Many people have been waiting attentively for the Ethereum merger, which was launched on the morning of September 15, and with which, the second most important cryptocurrency has made profound technological changes. With "The Merge", as this network update that merged Ethereum's mainnet with Beacon Chain is known, Ethereum's blockchain goes from using the Proof-of-Work (PoW) consensus mechanism to using the Proof-of-Stake (PoS) protocol, seeking to make Ethereum more environmentally friendly by reducing its electricity requirements. And an On-Chain analysis hours after marking this important milestone reflects a very high rate of ETH inflows to the exchanges.

Image edited in Powerpoint, the Ethereum logo was taken from Wikimedia.org and the background is from pxhere.com

In the simplest sense, this measure eliminates the traditional form of mining, and with it, in addition to seeking the environmental sustainability of the cryptocurrency, it also seeks to establish the basis for future optimizations, and as Ethereum has been a fundamental platform for the growth and expansion of NFT, DApps and DeFi projects, it was very likely that its implementation would have a considerable effect on the cryptographic ecosystem.

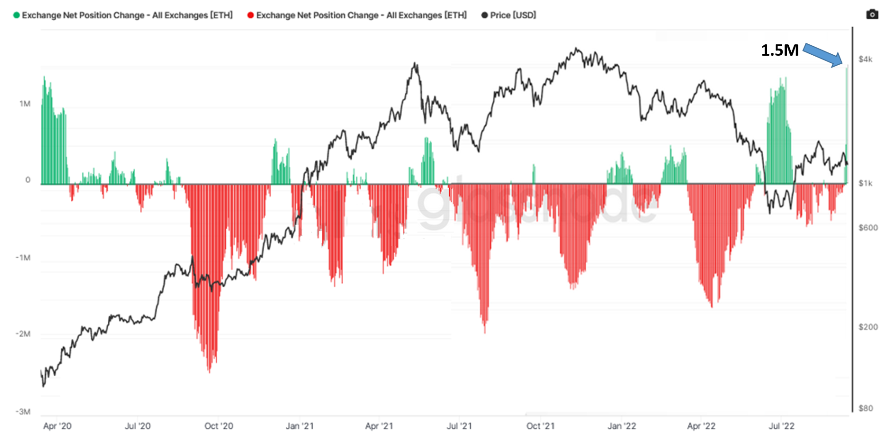

And according to data from the Glassnode portal, when the Ethereum merger went into effect, a large amount of Eth flowed into the wallets of the exchanges, we are talking about almost 1.5 million ETH being transferred to the exchanges in the first 24 hours, with no inflows of almost 1.5 million ETH recorded since February 2019.

Screenshot taken from Glassnode.com.

On the other hand, this induced the increase of ETH balance in the exchanges, although they had already stopped their long fall in May of this year, we can observe how they have just had a good boost, registering more than 22 million ETH, a level they had not had since March.

Screenshot taken from Glassnode.com.

One might think that this increase of ETH on the exchanges is a sign that investors were buying with the intention of selling after The Merge, hoping that the merger would revive prices, however prices have been falling for the last four days, rather influenced by the macroeconomic environment, as after the US inflation announcement many investors may have decided to sell their risky assets.

Screenshot taken from Tradingview.com.

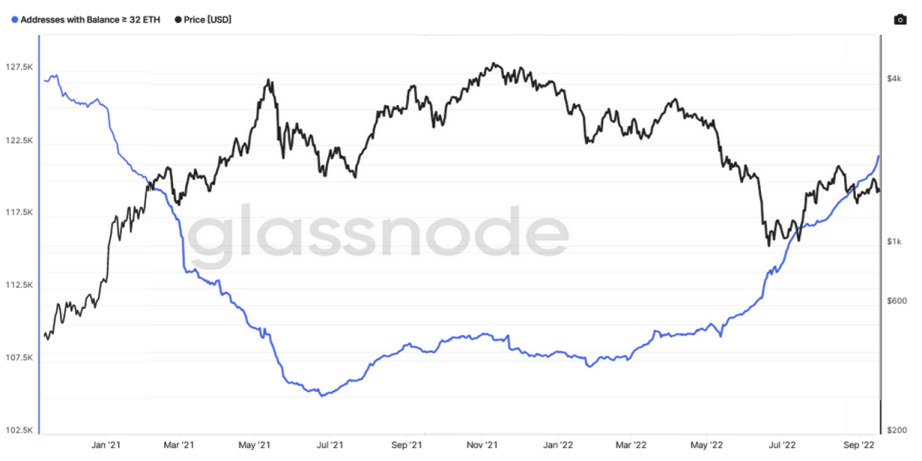

On the other hand, the number of addresses with 32 ETH, a number that corresponds to the threshold from which independent staking can be done with ETH 2.0 , has been increasing since a few days ago, which seems to suggest that there has been a genuine interest in becoming an independent validator with the new protocol.

Screenshot taken from Glassnode.com.

As we have seen in the metrics above, there has been interesting ETH growth after the successful completion of The Merge, with a significant amount of ETH flowing into the exchanges, and although currently the price of ETH has not reacted as expected by investors who accumulated tokens hoping to take short profits, an increase in addresses with 32 ETH suggests that many investors are staking to become validators.

Well friends, let's hope this merger will allow Ethereum to shed the criticism around the environmental impact of mining and achieve the goal of making the network more scalable. Thanks for reading, see you next time

Posted Using LeoFinance Beta

LOL. This was also what comes to my mind when I read your title. 😁 It must be one of the main contributor why ETH continues to bleed.

!1UP

Undoubtedly, investors who act in this way influence the bleeding of prices.

You have received a 1UP from @thecuriousfool!

@leo-curator, @vyb-curator, @pob-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

Thanks!

PIZZA Holders sent $PIZZA tips in this post's comments:

@curation-cartel(9/20) tipped @emiliomoron (x1)

Join us in Discord!