Hello everyone, in today's article I'm going to explain what is auction market theory, why this is important and what we need to do with this information, because regardless of what you are trading if you are swing trading if you are not even in futures if you are not using the volume profile whatever you are doing auction market theory is going to elevate nd make you better at trading and then if you want to use profiling specifically, it is a core pillar you have to know about. Let’s go ahead and jump into it.

What is Auction Market Theory?

It is the understanding that the market is a giant auction. When you are looking at pricing, when you are looking at the charts it is not just this random thing that is just chaotic. What we are doing is trying to match together buyers and sellers and we look at the price. Price moving up and price moving down. It is not this random thing but price is a tool that advertises value. The market is using price to advertise and try to attract buyers and we are trying to attract sellers so that we can match them together. The market is always moving between either being in balance in what we would call horizontal development where we found an area that is value. We found an area where prices are agreed upon and trade is happening. We go from these areas of efficiency to where the market becomes inefficient, where the market is in vertical development, where the market is in price discovery mode. All these things mean the same and when we are moving out of balance into vertical development then we are looking for another area of balance to be established something has come into the market to change the dynamic where all of a sudden these accepted prices are now too cheap or now they are too expensive and so price is moving.

Why is this important?

What this will allow you to do when you understand auction market theory is it just like removing this haze that is on your eyes. If you don't know about it what the average trader is doing is looking at the screens and it is very confusing. The majority of what is going on seems very random and it looks very chaotic but when you understand auction market theory and you can put what it is going to do it is going to allow you to look at your charts and where it used to be confusion, where a lot of other people are seeing chaos you will understand that this is by no means a random walk, that there is a lot of structure and to what other people are just seeing as confusion and chaos, there is a lot of order inside of that and that is the really the power of what auction market theory allows you to do. If you can learn this and if you can study these things out it is going to just like take off this cloud of mysticism around the markets and it is really going to allow you to see that this is very normal of what is happening. The market is in price discovery mode then the market will find balance. You will be able to put together a lot of things that you just can't put together if you don't understand auction market theory

The Auction Market Theory Rules

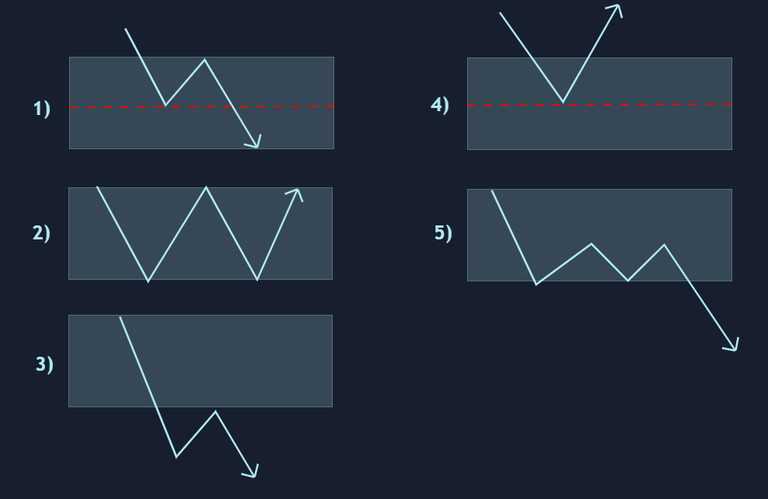

Rules that can be used in your day-to-day trading:

- If the price accepts into the balance area, it’s likely to revert to the other side. Price often retests the edge of the balance area before travelling to the opposite side.

- Price inside a balance is expected to reject the edges and is choppier.

- Once price accepts outside the balance, is likely to become imbalanced and seek new value – often POC of older balance area.

- If the price reacts strongly from POC, it can disrupt the rule #1.

- If time/volume build at the edge of a balance, price is likely to push through.

Hope you found today’s article helpful. If you want to learn more about trading and crypto in general follow me at @fizzonmyjayyce. Have a nice day :)

Posted Using LeoFinance Beta