Unbelievable. It's March already! I'm not going to say time is flying because I live every moment of my time, but it's Sunday again, so it's time for another technical analysis post. Let's see what $HIVE and $BTC has been doing lately.

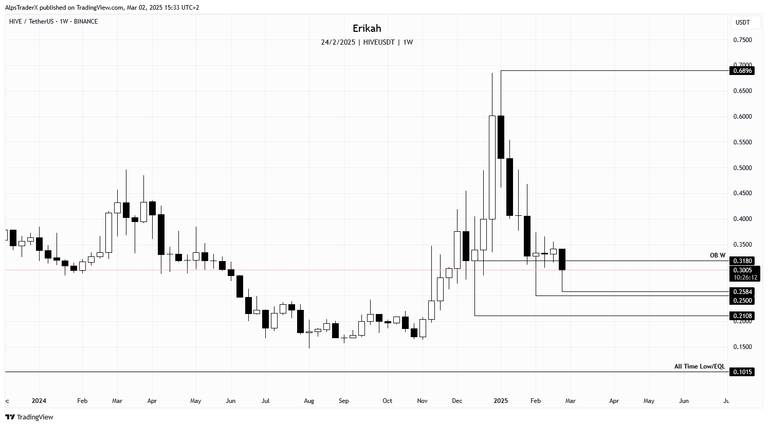

Earlier this week we got the monthly candle closed, which is a bearish engulfing candle. It's way too early to say more about the monthly as we only spent 2 days of the month, but for bullish continuation, price needs to close above $0.3999. In case price can't hold the current level, we could see $0.258, $0.2108 swept, or even lower levels, marked on the chart, but again, there are still 29 days left of the month.

The weekly chart chart shows a bearish engulfing candle for this week. Again, the weekly candle close will happen in approximately 10 hours, but I doubt much is going to change. Price most likely will close below the weekly bearish order block. There are no gaps in either direction, to attract price, so as next liquidity pool I'm looking at $0.2584 and $0.25 to be swept, in case price continues to be heavy. In case price manages to hold the current level and make a move to the upside, we can expect $0.3555, $0.3562 and $0.3735 to be swept.

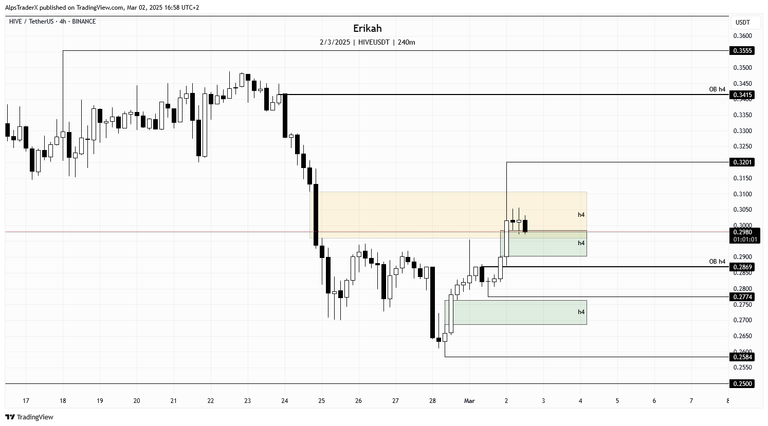

On the daily time frame, this week price retested the bullish gap that was created on December 22, last year and was able to hold price nicely. Today price attempted to rebalance the the bearish gap, marked with yellow on my chart, but so far it seems like the candle is going to close inside or below the gap. We'll know more in 9 hours, when the candle closes. Being Sunday, without any news catalysts, I don't think we can hope for the daily candle to close above the gap.

What is interesting here is the OB price has to close above ($0.3493 marked with green), for bullish continuation. Last week price had a failed attempt, this week is miles away from it. Hopefully next week we can see price turning bullish on the daily and have another attempt of closing above $0.3493. In case price can't hold this level and we're going to see a move to the downside, as I mentioned above, I'm looking at $0.2584 and $0.25 to be swept.

Interesting situation on the h4 chart. Price ran into a bearish gap and it is retesting a bullish one as well, which seems to be holding price so far.

The current h4 candle closes in 1h. So far it looks like a bearish engulfing candle and if it stays this way, then I'm expecting price to rebalance the bullish gap (green on my chart) and maybe engage with the OB too, then continuation to the upside. In case the OB can't defend price, I'm expecting price price to sweep liquidity below the current wick at $0.2774, and maybe rebalance the bullish gap below it.

$BTC had an interesting evolution this week, lost some important levels. As a liquidity based trader, I use gaps in my analyses and as you can see, some of these gaps have never been retested, till now. At the time of writing, price dipped into the gap in the middle, bounced off, rebalanced the top gap and closed above it. At the time of writing, price is retesting the mid range level.

This move caused a lot of panic in the market, many got liquidated, but the truth is, this move was always in the cards, charts don't lie. These inefficiencies usually get rebalanced and better now than later. We're not out of the woods yet though. We got a strong bounce off $78,210, but the gap on the bottom has still not been retested.

I wouldn't be surprised to see price rebalance the two bearish gap marked with yellow on the chart, then come back to retest the area between $70,540 and $74,476.

For bullish continuation, price needs to get back, close above and hold the $95,254 level. No one knows what's going to happen, but I would not expect price to shoot for new highs soon. Most likely we're going to have a sideways period.

Next week is going to be eventful, as far as the economic calendar is concerned. We have four red folder days and on top of everything, Powell speaks on Friday.

I'm really curious what $BTC is going to do as it drags the whole crypto market with itself, so I'd keep an eye on it and protect my capital for sure.

Remember, technical analysis is not about forecasting the price, but about reacting to what price does.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27

Se me cumplió la orden de los 0.27 y 0.26, espero que la dos que me quedan en los 0.25 y 0.23 se cumplan 🤗🤗 para seguir acumulando por si sube en los próximos años, si el proyecto se sigue expandiendo, creciendo y capitalizando 😉.

Saludos @erikah y feliz tarde de domingo!!! 😊🙏🏻

The truth is, no one knows what's going to happen, but it doesn't hurt to place some orders in case you want to buy.

Have a nice week @ibarra95!

I don't think Hive totally followed BTC up so hopefully it won't follow it down 🤞

It doesn't always follow $BTC, so I don't think we need to expect that to happen. Different assets moved by different events, so who knows.

You inspire with your words.

Now inspire with your wins.

Join BHR and claim your reward.

!discovery 30

!PIZZA

Thanks Jesus!

Thanks you for your analysis post @erikah friend and have a great week!!

!PIZZA

Pleasure as always!

This post was shared and voted inside the discord by the curators team of discovery-it

Join our Community and follow our Curation Trail

Discovery-it is also a Witness, vote for us here

Delegate to us for passive income. Check our 80% fee-back Program

$PIZZA slices delivered:

(1/15) @jlinaresp tipped @erikah (x2)