But they aren't worthless, are they?

In fact, USD is the most valuable asset on the planet. It is the global unit of account; The product that every other asset is measured against. It is the most powerful and deeply liquid asset on foreign exchange (FOREX) and everywhere else. The DXY is used to measure its value against a basket of other fiat currencies. Everyone alive in the world today can rightfully say that USD has never failed them (inb4 even if the banking sector has failed). It has never experienced systemic failure within anyone you know's lifetime.

It is the most stable asset that humanity has ever created. There is no competition. USD stands alone, and is often a coveted asset in countries like Nigera where it's not even allowed to be traded at a fair price. That's how good it is: it annihilates the competition so badly that the competition has to ban it from being traded on a fair market using a haircut.

Where will we be when Ukraine is over?

Not only that: the incentives align.

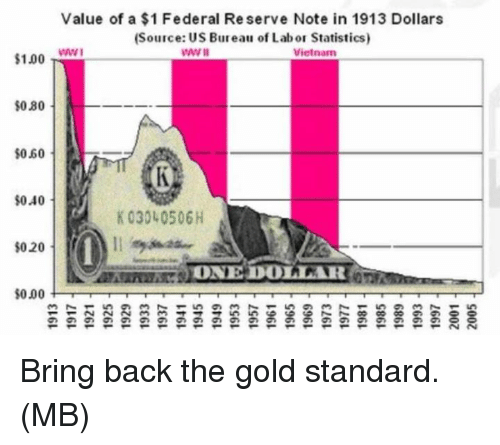

Everyone talks trash about USD and central banking because the value of fiat ever-so-slowly declines over time. Charts like the one above are shown frequently and aggressively.

If you held USD for 100 years it would have lost 95% of its value.

Uh, okay?

And if unicorn rainbows existed we could save 15% or more on car insurance! The fuck are these people babbling about? Nobody holds USD. Nobody is supposed to hold USD. The entire point of this asset is for people to spend it and create velocity and volume within the thousands of markets that exist worldwide. It was never meant to be held, and yet the examples against it always assume that people are holding it for ungodly amounts of time like complete idiots.

What if that USD was being held in a government bond that dished out 5% yield a year? Has anyone ever done the math on this? Yeah, you lose x20 the value in purchasing power but guess what? You gain x131 in terms of compounded interest per year. So even when USD is simply held over time it still makes money when managed properly within super ultra-safe "boomer" investments.

Slow siphon of value.

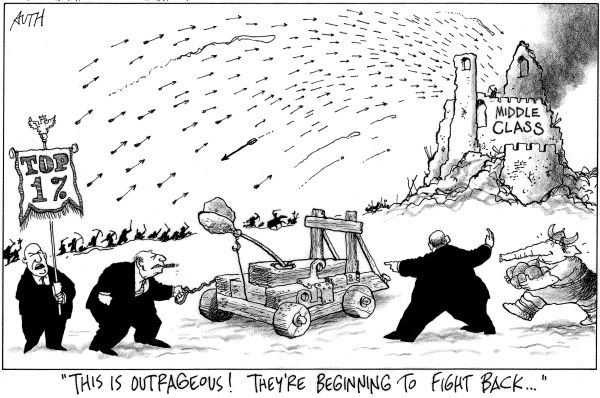

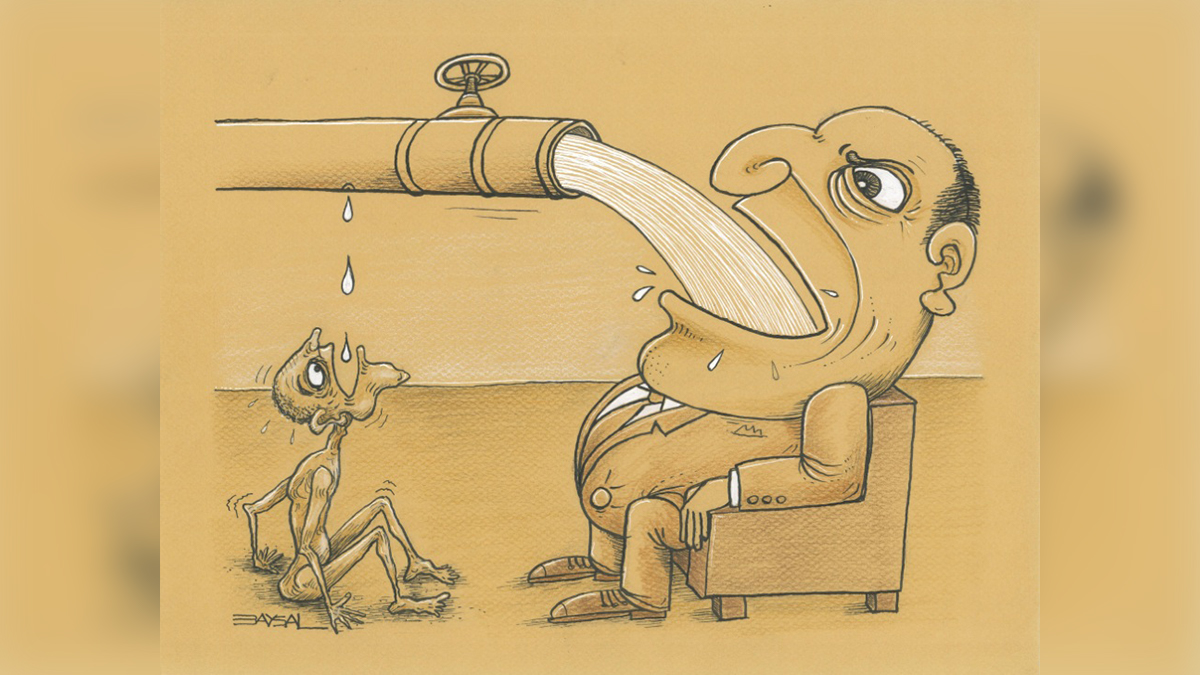

Ultimately the problem here is simply that the gap between the rich and the poor keeps getting bigger. Poor people don't have a lot of money, but they do have a little bit of money, don't they? So when a billion poor people hold a little bit of liquid USD that isn't held as an investment... well all that value just trickles upwards into the banker's pockets.

I think the hard question we have to ask ourselves is: is this unacceptable? Seriously though, is it? USD is a product. It is a privately owned product at that. How can we praise capitalism... and then expect the most important product of our entire lives to be run like a charity? Does that really make sense? Would money really be better if the government directly controlled it? With CBDC we might find out!

And so we have to come to realize that the world economy is in fact decentralized, and that we can play the blame game all we want and point the finger at these institutions and scream about how it's all their fault. But it isn't their fault, and it's never going to be. The problems with society are multi-tiered; a very sad onion indeed. It's everyone's fault, and it's no one's fault. That's why it's so easy to get away with "murder" when considering the shear economic scale of things.

This is why it's so easy to play hot potato at the top of the pyramid and act like the thing you are doing is not the problem even when it certainly is part of the problem. Anyone can correctly demonstrate that if you stopped them from doing the bad-thing the systemic problem would still remain; just like an athlete claiming they need to juice in order to compete.

"Everyone's doing it"

And so round and round we go until the music stops and some overleveraged sector of the economy blows up and needs a bailout. "Too big to fail," they exclaim! There's a pattern here: we always take the path of least resistance. We always sacrifice long-term gain in order to fix todays problem and carry on as if everything is business as usual. Zombie corporations wins.

Most All economists believe that it is impossible for a currency to have all three properties (MOE/UOA/SOV). After years of research and the recent DEFI bull run of 2021: I know better. How is it possible that I know better than a thousand 'experts' telling you otherwise? It's quite simple really: there's a forth variable in play that none of them ever talk about because that fourth variable is actually a constant for legacy economists.

The forth variable is: debt.

Indeed it is. Every economists operates within the bounds of a debt-based system operated by a centralized agent who needs to suck value out of the system for themselves. That's the entire core business model. This is simply the only way to scale a legacy currency and make it profitable for the institution doing all the work to bring the product to life.

But what if I told you about another currency that didn't have this centralized agent gobbling up value like a greedy goblin?

USD is a great medium of exchange and the best unit-of-account the world has ever known. However, the store-of-value side is lacking, is it not? Within this context it becomes painfully obvious that if currency itself was altruistic in nature and the elite and their cronies weren't sucking up every last drop for themselves... then it would OBVIOUSLY be a store-of-value and tick all three boxes.

Meanwhile if you tried to tell a Keynesian economist this fact they'd look at you like you were a fucking moron. The idea is so out of the realm of possibility for them it doesn't even compute within their own scope of reality. That's how valuable crypto is: it doesn't even make logical sense to most people. They just assume it's too good to be true so therefore it isn't true. This strategy is not going to age well, that's for damn sure.

Bitcoin will never be a unit of account.

It really is as simple as that. Maximalists are delusional and think that BTC will become stable as the market cap ascends into the $100T range, but the entire concept is founded on delusion. Bitcoin can never be stable because Bitcoin has zero elasticity. In fact Bitcoin has negative elasticity due to the halving event every 4 years that continually chokes the supply and creates deflation where there should be inflation.

Luckily decentralization ensures that other networks will pick of the slack and Bitcoin's niche can continue to be security/collateral rather than an actual currency. BTC is an important piece of the puzzle. The backbone; The anchor. But to assume that a person is just a backbone or that a ship is just an anchor is beyond foolish.

But it will be the collateral in which unit-of-account can be derived.

I'm not sure when this clicked for me but when it did it was quite the "Eureka" moment. Fractional reserve systems will be able to collateralize debt using Bitcoin in ways never before thought possible. Everyone seems to think that "disruption" means the "annihilation" of fiat. Contrary to this popular belief nothing could be farther from the truth. As a neutral platform Bitcoin can only empower the banking sector. El Salvador will be an excellent case-study.

"Disruption" in this context just means that central banks will be using Bitcoin as collateral for their main business within a few decades, and that's fine. In fact, that's much better than the alternative which involves an Apocalyptic event that wipes the entire legacy system off the map. Again, the path of least resistance will always be taken. Go with the flow.

The value of a dollar is unknown.

Another thing worth mentioning before I wrap this up is that it is not possible to measure the value of a dollar. I find it so comical that people were freaking out over BUSD "breaking the peg to the downside". Really? I looked at it and the peg had broken like 0.1%. Do people not realize that USD itself is more volatile than this? They have no idea because again, as the unit-of-account, they have no idea how volatile USD is because they measure everything in USD.

1 USD == 1 USD is WAY more accurate than 1 BTC == 1 BTC

When the price of BTC goes up or down, it is quite obvious. We can see the new spot price reflected across all the markets. No one measures anything in the value of BTC because BTC is too volatile (and it always will be).

When the value of USD goes up or down, we have no idea how or why this happened. As @taskmaster4450 and I have been trying to point out: the money supply absolutely is not expanding right now. In fact it is deflation that is tanking these markets. Liquidity is being sucked out of these markets with higher interest rates. That is the definition of deflation.

The value of USD could drop because of an expansion of the money supply (real inflation), or it could drop because demand for products and services is going up (demand-pull inflation), or it could drop because of supply chain disruption (cost-push inflation). What has been happening since 2020 is so obviously cost-push inflation, but everyone wants to blame the federal reserve and tell them to fix it. They can't, but that won't stop them from playing the politics game and shining everyone on like they have power over this situation.

The inflation target for USD is 2%

Getting back to the whole BUSD comparison, imagine thinking a peg break of 0.1% is a big deal when USD is designed to lose 0.005% of its purchasing power every single day. After 30 days USD loses 0.16% value by design, and that assumes that the system is working perfectly... lol. It's not... if you haven't noticed. Most people don't think of it this way. "Price of eggs went up now I'm pissed," is how they frame their thought patterns. It's not a good way to understand what is actually going on here, that's for sure.

Conclusion

USD is the most important asset on the planet, and BTC isn't going to magically dethrone it. BTC will empower USD by giving our debt based economy exactly what it needs: pristine collateral that skyrockets in value every year on average (+100%).

The only way to dethrone fiat is to make a cryptocurrency that is superior in every way to fiat. It must be a UOA, MOE, and SOV all at once. Many think this is impossible, but I have very clearly explained why they are obviously wrong. When the unsustainable debt variable is taken away from currency everything changes.

In addition, the borderless and interconnected nature of crypto means that medium-of-exchange is the new constant for all currencies from here on out. MOE has become a non-issue. SOV is a non-issue as well when no centralized agent exists to siphon value into their own pocket. Unit-of-account and stability is the only problem we need to solve going forward. Solving it will have no effect on SOV or MOE. This is something economists can not understand given their previous knowledge of legacy debt-based systems.

Stability and reliability are key in building any economy of scale. Until crypto can prove that it can provide said stability without piggybacking on top of USD: crypto will always simply be collateral and USD will remain the dominant currency. I believe we will accomplish this feat, but the pushback from the legacy economy could result in actual warfare. Whether that war is worth fighting for (on either side) is yet to be seen. Hopefully peace will be the path of least resistance for all parties concerned. Somehow I doubt it, but maybe I'm just jaded.

Very good points. Half the world is now moving to another parallel alternative system led by China, that’s going to decrease the demand for USD. Didn’t Iran announce now oil will be settled in RMB?

I talked about the whole notion of devaluation” couple months back, and this piece is my opinion.

https://ecency.com/hive-167922/@slhp/fiat-currency-like-us-dollar-has-lost-97percent-of-its-value-since-1913-does-it-really-matter-why-should-we-not-care

Yes, as well as Saudi Arabia and Iraq.

So much valid points in one single posts.. Respect to you..!!!!!

Let me add to it that I personally love to give alot of attention to the USD because of the negative correlation that it often have with the crypto market e.g A weaker USD leading to a bullish crypto market and a stronger USD leading to a bearish crypto market..

We've got a crypto slack channel at work and a Bitcoin Maxi found it and is just continuously pounding everyone with constant BTC talking points and emotionally reacting to any pushback. BTC Maxis are honestly the worst. So delusional.

As you mentioned though, their incentives are to encourage everyone else to purchase BTC so their investments go up.

It's just really disappointing because their greedy attitude is a red-flag for exactly why Bitcoin was invented in the first place. People get into power and become immediate greed-monsters no matter who they are.

What do you think of that?...

I'm thinking who gives a fuck about Iraq along with 99% of everyone else.

I'm thinking watch what happens when people start using Yuan and then China prints a bunch out of thin air and everyone realizes what a dumb fucking idea that was.

China's estimated gold reserves are 3,306,030.80 tons while US estimated gold reserves are 707,010.31 tons. Makes one wonder who is printing money out of thin air and whose money is the most sound. Your premises seem based in old school American exceptionalism to me.

You're operating under assumption that both China and USA would use their gold reserves to prop up the currency. Yeah they wouldn't though. Paper money hasn't been backed by gold in a long long time. It is extremely reductive to boil down a country's worth to how much gold they have.

Aug 9, 1971 is certainly within my living memory.

Agreed, however it plays a large role in BRICS' evolving goal of creating the new global reserve currency. If "...intra-BRICS commodity trade were to be settled in a commodity-linked basket of currencies among members as well as willing non-members, it would constitute an effective end to the petrodollar..."

Yeah except it wasn't backed in 1971.

Didn't Nixon only prevent foreign redemption?

The real peg was broken back in the WW2 era.

Silver quarters stopped being minted in 1964.

People say Petrodollar like the value of USD hinges on a single commodity.

It doesn't.

In fact I realize that I don't even know what this conversation is about.

USD stops being the world reserve currency.

So what? Why do I care? Doesn't seem like a 'me' problem.

It will not hinge on a single commodity, but likely a basket of commodities going forward.

The main take away is that without demand being driven by being a global currency then that 30+ trillion dollar debt should be unsubstanable.

Good point. I'd rather prefer people start using all sorts of currencies and settle trades not just in yuan or the dollar and maybe... maybe one day we will see them adopting bitcoin... maybe one day...

They will all adopt Bitcoin, just not as currency.

It makes a ton of sense for every government, bank, and corporation to embrace Bitcoin for quite a few reasons. One of the best reasons is that it provides them with financial privacy while still being able to track everyone else who has doxed accounts.

In a world where every institution can create their own token, what will the institutions trade with each other? The answer is something that no one entity controls... which is Bitcoin. This in combination with the fact that BTC is the most secure network means it will eventually be coopted by entities which need security the most... which again points to the most powerful institutions in the world as the target audience after mainstream adoption.

So, HBD (and Hive) are still "piggybacking on top of USD"? Even though HBD is not pegged to USD, it is derived from 1 USD worth of Hive (1 HBD = 1 USD of Hive). The Hive system is still based on USD as a unit of account. Correct?

Posted Using LeoFinance Beta

That is 100% correct.

In fact the way that HBD works is actually guaranteed to make Hive even more volatile and unstable than it would be otherwise. We will experience bigger pumps and bigger dumps because all the volatility of HBD is outsourced to Hive though conversions. So in a way Hive becomes twice as volatile. Hive will pump twice as it gets burned to create more HBD during the bull, while dumping twice from HBD converted to Hive during the bear.

I do not think this is necessarily the worst outcome.

There are a lot of perks that are gained by doing it this way. First of all it's a great shortcut that allows us to focus on other important things while still having access to a stable asset with atomic swaps. It also allows us to siphon value from HBD debt holders into Hive just like central banks siphon value into their own pockets. This value drain can easily be displaced with savings account yields (clearly 20% yield is higher than inflation).

It's also very easy to create organic demand for our debt when our debt is pegged to USD and USD is the most stable asset possible. In the event that some miracle crypto becomes superior to USD we can switch the HBD peg to that new asset quite easily. There's a lot to unpack regarding this topic.

The supply chain disruptions resulting from lockdowns and the cascading effects of that ever since are certainly a factor, and I agree with you and @taskmaster4450 that this has certainly caused an increase in prices. Fewer goods and services with no change in demand or money supply will certainly still increase prices. This is not the only variable to consider though. The massive price increases that we've seen have also coincided with the growth of M2 from 15 trillion to 21 trillion since Feb 2020. There has been a recent decline in M2 since March 2022 to the tune of about 500 billion, but it's relatively small compared to the 6 trillion increase over the previous 2 year period. We still have roughly 40% more dollars in M2 than we did before the pandemic. How is it even possible that this doesn't also put upward pressure on prices? It's simple supply and demand. All else equal, increased supply of dollars will reduce the price of those dollars as measured against other units of account, which will have an inverse effect on prices as measured in those dollars.

The rewards earned on this comment will go directly to the people( @alummno ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

There is a lot to unpack in this post but one thing everyone can agree with first of all is that 1 USD is more Equal to 1 USD than 1BTC is equal to 1BTC... across time and transactions.

Reading your post was like going against programming and I have been thought to accept as true. I read a book that said a time is coming when a wheelbarrow full of dollars will be stolen for the wheelbarrow and not the notes in the future.

I went against taskmaster once saying that gold would be a better store of value than the dollar...it didn't end well with me. I need to read more on the topic.

I am reading for my medical board exams... I hope to be earning in dollars as a doctor sometime next year...wish me luck

I have always been of the opinion that even though the dollar falls... other fiat currencies will ultimately collapse into the dollar. Essentially, everything else falls faster, harder. In other words, the purchasing power of the dollar remains king, despite devaluation.

The rewards earned on this comment will go directly to the people ( @andyblack ) sharing the post on LeoThreads.https://leofinance.io/threads/@andyblack/re-leothreads-5h7uwz

Love your perspective. This is pretty bad in the world economy I guess