Money laundering is a trigger phrase for a lot of people. It's most commonly associated with drug dealing and mobster activity, but most people have no idea what it actually means.

I can't find the scene but at some point they are searching the Internet for how to launder money and it comes up blank... my how the Internet has changed.

Apparently the Internet has come a long way in terms of abundant information scopes across all sectors: even illegal activity. But like I said, most people have no idea what money laundering actually is, especially crypto users, because the word is purposefully used incorrectly as a matter of propaganda.

So when regulators talk about crypto you'll notice they NEVER use the term tax-evasion: ever. Never never ever. They will ALWAYS use the term money-laundering. Why is that? Because propaganda, that's why. They want crypto to seem more illegal than it actually is.

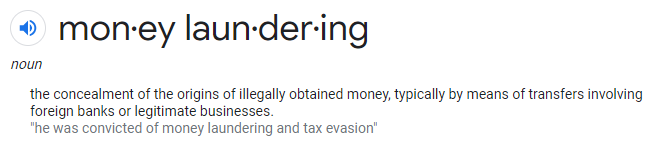

We can clearly see that the definition of money laundering is the concealment of illegally obtained money. It's quite obvious that the vast majority of crypto is obtained legally, so the term money laundering quite literally makes no sense in the context of crypto unless one is referring to the Silk Road drug trade, funds that were stolen by hackers, or dev team rugpull exit scams. By in large, most crypto is obtained 100% legally with money that was already taxed by the government. They need to start showing some more respect now that institutions are entering the fray.

It's quite offensive for regulators to use the term "money laundering" as it pertains to crypto because it implies two things:

- They don't even understand the technology they are regulating.

- They are purposefully attacking crypto with their language.

Both of these things are true at all times. Regulators legit can't contain this new disruptive abundance technology and attack it in any way they can like the squabbling children they are. Step aside kids, there's nothing you can do.

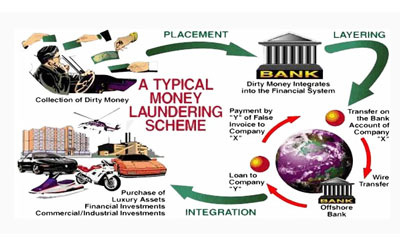

This is how money laundering actually works.

Somehow you've obtained money illegally, and you need to get your money into your bank account without raising any flags with the IRS or law-enforcement. How is this accomplished? In the exact opposite context that money laundering is used to describe crypto: paying your damn taxes.

You take the dirty money and you layer it with another form of legitimate income (a legitimate business for example). After you've concealed the source of the money then you PAY TAXES ON IT. Boom: you've successfully laundered the money and no one is going to ask questions. Enjoy the fat stacks of fiat in your bank account, friend!

Crypto tax evasion:

Meanwhile, here we are over here in crypto land, and the government wants their cut. I'll probably have to write an entirely separate post on why this is ridiculous on multiple levels.

We are over here building value on permissionless borderless networks that have nothing to do with the country we are living in. In many respects it makes no sense to pay taxes in this context, which is why the government is freaking out about crypto so badly. Because they can see what's happening and how they could become irrelevant by this technology.

The veil is being lifted.

Soon it will be revealed to the majority of the population that they are actually property: debt slaves owned by their respective governments. Over time crypto will only make this more obvious as mainstream adoption begins to takeover.

Why do I make these outrageous claims?

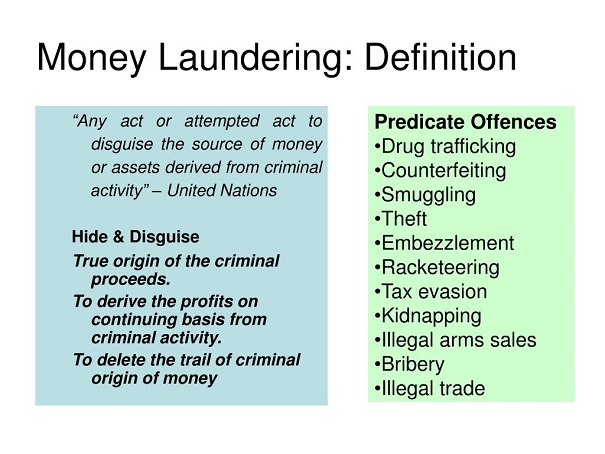

Because governments are basically just legalized organized crime.

It's when mobsters are so powerful that they own an entire country.

We've all seen the movies where the mean ol' mobsters come into the coffee shop or whatever and demand "protection money" or "something bad might happen". When the mobsters are the government, that protection money is called taxes, but don't worry:

The failing legacy economy and blatant central banking corruption is finally coming to a head. People can see that the government never needed to tax its citizens to begin with due to the rampant quantitative easing going on.

Money go brrrr

If the government can just print money on demand to pay for everything, diluting everyone's money in the process, why haven't we just been doing that the entire time? Taxes are offensive in terms of how inefficient and ridiculous they are. So many loopholes, so many needless laws we just could have avoided if we scrapped the entire thing and just printed the money out of thin air.

So why do taxes exit?

So that the super-rich can loophole out of them, of course! Taxes are complicated and ridiculous by design so that the higher one is on the pyramid the less they'll have to pay.

Even on Hive we can see this scenario play out. We created complex systems like curation what whatever else. Who benefits from those systems? The people who know how to game them: the devs and their bots who game these systems automatically. The same is true with the legacy economy. It is gamed automatically by the ones in charge using a series of loopholed swiss-cheese laws.

The purpose of taxes is for the people who aren't in charge the bear the brunt of all inflation. If we just printed money out of thin air the entire time, the mega-wealthy would have their value diluted. Can't have that! Until now!

Because the system is on the brink of collapse: everyone will lose in that scenario. That's why the FED is on the backfoot printing money like it's going out of style. The party is over for everyone (including the mega wealthy) should the legacy economy implode from its own corruption. We are on borrowed time. We can only delay the inevitable for so long.

In any case, the government is trying to charge this "protection money" just like the mob would. They then theoretically use that money to pay for infrastructure that we use. But as we all know the inefficient mechanisms of government see that money go all over the place like paying $150M for Trump to go golfing over his term as president.

As that pertains to crypto, we are building our own borderless digital governments (soon to be physical governments) so from that context it doesn't really make sense that we would then pay taxes to another country. Bitcoin is the country. Ethereum is the country. Hive is the country. The only logical reason I would pay taxes on those gains to the USA is because they are threatening me with torture and slavery if I don't (which they are).

Classic mobsters.

All this being said, I've learned a lot about crypto, the legacy economy, taxes, and the law over the last three years, and I'd like to compile what I've learned here so that it may be useful to others going forward:

Guidelines for tax-evasion:

The IRS is underfunded by design.

The IRS catches bottom feeders and blatant greedy offenders who raise serious red flags. Obviously if you withdraw a million dollars into your bank account and then don't pay taxes on it you're going to get caught. How could you not? Like: don't be an idiot.

Fear is the ultimate motivator

Many people pay their taxes because they are under threat of torture and enslavement via the prison industrial complex and the 13th Amendment of the constitution. Nothing like negative reinforcement and force to get what you want.

Others pay their taxes because they think it's the right thing to do. When it comes to "building roads", paying for social services, and other forms of required infrastructure: they take credit. "My taxes pay for that!" What they don't seem to take credit for is all the other bullshit they are paying for: the military industrial complex, the surveillance state, the prison industrial complex, Guantanamo Bay, backdoor political gladhanding, rampant imperialism, etc. Most people do not know what they are paying for or bury their heads in the sand while chanting to themselves there's nothing they can do about it. Crypto and censorship resistance are making it harder and harder to look away from the truth.

Understand reporting laws.

Regulations come from the top down. Laws cannot be enforced efficiently in a decentralized manner. Your employer is legally required to report your income to the government, which they in turn use as a tax writeoff in order to stick you with the bill. It's pretty difficult to not pay taxes when the IRS gets sent the information directly from your employer: so you have to pay it.

However, reporting laws for crypto exchanges are much much different. So far American exchanges only report to the IRS when a user incurs over $20k worth of trades. This counts for both buying and selling, so if you bought $1k worth of Bitcoin and then sold it and then rebought it and sold it... etc... if you did that 20 times you'd hit the $20k threshold and the exchange would report you to the IRS.

Fiat >> crypto only!

Therefore is very obvious that one should NEVER trade on KYC exchanges. KYC exchanges should only be used as an onramp to turn fiat into crypto. This allows you to turn $19,999 USD into Bitcoin (or better yet Litecoin for cheaper fees) and then move it to another exchange that doesn't employ KYC: like Binance or Huobi.

There are three main exchanges that I know of in America: Coinbase (only use Coinbase Pro), Bittrex, and Kraken. If you do KYC at all three you could theoretically turn $59,997 USD into crypto every year and still never get reported to the IRS. Even if you did get reported to the IRS, they'd have no proof that you actually made any money or took any gains because you moved the crypto to other places that are much harder to track.

Again, the IRS is underfunded. They aren't going to track the money farther than that for such a tiny amount in all likelihood. It is also highly likely that exchanges like Binance and Huobi would not comply to their requests. We've seen evidence of this in the form of hackers themselves being protected by Binance and wallets of known thieves being used multiple times. Binance mafia doesn't fuck around and already has a strong reputation of protecting client information no matter what (as doing so also protects themselves). I <3 Binance Mafia.

Non-KYC hotwallets are just as good as mixers.

Assuming a non-kyc exchange refuses to rat you out to your government, that makes their services even better than a Bitcoin tumbler/mixer. Bitcoin tumblers and mixers are designed to obfuscate funds, which ironically puts them under intense scrutiny by the regulators.

When you use an exchange to funnel money through a hotwallet, it becomes untraceable unless the exchange complies to a request from the outside. That makes it better than a Bitcoin mixer because there is a legitimate reason to use an exchange, while a regulator will only look at a Bitcoin tumbling service with suspicion. Again, in all likelihood an exchange like Binance is not going to comply with any such request. This is a big reason why they created Binance.US, so that they'd have an exchange in compliance with KYC while the global borderless option was left alone.

Robust redundancy

Also consider the idea of funneling money through multiple non-KYC exchanges. Say the IRS was trying to track your money that got shuffled through Binance, and Binance ended up complying with the request and gave them the information they needed: where did that money go? Now imagine the money went to Huobi.

The IRS now needs to get Huobi to comply with violating client privacy. What if you then sent the money to Ionomy? Now in order for the IRS to track the money they have to get three different non-KYC exchanges operating outside the United State to comply with American regulations.

The chances of that happening are basically zero. Consider the money successfully shuffled and privatized. As one last final "fuck you" you could turn all the money into Monero and transfer that to another wallet, fully breaking any connection to the paper trail using their incredible privacy protocol.

Seriously though... Monero privacy tech is legit crypto magic. You can send money without revealing the sender, receiver, or amount given. That's insane. It legit doesn't even make sense. Look how much effort has to go in to just trying to figure out the IP address of the sender! And even then they have protections against that. Reminder: use a VPN.

I guess that's crypto for you.

How funny would it be if the person sent the money from a coffee shop WiFi and the IP address that got hacked was largely useless to 'law' enforcement? No one gives enough credit to how amazing Monero is. Privacy is the backbone of fungibility.

Moving on

Rule #1: Don't break the law.

Obviously the best way to evade taxes is to do it legally just like the big boys. During my research I was floored at how easy it was to pay zero taxes on crypto gains.

0%? Are you joking?

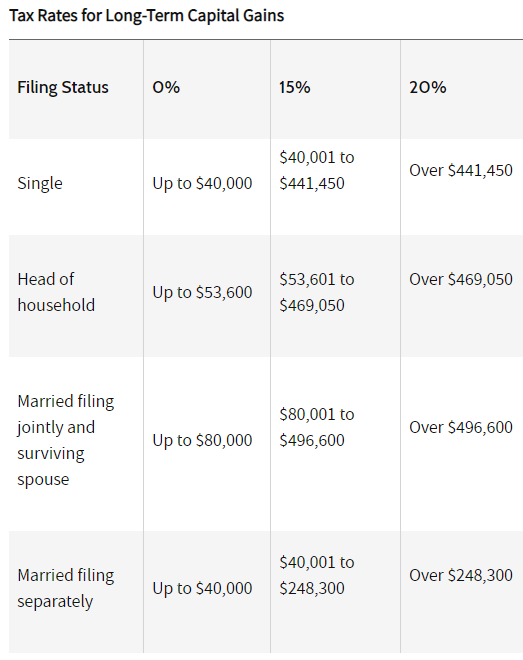

If you have less than $40k worth of income for the year, you pay ZERO PERCENT long-term capital gains tax. Who knew!?! What? How is this possible? Yep, here it is! The ultimate loophole.

Also, let's be honest with ourselves, 15% capital gains tax or even 20% aren't that big of a deal. Simply paying the taxes might be way way more convenient than risking life and limb for the five-finger discount. These are all risk vs reward scenarios. When the risks outweigh the reward, they should be avoided at all costs.

Wash-Trading

Crypto is legally considered property in the United States. This obvious misclassification creates yet another tool for us to pay less (or zero) taxes. With securities (stock market) there are laws against selling stocks, declaring the loss we took as a tax deductible, and then rebuying the security on the same day. This is called wash trading.

However, because 'property' is normally very difficult to wash trade (low liquidity and high overhead fees) these wash trading laws do not apply to crypto. So imagine investing in a token that just lost 90% of its value. That would be devastating, right? Not necessarily.

We can take that loss and turn it immediately into a tax deductible event. We can use the volatility of crypto to take losses when we incur them, write them off as a deductible loss, and then offset our gains to incur zero taxes.

Example wash-trade

So imagine we have a million dollars worth of Bitcoin we are looking to get as much as possible into our bank account without paying any taxes. Let's assume we bought said bitcoin at $10k a piece and the current value is now $100k. We bought 10 BTC at $10k for $100k. Let's assume taxes have already been paid on that $100k so we don't have to worry about that side of the equation. Let's also assume that we've held the Bitcoin for a year or more so long-term capital gains laws apply. In addition, lets assume that we have no job and this is our only source of income.

Now every time we sell one BTC we have to pay taxes on $90k worth of long-term gains. Imagine we sell one BTC to enter an extremely risky DeFi farm. Imagine the value of this stack falling 90% to $10k. We take the losses (sell everything) and then buy back in. We just incurred $90k losses. The $90k gain and the $90k loss are going to cancel out, but the important thing to note is that the money in the DeFi farm has been wash traded and taxes have been paid on it.

At this point, we can still sell $40k worth of Bitcoin for the year and pump it into our bank account, incurring 0% capital gains tax for the maximum allowed by law. However, what if after a year of farming the risky DeFi pool it moons x100? That's yet another investment asset we can declare long-term capital gains on, and we are up a ton of money at this point, and there's $40k in our bank account and we've still paid 0% taxes legally.

Honestly this is not a great example and I'm sure there are much better ones, but I need to move on as this post is already ridiculous.

If you're compelled to break the law: be smart about it.

Theoretically there are a multitude ways to evade taxes and get away with it. The easiest way would be to simply spend the crypto directly without ever attaching your identity to the money. Obviously you can't buy something crazy like a car or a house without KYC but more and more online retail stores are going to be accepting crypto. Obviously they won't be asking for social security numbers. Use a fake name if at all. Easy.

In addition, the anonymity of cash could make it extremely easy to move money around undetected. Imagine going onto a college campus and looking for students who have no income. Each one of these students could theoretically siphon up to $40k a year into their bank accounts and turn it into cash for you, taking some kind of fee for themselves. This kind of evasion would be extremely easy for hardcore libertarians who are politically motivated to stiff the IRS out of shear spite.

Say you're willing to give someone a 25% cut for this service: sure that's a lot more than capital gains tax but that wasn't the point, was it? The point was that the government gets nothing, not that you were trying to save money. Also, that kind of good-faith and networking could be even more valuable to you later down the road. Crypto crack is a powerful drug.

Cash for Crypto

Other possible targets for this kind of crypto to cash conversion are those who work in the service industry. Waitresses and anyone else who receives cash tips are perfect for converting cash to crypto on the sly. Strippers could be especially helpful, as the sheer amount of cash volume they handle is immense, and as it turns out, they are very good at paying taxes and can claim a crazy amount of deductibles (more in another post).

Upgrading to long-term capital gains.

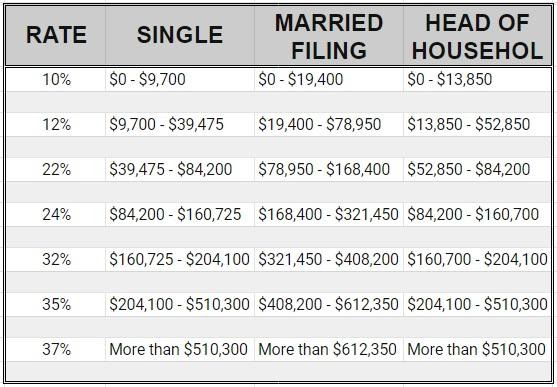

Another easy way to break the law and avoid taxes is to turn income tax into long-term capital gains tax. Say you want to get blog rewards from Hive into your bank account. That's clearly income that you've earned, and therefore you obviously owe income taxes on it, which could run as high as 37% (ouch).

Whelp, just lie and say that the money being funneled into your account is actually not income, but rather long-term capital gains. As long as you don't get audited there's no way for them to know the difference. Even if you do get audited there may be various ways of plausibly faking it.

This kind of lie could potentially be pretty risky. When you declare long-term capital gains tax, you make the claim that your money (that you already paid taxes on) was invested at a certain point 1 year or longer ago. If you can't provide documentation of where the original amount came from and the address/account in which the investment was held for a year: that could be a big problem.

Bitcoin ATMs

Luckily, it's much easier to turn fiat into crypto than it is to turn crypto into fiat. Theoretically you might be able to say you mined a Bitcoin block back in 2009 when it wasn't worth anything. Of course then you'd have to go full Craig Wright and just start making shit up and claim to have control of wallets that you don't. No one wants to be on that much thin ice.

Bitcoin ATMs are largely anonymous and accept cash. Just the fact that they exist means you could claim you used one to buy Bitcoin back in the day. Oops, I forgot what account that was... it was so long ago... zero paper trail... lol. Seriously though when crypto goes mainstream just look at how fucked the IRS is gonna be. Christ. There is zero documentation for this stuff. You can say Bitcoin isn't anonymous all you want, but it is. It's the legacy system it's connected to that's not anonymous, and that's the problem: not Bitcoin.

Separate your accounts

Like like a mobster has one black book for legitimate business and another black book for all the illegal activity, so must you have separate accounts for legal/illegal activity. Imagine the IRS asking for legit documentation of a legit transaction that you made. The only problem is that you made that legit transaction on a Binance account where tons of other shady trades went down. Now you're screwed because even though the long-term capital gains tax your claiming on your taxes is legitimate, it was funneled through an account that would expose you to dozens of other fraudulent activities. Oops.

What happens if I get caught?

Don't talk. Get a lawyer. If you think you can talk your way out of these situations after the IRS starts putting you under a microscope, you're just going to dig a hole for yourself that goes all the way to China. It's only a matter of time before you get caught lying. Shut up and get a good lawyer. You can afford it.

Citizen X

Citizen X is an individual that stole Bitcoin from Silk Road and got caught recently. Wanna know why his name was Citizen X? Because he cut the best deal ever and obviously served zero jail time in exchange for the Bitcoin.

This is going to happen again and again. Citizens who are caught evading taxes are going to have a massive amount of leverage if they have proper security. Why? Because the government CANT confiscate their money. They'd have to find the private keys first. If your private keys are secured correctly, they will not be exposed when you are taken into custody (if that even happens).

Not your keys, not your crypto.

Possession is nine tenths of the law. Even if the IRS knows you evaded taxes, you can still make a pretty strong case that you don't actually control the money they think you control. The burden of proof is on them. Lots of weird court cases will showcase this in the future.

Whatever you say can and will be used against you. If you admit that you control a certain account, the government doesn't have to find the private keys to prove you broke the law: because you just witfully admitted that you broke the law: like an idiot. Do not say anything. Trying to talk your way out of a legal bind is like trying to fight a UFC champion. You're gonna get your ass kicked all over the damn ring. Shutting up is like achieving a draw against a grandmaster in chess. Good job you just tied a grandmaster. Smart move. Tie goes to the defender.

Again, crypto gives us a lot of power. We can use that power as leverage to get out of a bind. Never before has it been possible for a millionaire to go to jail and still be able to control those funds without losing them. This kind of power hasn't even been showcased yet, and as crypto starts going mainstream be prepared to witness a lot of crazy stuff like this going down as the cryptoverse battles the prison industrial complex.

Conclusion

The government wants us to pay protection money, but they can no longer protect us. We are now our own central banks. Our money is under attack world wide 24/7 and if it gets stolen our government will offer us zero protection or security. The new economy is borderless and is in itself an entirely new government. All the legacy systems are being outdated in a big way.

As you can see I've done a lot of brainstorming about how I might break the law and for what reasons. Honestly, the reason I spell out many of these thoughts so publicly today is that I want to have all the more reason to avoid these temptations and play it safe going forward. How dumb would it be to detail illegal activity in such a public setting? I do enjoy a good thought experiment though, and I can see some serious storm-clouds on the horizon.

This is all a game of risk vs rewards. At the end of the day it's much smarter for someone like myself to simply keep paying the mobsters in order to avoid the torture chamber they have waiting for me. Still, it's fun to dream of a glorious life of crime... lol.

Disclaimer: I'm not a lawyer or an accountant and this post should be considered entertainment above anything else. I take no responsibility for giving bad advice on these matters. Besides, who is @edicted? @edicted is anyone with the posting key. Remember that.

Posted Using LeoFinance Beta

Would it be enough to buy monero from binance and send it to a hot wallet ? If you hypothetically wanted to make your asset invisible ?

Posted Using LeoFinance Beta

If you're going to buy a privacy coin like Monero it would be smarter to transfer it on-chain after Binance sent it to you. That way you get the privacy of a Binance hot-wallet in addition to the privacy of all of Monero's decentralized tech. Combining both of these features make the money almost completely untraceable (especially considering how underfunded the tax man is). You should also be using a VPN the entire time and perhaps not even be making the transaction from home (or even from a computer you own). It also wouldn't hurt to create a new Binance account that's also not connected to any of your hardware or IP addresses or email accounts.

All this being said you'd have to be moving quite a bit of money around for all these tactics to be worth it imo.

Personally the money laundering stuff with crypto is nonsense. All you have to do is look at all the big banks laundering money in the news and just one or two banks will surpass the amount of illegal money in crypto (Deutsche bank is an example).

Definitely quite a good informative post about BTC and the taxes. As long as you aren't breaking the law, I see no reason to worry. At least in the US, we only need to report the amount of income earned. You are also allowed to take losses out. The only thing I am confused about is whether or not selling out of a lost and buying back in will work as an argument. At least in the stock market, you need to wait for a period of time before buying back in for it to count.

Posted Using LeoFinance Beta

There were many parts I copied in order to highlight in a response to this post as I was reading it, but it has to be this one:

Once again, you've said it all in a couple sentences. I generally agree with your views regarding what governments really are. But then again, isn't it absolutely reasonable that it has come to this? We all know big money is what really runs a country, not some lame politicians in cheap suits. I guess this is how capitalism works.

Thanks a ton for the Bitcoin ATMs excuse! Never thought about that.

Posted Using LeoFinance Beta

and this is why monero is not the darling of the top 10

Posted Using LeoFinance Beta

At a certain point privacy is going to be the number 1 concern and Monero's gonna moon pretty hard. I imagine we need more DEXes and atomic swap tech for that to happen.

I lost all of my crypto on one of those Bitcoin poker sites.

Posted Using LeoFinance Beta

From scam or getting wrecked at poker? 😅

beat me to it!

Which one ?

In crypto, it is completely different. You can think that there is no great oversight as in the case of banks

But if you decide to launder your money through crypto, I think that it is a little difficult because in the beginning you need cash money and all of this is recorded.

However, many sites do not accept large amounts of crypto through identity investigation

Posted Using LeoFinance Beta

Its funny how crypto programmers and users have to put so much effort if they want to conceal their own identities yet for fiat all they have to do is print the paper. So much government spending wasted/lost but was spent. https://www.yahoo.com/now/pentagon-35-trillion-accounting-black-231154593.html

The real money laundering is in plain site that has been used for ages, paper currency once printed can not be traced or tracked. Crypto offers the transparency that is sorely needed and I hope most adopters of its use is willing to accept being transparent. That way government has no excuses to blame crypto is worse than fiat when it comes to money laundering. Thanks.

this was not a post, it was a class

one of the best I've read in the last few months, man you're insane, on the bright side of the word

Posted Using LeoFinance Beta

Congratulations @edicted! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

You hit it all. Pertaining taxes, that's why government are on their feet sour the cryptoworld

Hopefully it won't be long until I can just set my phone to pay out of whichever wallet I choose at the time of purchase, like I do with Apple Pay and my bank cards. There are a few things that come close to this, like BlockFi and others, but they are backed by Visa so likely require KYC, although I'm not certain.

Entertaining and insightful! Love the content @edicted

Posted Using LeoFinance Beta

If Grandpa were smart he would institute a consumption VAT and rid society of the income tax. Everyone wants freebies yet no one is willing to pay. In the end crypto will make it all irrelevant.

Posted Using LeoFinance Beta

Is it even safe to upvote this? 😄

So you could buy exactly 1 bitcoin per year. That's convenient!

I know this post is old now, but I still just absorbed so much from it. This kind of stuff is super empowering and makes me feel like less of a slave to the system. Thanks!

Posted Using LeoFinance Beta