Is this worldwide or just in the US?

I believe this is a USA law as the report goes to the American IRS.

Also, if I move some of my crypto in there and sell for USD to get the USD then in my bank account, would that make it illegal? It will obviously be over the 600$ thingy they mention.

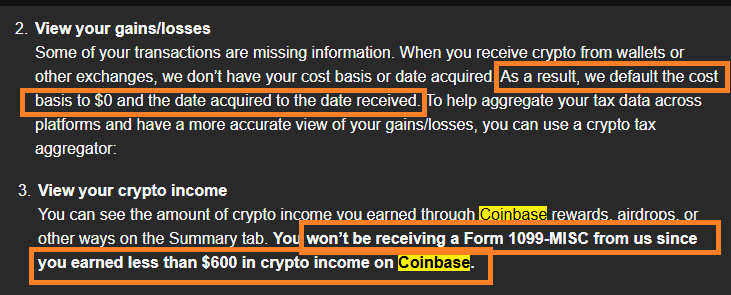

It actually won't be over $600 profit because Coinbase doesn't know how much you acquired said crypto for. As far as they are concerned you made $0 profit because they have no idea what the cost basis is.

Getting reported to the IRS just means that a tax form has been sent to them.

Nothing discussed here is illegal.

If it happens Coinbase will tell you it happened.

You should pay your taxes correctly either way, but it's better to not be reported (in theory).

In America there are many ways to avoid taxes legally.

There are two main ones I know of:

- Hold for 1+ years and make sure to stay in the 0% long term capital gains tax bracket.

- Borrow money using a secured loan (crypto as collateral) to create untaxable debt.

Greetings to Romania!

Thank you for your reply! Greetings back to you!! ❤️