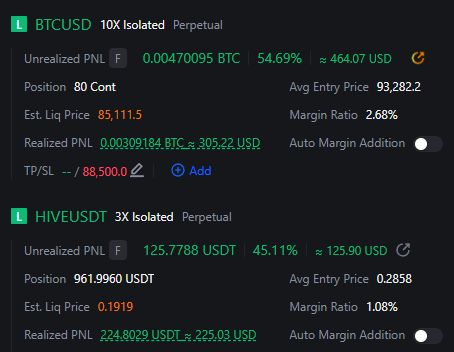

Up quite a bit after last night's kerfuffle.

Even though my bags are still a bit wrecked my trading account is doing very well in this volatile environment. I'm a little annoyed I didn't short $106k because I was feeling intense feelz at that time like: WE HAVE TO BREAK OUT OF THIS TOXIC ZONE WE JUST HAVE TO. I should have obviously countertraded this feeling and thrown in a short, but alas I did not. Maybe next time.

We can see here that I'm long both Hive and BTC, which is not particularly smart, as gambling on Hive is far less profitable than just sticking with the less volatile market I know and understand. But still last night was the first time the funding rate on Hive was -2% after a huge dip and the price of Hive was actually fair. There's a solid support range for Hive in the 30-33 cents band. Will consider buying more here especially with a 300 sat value (which was the Bitcoin price during the bottom of the last cycle four years ago).

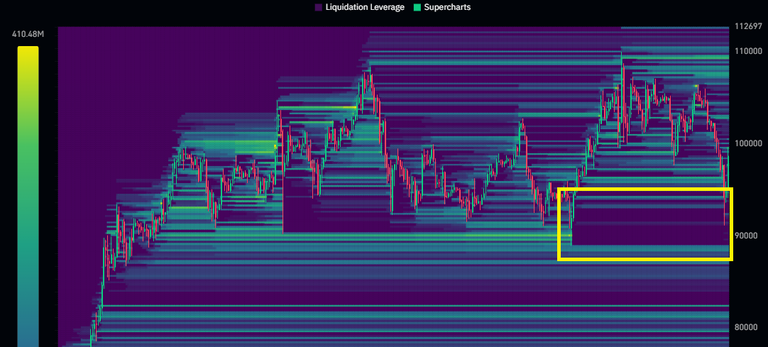

The reason why I was so confident going x10 long on BTC last night was mainly because there was near-zero leverage to liquidate within a wide range ($89k-$92k). I was able to set up extremely aggressive long positions with a stop-loss at $88500.

Another reason I had confidence was by how absolutely destroyed the alt-market was last night. Clearly money was fleeing from alts into BTC rather than alts into USD. This buffer in addition to the low leverage in addition to Sunday fuckery convinced me I could make a big move. I've since taken some gains off the table as can be seen on my orderbook but I believe this bounce is going to last at least 24 hours... and much more likely 48-72 hours. What just happened looked a lot like early August.

Early August was when we hit the local low of $50k in the crab market and reached max pain and long-squeezes for the bulls. We had 3 red days in a row... it looked like a bounce was coming... but instead of a bounce we got that one final murderous wick downward into immediate recovery.

The difference between August and now is that back then we had to wait two full months to recover and breakout from $72k resistance. We may be in that exact same situation right now... it would make sense. March and April are floundering and then we get a killer rally in summer. However I think the current market we are in is way too easy mode and bullish to need to wait that long.

The history shows that these crab markets get shorter and shorter as we approach a blow-off top. The crab market starting January 2023 (when the FTX bear market ended) lasted 10 months. The $58k crab market lasted 7 months. If this cycle is going to end in 2026 we don't have a whole not more time to be messing around. We've already been crabbing for 3 months, and this range is highly toxic.

Another huge difference between this crab and the last is that we consistently only suffer 15% dips from top to bottom. If we compare the current crab to the previous one almost all the moves are right around half as bad. It would stand to reason that this one could also be half as long. Such a scenario puts the end of this crab around February 22, which fits in perfectly with the current TA I've done thus far.

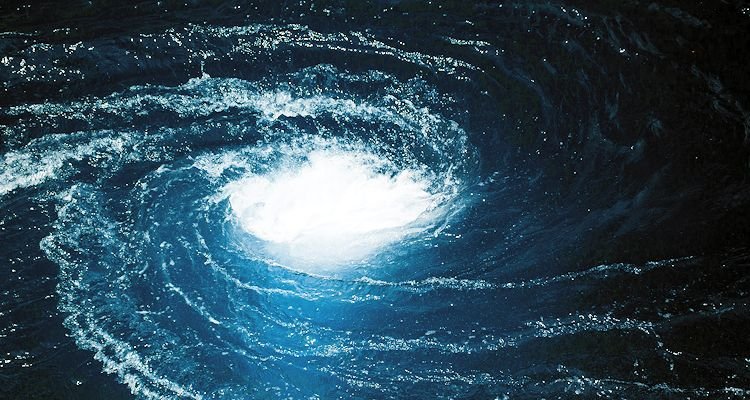

The liquidity vortex

The liquidity vortex is an idea I've been alluding to for months now. $100k is a toxic storm of fear and dumping that has resulted from the culmination of 5 years of 6-figure unit bias, memes, laser-eyes, and everything else. Further, we are in a situation where a lot of folks are calling the top here. This created the perfect storm for last night's Sunday fuckery in which it was very easy to manipulate the market downward for a profit... and then back up for another easy profit.

Moments like these only convince FUDsters even more that this is indeed the top. It very well may be the top for memes, but the exact same thing happened to DEFI 4 years ago, and everyone seems to have forgotten. The fact that Bitcoin is sucking up liquidity from all these bullshit memecoins is a good thing. Unfortunately valid networks like Hive become collateral damage within this maelstorm. However if you're a buyer like me the low price is a gift rather than a burden. I've been waiting for this level to buy in for over a month. No sense in getting cold feet now that my moment has arrived.

The narrative for this FUD:

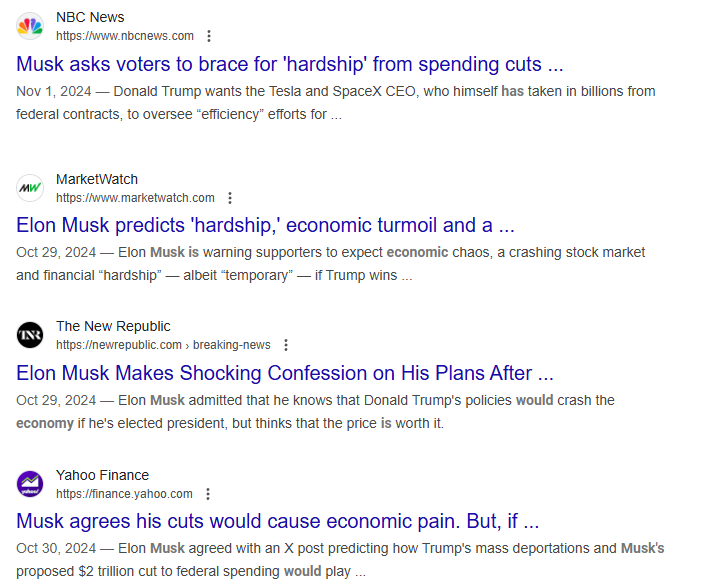

People are worried Trump is creating a global trade war with the whole tariff situation. We tariff Mexico, Canada, and China... and they tariff us back in retaliation. This adds immense friction to the engine of commerce. Add too much friction to an engine (like removing the oil) and the entire thing seizes up and breaks.

It's unclear if Trump is playing games with these threats. Already the situation seems to be getting diffused. Is he trying to force the FED to lower interest rates by creating an artificial crisis? There's a lot of speculation going on.

When someone tells you who they are: believe them.

And if we will recall Elon Musk also said that Trump's policies would lead to a period of economic downturn followed by prosperity. However, now that he's balls deep in the Whitehouse we have to ask serious questions like... are these billionaires going to do what they always do... and simply tank the economy on purpose so they can short the top and buy up all the real assets at the bottom? I don't know kinda seems like what might end up happening. There's a reason why Bezos and Zuckerberg are currently tickling the new administration's balls so fondly even though they stand for all the opposite policies.

Conclusion

Bitcoin is fine. Crypto is fine. This isn't the part of the cycle when you should be selling anything anyway. Price action for the next few months is pretty irrelevant in the grand scheme of things. Of course we'll have to circle back to this when "Sell in May and Go Away" season comes around in 3 months.

Bitcoin is not correlated to legacy finance. Something happens and people panic? It doesn't matter. The price can bounce back in a day. In fact the threat of a trade war couldn't possibly be a bad thing for an open system that can't be regulated in such a way; quite the opposite. But don't forget that Bitcoin can still "easily" crash to $72k and still be fully within the bounds of a normal bull market. I don't think it will happen but we never know what the max-pain moment will be.

I'm just going to keep holding on until what I think might be the top. I don't even know. You said hold until like September before. That seems pretty reasonable to me.

I've always maintained that November of the bull market year (2013/2017/2021/2025/2029) is the crux of the cycle. My only mention of September is that if September does something crazy (like +30%) we should be worried about that being a top signal. IMO the chance that September does something like that is extremely low... but many of the cycle chart guys are looking at September so I have to mention it.

Fair!

If BTC were a person, she'd actually be elitist. At the top yet giving no room for any challenge whatsoever. Going long on BTC is one definite plan for any crypto enthusiast

Yesterdays crash felt really somehow, for the first time in a long time I felt just tired.

Today, sentiments are changing again, but here I am sad that it’s changing too fast, I wanted more blood even though it makes me feel somehow. What type of condition is this.

Anyway I longed hive at $0.30. My liquidation is at 0.26$. I’m already up 80% lol. I will leave it for a while.

It is very good to take profit of the market in both situation "High and Low"

2026 is going to be majestic for shorting...

This is always true for actual investors.

Thanks!

The ish has hit the fan and things are getting dicey quickly.

What do you think is the floor for Hive?

#cutecurator

The floor for Hive has been 10 cents for multiple cycles.

You're not supposed to actually reach the floor if you're lucky.

I plan to DCA in on the way down and boost my stack that way, going in and out of HBD. Are you buying Hive or just holding what you earn and saving cash for lower price?

hehehe.. those market fuckers! :P indeed.. the sky is red! 😉😎👊