Introduction

Recent trading insights from Binance reveal a significant influx of HIVE tokens onto the exchange, raising concerns about potential downward price pressure. A total of 6.98 million HIVE was deposited at an average price of $0.48 . Historically, such large inflows have correlated with substantial price drops, prompting traders to analyze the impact of these movements.

Historical Patterns of HIVE Deposits

| Date | Deposit Amount | Price Before | Price After | Change |

|---|---|---|---|---|

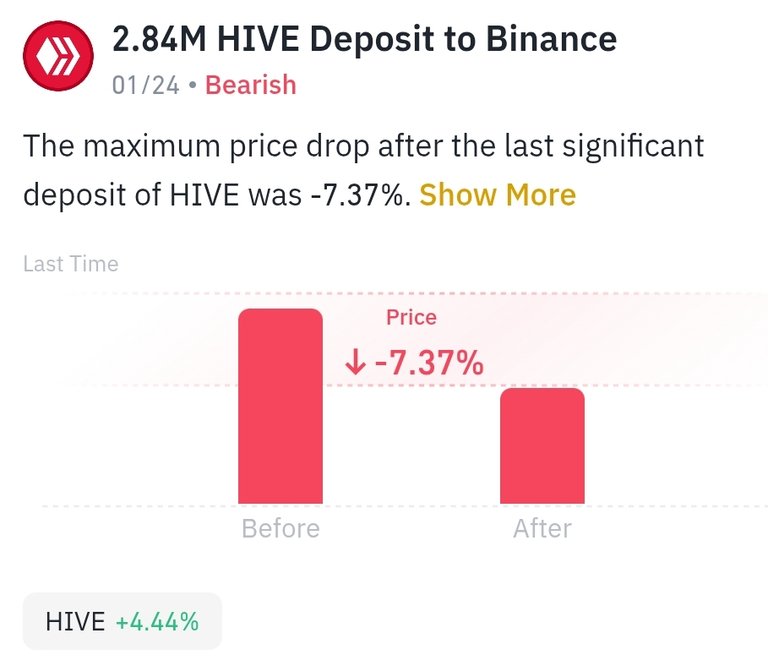

| January 19, 2025 | 2.84M HIVE | $0.41 | $0.38 | -7.37% |

| January 17, 2025 | 4.04M HIVE | $0.53 | $0.38 | -28.29% |

| January 15, 2025 | 3.69M HIVE | $0.51 | $0.38 | -25.65% |

Why Large Deposits Matter?

Large token deposits to exchanges typically signal selling intent by whales or large holders. This influx increases the available supply on the market, often triggering a price drop, especially if there isn't enough buying demand to absorb the sell pressure. The price history of HIVE over the past weeks suggests that this pattern has played out repeatedly.

Given that the latest deposit on January 24 was 6.98M HIVE, traders should closely monitor whether this trend continues.

Current Market Conditions

As of the latest update, the HIVE/USDT pair is trading at $0.4379, showing a 4.29% increase, but this could be a short-term reaction before further volatility. The key question now is whether buyers can absorb the new supply or if a further dip towards previous lows (~$0.38)

What Traders Should Watch For

- Sell Orders on Binance: If a large portion of the 6.98M HIVE is sold quickly, expect increased volatility and downward pressure.

- Support Levels: The previous price floor of $0.38 has been tested multiple times after large deposits. If broken, HIVE may enter a new downtrend.

- Buy Volume & Demand: If strong buy orders appear, it could indicate market confidence and potential price stabilization.

Conclusion

HIVE’s price action over the past few weeks suggests that large deposits on Binance often precede sharp declines. With 6.98M HIVE recently moved onto Binance, there is a real possibility of further price drops. Traders should stay cautious, watch the order books closely, and consider the historical impact of such deposits before making trading decisions.

Congratulations @failingforwards! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 500 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP