Yes, I know. Sometimes I'm inconsistent and I made quick decisions on the go.

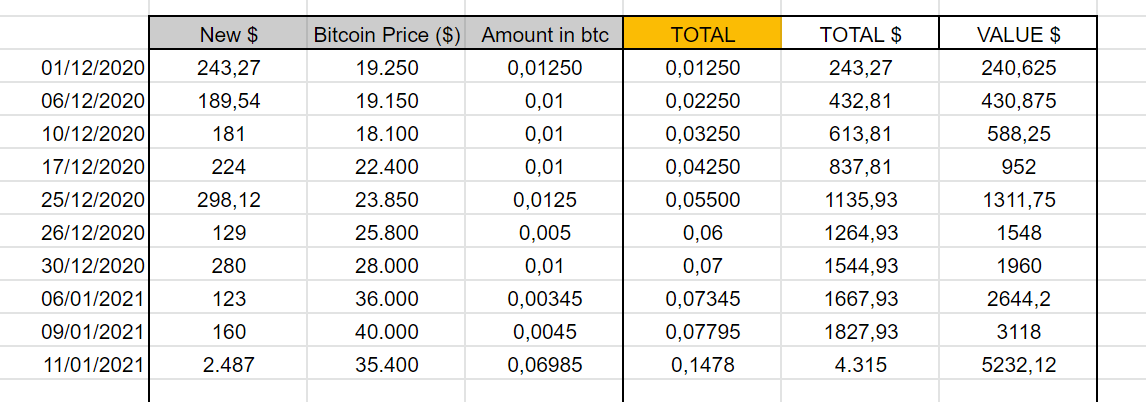

Yesterday we had a pretty violent correction (which I was waiting for a week or so) and decided to give a little 'twist' to the challenge. Deposited ~2500$ from other sources into Bitcoin buying at an average price of 35K$ (I should have waited a little more)

From now on I'll not only focus on simply 'hodling btc', I'll also try to trade the market only with the funds that I'm able able to borrow through Venus in BSC.

The number stays as follows with the latest big chunk added:

Almost forgot to mention that in the middle of this year I'll probably need some spare money to face a few payments, and I thought that this hodling challenge could be a great way to 'force myself to hold'.

Think about it (I feel like it's a great plan):

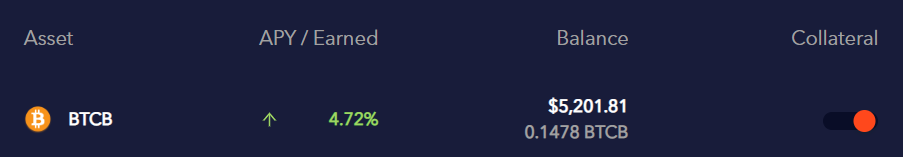

- You're holding spot BTC which you supply to the protocol (profiting you a ~5% APY). This alone is huge.

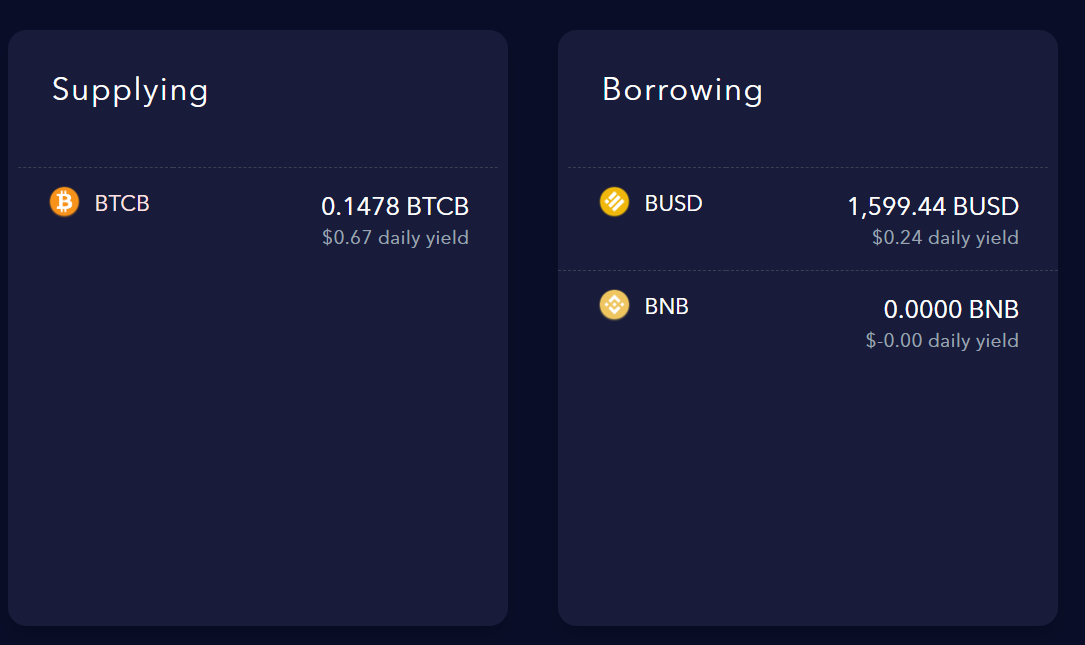

-Then you borrow a desired amount of assets, in this case, I'm borrowing 1600 BUSD and I still have a 50% collateralization ratio, which is my ability to keep borrowing money (I could double the amount or afford a ~45% retrace in BTC price from the 34K$ levels so In practice I'm safe).

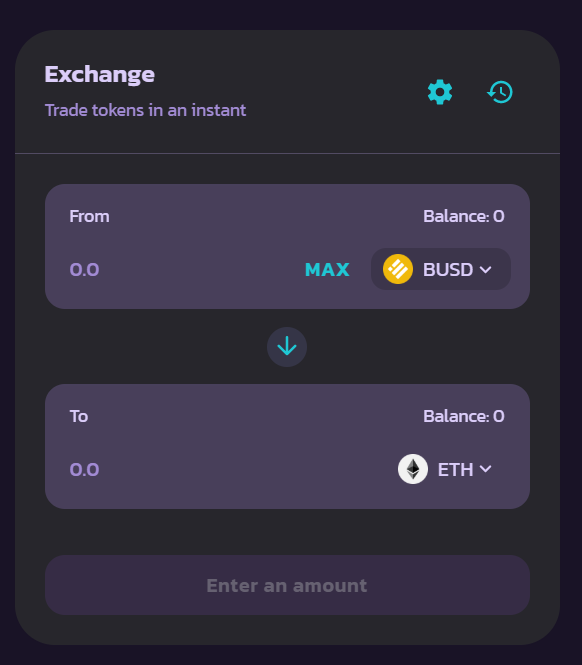

Then you use pancakeswap to swap your BUSD for ETH & BNB (to have bluechip-alts exposure in my case).

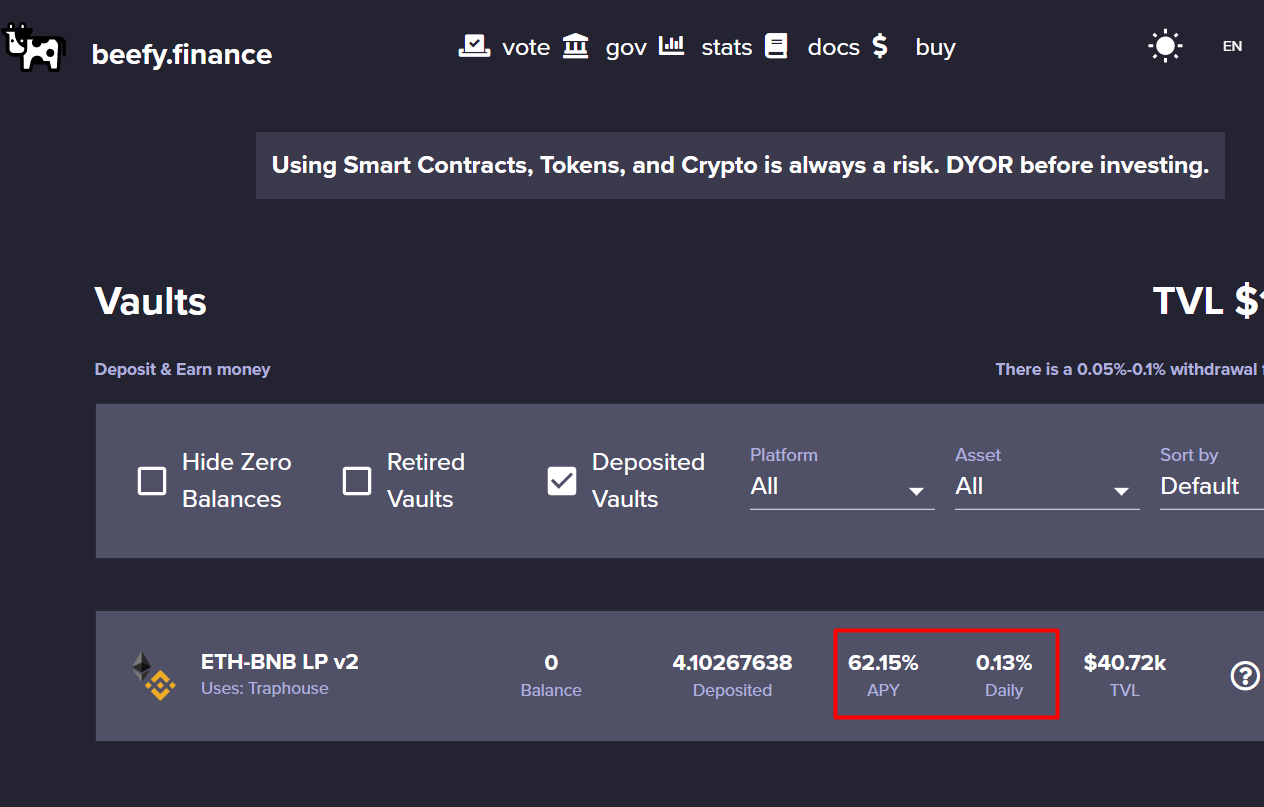

Then you can deposit your assets into a pool (traphouse/pancake, whichever suits you better) and Beefy to automatically compound your earnings. I'm currently receiving a 0,13% DAILY for holding ETH+BNB. Crazy.

Summary

- Hold BTCB in Venus for a 5%

- Borrow assets and stake them into a Pancake/Traphouse pool.

- Automatize the compounding process with Beefy and get paid by holdings that don't belong to you.

Currently:

- 5K$ BTCB profiting a 5% yearly (+250$/year)

- 1,6K$ borrowed distributed between BNB+ETH receiving a 62% yearly (+992$/year)

Not to mention if ETH/BNB prices increase (I'm perfectly OK being underwater for a while).

You can follow me on Twitter

Posted Using LeoFinance Beta

Magnificent as always!

By the way, how deep can this rabbit hole go? I mean, could you extend this hold/borrow a few more steps? I comprehend the risks but man, this sounds so good explained as you did.

Keep it up!!

Posted Using LeoFinance Beta

We're talking one of these days about the matter my friend.

Welcome to LeoFinance btw! I'm happy to see you there :)

Posted Using LeoFinance Beta

This is the right mindset for long term Hodling and guaranteed gains in a still undervalued crypto market.

You pretty much can't lose, yet. Unless Bitcoin crashes for good. Which I don't think will happen in the near future.

How do you deal with the anxiety of wanting to trade or sell partially at peaks and take some profit?, if you even have that anxiety. Well, I guess trading with the borrowed funds probably takes care of those needs.

Posted Using LeoFinance Beta

I control anxiety trading with a lesser amount of funds.

Anxiety is one of those indicators that you're overleveraged. My mind with this BTC/ETH/BNB scheme isn't in the 'take profit' phase (yet), it's in the 'let's scoop as much as I can).

Remember that 0,1% that I'm receiving daily is being received automatically in BNB+ETH, and then is reinvested, making the next 0,1% payout higher.

Overall is a very big compounding machine. With a bit of patience it starts to scale like mad (and eventually will make my weekly purchases feel small).

Good point. I'm also still at that 'get as much as I can phase', whenever I have profit I either reinvest, or move it to another project I'm also interested in. Haven't pulled anything out of crypto yet since I started.

Posted Using LeoFinance Beta

Love that.

Funnily I was playing with Venus yesterday and I chose the VAI mint and stake path instead of the borrowing and swap + stake on beefy path.

I chose this path only because I had almost no clue what I was doing :D

Next time I'll try your way !

Don't you love those 0.05 USD trx on BSC mate ? :)

By the way your BTCB APR is now 12.26% on Venus haha

Posted Using LeoFinance Beta

BNB+ETH receiving a 62% yearly (+992$/year) :O

About the BTC I think you are right ( or we both wrong :)), I stack also some more in the latest correction :)

We see us on moon

Posted Using LeoFinance Beta

Those are some incredible APR! If luck favors, people will remain oblivious to these projects for just a little longer and these rate of returns will remain for a longer time. I personally don't have much liquidity left for basically anything. My earnings mostly get recycled in the HIVE ecosystem mainly distributed between DEC purchases and loading up LEO before _______ get released.

Posted Using LeoFinance Beta

GENIUS. And I mean that.

Are you going to hodl the BTC for years or just until it blow through the roof.

Posted Using LeoFinance Beta

you hold me in too high regard :)

Honestly, I don't know.

I feel 'Ok' holding BTC for now, but sometimes I have inner voices that tell me to swap everything for ETH. I have to keep working on that shitty behaviour, I know I can't afford to not own 'enough' BTC.

My intention long-term (VERY LONG TERM), like 10 years or so is to hold a few BTC and use them to borrow the fiat that I need. Fuck the system I won't need to sell for an ever depreciating asset.

Posted Using LeoFinance Beta

That's a plan. Instead of selling BTC for ETH why not sell some shitcoins?

Posted Using LeoFinance Beta

because it's shitcoin season soon.

It seems what youre doing with borrowing of assets is offering you more APR than holding $5k btcb on Venus, any particular reason for that?

Posted Using LeoFinance Beta

That 5%~ is being received from newly minted Venus coins (XVS$). This will slowly go down.

The 60% APY is received from staking that pair into a farm pool (similar to yield farm WLEO).

What beefy does is automatically harvest the rewards and sell them for more BNB-ETH (which is automatically staked).

For that reason the returns are that high, but you have to adapt continually.

Posted Using LeoFinance Beta

Ah thanks a lot for the explanation

Posted Using LeoFinance Beta

Sounds like a great plan, but there is also quite some risk involved, right?

!gif risky

Main risk is Binance collapsing, something that I don't see happening pretty soon.

Venus is a fork of compound and Coinbase is invested into compound and Maker...so... pretty low risk from a 'system view'. The 'too big to fail kind of arguments'.

user risk is always higher IMHO. You messing up with keys, and all that stuff.

Posted Using LeoFinance Beta

Maybe I will try it out with a low stake.

Anyways, a great way of making some money on the side you have found there!

Via Tenor

I like your compounding!

Keep stacking sats!

Posted Using LeoFinance Beta

When you'll switch to BSC? You're missing out a lot of potential profits IMO

Posted Using LeoFinance Beta

When I grow up, I want to be like you 😄

Posted Using LeoFinance Beta

If you don't mind me asking... for what particular reason? Becase I'm a bit of an ape?

Posted Using LeoFinance Beta

lmao nah. Because you go hard on these tokens and your strategy always seems solid

Posted Using LeoFinance Beta

Sometimes, quick decisions are just a part of the whole process.

Posted Using LeoFinance Beta

Guess so.

Posted Using LeoFinance Beta

really valuable info because I'm trying to learn all of this during a bull market lol. I still don't understand how pools are able to guarantee returns. Once I figure that out I might take the plunge.

Posted Using LeoFinance Beta