Ew

So the market is in an extremely awkward state right now.

- The macro economy looks extremely weak.

- Inflation is too high.

- Interest rates are also somehow too high.

- Stagflation is a threat.

- Banks are teetering on the brink

- Real estate could get rugpulled.

- Europe is totally screwed.

- Several developing nations are experiencing galloping inflation.

- The macro crypto looks extremely strong.

- 2025 four-year cycle bull market.

- Trump administration rolling back all regulations.

- All court cases are being differed.

- All types of institutions are acquiring BTC.

- Banks/gov/corp/sovereign

- Psychology of the market in disbelief/fear.

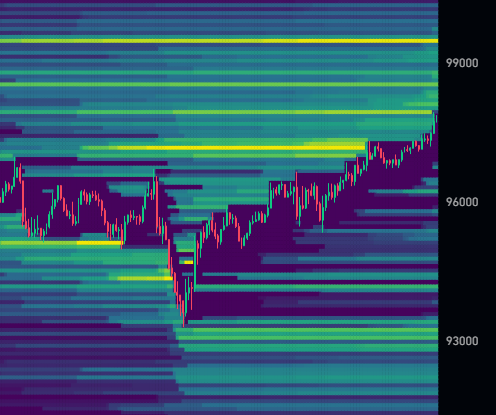

More mixed signals in the chart

Just now BTC recovered a little bit but then got slammed back down at the DMA(100). The big death cross inches closer and seems guaranteed to hit, but it could be a total deflection psychout now that both lines are starting to level off a bit.

Unfortunately we'd like to see the MA(200) up in this $97k area as well, but alas it's still trailing way back at $80k. There's also a CME gap that may need to get filled around $77k, which would suck but also be an amazing entrypoint opportunity for anyone on the sidelines looking to jump in (or in my case an x10 degen long).

Bears got punked today.

It looks like the sellers finally got caught with their pants down. There's still a ton more to squeeze right before $100k as well. Why would bears put their liquidation point right before $100k instead of right after? I don't know they must be idiots or something (not as degenerate as the bulls though obviously). In fact there are a lot of shorts to squeeze all the way up to all time highs at $110k, so going short isn't really an option until we flush all this garbage out of the system.

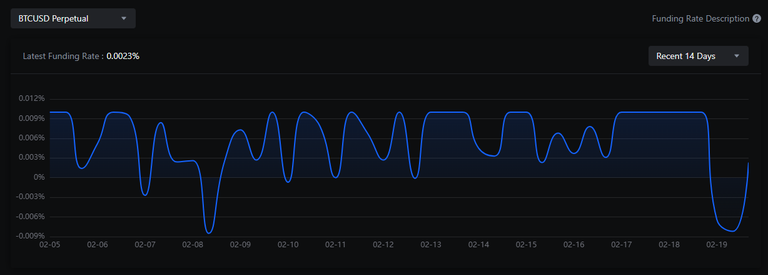

Funding rate

The perps rate also keeps consistently moving under the standard 0.01% fee per 8 hours (10.95% per year). This means that longs are getting a huge discount on going long, which is something that Bitcoin almost never does... in fact don't quote me on this but it's possible that Bitcoin has NEVER done this during a crab at all time highs. Normally this would be a time of extreme greed, but the metrics show us the exact opposite: the bulls are afraid. That's actually a good thing; the last thing we want is overconfidence.

Jesus Christ stop selling your BTC to Saylor Moon

The infinite money glitch continues. Saylor just keeps issuing convertible bonds at zero percent interest and zero risk and dumps it into Bitcoin. It's truly insane. Why is it "zero risk"? Because there is zero obligation to sell the Bitcoin back into MSTR should the stock collapse into the mountain; which it surely will inevitably.

At the point MSTR is the best most ultimate shitcoin on the entire market right now. Why is it so good? Because Saylor has found a clever legal way to trick all the maximalists into buying his shitcoin in exchange for their Bitcoin. And of course they're all very happy while number goes up. Watch how quickly that sentiment fades away in the bear. Personally I'm old enough to remember when everyone was calling for MSTR to get margin called and wiped off the face of the earth. Think it won't happen again? Oh... it will. The mob does mob things.

And the best part of all?

Michael Saylor specifically tells people to buy BTC; not his stock.

Which is just... mindblowing.

These greedy goblins get what they deserve.

On chain analysis:

Notice how the 8 month $58k crab market was a net-neutral in terms of long-term holders buying and selling. Sure, when we hit all time highs in March and April the old guard sold off a lot of coins... however they all seemed by buy back in at a light loss and then a pretty decent gain right before the Trump victory.

Now the pattern in play appears to be a reverse head-and-shoulders, which is one of the most bullish paints in crypto. Most people that wanted to sell at $100k had more than enough opportunity to do so. Now we wait.

Feb 22

I made a somewhat blind prediction that the alt-market is going to start on FEB 22... which is now only two days away. I'm often pretty good at predicting volatility but direction of the volatility is another story. Needless to say I'll be pretty worried if we are getting rejected at $100k in a couple days. There are a lot of resistance lines and a death-cross and a liquidity gap to contend with. It's not looking great, but also that's proven to be the perfect setup for a big surprise.

Paper Bitcoin?

Many are absolutely convinced at this point that the ONLY WAY Bitcoin could have avoided mooning thus far with so much adoption is that Coinbase and Blackrock are shorting Bitcoin by not allocating it to their balance sheet when plebs buy it from them. This is a fun way of claiming you're 100% sure Coinbase and Blackrock are going bankrupt this cycle... which is funny to me considering Coinbase has survived many 80% pullbacks at this point and Blackrock isn't going anywhere.

It's especially absurd when the on-chain analysis shows all the long-term holders selling at the obvious laser-eyes-meme range. Making the claim that paper Bitcoin exists to the point of systemic collapse just because we are lagging at $100k is not a serious accusation. It gives off a definitive "are we there yet" vibe. Could it be possibly this much paper BTC exists? Sure, but there's zero evidence for it, and even if true the institutions are engaged in this fraud need to eventually pony up the Bitcoin or go bankrupt just like they always do every cycle. I don't see a problem here. We're doing just fine.

15% pullback easy mode

In 2017 almost every local peak had something like a 30% pullback. In the current easy-mode environment we see 15% dips instead, and still the children ask why it's not even more easy-mode. I grow bored of these petulant accusations born of impatience. We need to stop thinking about ourselves and our bags and instead switch perspectives to the big picture.

Conclusion

There's quite a bit of fear in the market causing a fair amount of knee-jerk reactions and overcorrection in the world of crypto. Alts are still suffering which is the main point of contention making everyone worried. The Bitcoin only guys are doing just fine.

Even the bearish scenario is ultimately bullish. Either we break out to new all time highs soon or we nuke down to $77k (which coincidentally is exactly a 30% retrace). We'll be fine either way but the degens will always pray for an easier battle. Diamond hands.

The only thing that is stopping me from calling this a top, is that people are fearful, that's for sure.

It's precisely when I get phone calls from cousins who can barely do math about how to get into crypto, how to invest, because it's going to the moon when I know I gotta cash out a bit to survive winter.

Regarding Saylor, I can't say I'm a fan of the guy and it's not because I'm a maxi, far from it. I just don't see what he's doing to be beneficial to crypto, but maybe I'm wrong there. Maybe his "venture" failing would mean that decentralization won, but then again who knows.

Since you are predicting, I'll do one too.

Top will be in June...

Who knows for sure if there is paper Bitcoin being traded or if those doing it will blow up. But Coinbase & MSTR could easily provide on chain verification, that is the ethos after all. If Kraken can provide proof of reserves, so can Coinbase. That they don't says alot. Their ridiculous cbBTC is also probably part of a way to count non Bitcoin assets as Bitcoin.

Certainly going to be interesting next year who will blow up. All bets are open with many Ftx-esque candidates.

I don't think it is really possible to do a proof of reserves because it is very easy to rehypothecate the tokens. For example coinbase can prove they they own X amount of BTC, but they can't prove how much Bitcoin they owe. They can prove the assets but not the liabilities.

Say Microstrategy demands coinbase prove they have their money.

Coinbase can point to a wallet with 10000 BTC in it and claim it's MSTR BTC.

They can then go to Blackrock and tell them the same wallet is their BTC.

The only way to avoid this is to make ALL the data public which a lot of these institutions don't want.

Not even for nefarious purposes, just for security.

I think eventually the tech should get good enough that most of these institutions will be able to setup their own wallets or setup multisig with partnered institutions to make sure BTC can't be rehypothecated. I assume this is how a lot of it works already and they again just don't explain how it works exactly for security reasons.

Great points.

I've actually been so busy doing other stuff that I haven't really even been paying too much attention to the markets. Wake me up in summer I guess...

I think you'll be quite awake around $120k whenever that comes.

As long as it makes everything else move. My BTC is a long term hold for me, so all I care about is alt season or bust!

Diamond Hands have frozen over, splintered to pieces and now we only have bloody gushing stumpy wrists. With meme coin ghouls slurping at the gush. Welcome to the Revolution.

Wow have you tried poetry?

You've got talent sir.

Move over Wordsworth, The Butt has come to town.

People are getting crushed by inflation. They try to save money by eating even faker food.

Also a lot of Degens have focused on Sports Betting and are out there getting destroyed.

I'm still banking on 1 last leg up to $120K

yea.. i blame Trump! and other stuff. but really, just profit on trading the short moves Up or Down. That's my plan. 🤔😎🤙

Am guess life takes its turn, it was vizversa years ago, crypto world low and the economy improving and now its the opposite, just hoping one could survive the trauma there both bring

This was a very detailed analysis, I haven't noticed the trend on the chart