After the silicon valley bank collapse (2nd largest in US history), USDC depegs to $0.87 due to the recent sell-off. $3.3 billion of the ~$40 billion of USDC reserves remain at SVB and Circle cannot find a way to get this money out.

Several centralized crypto exchanges blocked the USDC to USD conversion citing reasons that are not looking good for the holders. Just before the collapse, SVB's CEO Gregory W. Becker sold off $3.57m worth of $SIVB stock. Shady mfkn move, right?

As of today, I have converted all my USDC to MATIC & ETH. Soon I will move them to HBD if I feel the need to take profits in stablecoins. Lots of my friends are still confused because Tether had deposits in SVB too. So there is hardly any reliable stablecoin left for crypto users to book their profits and safeguard themselves from volatility.

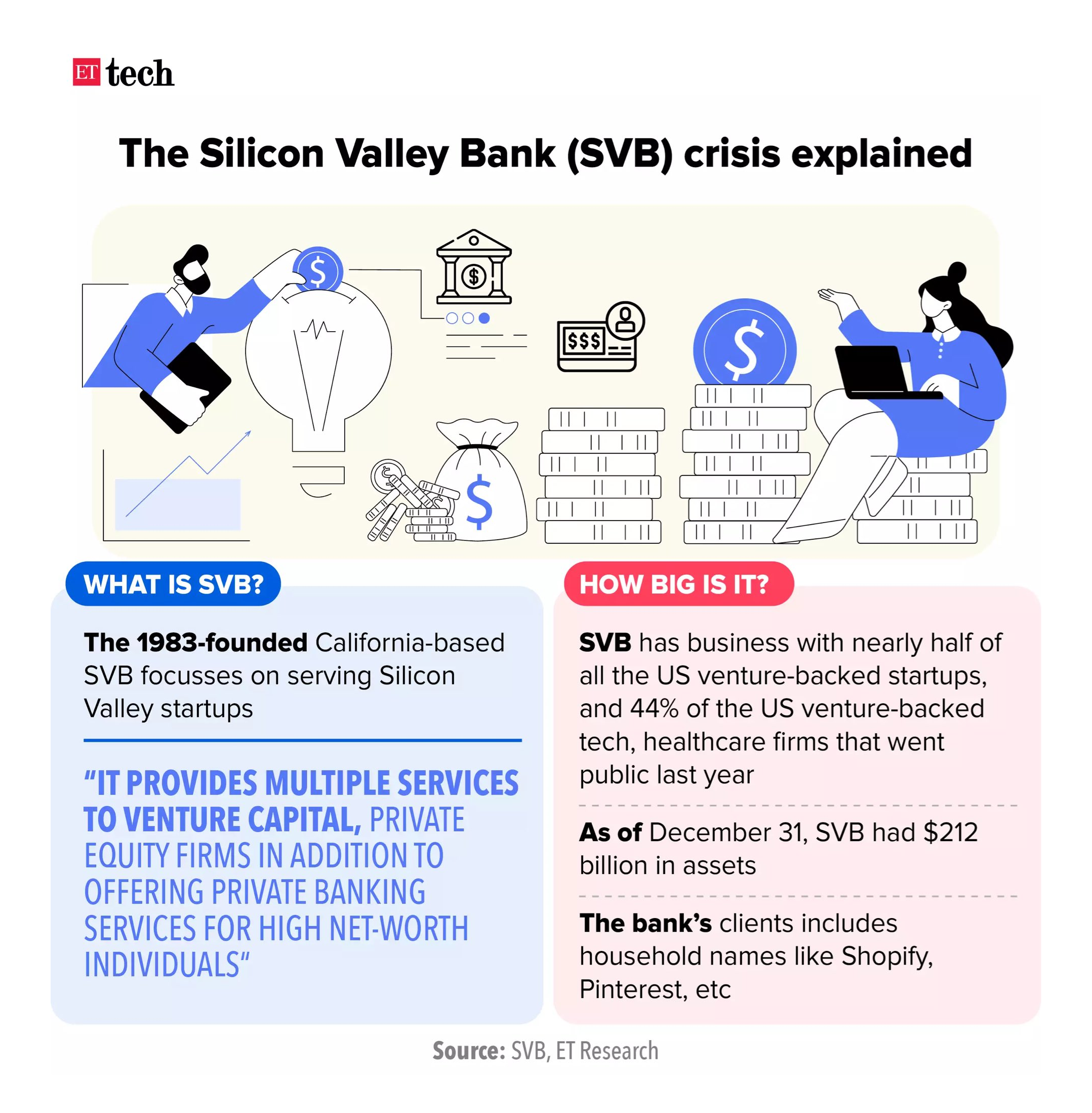

SVB Crisis Explained

For those who don't know, SVB was one of the preferred banks by tech startups in the valley for corp banking services. It was also preferred by VCs, Private Equity Firms, and high-net-worth individuals. All of them got fkd badly with SVB's bank run.

After failing to raise capital or find a buyer to clear out its dues, it collapsed. The major reason is the exits taken by tech startups that are collapsing themselves due to the recent meltdown in the tech industry. Cash crunch and high-interest rates killed their operations within 3 days.

Be Your Own Bank

Relying on centralized cryptocurrencies in today's volatile market is the biggest risk you can take. No matter how big they are, there's a good chance they might not survive due to regulatory changes, crackdowns, and bank runs. It has been proven time and again. Becoming your bank has never been more important for the following reasons:

- Greater Financial Control (Your Keys, Your Crypto)

- Security and Privacy (Be Rich & Anonymous)

- Reduced Fees (Hive Is Feeless)

- Potential for Higher Returns (DeFi)

- Protection Against Economic Uncertainty (Screw Bank Runs & Recession)

Cryptocurrency has made it possible for everyone to become their own bank yet many still rely on traditional banking and centralized exchanges for investment and transactions. 2022 was the year of awakening and looks like this awakening will continue until we see many more such collapses.

Need For Algo Stablecoins?

Options for reliable stablecoins is decreasing every day since UST Collapse. The world still needs a solid algorithmic stablecoin that can do its job well and sustain itself without the need for intermediaries. We already know that HBD is the perfect replacement for all the shit unstable coins out there.

Do you think the wider crypto community will catch up to it and find a new trusted decentralized gem? I belive we (hive community) have got some work to do. Please let me know your thoughts in the comment section below.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @finguru ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

You challenge the god with undeniable logic and the clerics will make you the god!

Satoshi challenged the monetary system and ........... UN-stable coins on the blockchain.

After the collapse of UST and now USDC we should rethink about the concept of stability of any asset.

Definitely, we should. Stablecoins de-pegging is not a great sign tbh. But it will bounce back once the dust settles. It isn't going anywhere for sure.

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

It's a huge issue due to all the unrealized losses that the banks have and those centralized stable coins are definitely in danger. From what I have read, there were a lot of securities that were unrealized losses and they had to sell early. If you wait till maturity, they wouldn't have any issues. So I think the banks are in danger but I only think the small and middle sized banks are the ones in the most danger.

Posted Using LeoFinance Beta