Again, not 100% sure if part of that goes to the exchange or if the fee that occurrs when you open the trade is the only one binance gets

Funding fees go to those who are participating in the "Earn" project, locking their assets for a certain period of time to be precise. It works similarly to how a bank system works. The exchange is keeping a part obviously but the majority goes to paying yield to those locking their assets for 3 months, 6 months or for a longer period.

Regarding placing orders, you can place a Limit order or a Market order, or both. With Market orders you have to factor in the slippage, which, if price is running hot, can be high. I prefer limit orders, even split orders to DCA my entry and avoid slippage, but for that, you need to know your levels, or price takes off without you.

Choosing trade type can also be tricky as you have 2 options: Isolated and Cross. You need to be sure which one you're comfortable with as Isolated refers only to your position size, while with cross you're guaranteeing with your entire wallet. Bybit has Unified Trading Wallet now, which means you don't have to split your capital between spot and futures, and transfer funds back and forth, which is a huge advantage for me. Binance doesn't have it yet, but this is the future, so I believe it's just a matter of time. Anyway, I prefer Isolated, as when my SL is hit, I know I was wrong and no need to risk more than I want to. I can reassess, look for another trigger and enter again if the market gives me what I need.

Stop loss is a must for me. No SL, no trade, but again, you need to know your levels because otherwise you become a feeder to SL hunters. When scalping on the 1 min time frame, there's no room for errors.

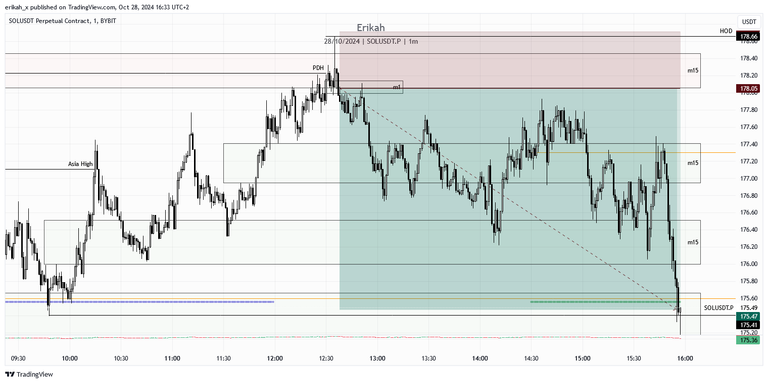

This was a scalp short on SOL on the 1 min time frame, with 3.9 R/R. I try to keep my charts simple, but still, you need to know there to mitigate risk, especially if you're trading on a red folder news day, when volatility and manipulation is high and things can turn against you quickly.

This doesn't mean you can't use leverage. It has its advantages, but ultimately, position size is what counts.

All in all, I've been waiting for $HIVE to be listed as perp futures for a long time and I'm glad it happened.