Let's see what is this Bitcoin On-chain indicator, the realized price, and what is the meaning of the current BTC price moving above this value again.

Source: pexels.com.

Let's start by defining what the realized price of Bitcoin is.

The realized price is an on-chain indicator that is calculated by dividing the sum of the value of the coins they had at the time of their last movement by the amount of coins in circulation, it is a way to measure the price that coins that are actively moving have, and that makes it different from the real price, since this metric points out the price of active coins excluding those coins that are losses or that have not moved from a wallet in years.

Thus, if the last movement of a Bitcoin was in 2018 when its value was $4000, the metric takes this value into account instead of the current price when performing the calculation of the realized capitalization, so in a way it could represent a weighted average of all Bitcoin that have been acquired.

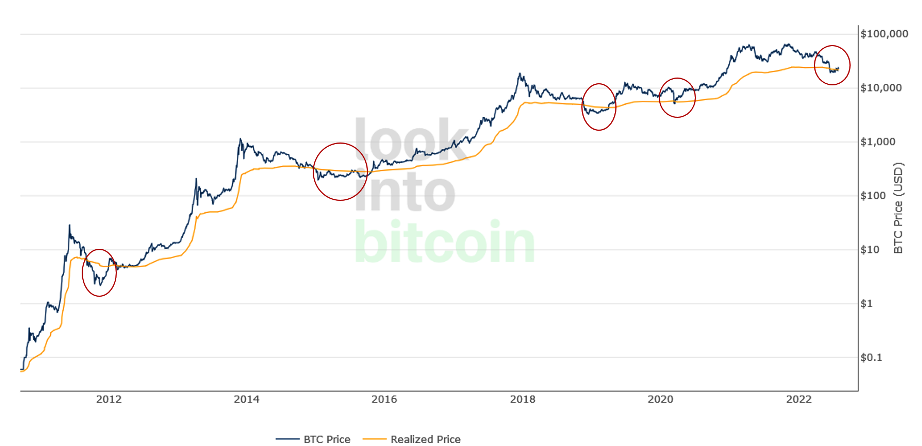

This metric is very much taken into account as every Bitcoin price movement below the line of this indicator has provided solid support in major bearish cycles. For example, in the following chart we can observe that the Bitcoin price in its entire history has only fallen below the line of this indicator five times, these being between September and December 2011, between January and October 2015, between November 2018 and March 2019, in March 2020 and the most recent has been in July this year. And as we can observe all those periods have represented a bottom in the market, and a subsequent recovery.

Screen shot taken from lookintobitcoin.com.

In the image we can also observe that in the last movements that the price has had below the indicator line, in each new bear market the price spends less time below the realized price value. Perhaps because more and more people are aware of this metric and seem to respond strongly to price movements below the realized price, using this moment to accumulate more BTC in their wallets.

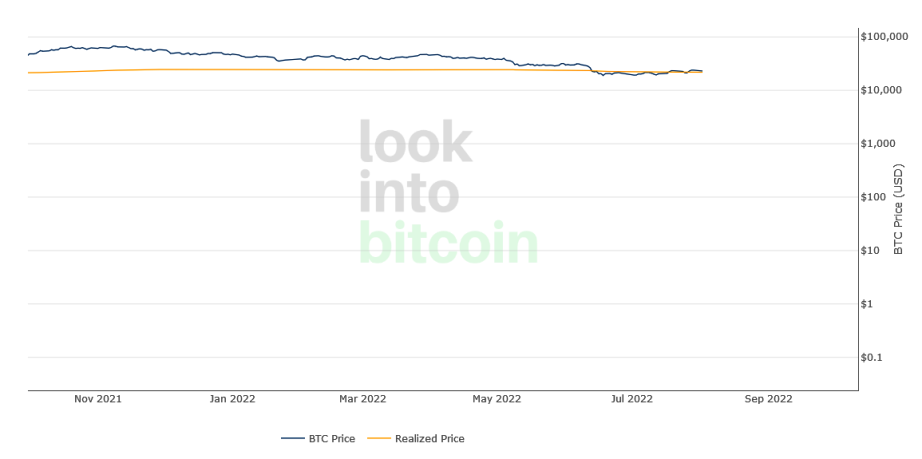

Currently the Bitcoin price is $23318, while the realized price is $21947, so the current price has again moved above the realized price, and if history repeats itself as in the previous cases, after the price recovers and crosses above the indicate we see that it starts a growth phase and does not fall below this value again for a long time.

Screen shot taken from lookintobitcoin.com.

Which would be good news as it would indicate that the Bitcoin price has already bottomed which could trigger strong buying activity driven by traders preparing for a bull market by buying at the dip.

That means that this metric is very useful in bear markets as it gives us signals of the best time to buy, or it can also give us an idea of the potential losses that an investment would generate, if we consider the realized price to be the potential lowest price at which the purchased coins could fall.

Thanks for coming by to read friends, I hope you liked the information. See you next time.

Posted Using LeoFinance Beta