Although still the crypto environment remains bearish as a result of the conditions and macroeconomic context experienced by global markets, some experts begin to see the light at the end of the tunnel and suggest that the Bitcoin could be close to bottoming, let's look at two metrics that support this idea.

Image edited in Powerpoint, original from pixabay.com.

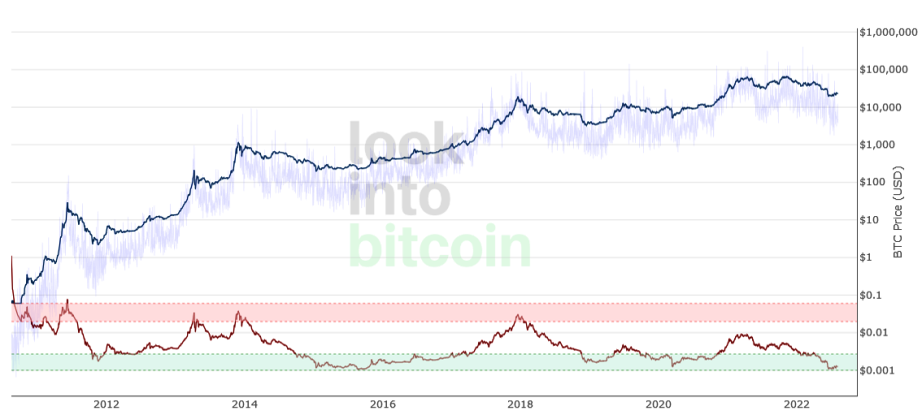

Reserve Risk

Reserve Risk is an on-chain Bitcoin indicator that allows us to visualize the long-term confidence of holders in relation to the current price of the currency.

Reserve Risk is defined as BTC price / HODL Bank, and is very easy to interpret, it is based on the principle that, when confidence is high and the price is low there is an attractive risk/reward ratio for investors, then the indicator gives low values and is located in the green zone. But when confidence is high and the price is high, the risk/reward ratio is not attractive to investors, then the indicator gives high values and is located in the red zone. And history has shown that investing in BTC when the Reserve Risk has been in the green zone has given the best returns.

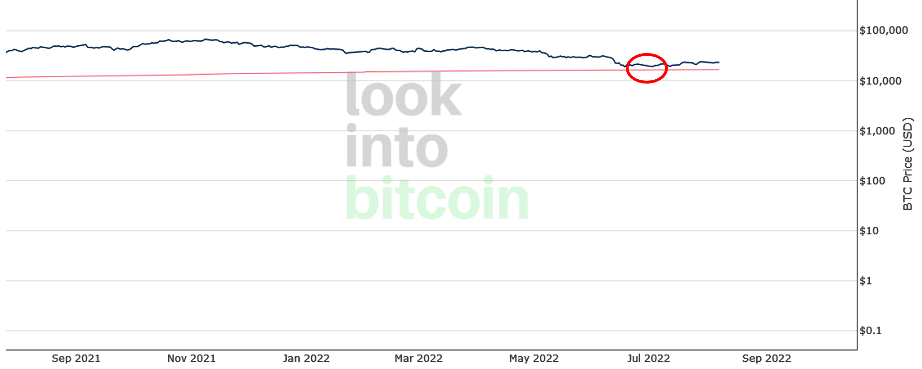

Screenshot taken from lookintobitcoin.com.

In the image above we can see that at the beginning of July the Reserve Risk recorded a new low of approximately 0.001, so it is possible that a bottom has already been reached. In the past we have already seen this behavior in March 2020, February 2019, July 2015 and November 2011.

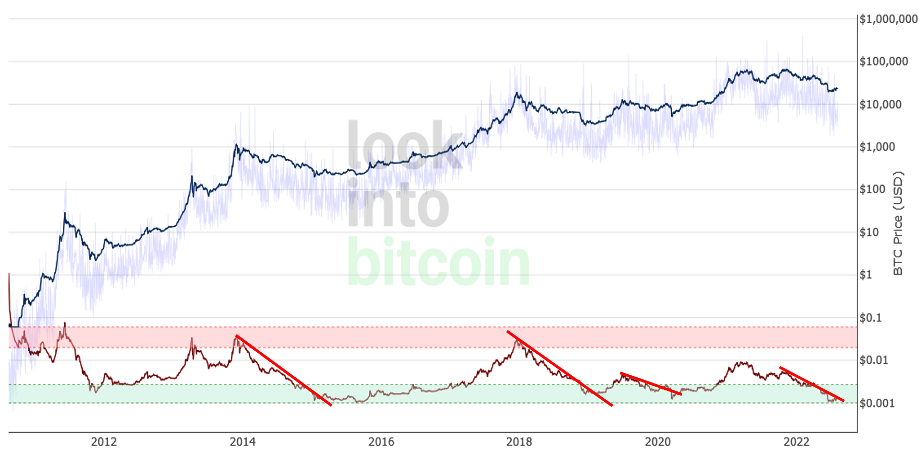

Now, a highlight with this indicator is that the bottom in the BTC price has been confirmed after the indicator breaks its downtrend line, which would be close to happening, and if history repeats itself, it would begin to reverse the price trend.

Screenshot taken from lookintobitcoin.com.

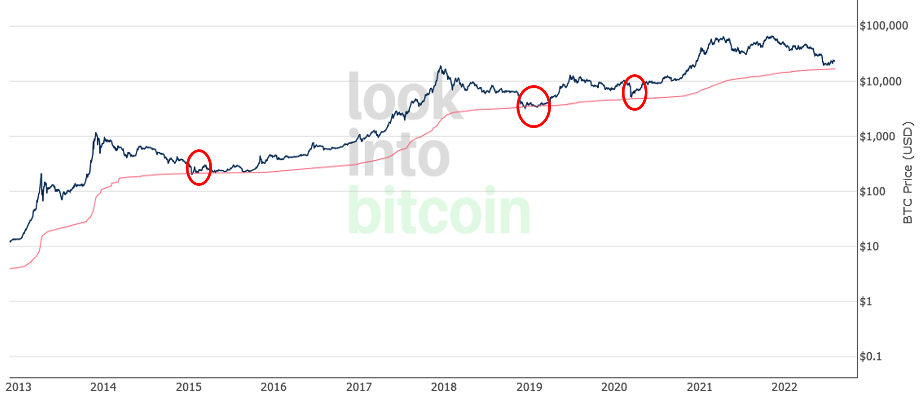

Cumulative Value-Days Destroyed (CVDD)

The Cumulative Value-Days Destroyed (CVDD) indicator focuses on transactions and establishes the relationship between the cumulative value in USD of Coin Days Destroyed with the age of the market in days. Coin Days Destroyed is a measure that tracks economic activity, giving more weight to coins that have not been spent in a long time.

That is, when one HODLer sells to another, that transaction contains both value (USD) and a duration of time, the CVDD is the cumulative sum of that value and the destruction of time for each transaction, since when coins that have been stored for a long time are spent it is because there is an important change in the behavior of the long-term holders.

And CVDD has been remarkably accurate in pinpointing market lows, at least it was for the 2020, 2019 and 2015 funds.

Screenshot taken from lookintobitcoin.com.

The highlight of this indicator is that, as we can notice in the chart above, the price never manages to break the indicator line, it always reverses its trend before touching it. Currently the indicator line is near $16700, while the current low of BTC is about $18000.

Screenshot taken from lookintobitcoin.com.

So we could say that, compared to the previous bottoms, that BTC has already bottomed out or that it could fall a little further to the indicator line, but experience has shown that the price has bounced just before reaching this value.

Well friends I hope you liked the information about these metrics that might suggest that BTC has already bottomed out. See you next time!*

Posted Using LeoFinance Beta